Beating The Market With Just 5 REITs

Summary

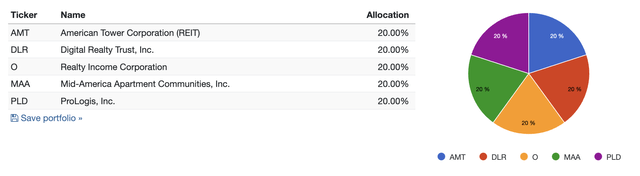

- We discuss a diversified basket of five REITs that have historically outperformed the market and exhibited subdued volatility.

- These five REITs include cell tower, data center, retail, apartment, and industrial assets.

- The basket has delivered a higher annual return (13.9%) compared to the S&P 500 (9.5%) and the Vanguard Real Estate (6.7%), while also having lower volatility.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

tadamichi

This article was co-produced with Leo Nelissen.

In this article, I'll do things a bit differently. We're not going to discuss a single stock or a sector, but a mix of five unique REITs that come with two benefits - at least historically speaking.

These benefits are market outperformance and subdued volatility. We can also add steadily rising income to make it three major benefits.

Last week, I watched Brad's interview with the Schwab Network, which discussed the power of REITs. Among a wide range of other things, Brad highlighted a number of attractive REIT sectors, including cell towers, retail, and data centers.

This gave me the idea to put some of these favorite REITs into a well-diversified basket to prove that investors can, with limited effort:

- Beat the market on a consistent basis.

- Erase unnecessary volatility.

- Generate steadily rising income.

So, without further ado, let's dive right in!

The Perfect Mini ETF To Beat The Market

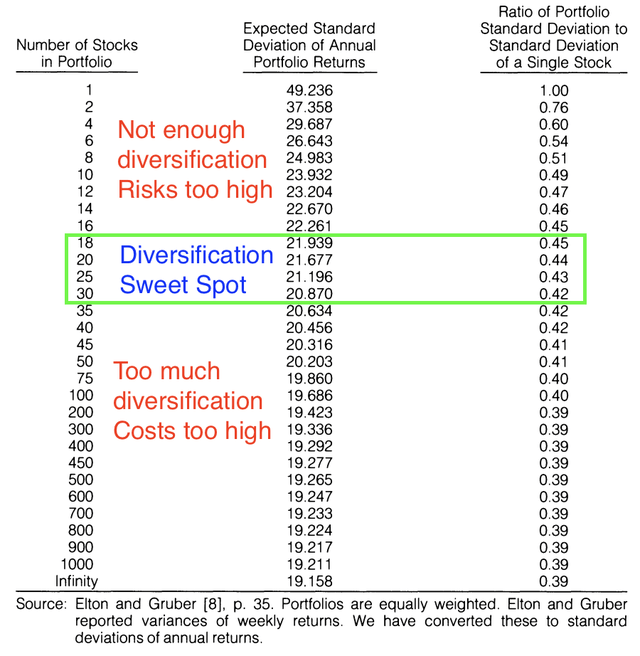

I'm not writing this article to get you to buy just five REITs. After all, we can assume that it takes a lot more to be diversified.

For example, in 1987, Meir Statman wrote a scientific article that showed that the perfect diversification is somewhere between 18 and 30 stocks.

Essentially, at a certain point, adding more investments doesn't have a significant impact on diversification anymore. To give you an example, going from four to five stocks is a much bigger move than going from 100 to 101 stocks.

Meir Statman, 1987

So, when I show you a five-stock portfolio, I'm not making the case that it's enough.

However, I'm showing that it's possible with minimal effort to beat the market with subdued volatility while benefiting from a consistently rising dividend.

And isn't that what we're all trying to achieve with our portfolios?

What's so fun about real estate is that investors can buy a physical part of almost every economic sector. Investors can buy retail properties, casinos, data centers, cell towers, self-storage, and so much more.

In this article, I picked five different stocks, each among the leaders in its industry. All of these stocks have healthy balance sheets as well.

