CrowdStrike Earnings: Balancing Prospects And Investor Sentiment, What To Know

Summary

- CrowdStrike is a highly followed cybersecurity company with strong growth and profitability.

- Investors' expectations are high, so CRWD stock may not experience a significant boost unless it exceeds expectations.

- The Company's valuation is not too stretched, making it a potentially wise investment choice.

Sundry Photography

Investment Thesis

CrowdStrike (NASDAQ:CRWD) is a highly followed best-in-class cybersecurity company. It stands out for its strong growth and attractive profitability. And right away, in this first paragraph, we get into the crux of the argument.

CrowdStrike is so highly followed, that investors' expectations are extremely high. This means that unless CrowdStrike blows investors' expectations out of the water, the stock doesn't get a nice pop after hours.

That being said, its overall valuation of approximately 27x next year's free cash flow isn't too stretched. So, investors would do well to stick with this name.

Why CrowdStrike? Why Now?

More than a year on since the Russian invasion of Ukraine and it appears that most of the buzz that was expected to surface from the need for cybersecurity associated with geopolitical tensions has died off the sectors' narrative. Today, the narrative is focused on the need for increased cybersecurity in an increasingly digital world. Here's a quote from the earnings call highlighting this:

In an increasingly digital cloud-defined world, cybersecurity is becoming more important than ever. The SEC's recently enacted cybersecurity disclosure requirements substantiate the growing gravity of cybersecurity threats, elevating the category from an operational concern to an urgent Board level and CXO spend priority.

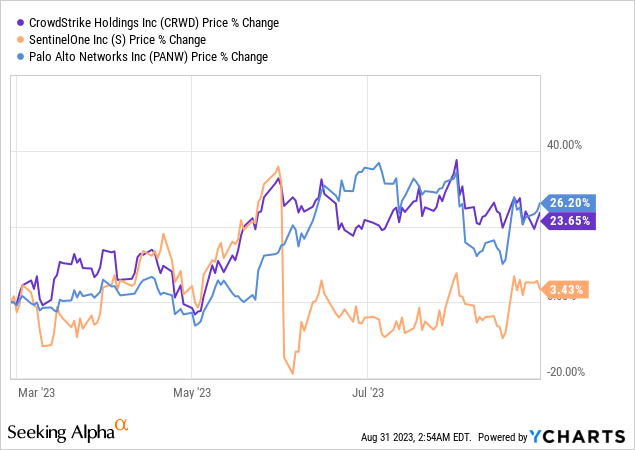

Moving on, this past year, the topic that has actually surfaced numerous time, both with Palo Alto Networks (PANW) (disclosure, I'm long PANW) and with CrowdStrike, is that there's a lot of vendor consolidation happening in the sector. Here's another quote from the earnings call:

Following remediation by CrowdStrike incident responders, this [financial] customer consolidated on the Falcon platform, adopting Falcon Complete, Falcon Identity Complete and Falcon Cloud Security Complete, displacing and consolidating four vendors in the process, Microsoft, SentinelOne, Arctic Wolf and Sophos.

Anyone on SA that follows my work in this sector should not be surprised to hear this sort of commentary coming from CrowdStrike.

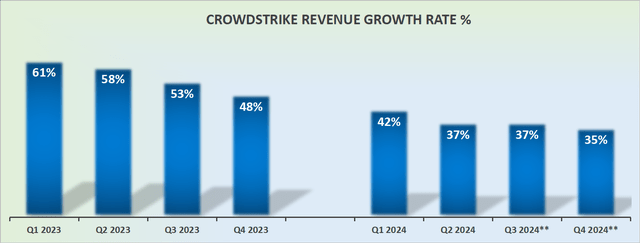

Revenue Growth Rates Continue to Tick Along

Two noteworthy insights stick out from the graphic above. In the first instance, CrowdStrike can still be counted on to deliver +35% CAGR into the end of its fiscal year.

Secondly, and more interesting, is that the comparable ease up in the second half of fiscal 2024. Leading one to believe there's still some room for CrowdStrike to later on upwards revise its revenue growth rates later.

On this topic, this is what CrowdStrike said in the Q&A section of the call:

We think they're best in class, as well as I think we're seeing strength from multiple aspects of the business, right, from either our enterprise or SMBs. We see strength in both. So that's why we get confidence in the second half.

