Flowers Foods Stock: We Want To See More Than Just Price Hikes

Summary

- Flowers Foods reported Q2 results highlighted by price hikes driving revenue growth.

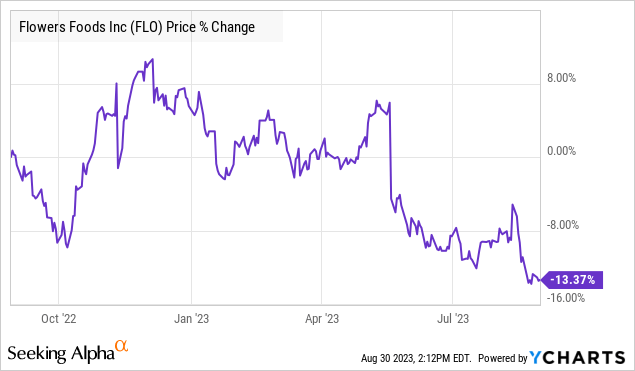

- Lower volumes and a drop in market share likely explain some of the recent stock price weakness.

- The company is fine, but we expect shares to remain volatile.

- Looking for more investing ideas like this one? Get them exclusively at Conviction Dossier. Learn More »

SDI Productions

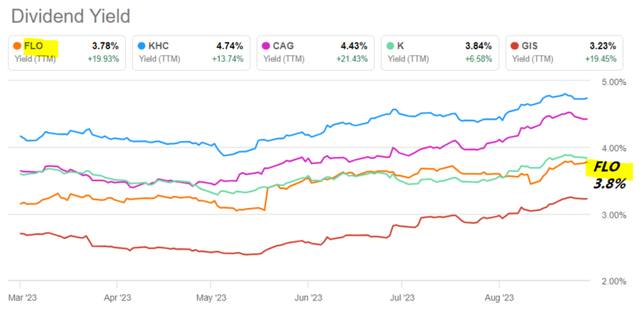

Flowers Foods Inc (NYSE:FLO) is a leading producer of packaged baked goods with a portfolio of bread brands like "Wonder", "Nature's Own", "Dave's Killer Bread", and "Canyon Bakehouse". There's a lot to like about the company with a long history of growth and solid financial execution. Shares yield 3.8% with FLO on an impressive 21-year streak of dividend growth.

At the same time, the stock has been under pressure, down more than 20% from its 2022 highs, amid some mixed results and areas of concern. In our view, even following the recent selloff, FLO remains pricey relative to packaged food peers and we're not convinced that the valuation premium is justified right now. We expect shares to remain volatile and see better value elsewhere in the segment.

FLO Q2 Earnings Recap

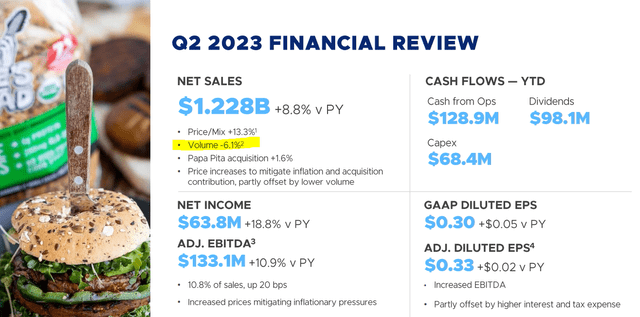

FLO reported its Q2 results on August 10th with EPS of 0.33, beating estimates by $0.05, and up from $0.31 in the period last year. Net sales of $1.2 billion, climbed by 8.8% year over year, also coming in ahead of estimates.

The headline figures appear strong, but they also deserve some context. Expectations were low coming into this report, following a particularly weak Q1 where management cited a "slow start to the year". By this measure, Q2 represented an improvement, but the trends are still below loftier expectations several quarters ago.

What we find is that the sales momentum in Q2 was driven by a 13.3% increase in pricing and sales mix along with a 1.6% boost from the company's "Papa Pita" acquisition. These steps helped cover a -6.1% decline in total volume which is more concerning in terms of the operating performance and explains some of the stock price weakness.

The adjusted EBITDA margin of 10.8% climbed by 20 basis points from 10.6% in Q2 2022, again propelled by the price increases, but this metric is also down from levels above 12% back in 2021. The takeaway for us is that the company is running at a lower gear compared to its peak.

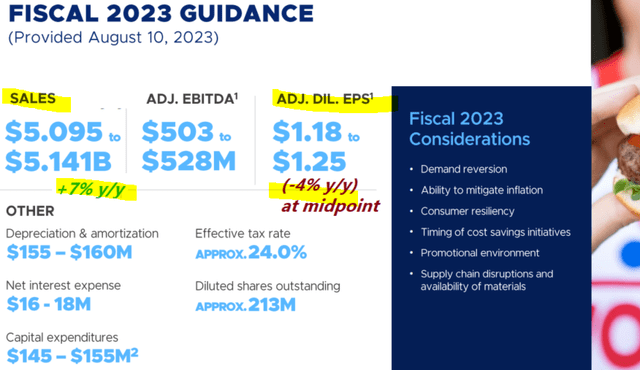

Looking ahead, management is guiding for full-year 2023 sales of around $5.12 billion, representing a 7% increase over 2022. An adjusted diluted EPS target between $1.18 and $1.25, if confirmed at the midpoint, represents a decrease of -4% compared to last year.

What's Next For FLO?

Flowers Foods intends to continue expanding distribution nationally while also seeking opportunities for direct store deliveries, which essentially bypasses distributors.

