MGK: Potentially From First To Worst

Summary

- Large-cap growth stocks are vulnerable and may experience a correction, particularly in the technology sector.

- Vanguard Mega Cap Growth Index Fund ETF Shares has seen strong performance, but momentum may have peaked.

- The MGK ETF has a high concentration in technology stocks, which poses a risk in the event of a downturn in the sector.

- Looking for a helping hand in the market? Members of The Lead-Lag Report get exclusive ideas and guidance to navigate any climate. Learn More »

eAlisa

The pressure to perform is actually a privilege. Being left out of the starting rotation is a sign you must work harder. - Julie Foudy.

I continue to sound the alarm on conditions that favor a credit event, potentially beginning next month in September. For all the talk around it being a "new bull market," the reality is that a rising tide has not lifted all boats. The only boat that really has risen is the largest of all, and that's exactly why large-cap growth is very vulnerable in my opinion.

The issue is that it's been a story of just a select number of large-cap tech names that are leading, while everything else is lagging. The Vanguard Mega Cap Growth Index Fund ETF Shares (NYSEARCA:MGK) is an exchange-traded fund, or ETF, that aims to track the performance of the CRSP US Mega Cap Growth Index. This index represents the growth companies of the CRSP US Mega Cap Index, which includes approximately the top 70% of companies in the U.S. equity market. MGK offers diversified exposure to the largest growth stocks in the U.S. market and employs a passively managed, full-replication approach.

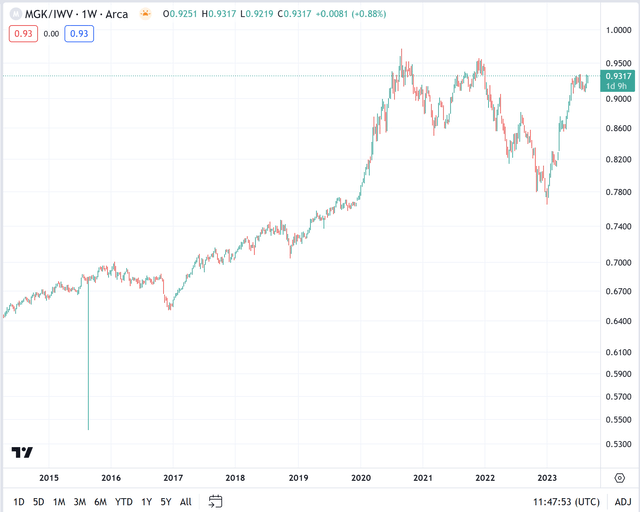

It's clearly worked. But if we look MGK divided by the iShares Russell 3000 ETF (IWV), we can see momentum on a relative basis may finally have peaked.

MGK's Top Holdings

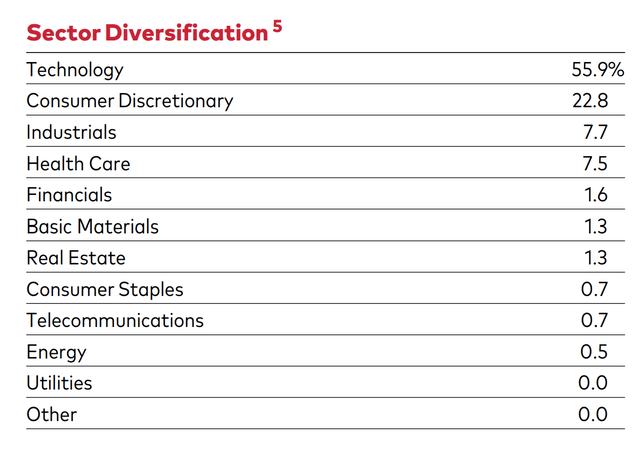

The holdings of an ETF provide insights into its investment strategy and potential performance. As of June 30, 2023, MGK held 96 stocks, with technology having a 55.9% allocation on a sectoral basis. The ten largest holdings of MGK accounted for 62.5% of its total net assets. These include:

- Apple Inc. (16.2%)

- Microsoft Corp. (14.1%)

- Alphabet Inc. (7.3%)

- Amazon.com Inc. (6.3%)

- NVIDIA Corp. (5.0%)

- Tesla Inc. (3.9%)

- Meta Platforms Inc. (3.5%)

- Eli Lilly & Co. (2.2%)

- Visa Inc. (2.1%)

- Mastercard Inc. (1.9%)

These companies are industry leaders with strong global brands, robust market positions, impressive records of innovation, and significant positions in Artificial Intelligence ("AI"). They also boast strong balance sheets with large cash positions and generate robust free cash flow. Having said that, they are also the most crowded parts of the marketplace.

MGK vs. Peers: A Comparative Analysis

Let's face it - there are tons of large-cap growth ETFs. Some of the close peers to MGK include the Schwab U.S. Large-Cap Growth ETF (SCHG), Invesco QQQ Trust (QQQ), and Vanguard S&P 500 Growth ETF (VOOG). All these funds have largely performed the same over the long term. It's worth mentioning here that when it comes to expense ratios, MGK scores well with a low expense ratio of just 0.07%, which is significantly lower than the average expense ratio of 0.96% for large-cap growth funds. This low expense ratio means that a larger portion of the investment returns goes to the investors rather than being spent on fund management expenses.

Risk Factors and Investment Considerations

The problem I have here is more a function of timing and concentration risk. More than 55% of the Vanguard Mega Cap Growth Index Fund ETF Shares is Technology.

Maybe this is a feature and not a bug, but it is undeniable that it's a concentration risk for the fund. Any downturn in the technology sector can significantly impact the performance of MGK. Furthermore, investors should also consider the valuation of the ETF. As of June 30, 2023, MGK was trading at a price-to-earnings (P/E) ratio of 38.5x and a price-to-book (P/B) ratio of 10.0x. These figures are relatively high, indicating that the ETF may be overvalued, and meaningfully so.

Final Thoughts

I just don't think Vanguard Mega Cap Growth Index Fund ETF Shares is worth allocating to here. Stocks broadly look vulnerable to a correction, with Technology likely taking the biggest hit just given how well it's performed so well. Value has gotten destroyed by Growth, but that could change in the very near future.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.