C3.ai: High-Risk, High-Reward With A Possible Short-Squeeze

Summary

- C3.ai stock has a 33% short interest, but underlying fundamentals are solid, with bright revenue growth prospects and a strong balance sheet.

- The company is still unprofitable, but I consider the management's path to turning profitable sound.

- AI stock is attractively valued despite a massive year-to-date rally, making it a high-risk, high-reward play for long-term investors.

imaginima

Investment thesis

C3.ai (NYSE:AI) stock is one of the most shorted, with a massive 33% short interest. At the same time, my analysis suggests that the underlying fundamentals are not that bad. Yes, the company is deeply unprofitable, but it is young and reinvests more than half of its sales in R&D. C3.ai possesses a strong balance sheet with a massive net cash position, meaning there is still vast room to continue reinvesting in its offerings improvement and marketing. Revenue growth has decelerated due to the challenging environment, but consensus estimates forecast a 32% revenue growth over the next decade. My valuation analysis suggests that the stock is still attractively valued despite a massive year-to-date rally. The stock is a "Buy" for long-term investors seeking a high-risk, high-reward play.

Company information

C3.ai is an Enterprise AI application software company offering its clients solutions to simplify and accelerate AI application development, deployment, and administration. The company's revenue consists primarily of subscriptions to services.

The company's fiscal year ends on April 30 with a sole operating segment. According to the latest 10-K report, AI generates about 20% of its revenue outside the U.S.

Financials

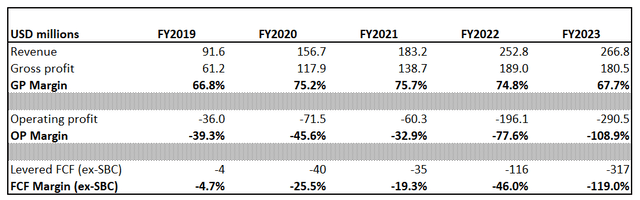

C3.ai went public in December 2020, so we have a short earnings history. Over the past five years, the company's revenue compounded at 31% per annum, which is impressive.

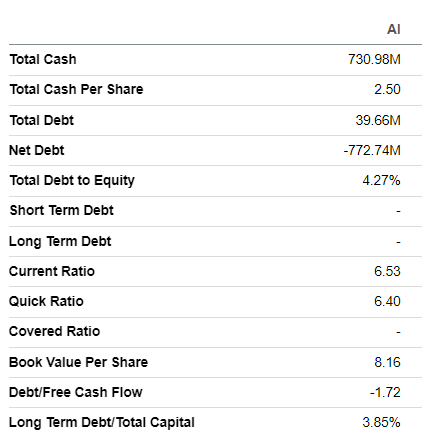

The gross margin is relatively high at about 70%, allowing the company to invest heavily in marketing and innovation. For example, in the last fiscal year, the company reinvested 79% of its revenues in R&D, and almost 98% of sales were spent on SG&A. That said, the company is still massively unprofitable from the operating margin perspective. However, I like that the management focuses on the long-term and invests substantial amounts in innovation. It is also important to underline that the company possesses substantial resources to continue reinvesting. AI has a solid $772 million net cash position with almost no leverage and high liquidity ratios. That said, the company is well-positioned to continue investing in marketing and its offerings improvement.

Seeking Alpha

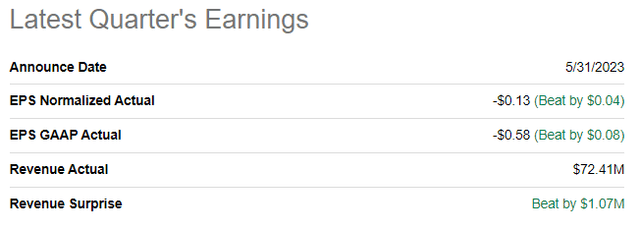

The latest quarterly earnings were released on May 31, when the company topped consensus estimates. Revenue was flat YoY, and the adjusted EPS has improved from -$0.21 to -$0.13. The gross margin decreased notably YoY by almost ten percentage points. The operating margin is still below -100%, with the company reinvesting heavily in the business growth. During the quarter, a net decrease in cash was $26 million, which looks insignificant compared to the accumulated net cash position.

