Alteryx: Not Cheap Enough

Summary

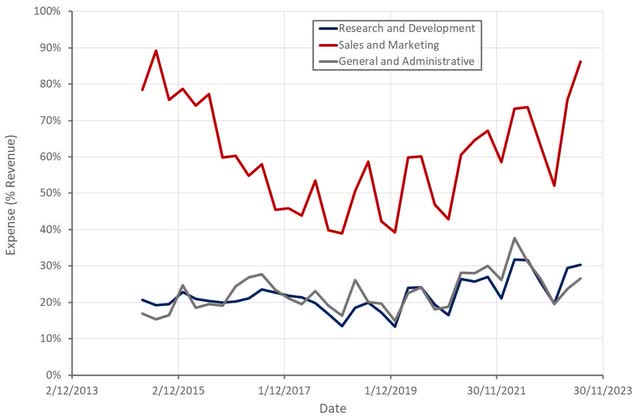

- Alteryx's stock is being weighed down by soft growth and high sales and marketing expenses.

- Alteryx's weak guidance relative to peers suggests there may be company-specific issues affecting performance.

- While Alteryx's stock may seem inexpensive, the company will likely need to significantly improve margins before investor sentiment turns.

ismagilov

Soft growth and high sales and marketing expenses are weighing on Alteryx's (NYSE:AYX) stock. While data analytics provides a large opportunity, the competitive landscape is fragmented, and Alteryx's positioning is unclear. Alteryx still appears to be gaining traction amongst larger organizations, but its return on sales and marketing investments is poor. Forward guidance is weak and is seemingly at odds with the expectations of peers, suggesting there is an Alteryx specific problem. While the stock trades on a low revenue multiple, unless the company can get its costs under control while maintaining growth, this may not matter.

Market

Alteryx’s rapid growth deceleration raises questions about both the demand environment and competition. Many peers with exposure to similar demand drivers appear far more upbeat about current market conditions than Alteryx, suggesting that idiosyncratic factors may be in play.

Alteryx believes that demand has been fairly consistent, with data analytics continuing to be a priority for CIOs. The macro environment is having a negative impact though, with Alteryx witnessing longer sales cycles and greater deal scrutiny.

In the first quarter, Alteryx attributed weakness to the uncertainty caused by Silicon Valley Bank, which presumably should have been temporary. Management suggested on the second quarter earnings call that the macro environment was tougher than expected, with a significant change in customer buying behavior observed in the last two weeks of the quarter. The fact that a large portion of business typically closes towards the end of the quarter meant that this shift was not apparent until late June. This change was pronounced amongst larger customer expansion projects outside of the normal renewal cycle. As a result, a number of large opportunities pushed out of the quarter or closed at a smaller size.

There also appears to be some pricing pressure, although Alteryx has suggested that it hasn’t resulted in major price changes. Alteryx has been reducing discounts over the last 6-7 quarters, which should be helping to offset pricing weakness.

On the competition front, Alteryx does not think there has been a material change in recent quarters. Renewal rates are reportedly still high, as is expansion within those renewals. Alteryx still considers internal solutions its biggest competitor, with many enterprises still managing labor intensive processes for aggregating, cleaning and analyzing data.

Alteryx is trying to position itself as a data orchestration layer across systems, which means that it is dependent on data fragmentation. Growing adoption of ELT and the cloud are potentially undermining Alteryx's value proposition though. Companies like Databricks and Snowflake (SNOW) are trying to reduce the prevalence of data fragmentation, and there is also a risk that they will vertically integrate into analytics in time.

Alteryx

Over the past few years, Alteryx's product portfolio has expanded from Designer and Server to a range of solutions covering the entire data science workflow. This was a necessity brought about by the rising importance of the cloud and evolving data architectures, but the ultimate impact on Alteryx's future remains unclear.

Figure 1: Alteryx Analytics Cloud Platform (source: Alteryx)

Alteryx's product portfolio continues to expand, with several solutions already released this year and a number of new offerings are tracking for early availability later this year. Recent introductions include:

- AI Workbench aims to help customers introduce large language model into their enterprise. AI Workbench is designed to effectively train these models using customer data and proper governance and security.

