Altria: Proving The Bears Wrong For 54 Years And Counting

Summary

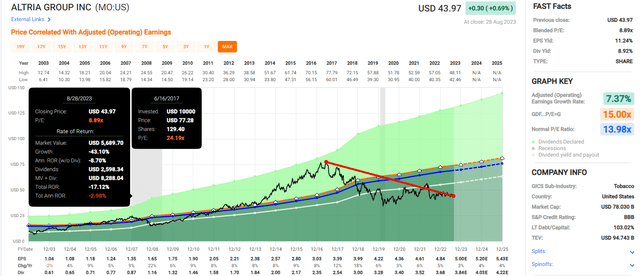

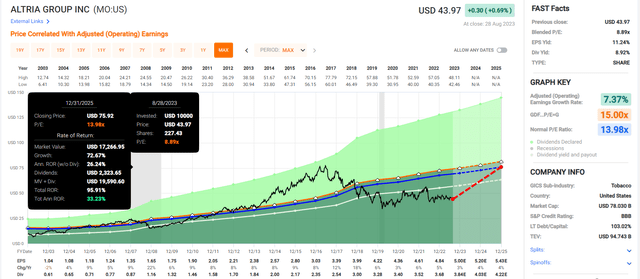

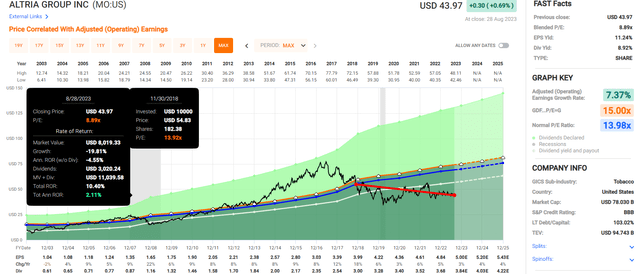

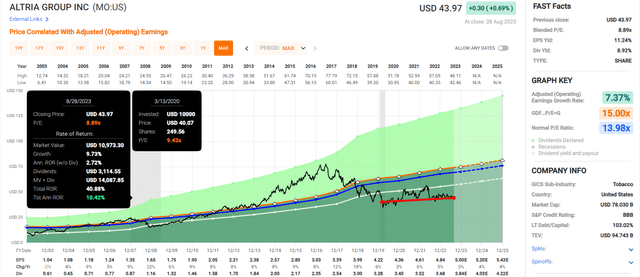

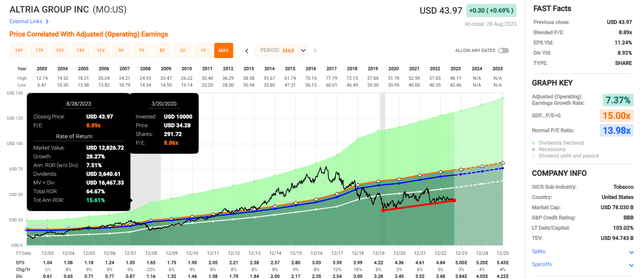

- In 2017, Altria Group, Inc. was 75% overvalued and has since delivered six years of negative returns for speculators who thought valuation didn't matter.

- Any patient long-term income investor who bought at fair value or better has made money, sometimes 16% returns, even in this bear market.

- Altria Group has been steadily growing sales, earnings, and dividends for the last 54 years despite continuous challenges from regulators and missteps with JUUL and Cronos.

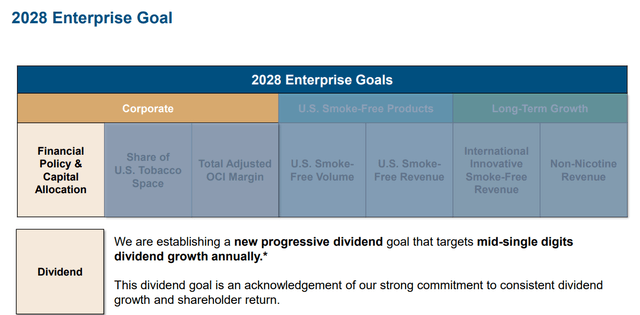

- Altria just delivered its 54th consecutive dividend hike, and management has a plan for around 5% growth through 2028. Management hasn't missed its guidance in over a decade.

- Altria could double by 2025, but long-term 13% to 14% total return guidance from a team that always delivers on long-term guidance, makes Altria a potential 9% yielding rich retirement dream stock for anyone comfortable with the risk profile. A profile which is described in great detail in this article.

- I do much more than just articles at The Dividend Kings: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

RgStudio

Altria Group, Inc. (NYSE:MO) has become controversial in recent years, not just because it's a tobacco company.

Negative returns after six years, and that's including dividends! Adjusted for inflation, that's a -18% total return after six years! Proof positive the MO is a value trap, a dying company, and only a fool would buy it!

Except for one thing.

MO is historically valued at 13 to 14X earrings. In 2017, thanks to, at the time, record low-interest rates, it was in an epic bubble. At 24X earnings, MO was 75% overvalued, 25% more than the S&P sported in March 2000, the peak of the tech bubble.

Since March 2000, The Peak Of The Tech Bubble

Value stocks like MO, pipelines, and real estate investment trusts ("REITs") were in a 50% bear market at the height of the tech mania in 2000.