In other words, CrowdStrike leads one to believe that it still has levers to pull to increase its revenue growth rates, while failing to provide investors with hard upward revised revenue figures.

Profitability Profile Moving Higher

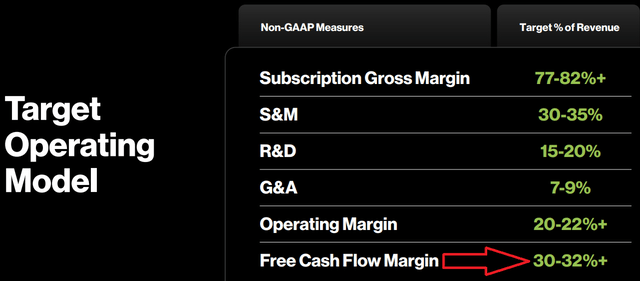

CrowdStrike is eager to keep bears at bay. Recall, bears have made the case that CrowdStrike's profitability gives up too much stock-based compensation. Case in point, during fiscal Q2 2024 we saw CrowdStrike's non-GAAP operating profit expand by 500 basis points to 21%.

However, on a GAAP basis, the business remains unprofitable. On the other hand, CrowdStrike can make the case that its clean GAAP profitability increased by 700 basis points, delivering even better results than its non-GAAP profitability. Even though its GAAP operating margins were in actuality negative 2%, this was a massive improvement from negative 9% in the same period a year ago.

What's more, CrowdStrike declares that looking ahead to the next calendar year, the business is expected to deliver somewhere around 30 to 32% free cash flow margins.

Consequently, investors can start to pencil in CrowdStrike reaching close to $1.3 billion of free cash flow. In other words, CrowdStrike is priced at around 27x next year's free cash flow. I won't argue that this is a total steal for CrowdStrike, as it clearly assumes that CrowdStrike can continue to deliver 30% CAGR for a good number of years, a feat that is undoubtedly challenging for any company.

On the other hand, keep in mind that CrowdStrike holds about $3 billion of liquid cash on its balance sheet. This means that not only is that more than enough cash for it to make a bolt-on acquisition, but given that CrowdStrike is clearly so profitable, it's possible for it to take on some debt onto its balance sheet to make a large significant acquisition.

In summary, the stock is reasonably attractive, although it must be said, that there's still a relatively high level of expectations baked into the share price. This means that CrowdStrike has a high bar to cross to meet and impress against investors' expectations.

The Bottom Line

As I delve into CrowdStrike, I can't help but feel a sense of uncertainty looming over the stock. It's undoubtedly a standout cybersecurity company, known for robust growth and appealing profitability. However, the catch is that it's so highly anticipated that meeting, let alone exceeding, those sky-high investor expectations is a daunting task. Unless CrowdStrike manages to truly dazzle, I fear it won't experience a significant stock boost.

On the bright side, its valuation doesn't seem excessively stretched, at roughly 27x next year's projected free cash flow. So, it might be wise to stick with CrowdStrike.

What's intriguing is the shift in the cybersecurity landscape. While geopolitical tensions aren't the primary focus anymore, the need for cybersecurity in our increasingly digital world has never been more evident. But here's the hitch: industry consolidation is in full swing, with companies like CrowdStrike taking the lead, which could either lead to even better growth or the pressure to meet heightened expectations.

Overall, I have to say that CrowdStrike is an attractive investment even if there's some lingering uncertainty about whether it can truly shine against these towering expectations.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

Our Investment Group is focused on value investing as part of the Great Energy Transition. For example, did you know that AI uses thousands of megawatt hours for even small computing tasks? Join our Investment Group and invest in stocks that participate in this future growth trend.

I provide regular updates to our stock picks. Plus we hold a weekly webinar and a hand-holding service for new and experienced investors. Further, Deep Value Returns has an active, vibrant, and kind community. Join our lively community!

We are focused on the confluence of the Decarbonization of energy, Digitalization with AI, and Deglobalization.

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

DEEP VALUE RETURNS: The only Investment Group with real performance. I provide a hand-holding service. Plus regular stock updates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Michael is long PANW.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.