Takeda: Innovative But Volatile, Fairly Priced For The Risk (Downgrade)

Summary

- Takeda Pharmaceutical has recorded a 16.79% total return over the last 50 weeks, but risks are piling up, including loss of exclusivity and a sizable debt load.

- The advent of biosimilars for Takeda's major pharmaceuticals, Velcade and Vyvanse, will significantly impact revenues this fiscal year.

- Takeda is making lateral steps in their portfolio to find new markets and exploit new mechanisms of action, with several treatments well on their way.

- The operational efficiency is improving, but the continued dependence on inorganic growth gives us pause regarding volatility.

Sewcream

We timed our first article about Takeda Pharmaceutical (NYSE:TAK) in September 2022 pretty well as they've recorded a 16.79% total return over the last 50 weeks. Taking a fresh look at the results since then, however, the risks appear to be piling up. Between loss of exclusivity, continued emphasis on non-organic growth, and stable-but-sizable debt load, it seems like there's more risk for the same return, which makes it harder for us to recommend them as a buy at this point.

Out with the old…

The story of Takeda's guidance for this fiscal year has to be the advent of biosimilars for two of their major pharmaceuticals, Velcade (systemic name: bortezomib) for multiple myeloma (MM) and Vyvanse for ADHD management. MM therapies have come a long way since Velcade, including Takeda's own therapeutic Ninlaro; however, a nearly 90% drop in revenues for Q1 year-over-year (1.8B JPY vs 16.5B JPY) definitely still hurts to see. Management kept their guidance for 2023 constant in the face of this drop, citing timing of biosimilars (May 2022) as the main reason for the sharp drop this time around.

Vyvanse got a revenue boost in Q1, credited partly to a supply shortage of generic Adderall, but management expects to see biosimilars starting in August. With Vyvanse one of the top-prescribed drugs in at least the United States (#85 as recently as 2020), bringing in at least 100B JPY per quarter worldwide (the third-highest grossing drug behind Entyvio and the immunoglobulin portfolio), generics will bring a lot of pain to the next few income statements. Considering that the Adderall formulation is at least three times as popular in the United States, and that Takeda's Adderall XR brand-name drug only brought in 13.5B JPY in Q1, it stands to reason that Vyvanse revenues could crater to the mid-single-digit billions of JPY by next year.

Meanwhile, the clock is still ticking on Entyvio as the tentpole drug for Takeda. While exclusivity is still not in question for another eight or nine years, drug development is a slow and costly process, so the time is now to get the pipeline ready for that transition (compare how Roche (OTCQX:RHHBY) managed the phase-out of their legacy "AHR" portfolio, in particular the HER2 therapeutic Herceptin). Warning lights are already flashing this quarter, as revenue growth was slower than expected due to a softer market. On the Q1 earnings call, when asked point-blank about the soft report, Global Portfolio head Ramona Sequeira attributed part of it to "rebates and price cuts in Europe". Management seems to believe they have Entyvio's lifecycle management well in hand, with additional label expansions and a subcutaneous formulation on the way, but looking at the GI portfolio, there really isn't anything else in the works yet that matches Entyvio's label. Compare the work that AbbVie (ABBV) put in to shore up their own Immunology portfolio post-Humira, with both Skyrizi and Rinvoq approved in 2019, three whole years before Humira's exclusivity expired. NB: Humira biosimilars are rolling out now as well, and with GI indications, Entyvio may see further market share erosion even before exclusivity ends.

...In with the new

The encouraging side of the story is that the company is making several lateral steps in their portfolio to find new markets and exploit new mechanisms of action in order to unlock value. We see all of the major product areas contributing to this push, which is promising when balanced against the ROIs of each new opportunity.

In GI and immunology, several different types of treatments are in-flight:

Alofisel, an allogenic stem cell therapy, first-in-class, for the treatment of anal fistulas. The treatment has been approved in the EU and Phase III readouts in the US are due later this year. While the market is small enough that the EU considers it "rare", it is certainly noteworthy as a somatic cell therapy, using whole cells as the treatment, which may be easier to tune and less prone to side-effects than even antibody therapeutics.

Fazirsiran, an RNAi-based treatment for genetic liver disease associated with alpha-1-antitrypsin (AAT). It suppresses the expression of mutated AAT, reducing toxicity and inflammation in the liver. We gushed about RNAi previously with Regeneron, so it should come as no surprise that other big pharma companies are starting to break ground with their own therapies.