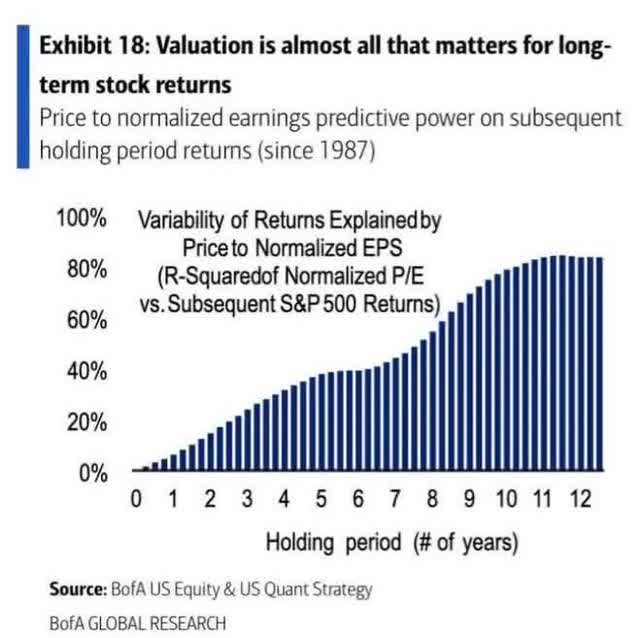

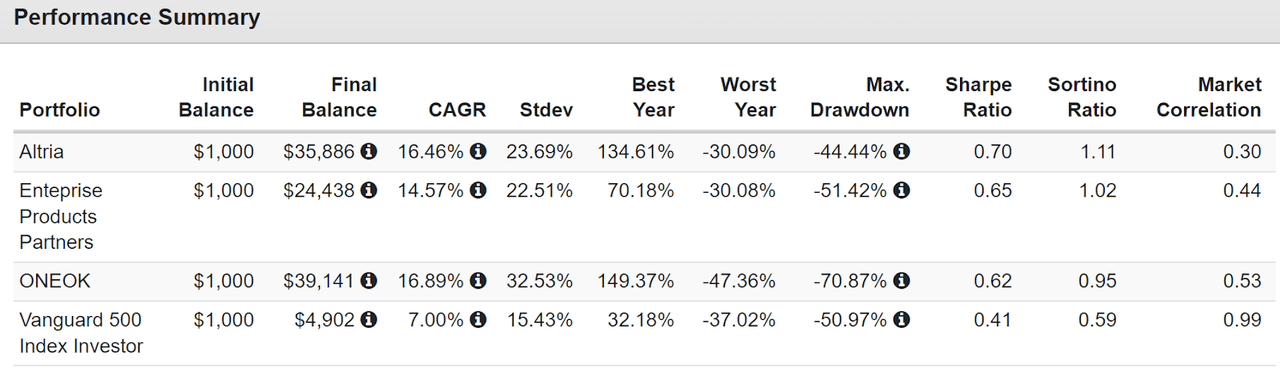

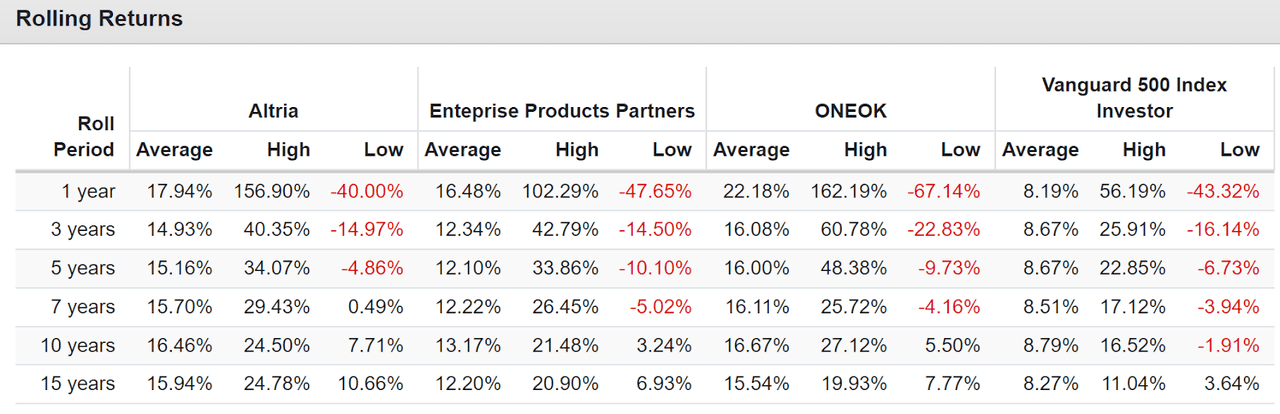

And since then, they have crushed the market, delivering rolling returns 50% to 100% better.

Twenty-three years after paying a 50% premium for the S&P, investors have earned 8% returns, while smart value investors who bought high-yield Ultra SWANs have raked in much better returns.

I'm not here to tell you that MO can yield 18% returns over the long term. I am here to explain why this beloved 9% yielding dividend king has a bright future and can likely generate 13% to 14% returns for years or even decades.

So, let's look at why 9% yielding Altria is a rich retirement dream machine and might be just what you need in today's dangerous market.

One that keeps proving the bears wrong, and making patient income investors very, very rich.

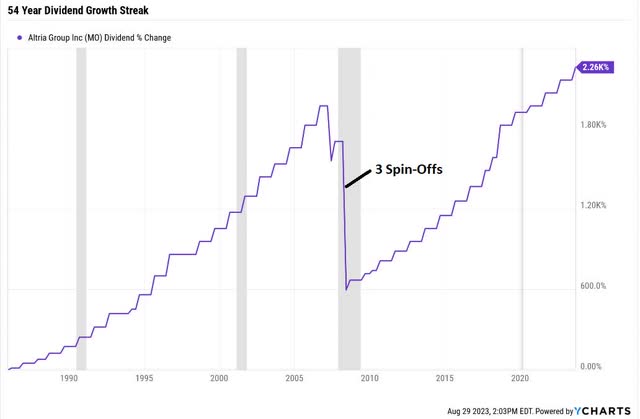

Altria Keeps Delivering Where It Matters Most: 54-Year Dividend Growth Streak

MO's dividend growth is legendary for its 54 years in the face of unrelenting challenges and its growth rate of about 8.6%.

- doubling every nine years for nearly four decades.

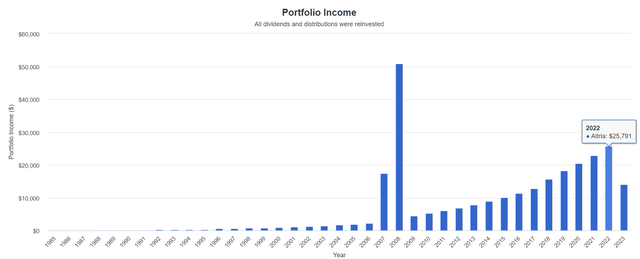

Here's what that means in terms of income for MO investors.

$1,000 Invested In Altria In 1985 18% Annual Income Growth

According to management, $1,000 invested in MO in 1985 paid $26,000 in dividends in 2022 alone, which is expected to keep growing at 4% to 6% over time.

MO has a policy of growing the dividend over time to maintain an 80% payout ratio on earnings and not cutting unless necessary.

MO says it offers a safe 9% yield with 5% expected long-term income growth.

If they can deliver on that, MO is hands down one of the best rich retirement dream machines on Wall Street today.