Name | Type | Dividend Yield | Dividend 5Y CAGR | Credit Rating | Our Rating |

American Tower Corp. | Cell Tower | 3.5% | 16.4% | BBB+ | Strong Buy |

Digital Realty | Data Centers | 3.9% | 5.7% | BBB | Buy |

Realty Income | Retail | 5.5% | 3.7% | A- | Buy |

Mid-America Apartment Communities | Multifamily Apartments | 3.9% | 8.4% | A- | Buy |

Prologis | Industrial | 2.8% | 12.5% | A | Buy |

- Average dividend yield: 3.9%.

- Weighted average dividend growth rate: 8.6%.

In other words, we're dealing with five sectors that cover a huge part of the economy.

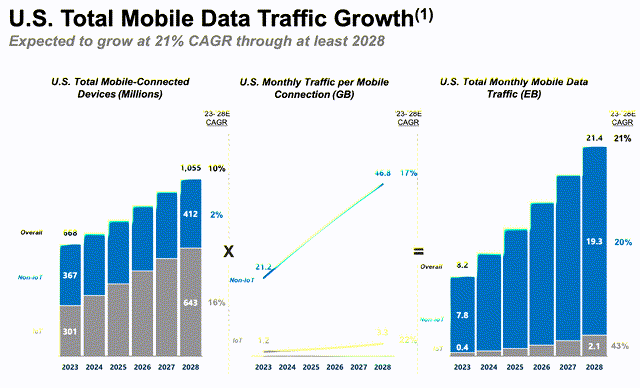

Cell towers cover our increasing data needs. As we discussed in a recent article, auctions for ultra-fast gigabit connectivity spectrum by the Federal Communications Commission ("FCC") will continue to drive demand for tower space.

For example, Verizon's aggressive deployment of C-band spectrum, AT&T's upcoming plans, and T-Mobile's and DISH's continued installation efforts contribute to this growth.

With American Tower Corporation (AMT), you're essentially buying the biggest owner of infrastructure that connects individuals and businesses in an increasingly digitalized world. These businesses also have business models that can easily be leveraged, as up to three (or more) tenants can use one cell tower.

For example, as most costs are fixed, American Tower has a 3% return on investment with one tenant on a cell tower. That number rises to 13% with two tenants and 24% with two tenants.

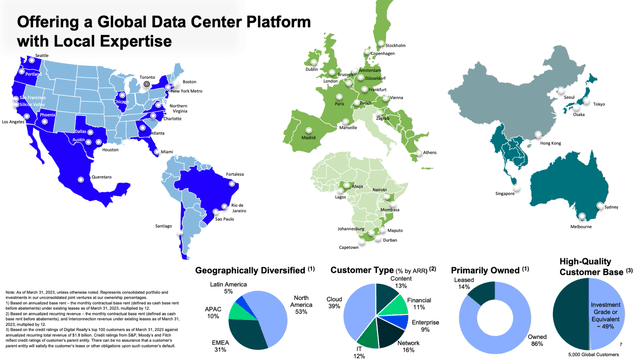

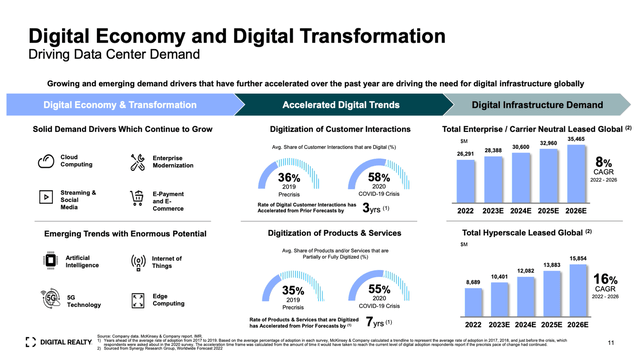

Digital Realty (DLR) is similar. While it doesn't own cell towers, it owns data centers, the very heart of the ongoing AI revolution and the core of tech trends like cloud computing.

DLR owns more than 300 data centers, servicing roughly 5,000 customers across the globe.