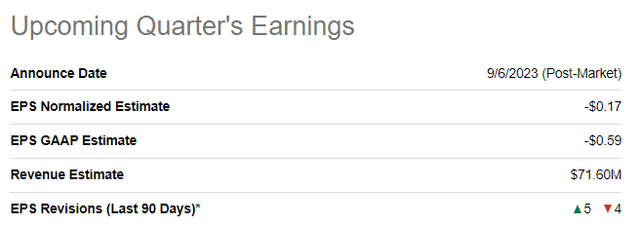

The upcoming quarter's earnings are scheduled for September 6. Quarterly revenue is expected by consensus at $71.6 million, indicating about a 10% YoY growth. On the other hand, the negative adjusted EPS is expected to widen YoY from -$0.12 to -$0.17.

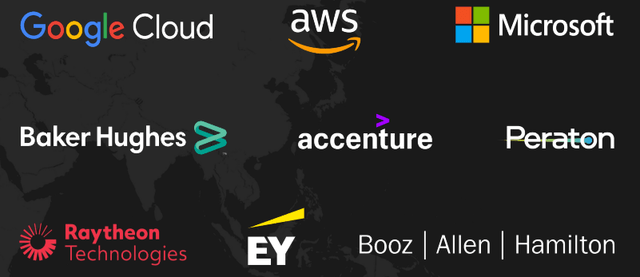

Now, let me look at the big picture. C3.ai operates in a hot artificial intelligence industry, which is expected to compound at 37% annually by 2030, which is a huge tailwind. While the AI field becomes increasingly competitive, it is crucial that there is no direct competition to the company's end-to-end Enterprise AI development platform suite. Strategic partnerships with the largest companies like Microsoft (MSFT), Google (GOOG), Amazon (AMZN), and many others say a lot to me.

From the latest C3.ai earnings presentation

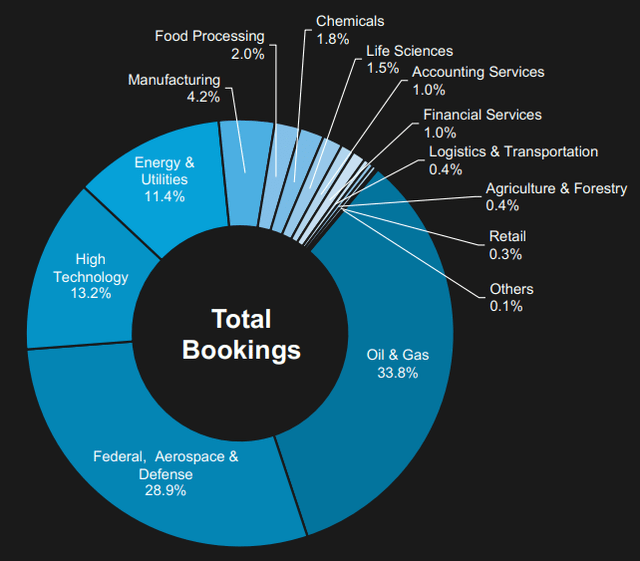

The company experiences strong momentum with attaining new customers. During the latest fiscal year, the company had 126 new agreements, which is a massive 52% YoY growth. New deals included oil and gas giants like Exxon Mobil (XOM) and Abu Dhabi National Oil Company [ADNOC]. I think that rapid customer acquisition is a solid bullish sign for the company because its diverse suite of applications means solid upselling and cross-selling opportunities. I would also like to underline that the company serves diverse industries, meaning its offerings are universal and have vast opportunities to penetrate all sectors of the U.S. economy.