And here is why I think they can deliver on that guidance.

Growth Outlook: Slow And Steady Driven By RRPs And Buybacks

The headline numbers of revenue net of excise tax up 1.5% year over year and earnings per share growth of 4% are representative of what we believe Altria can deliver in the medium term." - Morningstar.

Altria has never been a particularly fast-growing company when it comes to sales.

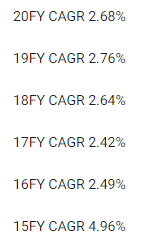

Altria's Sales Growth Over Time: 2% to 3%

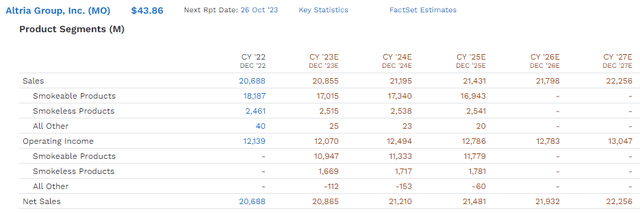

FactSet Research Terminal

In the last 20 years, the fastest MO sales ever grew was 5%; most of the time, the growth rate was 2% to 3%.

| Metric | 2022 consensus growth | 2023 consensus growth | 2024 consensus growth | 2025 consensus growth |

| Sales | 0% | 2% | 2% | 0% |

| Dividend | 5% | 5% | 4% (Official) | 5% |

| EPS | 5% | 3% | 4% | 4% |

| Operating Cash Flow | 0% | 10% | 1% | 2% |

| Free Cash Flow | 0% | 7% | 3% | 0% |

| EBITDA | 38% | -22% | 3% | 2% |

| EBIT (operating income) | 39% | -23% | 4% | 1% |

(Source: FAST Graphs, FactSet.)

Altria's growth isn't fast but steady, just as management guides.

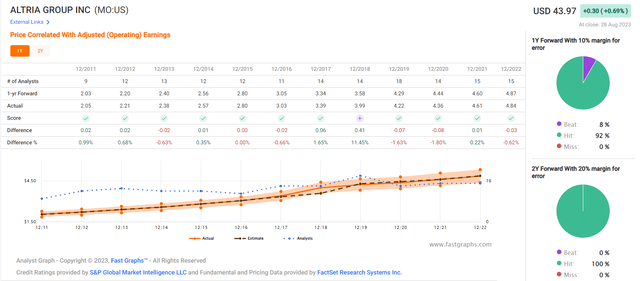

OK, but what if analysts are just blindly following management guidance? What if we're all being led like lemmings off a cliff by rosy forecasts that point to a wonderful outcome?

How accurate are analyst estimates based on management guidance for MO? In the last 12 years, the largest miss the company delivered to analyst estimates was 1.8% during the Pandemic.

If MO says it can grow 4% to 6%, you can bet that's how fast it will grow. This is a steady and predictable business, and management knows it well.

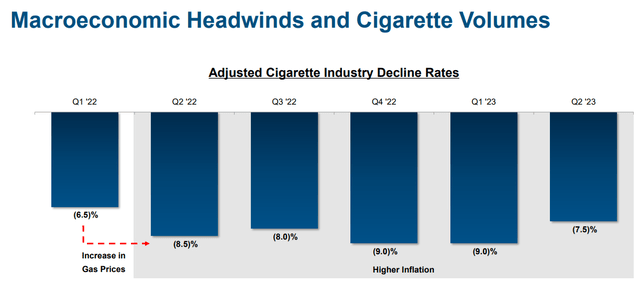

OK, but how exactly is MO going to overcome accelerating volume declines? Isn't there a limit to how long it can keep growing its top line by raising prices on exponentially fewer cigarettes?

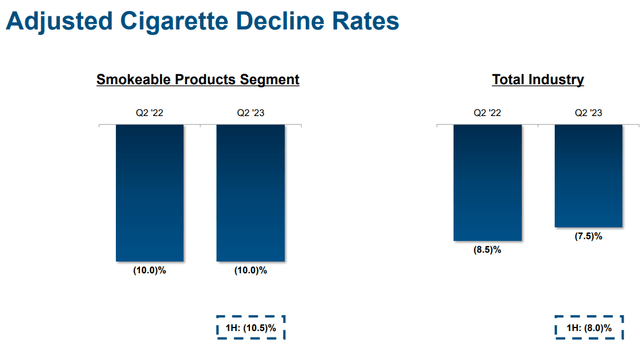

Cigarette volume fell 8.7% in the second quarter, with the discount segment particularly weak, down 24.4%. These figures were slightly better than those of the first quarter despite the flavor ban in California coming into effect. We expect this will have a slight drag on volume throughout the rest of the year, but on the evidence of the second quarter, it will not throw volume too far off its recent trend. The sharp decline in the discount segment appears to be an industrywide trend. It indicates that low-income consumers are quitting cigarettes faster than higher-income consumers are trading down." - Morningstar (emphasis added).

Yup, volume declines are rapid, yet MO raised prices by a net 9.9% and generated 1.2% sales growth. OK, that's impressive, but this is unsustainable. How long can MO keep hiking at 10% when a pack of smokes is $5 or $6 in some places?!

Since 2011, a series of draconian anticigarette measures in Australia have led to the introduction of plain packs and tax increases that caused the doubling of the retail price of cigarettes in just six years, which in turn has led to the smoking rate falling from 16% to 13% over the same period and to significant trading down between price segments. According to the National Cancer Institute, a pack of 20 cigarettes (equivalent, a standard pack contains 25 sticks in Australia) now costs roughly $25, well above the $6.50 in the U.S. We analyzed the affordability of cigarettes by estimating the number of minutes of labor required, on average, to purchase a pack of 20 cigarettes. The U.S. was the fourth most affordable cigarette market among the 38 OECD nations." - Morningstar (emphasis added).

Yup, cigarettes are expensive, but smokers in other countries like Australia indicate that MO has plenty of room to keep hiking and keep sales growth steady or modestly positive.

At 4% real pricing (based on 6% nominal price/mix and 2% global inflation), this crude calculation suggests that it will be 2046 before global pricing reaches levels at which price elasticity increased in Australia." - Morningstar.

Due to higher volume declines, MO likely doesn't have 23 years, as does British American Tobacco (BTI) and Philip Morris (PM). It also faces stricter regulations, including a menthol ban and nicotine reduction that the FDA is working on.