- Multimodal facilitates collaboration using a range of interfaces, including designer, coding or a simplified white board. Alteryx believes that this removes barriers between technical personnel and business users.

- Location Intelligence is a visualization and analysis solution for geospatial data.

Generative AI is also a focus for Alteryx, although its efforts in this area are still nascent. AiDIN utilizes generative AI technologies to enhance the productivity of Alteryx Analytics Cloud platform users. Generative AI can be used to improve productivity in areas like documentation, metadata management and systems integration. Alteryx is also trying to identify new areas in which to deploy LLMs.

Alteryx has long used natural language processing in areas like text mining and data extraction, but it is unlikely the company has any unique capabilities in this area. Capabilities in areas like governance and ease of use are more likely to be a differentiator than AI expertise.

Alteryx also appears to be admitting that some of its recent issues are execution related, and as a result the company has made leadership changes within its sales organization. Alteryx has also increased its focus on sales enablement, including training on how to navigate deals in a tougher macro environment.

Alteryx’s go-to-market motion shifted to focus on large global organizations in recent years. This is because Alteryx believes this is where the majority of the market opportunity lies and because large customers support net expansion growth. Alteryx has expanded its customer success capabilities to help customers create value with its platform, which should support expansion.

Alteryx is also leveraging partners to help scale sales and customer success reach. Partners played a role in over 75% of Alteryx’s top 20 new logo and expansion deals in the second quarter.

Financial Analysis

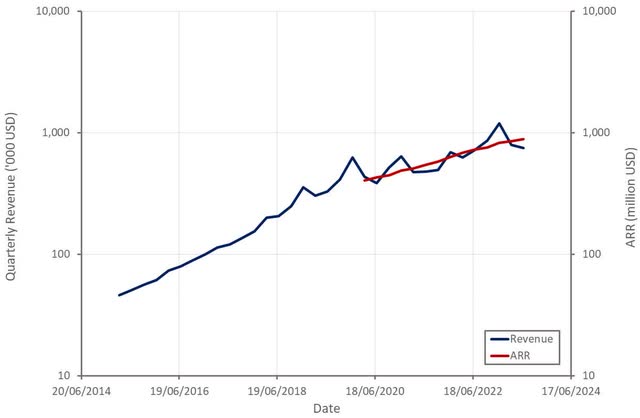

Alteryx's revenue increased roughly 4% YoY in the second quarter, while ARR grew 22%, although this was below Alteryx's guided range. The disappointing results were attributed to deals falling out of the quarter. Growth weakness appears to be concentrated in North America, with Alteryx stating that booking trends in Europe and Asia were solid.

Alteryx is having some success with its focus on larger organizations, but this appears to be coming at the expense of the rest of its customer base. While Alteryx is still landing larger customers, its total customer count has been fairly flat for over a year now. 48% of the Global 2000 are now Alteryx customers, and amongst this group the net expansion rate is 131%. This compares to an overall net expansion rate of 120%. There is also still significant room for expansion within Global 2000 customers, as roughly one-third are at less than $50,000 ARR and many are still in their first two years of an Alteryx license.

Figure 2: Alteryx Revenue (source: Created by author using data from Alteryx)

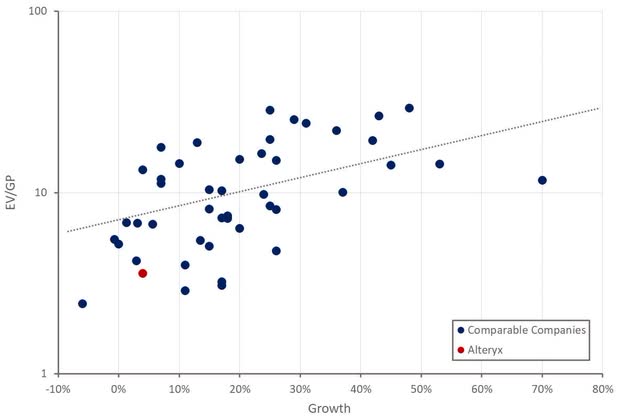

Alteryx's weak guidance implies that current issues may be ongoing. This is seemingly quite negative, as AI is attracting a lot of investment at the moment and a broad range of software companies have indicated that demand is stabilizing. Weak growth on the back of an enormous investment in sales and marketing and a more stable demand environment could indicate that there are Alteryx-specific issues.