The company benefits from strong demand driven by cloud computing, streaming (like YouTube), e-commerce, artificial intelligence, and everything related to the Internet of Things, which means connecting everything through high-speed Internet.

Among its clients are the largest tech companies in the world, communication providers, and banks like JPMorgan (JPM).

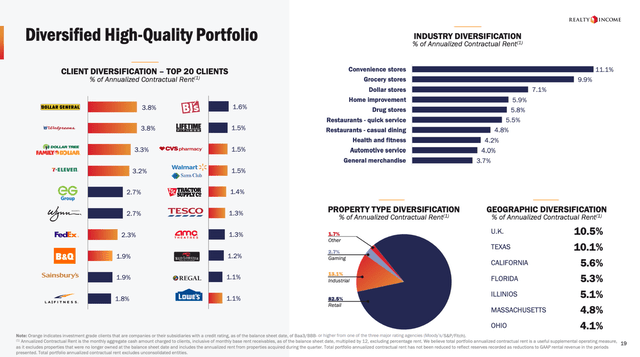

Next on the list is Realty Income (O), which allows investors to buy diversified retail properties.

This company owns more than 13,000 commercial real estate properties after being more than 50 years in business. The company has hiked its dividend for more than 29 consecutive years and a triple-net-lease model.

Even better, most of its properties have tenants operating in non-cyclical industries. This includes convenience stores, grocery stores, and dollar stores.

Its largest tenants are Dollar General (DG), Walgreens (WBA), Dollar Tree (DLTR), and 7-Eleven.

Now, the company also is getting into gaming and industrial properties as the high-rate environment makes sale-leaseback deals attractive. This is a deal where a company sells its property to Realty Income. It receives a large sum in return for regular rent payments. It's like a loan, just different.

In other words, while elevated rates and weakening economic growth aren't helping, the strongest players, like Realty Income, continue to be in a good spot.

Another major part of the economy we need to cover is apartments. After covering connectivity/technology/retail, we want to buy the houses people live in.

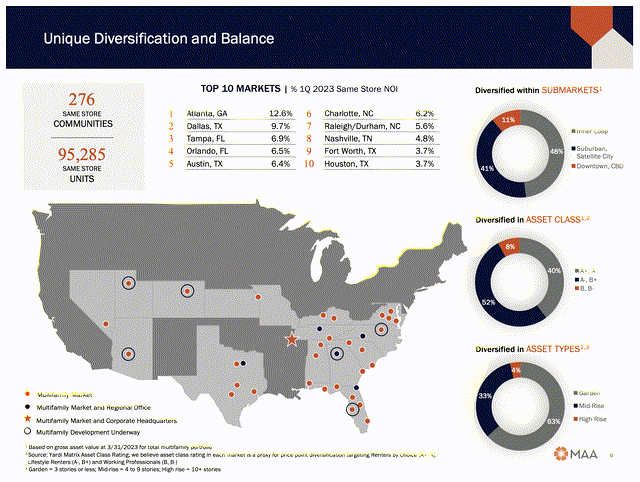

We can do this by buying Mid-America Apartment Communities (MAA), a player that owns close to 280 communities, covering more than 95,000 apartments in the Sunbelt. Even better, it has zero exposure in California, which means it benefits even more from the migration to non-CA Sunbelt states.

Mid-America Apartment Communities

With an A- credit rating, the company stands for stability, not only because of its anti-cyclical portfolio but also because it has kept its dividend consistent during the Great Financial Crisis.

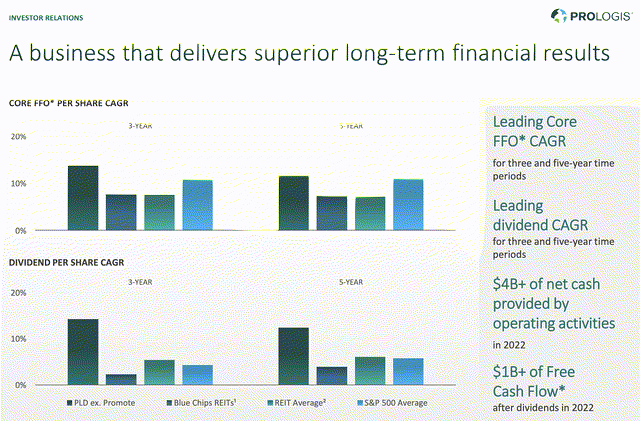

Last but not least, Prologis (PLD) provides industrial assets. In other words, we not only buy the places where people live but also the places they work - to complete our REIT puzzle.