- BTI estimates the menthol ban could happen in 2027.

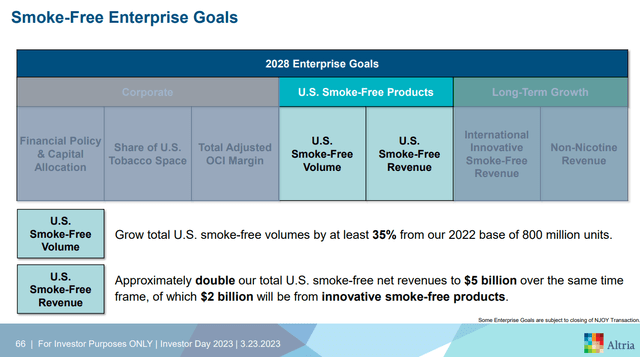

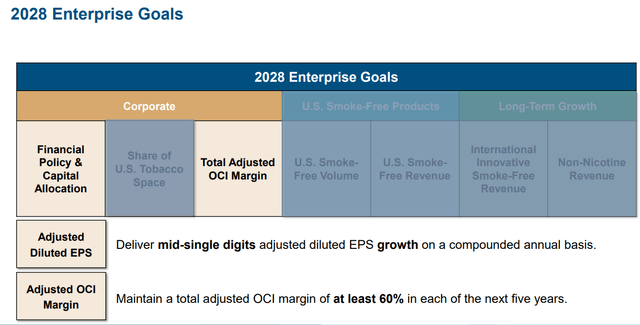

MO is confident that it can deliver 4% to 6% EPS growth through 2028, but beyond that, it will have to rely on its RRP portfolio to get it to its smoke-free future.

That's 1.5% consensus sales growth expected through 2027, similar to what MO is putting up now.

Does that mean volumes will keep declining by 8% to 9% per year, and MO will keep doubling prices every 7.2 years?

Analysts expect MO's steady 1% to 2% sales growth to be mostly driven by its legacy business, with little growth coming from its RRP portfolio.

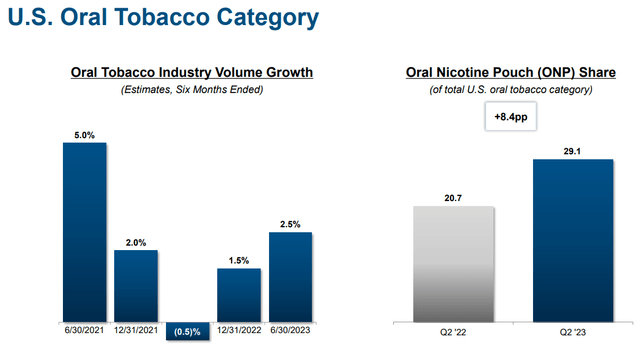

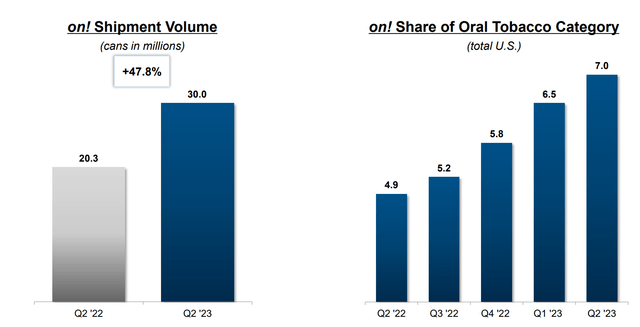

According to Verified Market Research, oral nicotine pouches are a $1.9 billion market that is growing at 35% per year and could hit $23 billion by 2030.

Swedish Match's Zyn and assorted brands own about 70% of that market (PM owns Swedish Match).

With about $20 billion in sales, MO would need a 10% to 20% market share in oral nicotine pouches by 2030 to make a noticeable dent and keep it on track for management guidance of 4% to 6% EPS growth through 2028.

If 29% of oral nicotine is nicotine pouches and on! has a 7% market share in oral nicotine, that implies a 24% market share in oral nicotine pouches.

- So Zyn (Philip Morris) + on! (Altria) own about 94% of the market in the U.S.

One year ago, On! had a 19% market share and has gained a bit, not necessarily at the expense of PM but from smaller rivals.

If MO can keep growing its market share and reach 30% in oral nicotine pouches, it could achieve about $6 billion in sales by 2030, which would be significant, though not necessarily as much as one might think.

- By 2030, the FDA might have reduced nicotine to nearly zero in traditional cigarettes.

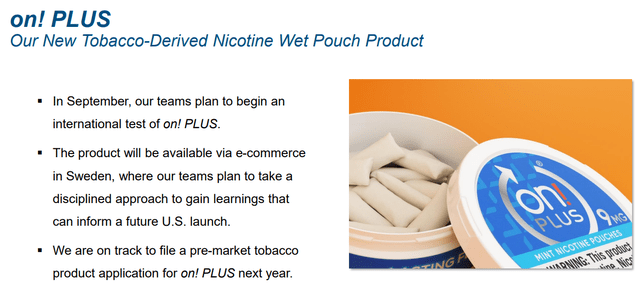

It's nice to see MO again expanding internationally, though it will be long before international sales will help diversify its geographic risk in the U.S.

- MO is at the mercy of the FDA.

Management has stated it would like to become an international company again through RRPs. However, that will be some tough sledding, given the dominance of BTI and PM in global vaping and heat sticks, respectively.

And Now The Ugly Side Of Altria Earnings

MO is holding its own in terms of sales growth, with 9% sales pricing in power in Q2. However, just because sales are still growing at 1% to 2% doesn't mean complacency is called for.

- MO is becoming more reliant on a smaller customer base

- one that will eventually die out

Thus far, Altria has primarily protected profitability and cash flow by increasing prices. We believe the rate of volume decline for Altria's smokeable products business will improve to about a mid-single-digit percentage rate by 2024 as very high inflation ebbs and consumer spending becomes less erratic, though this is a risk." - S&P.

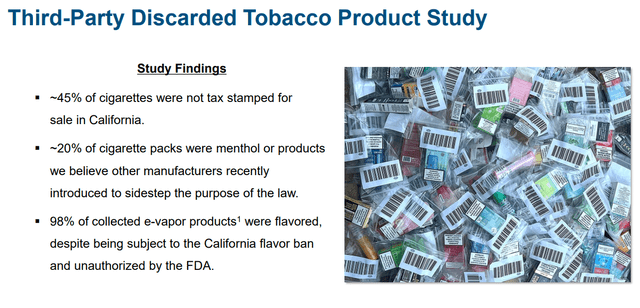

earnings presentation earnings presentation

You never want to see a company making excuses like this about why they are being persecuted or treated unfairly by regulators.

