5 REITs: Mixing Good And Bad

Summary

- Some REITs are good, some are bad, and most face challenges from rising interest rates.

- Good REITs have traits that lead to solid long-term returns, such as consistent revenue growth and the ability to funnel that growth into AFFO per share.

- Specific REITs mentioned include Hudson Pacific Properties, Terreno Realty, American Homes 4 Rent, Mid-America Apartment Communities, and Industrial Logistics Properties Trust.

- The REIT Forum members get exclusive access to our real-world portfolio. See all our investments here »

Sometimes mixing is good

YinYang/iStock via Getty Images

Like rapid-fire articles? This one is for you.

Some REITs are great. Some REITs are terrible. Almost all face at least some difficulty from rising rates. Most corporations also face difficulty from higher rates.

I don't like to mix high and low quality for my long-term positions. Thanks, I'll go with all high quality. However, mixing for an article sounds good.

Bad REITs

REITs that I'd consider bad generally are those that are more likely to produce weaker long-term returns for shareholders. However, some of those REITs can still be useful if they create nice trading opportunities. Therefore, the REITs that appeal least to me:

- Have significant risks and

- Don't have liquid assets that could pull prices towards NAV (net asset value).

Good REITs

Good REITs have traits that will likely result in solid returns over the next decade. To be clear solid doesn't mean 12% to 20%. It's very rare for long-term returns to run that high. Most companies that generate such high returns benefit from factors like using the government to prevent competition.

The market as a whole will not produce returns anywhere near that level over the long term unless we permit inflation to run hot. Real returns for the market remotely close to that level are simply not going to happen. Earnings cannot perpetually compound faster than GDP. Why? Because revenue is part of GDP and earnings will never consistently exceed total revenues. That's dumb.

So what you're looking for is a REIT that can generate consistent growth in revenues. That's the first step. Then they need to be able to funnel that revenue growth into AFFO per share. A portion of that AFFO should be paid out in dividends, but we value cash retained by the REIT (for our benefit) rather than focusing only on what they decided to hand us.

If you owned 50 apartment complexes and had a big manager who wanted to retain some of the cash to build complex 51, you probably wouldn't say he was an idiot for wasting your cash. Well, with interest rates this high, you might. But most of the time you would view an additional apartment complex as an increase in your wealth.

Now let's talk about REITs.

HPP

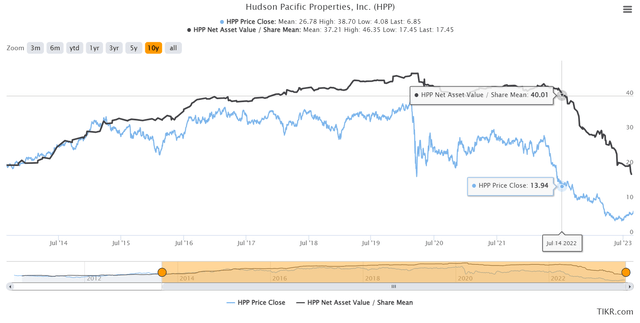

Is Hudson Pacific Properties (HPP) finally a bargain?

Maybe, but it's a stock for trading. The last dividend increase was in 2017, from $.20 to $.25 per share. They recently chopped the dividend from that $.25 per share down to $.125 per share. Not great.

Did they consistently build NAV per share? No. However, they weren't particularly bad at it prior to 2020. I won't call this a "bad REIT," but I still don't feel comfortable with office real estate. Here's a chart comparing the share prices with the consensus NAV:

TIKR.com

The last time shares traded above NAV was in early 2015. The other thing that's disturbing is that analysts were so terrible at updating consensus NAV. It didn't really plunge until the end of June 2022. Sorry analysts, that was a terrible job. Way too late.