TAK-279, a small molecule TYR2 Janus kinase inhibitor for various immunological indications. This one is trickier to justify as it came from an acquisition (much more on that later).

Neurology has also been in the news lately with their "orexin agonist" portfolio. They published the results of their Phase II clinical trial on candidate TAK-994 for type 1 narcolepsy in the NEJM at the end of July, which showed an improvement in wakefulness but also demonstrated liver toxicity at the target dosage, requiring them to halt the study. There's already another orexin agonist candidate in Phase II trials for narcolepsy, TAK-861, which is much more potent than TAK-994, meaning they can lower the required dose and reduce the risk of liver toxicity; the toxicity is believed to be associated with "reactive metabolites", meaning it's not a side effect in the strictest sense (orexin receptors are almost exclusively in the nervous system), and lowering the dose should keep the liver from getting overwhelmed.

Oncology and plasma-derived therapies also had a slew of pipeline updates:

Fruquintinib has been filed for treatment of metastatic colorectal cancer in the US and EU

Iclusig has entered Phase 3 trials for Ph+ ALL, with results shared earlier this summer at ASCO and EHA

Gammagard Liquid was filed for treatment of CIDP in the US

Hyqvia's Phase 3 readout demonstrated significant reduction of relapses for CIDP, which should help bolster the US filing

The dengue vaccine Qdenga had a bit of mixed news: while it received approval in the EU, the company voluntarily withdrew its marketing application in the US citing data collection timing. Given that dengue has been reported in parts of southern Florida, and with a growing contingent of the US population having connections to regions where the disease is endemic (i.e. - Central America), it would be massively beneficial for them to complete the process in the US to unlock the huge market opportunity and pave the way for the Zika vaccine still in development.

Operations

The pipeline is ticking along, so now we turn our attention to the business side. Margins are improving, which we like to see, but questions persist about organic growth, debt load and FX.

Acquisitions

We mentioned previously how Takeda has a pattern of acquiring to get themselves out of pipeline slumps, and predictably in December they continued their trend by acquiring a subsidiary of Nimbus Therapeutics for $4 billion upfront plus two $1 billion payments if products derived from this acquisition reach certain annual sales milestones. This acquisition is what brought the TYR2 Janus kinase inhibitor TAK-279 in-house. The drug is slated to start Phase 3 trials in psoriasis this fiscal year, and trials in other autoimmune conditions are forthcoming. Considering Janus kinase (JAK) inhibitors are currently a big deal in the immunology space, including Bristol-Myers' (BMY) TYR2 inhibitor Sotyktu for psoriasis and the approval of Rinvoq for Crohn's disease earlier this year, Takeda may be sensing a shift in the wind (and more threats to Entyvio) and using TAK-279 as a way to kick-start their own JAK inhibitor portfolio.

Takeda also entered into an exclusive licensing deal with Hutchmed for the ex-China rights to fruquintinib this year, which came with a price tag of $400 million. There is only one other VEGF inhibitor approved for the indication for which they are trying to get approval: Bayer's Stivarga, which has been on the market since 2013 and whose revenues have started to accelerate in recent years. Even with two years of lag time and half the revenues of Stivarga, the IRR of this deal should easily clear the cost of capital assuming final approval is actually forthcoming.

Fortunately, this time their acquisitions didn't come with any considerable debt load like the Shire deal; the balance sheet and cash flow floated them. However, given the emphasis we place on a company's cash flow in our valuation assessment, if these types of acquisitions are their "cost of doing business", we have to factor that into the volatility of their free cash flow.

Fundamentals

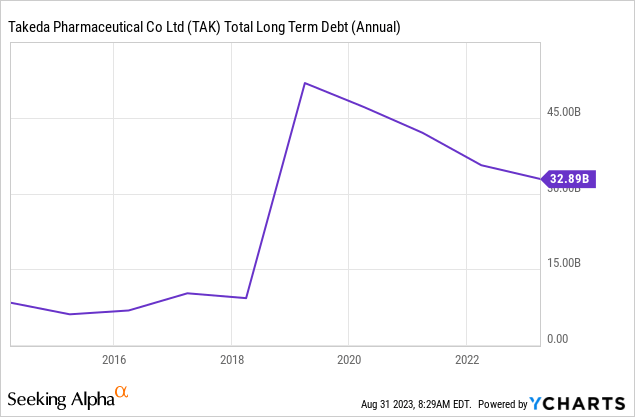

The balance sheet is holding steady at the moment, even if the cash reserves are a bit light. Debt load is still higher than it's been since the Shire deal, but it is improving:

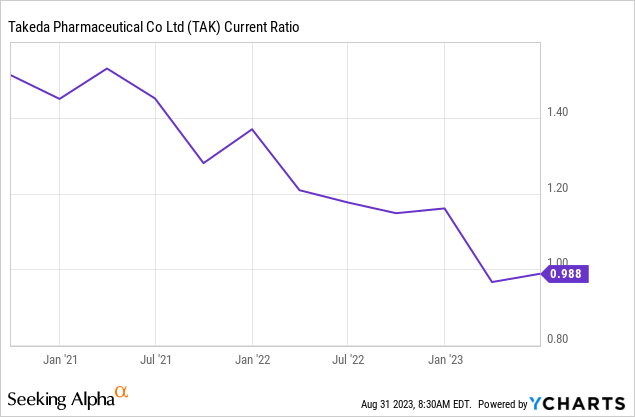

The company also highlighted that they received a ratings upgrade from Moody's, which solidifies them in the low-tier investment grade bucket. This rating is fine, but the drain on the more liquid part of their current assets from the recent deals calls into question how they might be able to weather a lean stretch:

FX continues to play havoc with the company's revenue; their FY'23 guidance assumes a USD/JPY rate of 131 while it currently sits around 146:

The company's operating margin has improved while the other components of the Dupont decomposition are holding steady, meaning ROE is showing a material improvement (but still much lower than we'd like):

| Sep 2022 | Sep 2023 | |

| Tax Burden | 84% | 84.5% |

| Interest Burden | 68.8% | 76.5% |

| Operating Margin | 9.52% | 12.18% |

| Asset Turnover | 27.4% | 29.68% |

| Equity Multiplier | 2.32 | 2.25 |

| Return on Equity | 3.42% | 4.55% |

Management

There is one piece we feel obligated to call out having looked through management's materials and read the Q1 transcript: CFO Costa Saroukos casually namedropped "including AI across the value chain" as a key investment area for the company during the earnings call. An analyst specifically asked them during the Q&A session about how AI could help them improve their margins and its applications to pharma. CEO Christophe Weber responded by basically listing off every single aspect of their business and at least one possible use of AI for each of them: manufacturing, drug research, commercialization, back office, etc.

However relevant these applications are, building up AI in every single one of them at once is a monumental effort because of the vast differences in the types of data and the models/features you would need to be able to do the training. In other words, saying you're looking at using it everywhere isn't any better than saying you're using it nowhere. Meanwhile, you could make the argument that something as simple as linear regression is a kind of machine learning model that's been used in bioinformatics and cheminformatics for literally decades now, is that what they're talking about when they say they're using AI in drug research? Is having your administrative assistants use ChatGPT to type memos a "back office" use of AI? It doesn't seem like a coincidence that the Financial Times recently ran an article stating that 40% of S&P 500 companies mentioned AI on their earnings calls, but only 16% mention it in their regulatory filings. It smacks of a desire to stay relevant and convince folks that you're hip with the latest trends without actually having a solid grasp of what's going on underneath.

Valuation

It's interesting to us that other Seeking Alpha analysts are so optimistic on Takeda that they're assigning valuations of $38 or even north of $40 per share, while for us the story hasn't changed materially enough for our own valuation to move. The spike in free cash flow we called out previously seems to have regressed and will stay around historical levels this year according to management guidance (400B-500B JPY). Growth prospects still seem on track, but we're increasing the discount rate to account for the increased volatility as a result of the losses of exclusivity, the streaks of acquisitions and the continued weakness of the yen. These changes basically cancel each other out, and we're left considering the stock fairly priced right now, which in conjunction with the higher volatility results in us recommending Hold for the time being.

Conclusion

Takeda appears to be approaching an inflection point in their business as key legacy medicines begin to lose exclusivity and new drugs are having their runway paved. This may be as prime an opportunity as you'll get for a mature pharma company to buy in to the prospects of a pipeline as opposed to the power of the established treatments. For us, though, the operations side keeps our enthusiasm tamped, and we need to watch how the next few drug applications pan out in order to solidify a long-term thesis.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RHHBY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Our long position to Roche is through direct ownership of Swiss ROG shares, not ADRs.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.