From the latest C3.ai earnings presentation

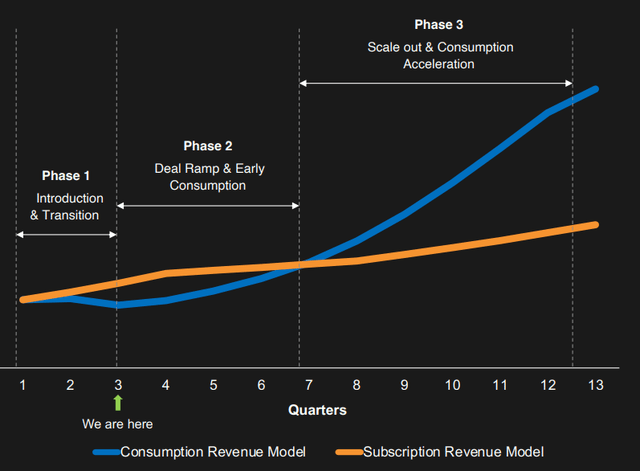

During the latest earnings call, the management emphasized its plans to turn non-GAAP profitable by Q4 of the fiscal 2024. It is also essential that the management expects to become consistently positive from the cash flow perspective starting this year, which means its substantial over $700 net cash position is safe and gives potential to fuel growth via acquisitions. This can also be a strong catalyst for the stock price. Given its solid cross-selling opportunities to expand contract values, I consider the management's vision of achieving profitability as sound as the company now focuses on the deal ramp.

From the latest C3.ai earnings presentation

The company plans to continue investing heavily in product development, meaning new applications and enhancements will likely be rolled out this year. This will improve the company's ability to cross-sell, which also would be a solid revenue growth driver.

Valuation

The stock significantly outperforms the broader market with a massive 183% year-to-date rally. Seeking Alpha Quant assigns the stock a relatively decent "C" valuation grade despite about 13 price-to-sales ratio, which is very high.

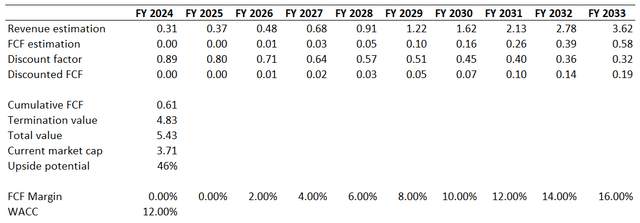

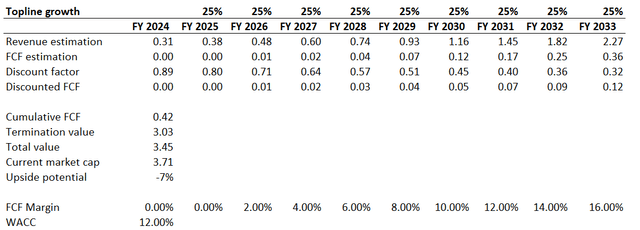

Looking at the discounted cash flow [DCF] simulations will help understand the valuation's fairness. Due to the company's short earnings history and high uncertainty regarding future cash flows, I use a 12% WACC for discounting. Revenue consensus estimates are optimistic, with a 32% CAGR over the next decade. I expect the company to start generating positive FCF in FY 2026 and expand it by two percentage points yearly.

With a 32% long-term revenue CAGR, the stock looks attractively valued with a 46% upside potential. However, I have to emphasize that the DCF model is susceptible to changes in the revenue growth rate. For example, if I use a 25% revenue CAGR for the next decade, there would be no upside potential. On the other hand, the downside potential is limited, too.

Risks to consider

As an aggressive growth company, C3.ai faces significant risks in delivering its ambitious revenue growth profile. A 32% revenue CAGR projected by consensus for the next decade is a challenging task to complete, even with secular tailwinds the AI industry faces. Investors should know that any signs of revenue growth slowdown and estimated downgrades will likely lead to a massive stock sell-off. The stock price is always at high risk during the earnings season. If the company's upcoming earnings next week disappoints, the stock price might demonstrate a double-digit intraday plunge. Therefore, potential investors should be prepared to tolerate massive short-term volatility.

The company is substantially unprofitable due to its significant spending on marketing and R&D. While I consider reinvesting in business growth and product innovation good, there is a high risk that these investments might not pay off in the future. There is still a very high level of uncertainty regarding the company's ability to achieve sustainable profitability. The stock is a high-risk investment, and its massive upside potential is comparable to substantial risks for investors.

Bottom line

The stock looks like an interesting high-risk, high-reward play for long-term investors. The company operates in a rapidly growing industry, which is expected to grow multiple fold by 2030, and its substantial R&D investments and strategic partnerships with giants like Amazon and Microsoft look promising to me. C3.ai possesses substantial financial resources to continue investing heavily in R&D and marketing, which is likely to be a good fuel for sustainable revenue growth. Of course, investing in an unprofitable company is highly risky, but I think the upside potential is worth it. The underlying fundamentals suggest that the massive 33% short interest in the stock is unfair, and I assign the stock a "Buy" rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)