Table 1: Alteryx Guidance (source: Created by author using data from Alteryx)

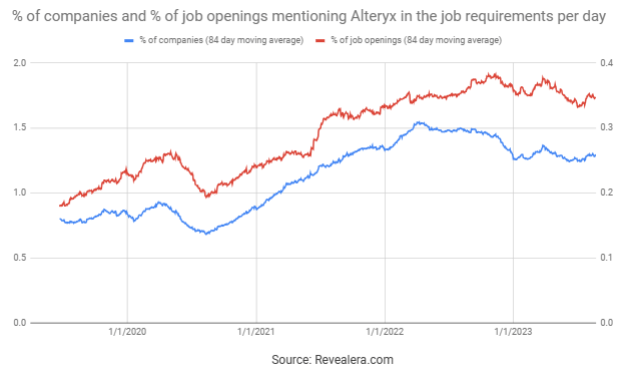

The number of job openings mentioning Alteryx in the job requirements continues to trend downward, which reinforces the belief that demand is weakening.

Figure 3: Job Openings Mentioning Alteryx in the Job Requirements (source: Revealera.com)

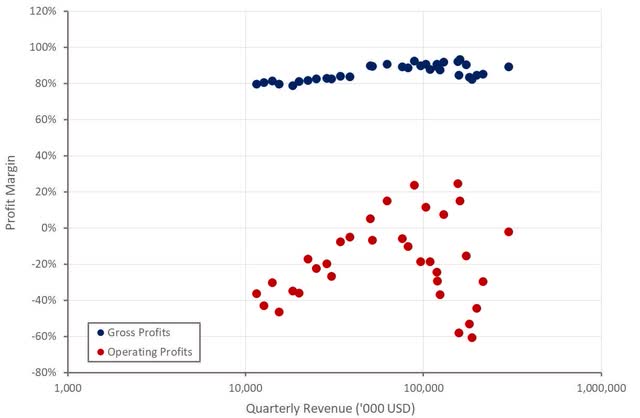

While Alteryx's decelerating growth is concerning, it is the combination of weak growth and large investments that are truly problematic. Alteryx has made a large investment in sales and marketing in recent years and this is not paying off at the moment. Alteryx margins have deteriorated considerably over the past 3 years, and the company now faces a long road back to profitability.

Alteryx is targeting non-GAAP operating profit margins of 25-30% by FY2028, with an expectation of 3-4% margin expansion annually assuming a 20% plus ARR growth rate. The assumed ARR growth rate seems optimistic at this point though.

Figure 4: Alteryx Profit Margins (source: Created by author using data from Alteryx)

Alteryx had an 11% RIF in April which primarily impacted the sales and marketing and general and administrative organizations. As a result, $8 million of expenses were incurred in the second quarter, with a further $4 million to be recognized. The Workforce Reduction Plan is expected to be largely completed by the end of the third quarter of 2023. Combined with other cost saving initiatives, like real estate rationalization, Alteryx expects to save over $30 million annually.

Figure 5: Alteryx Operating Expenses (source: Created by author using data from Alteryx)

Conclusion

Given its current growth rate, Alteryx could be considered undervalued, but without a clear path to profitability this may not matter. Absent a brief period of strong growth in 2022 Alteryx has been struggling for the past 3 years, although it is not clear this is purely a competitive issue as the landscape remains fragmented. A growing pipeline of products and a healthier demand environment may help Alteryx to turn things around, but this looks increasingly unlikely at this point in time.

Figure 6: Alteryx Relative Valuation (source: Created by author using data from Seeking Alpha)

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.