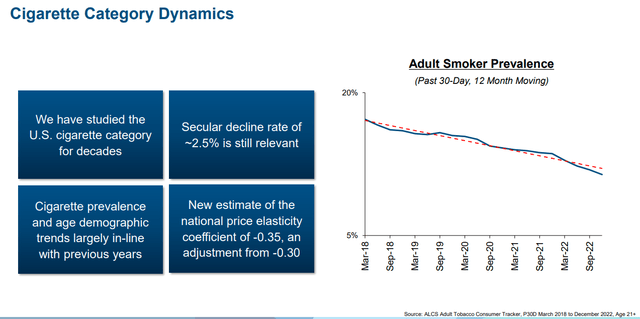

The inelastic demand curve that has protected MO during recessions and, given its strong pricing power, is starting to bend slightly.

- 0 elasticity means MO can raise the price any amount and not lose sales

- -1 means it raises the price by 50% and loses 50% of sales

- +1 means it would raise prices by 50% and gain 50% in sales.

MO's -0.35 elasticity means if it raises prices by 10%, it expects to lose 3.5% volumes.

Recent declines in volumes indicate the -0.35 estimate might be too low.

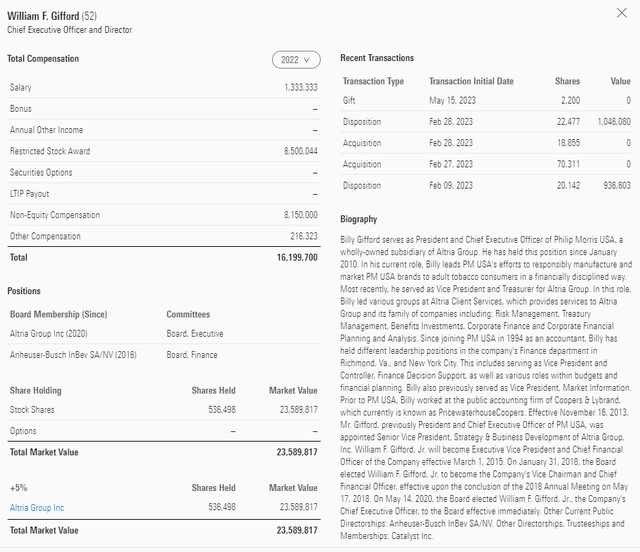

Even if true, the fact is that MO management is paid handsomely to adapt and overcome this.

- They guided for 4% to 6% growth

- Now deliver that 5% growth in any legal and ethical way it takes

- sell cupcakes if that's what it takes

- Pot-laced cupcakes;)

Management is paid $37 million per year at MO, including $16 million for its CEO, 94% of which is stock and perks.

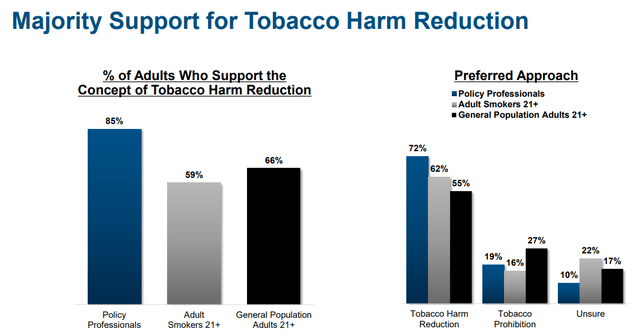

The FDA is prohibited by law from an outright ban on cigarettes, so pointing out how few Americans want such drastic actions is a bit misleading.

I should clarify that The Family Smoking Prevention and Tobacco Control Act of 2009 gives the FDA broad powers to regulate tobacco products' manufacturing, distribution, and marketing. However, it has some limitations.

For example, the law states that the FDA cannot require the reduction of nicotine yields of a tobacco product to zero. This effectively prevents the FDA from banning cigarettes by mandating that they contain no nicotine, as nicotine is the primary addictive component of tobacco. While the FDA can regulate various aspects of cigarettes, such as requiring warning labels and restricting marketing to minors, the legislation does not grant the agency the explicit power to enact an outright ban.

While Congress has not explicitly said the FDA can't ban cigarettes, the authority given to the FDA by current legislation doesn't include the power to implement such a ban.

In the past, the Supreme Court has come down on the side of tobacco when the FDA attempted to regulate them.

How worried should MO investors be that some Presidential administration would try to ban cigarettes or that the FDA would? The risk isn't zero, but it's best to focus on MO's plans for a smoke-free future.

- At some point, volume declines will overtake pricing power, and sales growth will fall below zero.

10% decline rates at MO are certainly concerning. Morningstar considers it "better than feared," but MO is going to have to make some solid progress on its RRP portfolio, which isn't expected to deliver significant growth until 2026

Altria's Plans To Sell Zero Cigarettes

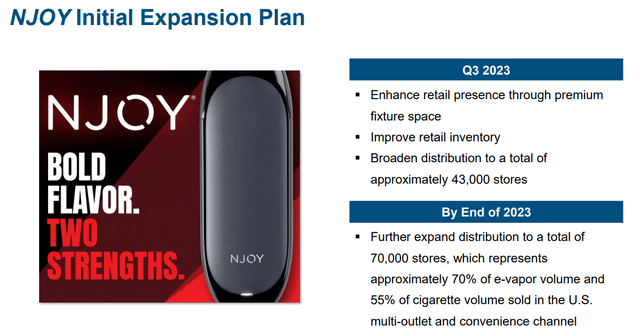

I understand why MO bought NJoy for $2.8 billion. It is the only vaping product with FDA approval. However, I am skeptical that this is the solution to MO's woes.