A theme for the company is a push toward "premiumization" which means shifting its portfolio to focus on more value-added brands in support of margins. During the earnings conference call, management maintained optimism for stronger conditions over the long run.

The efforts here are intended to sustain long-term growth in the low-single digits annually as an announced target, while earnings can trend higher through firm margins.

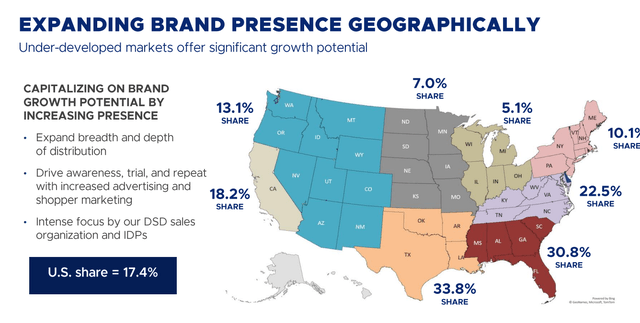

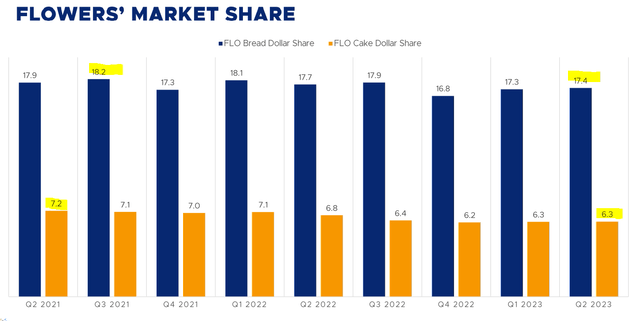

The company last reported a U.S. market share of 17.4% in the bread category, along with 6.3% in cake. The idea here is that from a strong brand presence in the South including a +30% market share across states like Texas and Florida, other regions like the Northeast and Midwest are still under-development, representing a "significant growth opportunity.

Unfortunately, it appears that the trends in recent years have simply gone in the wrong direction. The chart that stands out to us is the data suggesting that the same bread dollar market share of 17.4% has declined over the past two years, from a high of 18.2% in 2021.

The company simply hasn't made progress in addressing that apparent under-penetration in key regions. This raises questions about the brand momentum and competitive landscape.

One explanation here is that Flowers' higher pricing initiatives, which were so critical to supporting earnings this last quarter, have also pushed away a portion price-conscious consumers evidenced by the volume decline.

The argument we make is that higher pricing as a strategy and form of financial engineering can only go so far, while we'd like to see stronger volumes as a more important indicator of the health of the business.

The reason we bring this up is that efforts to reclaim market share through promotions or more generalized price cuts could adversely hit margins. In our view, the setup here is for headwinds that could open the door for weaker-than-expected results going forward.

According to consensus estimates, the forecast is for revenue growth to normalize around 3% by next year and for 2025. On the earnings side, EPS growth is expected to rebound by a stronger 7% EPS rebound in 2024 and remain in the 6% range in 2025.

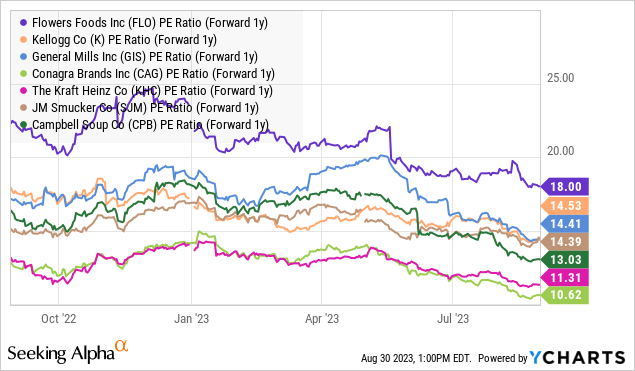

While these figures are certainly achievable, we wouldn't call them exceptional, particularly for a stock trading at a forward P/E of 19x.

In terms of valuation, we mentioned that FLO appears pricey. Even considering the 1-year forward P/E of 18x based on the stronger 2024 EPS estimate, the stock remains at a large premium next to consumer staples and packaged foods leaders like Kellogg Co (K), General Mills Inc (GIS), The Kraft Heinz Co (KHC), Campbell Soup Co (CPB), and Conagra Brands Inc (CAG) which as a group trade at a lower average multiple closer to 14x.

While Flowers Foods' dividend yield of 3.8% is solid and well supported by underlying cash flows, investors focused on income can find a higher payout with names like KHC and CAG yielding closer to 4.5%.

FLO Stock Price Forecast

FLO doesn't quite make the cut as a growth stock, and it falls short of being a big value play in our opinion. On the other hand, given the steep selloff this year, we'd also say some of its headwinds have already been priced in. By this measure, we rate FLO as a hold considering the near-term downside is likely limited but we'll want to see more before taking a bullish position. Our price target for the year ahead is $25.00, a level we believe reflects fair value.

While packaged foods and consumer staples are generally recognized as defensive or counter-cyclical segments, Flowers Foods remains exposed to shifting macro conditions. The risk here is that weaker economic growth pressures demand and forces a reassessment of the earnings outlook.

On the upside, it will be important for volumes to at least stabilize over the next few quarters. The market share and margin trends are also key monitoring points.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.

This article was written by

15 years of professional experience in capital markets and investment management at major financial institutions.

Check out our private marketplace newsletter service *Conviction Dossier* for curated trade ideas.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.