Exor: A Supportive Healthcare Acquisition

Summary

- Exor acquired a 15% equity stake in Philips, worth approximately €2.6 billion, confirming its repositioning in the healthcare sector.

- €2 billion of additional cash available for new investments, with now 11% of the total NAV invested in the non-cyclical sector.

- Exor already implemented Lingotto to manage third-party capital.

- Higher discount compared to the past with safer investments. Our buy is then confirmed.

mekcar

Here at the Lab, waiting for the updated H1 communications presented on September 13th, we are back to comment on Exor (OTCPK:EXXRF). Following our analysis called "Portfolio Companies Are A Margin Of Safety," Exor decided to become a long-term investor in Philips. Based in the Netherlands, the global healthcare leaders concluded a total investment of approximately €2.6 billion ($2.8 billion). In numbers, Exor has acquired a 15% equity stake. This is not a surprise and is in line with our previous coverage. Why?

The operation - entirely financed with cash - is part of Exor's strategy of focusing on health and technology, a sector in which it already invested €1 billion in 2022. At the end of 2022, Exor had €6.5 billion firepower for acquisitions. Exor is now a long-term minority investor with a Philips supervisory board member. Although Exor does not intend to purchase additional Philips shares in the short term, the agreement provides that it may increase its stake up to the maximum limit of 20% over time. Exor €2.6 billion takeover was sudden and silent. To get to 15% without being seen, without leaks triggering a rise in the stock price, Goldman Sachs helped Exor. The American investment bank raked Philips' derivatives, accumulating 12.11% of the potential capital between swaps, call, and put options. In reality, it had been months since Exor had entered Philips' wealth. Exor had holdings below the 2.99% threshold. Thus, the holding group didn't have to declare to the regulatory authorities. This period helped me study Philips, meet with the president, Feike Sijbesma, and see the company's transformation plan with the new CEO, Roy Jakobs, who took office last October. Philips is a recovery story due to the market recall of more than five million defective sleep apnea respirators in 2021. Last year, the company closed with €1.6 billion losses on €17.8 billion in turnover. Today, the most ventilator scandal seems behind, and in Q2, the company was back to profit for €74 million with margins recovered at 15% of revenues. As a giant in consumer technology (TV, light bulbs, etc.), for over a decade, Philips has reconverted into health technologies (diagnostic imaging, ultrasound, respirators, electronic hospital records). Today, it aims to "improve 2.5 billion lives a year by 2030, of which 400 million people in communities with little access to services". This is the area that Exor is investing in, even if the risks of collective lawsuits by patients remain strong, which could still weigh on the accounts. Having analyzed Philp's balance sheet, €575 million has been set aside for possible compensation and litigation.

Before the scandal, Philips was priced at around €50 per share. It has since plunged to lows of €12.6, and on Friday, 18 August, after Exor's announcement, it rose to around €20 per share. According to our estimates, Exor entry price might be around €19 per share.

Philips' strategy and plan to create value with sustainable impact are based on improving people's health and well-being through practical and effective innovation. The company holds leading positions in relevant market segments in the health technology sector, thanks to an innovative product portfolio and a solid customer base. For its part, Exor aims to build great companies by providing stability and commitment to support their long-term value-creation plans.

Including Philips investment, Exor invested around €4 billion in pharma with Institut Mérieux and Lifenet. Now, considering the generation of cash up to 2024, the resources available for new investments without issuing further debt remain at over €2 billion.

Changes in our estimates and Valuation

- Philips could become a new investment model for Exor, which intends to use its experience in company transformation. Exor already experienced restructuring processes with FIAT - FCA and then Stellantis in combination with CNH and Ferrari spinoff;

- At the holding level and to support our point 1) Exor repositioned itself to be an international investment vehicle. Indeed, according to the latest 13F filing for Q2 2023, the new Lingotto Investment Management division invested $1.5 billion in assets with assets in NVIDIA, Microsoft, Carvana, etc. Here at the Lab, we positively view this new division, and it might provide recurring fee generation on third-party assets thanks to a top-management team;

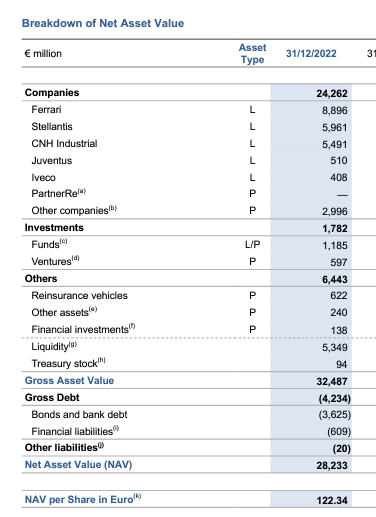

- Following Phillips' investment, according to our calculation, the new stake should now represent 8% of Exor's net asset value and move Exor's financial position to approximately €1.3 billion in debt. This is a significant step in Exor's portfolio rotation and diversification strategy;

- We estimate that Exor's concentration in its three main assets (Ferrari, Stellantis, and CNH Industrial) will decrease to around 67% from 74%. Additionally, exposure to the healthcare industry will increase from 3% to 11%. In addition to the healthcare industry, we expect that Exor will continue to aim for greater exposure in the luxury and technology segments to reduce the concentration in the most cyclical industrial sector (especially in auto);

- According to our calculations, Exor NAV discount is around 43.8%, valuing Philips in line with the current stock price. Looking at the historical average, Exor was valued with a 25% discount on NAV. Since our initiation, Exor discount has always been around 40%. Therefore, valuing the company with its historical discount, we confirmed our target price of €91 per share. Mare Evidence Lab's outperforming rating is given by a current valuation of Exor's primary financial investments at the current market cap versus the net asset breakdown of year-end. Our valuation is predominantly driven by Ferrari, CNH, and Stellantis, where Exor has an equity stake of 23.65%, 26.89%, and 14.22%, respectively. We also like the new Philips investment, given that it is listed on the Amsterdam stock exchange. In November, Exor will unveil the new strategy update, providing potential further upside to the company. Within our cross-coverage, we suggest checking up on Exor's portfolio companies: Ferrari: Outlook Appears To Be Conservative (latest update on 13th July 2023), Stellantis: Buy More (latest update on 24th May 2023), Iveco: Updating Our Forecasts Thanks To Daimler Truck (latest update on 24th July 2023), and CNH Industrial: M&A At Full Speed (latest update on 31st March 2023).

Exor Breakdown of NAV

Source: Exor Annual Report

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EXXRF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.