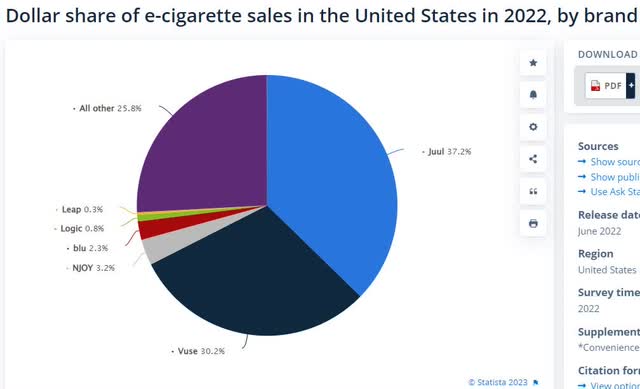

Despite the FDA's onslaught, Juul remained the #1 vaping brand in the US last year, and BTI's Vuse a close 2nd.

The FDA attempts to block both brands and pull them from the shelves.

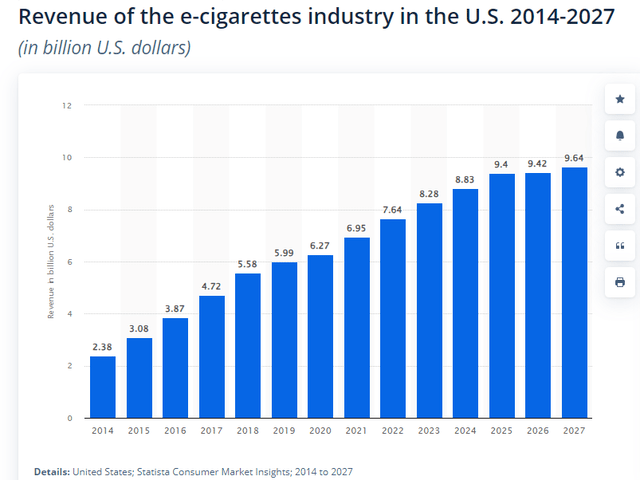

Statista is skeptical whether vaping has much more room for growth in the U.S.

This means that MO is likely going to have to do two things.

- go head to head with BTI and PM in heatsticks

- cannabis (once legal)

- probably both.

MO will have to work hard to live up to its long-term guidance.

Then again, MO has a perfect record of delivering on its guidance. So I'm not too worried about the next five years.

Why I'm Not Too Worried About Altria's Long-Term Future

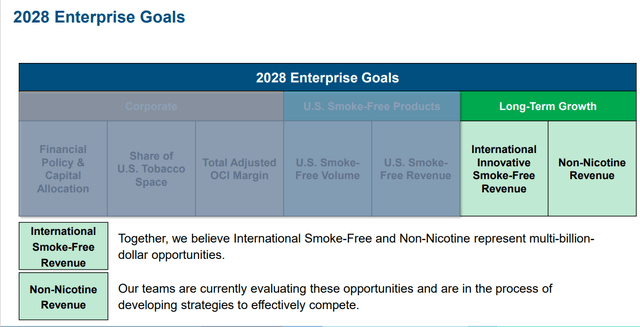

This presentation is a bit lackluster when it comes to specifics.

Management is basically saying, "Trust us, beyond 2028, we'll figure out a way to keep growing at a healthy rate."

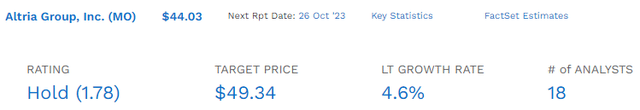

Eighteen analysts who study this company for a living and collectively know it better than anyone other than management think MO can keep growing around 5% long term.

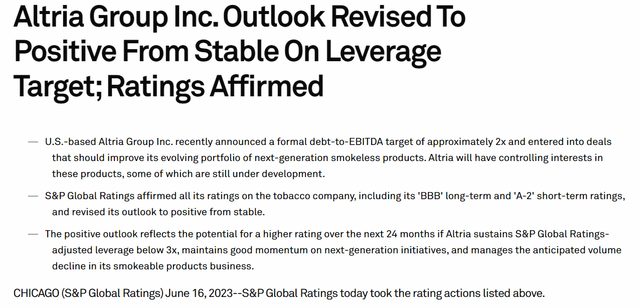

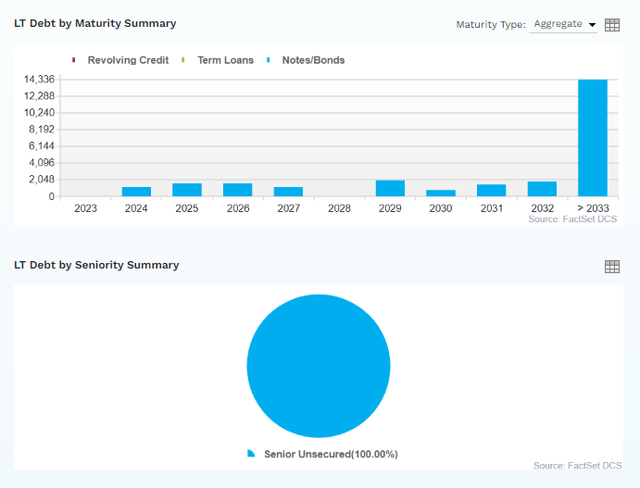

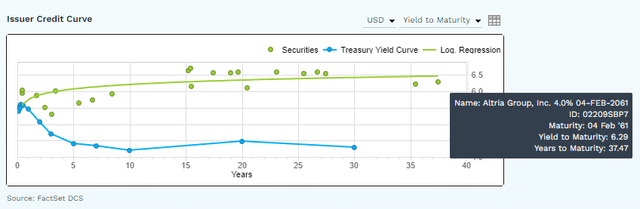

Rating agencies have noticed that MO has deleveraged and now has a 2X debt/EBITDA ratio, compared to the 3X they consider safe for the industry and consistent with an investment-grade credit rating.

What about the smart money? The bond market? It would be them if anyone is worried about MO's ability to survive long term and make good on its bonds.

Over 50% of MO's bonds mature beyond 2033. How far out do bond investors think MO will make good on its bond payments?

In 2021, when MO tried to sell 40-year bonds, the bond market was willing to accept a 4% interest rate.

With 10-year yields from 1% to over 4%, those same bonds trade at 6.3%.

- 10-year BBB-rated bonds trade at 6.0%.

So, the bond market thinks MO will still be around in 2061 and will pay its interest on time and in full.

And MO's 37.5-year bonds barely yield more than BBB-rated 10-year bonds.

And S&P thinks there is a 7.5% risk that MO will go under in the next 30 years.