PLD doesn't just own random industrial buildings. It owns a wide range of highly innovative properties that cater to the world's biggest transportation/logistics, retailers, manufacturers, and wholesalers.

Prologis

Moreover, while industrial demand is often cyclical, the company has only 28% exposure to cyclical demand. Other demand is non-cyclical, like basic needs or benefiting from secular growth like e-commerce, healthcare, and transportation.

This company, with an A-rated balance sheet, has exposure in the U.S., South America, Europe, and Asia, where it offers buildings that help customers achieve their climate goals. This adds to its appeal and lowers competition risks.

As a result, PLD has been a massive outperformer when it comes to funds from operations and dividend growth.

With all of this in mind, let's take a look at the performance.

Beating The Market With Subdued Volatility

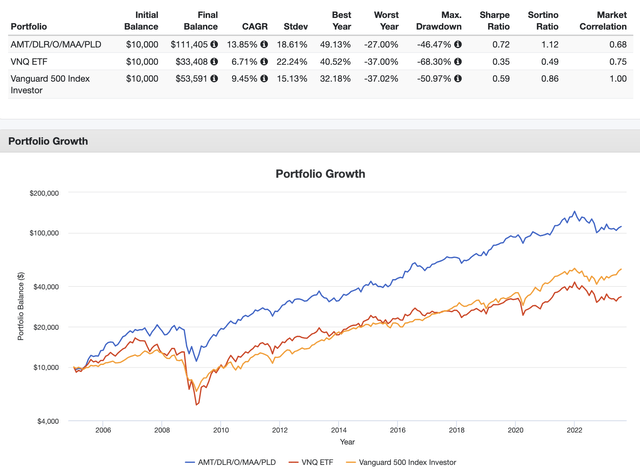

Going back since Dec. 31, 2004, an equal-weight basket of the aforementioned five stocks has returned 13.9% per year. This includes dividends.

During this period, the S&P 500 has returned 9.5%. The Vanguard Real Estate ETF (VNQ) has returned just 6.7%.

Simply put, our basket is performing significantly better than expected.

But wait, it gets better.

During this period, the five-stock basket had a standard deviation (volatility) of 18.6%. While the S&P 500 had a lower standard deviation of 15.1% (it has way more diversification), the VNQ ETF had a standard deviation of 22.2%.

In other words, by buying five diversified REITs, we beat an even more diversified ETF!

Our basket also had a lower market correlation of only 68%.

Here's an overview of these numbers and the stock price performance:

On top of that, it needs to be said that this portfolio has a very consistent performance.

- While the mini-ETF underperformed VNQ over the past three years, it outperformed using any other interval since 2004 - with highly favorable volatility.

- Despite the S&P 500's huge benefit from its technology exposure, the ETF has managed to keep up and even beat the S&P 500 over the past 10 years.

Based on this context, investors who buy these five quality REITs get:

- A yield close to 4%.

- A weighted average annual dividend growth rate in the high-single-digit range.

- Diversification.

- Potential outperformance.

- A low-volatility profile.

As I already said, the goal isn't to get anyone to buy these five REITs. The goal is to show that investors can achieve superior returns by focusing on a few high-quality REITs that provide diversification, income, and consistently rising capital gains.

Going forward, I'll dive into more model portfolios, covering various needs, including higher-income, growth-focused, and thematic portfolios.

Note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Sign Up For A FREE 2-Week Trial

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Builders, Asset Managers, and we added Prop Tech SPACs to the lineup.

We recently added an all-new Ratings Tracker called iREIT Buy Zone to help members screen for value. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 168,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 110,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College, and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMT, O, PLD, MAA, DLR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)