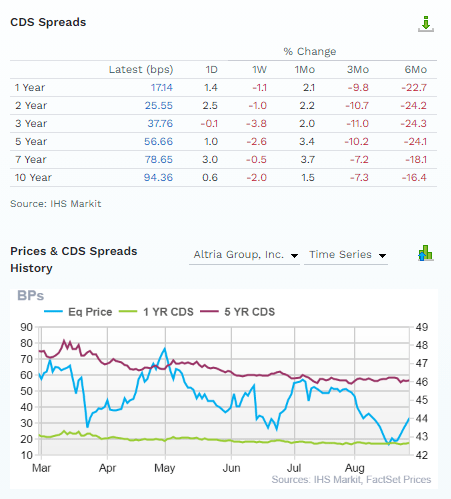

What does the bond market think?

FactSet Research Terminal

In the last six months, the bond market's estimate of MO's default risk in the next 1 to 10 years has dropped by 18% to 24%.

It's been falling steadily along with the price.

The smart money says MO is becoming slightly less risky over time.

The stock market disagrees.

Historically, when the stock market and bond market disagree, the bond market usually turns out correct.

So we have the stock market hating on MO despite:

- Sales are still growing

- earnings are growing (5% in the last quarter)

- Management says 4% to 6% growth

- rating agencies are getting more bullish

- Bond investors are getting more bullish.

Valuation: A Wonderful Company At A Wonderful Price

| Metric | Historical Fair Value Multiples (all-years) | 2022 | 2023 | 2024 | 2025 | 2026 | 12-Month Forward Fair Value |

| 5-year average yield | 7.32% | $48.09 | $51.37 | $51.37 | $58.33 | $58.47 | |

| Earnings | 13.98 | $64.45 | $70.60 | $73.67 | $77.31 | $78.29 | |

| Average | $55.08 | $59.47 | $60.53 | $66.49 | $66.94 | $60.18 | |

| Current Price | $43.96 | ||||||

Discount To Fair Value | 20.19% | 26.08% | 27.38% | 33.89% | 34.33% | 26.96% | |

Upside To Fair Value (Including Dividends) | 25.29% | 35.27% | 37.69% | 51.26% | 52.28% | 45.46% | |

| 2023 EPS | 2024 EPS | 2023 Weighted EPS | 2024 Weighted EPS | 12-Month Forward EPS | 12-Month Average Fair Value Forward PE | Current Forward PE | Current Forward Cash-Adjusted PE |

| $5.05 | $5.27 | $1.65 | $3.55 | $5.20 | 12.9 | 8.5 | 8.3 |

MO is trading at 8.3X cash-adjusted earnings, an anti-bubble valuation pricing in -0.4% growth.

It's growing 4% to 6%.

| Rating | Margin Of Safety For Medium-Risk 13/13 Ultra SWAN Quality Dividend King | 2023 Fair Value Price | 2024 Fair Value Price | 12-Month Forward Fair Value |

| Potentially Reasonable Buy | 0% | $59.47 | $60.53 | $60.18 |

| Potentially Good Buy | 5% | $56.49 | $57.50 | $57.17 |

| Potentially Strong Buy | 15% | $50.55 | $51.45 | $51.15 |

| Potentially Very Strong Buy | 25% | $42.37 | $45.40 | $45.14 |

| Potentially Ultra-Value Buy | 35% | $38.65 | $39.34 | $39.12 |

| Currently | $43.97 | 26.06% | 27.36% | 26.94% |

| Upside To Fair Value (Including Dividends) | 44.16% | 46.58% | 45.78% |

Altria is a potentially very strong buy for anyone comfortable with its risk profile because of return potential like this.

Altria 2025 Consensus Total Return Potential

Risk Profile: Why Altria Isn't Right For Everyone

There are no risk-free companies, and no company is right for everyone. You have to be comfortable with the fundamental risk profile.

MO's Risk Profile Summary

Investors in tobacco companies should have the stomach for fat-tail risk, particularly those holding shares in a single-market pure play like Altria. Overall, we believe the risk of a significant adverse event is lower than it was one or two decades ago, but the shifting sands of regulation have created some new risks to Altria's business model in recent years and our uncertainty rating is medium.

Litigation risk still remains, but adverse judgments have been manageable recently. While it is almost impossible to forecast the magnitude of any awards against the tobacco industry, we expect payouts to be within Altria's annual free cash flow.

The FDA regulates the tobacco industry in the U.S. The recent ban on flavored nicotine liquids demonstrates the FDA is willing to take significant steps to prevent the uptake of nicotine products by new consumers. The menthol cigarette category has had the sword of Damocles hanging over it for several years, although prohibition is yet to come to fruition. We estimate that 20% of Altria's revenue and operating profit is generated in the menthol category, although it is likely that most menthol volume would switch to non-menthol in the event of a ban. The potential for limits on the nicotine levels in cigarettes is a relatively new risk, with the FDA announcing in the summer of 2017 that it will investigate the potential for nicotine control. We do not believe such controls are a foregone conclusion, however, because it could have unforeseen consequences such as increasing cigarette volumes.

The social impact of tobacco products is rated as a severe risk in Sustainalytics' ESG risk rating of Altria. We assume a mid-single-digit volume decline rate in the cigarette industry, but we flex this assumption in our scenario analysis to reflect the risk that the decline rate could accelerate. Although the externalities of smoking have largely been internalized, the risk remains of increased taxation and/or operating costs."- Morningstar (emphasis added).

MO's Risk Profile Includes

- regulatory risk (plain packaging laws, menthol ban, nicotine level regulation, reduced risk product taxation)

- Smoke-free transition execution #1 risk; the whole ball game

- Margin compression risk: RRPs could have lower margins than legacy products

- M&A execution risk (Juul and Cronos investments thus far have not gone well)

- labor retention risk (tightest job market in over 50 years).

One of MO's biggest risks is that it doesn't scale up reduced-risk product sales as quickly as its peers.

- PM plans 50% of sales from RRPs by 2025

- Analysts expect just 14% from MO.

MO also has to contend that the FDA plans to lower nicotine in cigarettes to non-addictive levels and ban menthol.

- BTI thinks this will take until 2027 to be implemented.

In other words, MO needs to accelerate its RRP plans quickly, and there is no guarantee that its new RRP sales will be anywhere as profitable as its legacy business.

The potential for the FDA to mandate a reduction in nicotine in cigarettes to non-addictive levels is a low-probability but high-impact risk that--if successful--is likely a decade away due to the sweeping magnitude of such an initiative...

Altria's track record of developing and launching new products organically has been poor, specifically with respect to Mark Ten e-cigarettes, which were shuttered in 2018 about the time Altria paid $12.8 billion to purchase a minority stake in JUUL...

Even if the recent next-generation product initiatives turn out to be marketing successes, it remains to be seen whether they will achieve near 60% operating company income margins (as is the case today with Altria's mature, market-leading cigarette and moist smokeless tobacco brands). This is because it's unlikely Altria will have the dominance in these categories that it has today in cigarettes and moist smokeless tobacco (both near 50% market shares). Younger nicotine users may also be less brand loyal. " - S&P (emphasis added).

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Long-Term Risk Management Analysis: How Large Institutions Measure Total Risk Management

DK uses S&P Global's global long-term risk-management ratings for our risk rating.

- S&P has spent over 20 years perfecting its risk model

- which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

- 50% of metrics are industry-specific

- This risk rating has been included in every credit rating for decades.

The DK risk rating is based on the global percentile of a company's risk management compared to 8,000 S&P-rated companies covering 90% of the world's market cap.

MO scores 45th Percentile On Global Long-Term Risk Management

S&P's risk management scores factor in things like:

- supply chain management

- crisis management

- cyber-security

- privacy protection

- efficiency

- R&D efficiency

- innovation management

- labor relations

- talent retention

- worker training/skills improvement

- occupational health & safety

- customer relationship management

- business ethics

- climate strategy adaptation

- sustainable agricultural practices

- corporate governance

- brand management.

MO's Long-Term Risk Management Is The 344th Best In The Master List 31st Percentile In The Master List)

| Classification | S&P LT Risk-Management Global Percentile | Risk-Management Interpretation | Risk-Management Rating |

| BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL | 100 | Exceptional (Top 80 companies in the world) | Very Low Risk |

| Strong ESG Stocks | 86 | Very Good | Very Low Risk |

| Foreign Dividend Stocks | 77 | Good, Bordering On Very Good | Low Risk |

| Ultra SWANs | 74 | Good | Low Risk |

| Dividend Aristocrats | 67 | Above-Average (Bordering On Good) | Low Risk |

| Low Volatility Stocks | 65 | Above-Average | Low Risk |

| Master List average | 61 | Above-Average | Low Risk |

| Dividend Kings | 60 | Above-Average | Low Risk |

| Hyper-Growth stocks | 59 | Average, Bordering On Above-Average | Medium Risk |

| Dividend Champions | 55 | Average | Medium Risk |

| Altria | 45 | Average | Medium Risk |

| Monthly Dividend Stocks | 41 | Average | Medium Risk |

(Source: DK Research Terminal.)

MO's risk-management consensus is in the bottom 31% of the world's best blue chips and is similar to:

- Exxon Mobil (XOM): blue-chip aristocrat

- General Dynamics (GD): Super SWAN dividend aristocrat

- Honeywell (HON): Ultra SWAN

- Costco (COST): Ultra SWAN

- Leggett & Platt (LEG): blue-chip dividend king.

The bottom line is that all companies have risks, and MO is average at managing theirs, according to S&P.

How We Monitor MO's Risk Profile

- 18 analysts

- Three credit rating agencies

- 21 experts who collectively know this business better than anyone other than management

- the bond market for real-time fundamental risk assessment.

When the facts change, I change my mind. What do you do, sir?" - John Maynard Keynes.

There are no sacred cows at iREIT or Dividend Kings. Wherever the fundamentals lead, we always follow. That's the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

Bottom Line: Altria Is A 9% Yielding Rich Retirement Dream Machine

I'm sure the comments will be full of people screaming at each other and calling each other names. I'm sure people will ignore the introduction and say, "MO has been dead money for six years, so you're wrong."

Anyone who paid a 50% premium for MO in 2017 deserved to suffer for years.

Anyone who bought it when it became undervalued deserved to make money and has.

The First People To Buy MO At Fair Value Didn't Lose Money

The First People To Buy MO At A 15% Discount (Strong Buy Price) Made Money Even Adjusted For Inflation

The First People To Buy MO At A 25% Discount (Very Strong Buy Price) Made Double Digit Returns

The First People To Buy MO At A 35% Discount (Ultra Value Buy Price) Made 16% Annual Returns

Are you someone who worries that MO is a value trap because it is still down since its 2017 75% bubble high?

- 3.1% CAGR sales growth since then

- 9.5% CAGR EPS growth since then

- 9.7% CAGR dividend growth since then.

A value trap is something in which the fundamentals deteriorate along with price.

If sales, earnings, and dividends are all growing, investors have no reason to be upset. If fundamentals are going up and the price is falling, it either

- The stock was in a bubble (and your losses are your fault)

- The stock is now undervalued and a potentially wonderful buy.

While far from a perfect ultra-yield aristocrat, I just showed you why MO is a potentially rich retirement dream machine.

One the bond market is confident will be around four decades from now, and which has 13% to 14% long-term return potential that the S&P and even the Nasdaq have very little chance of keeping up with.

All while you enjoy the 2nd safest 9% yield on Wall Street.

----------------------------------------------------------------------------------------

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

Access to our 13 model portfolios (all of which are beating the market in this correction)

my correction watchlist

- my family's Charity hedge fund

50% discount to iREIT (our REIT-focused sister service)

real-time chatroom support

real-time email notifications of all my retirement portfolio buys

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.

This article was written by

Adam Galas is a co-founder of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 5,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha).

I'm a proud Army veteran and have seven years of experience as an analyst/investment writer for Dividend Kings, iREIT, The Intelligent Dividend Investor, The Motley Fool, Simply Safe Dividends, Seeking Alpha, and the Adam Mesh Trading Group. I'm proud to be one of the founders of The Dividend Kings, joining forces with Brad Thomas, Chuck Carnevale, and other leading income writers to offer the best premium service on Seeking Alpha's Market Place.

My goal is to help all people learn how to harness the awesome power of dividend growth investing to achieve their financial dreams and enrich their lives.

With 24 years of investing experience, I've learned what works and more importantly, what doesn't, when it comes to building long-term wealth and safe and dependable income streams in all economic and market conditions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I own MO via ETFs.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (8)

An investment in MO boils down to a bet that enough people will get/remain addicted to its products, not that many will die from their products, and they can keep increasing their prices as it’s unlikely the unit sales will increase. That sums up the whole strategy.