TRNO

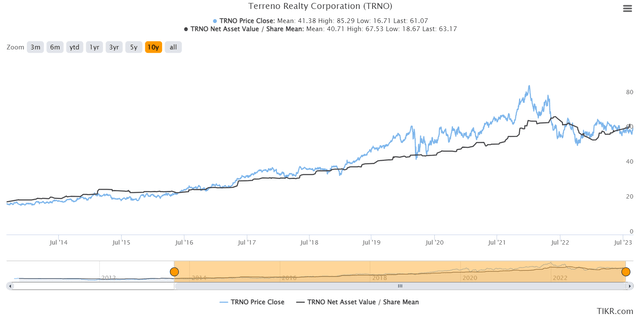

Next up is Terreno Realty (TRNO). TRNO is an industrial REIT. You'll notice they have often traded above NAV. Around the middle of 2022, consensus estimates began falling. However, those estimates bottomed out in early 2023 and since then they've been rising:

TIKR.com

TRNO definitely has the traits for a good REIT. Outstanding balance sheet. Great management. Strong corporate governance (which often comes with great management). Those factors make it easier to raise capital and acquire real estate at accretive terms.

As an industrial REIT, they also have huge leasing spreads. That drives strong growth in same-property NOI, which is fueling growth in FFO and AFFO per share.

What do they not have? They don't have a big dividend yield or the kind of low multiple investors keep being told to focus on. Investors who buy this stock are in it for the growth over the next decade, not for the current dividend yield.

AMH

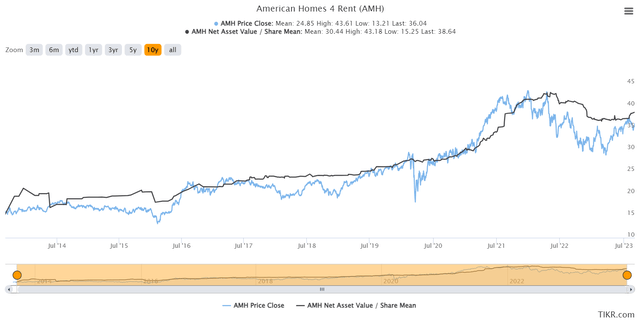

American Homes 4 Rent (AMH) is a good REIT. Perhaps a great REIT. Valuation has been pretty interesting, as have consensus NAV estimates.

Are home prices up or down? It depends on where you live.

Consensus NAV estimates for AMH grew very slowly prior to 2019. They ripped higher going into 2022 as everyone was aware home prices were skyrocketing and AMH owns single-family homes.

Yet the consensus NAV figures look a bit funny here as well:

TIKR.com

See how consensus NAV falls? That sharper dip toward the end starts around early November 2022.

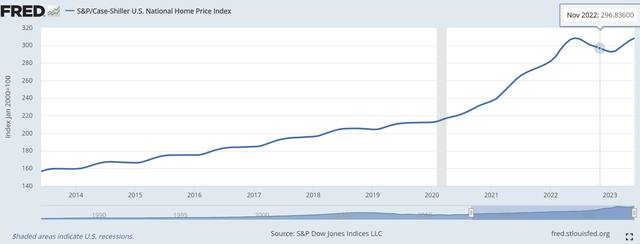

Was that the time for home prices falling? The Case-Shiller index doesn't think so:

FRED

That doesn't line up all that well with the move in consensus estimates. As it stands, the index is at a new all-time high, though only by a tiny margin.

That's pretty interesting given the rise in interest rates. I didn't expect home prices to remain that strong.

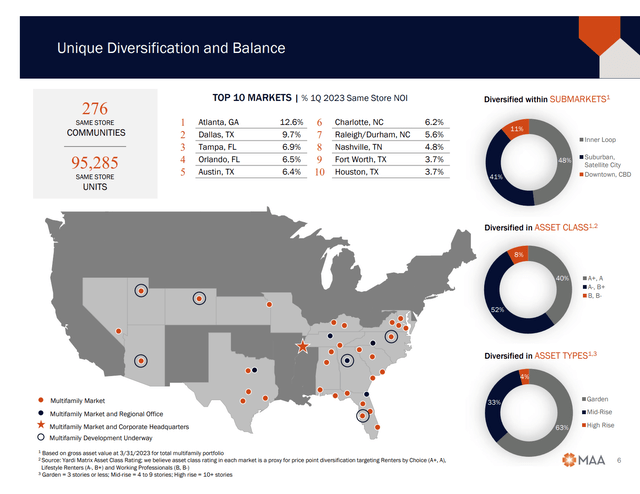

MAA

Mid-America Apartment Communities (MAA) owns apartments. Obviously. They don't own apartments in California.

MAA

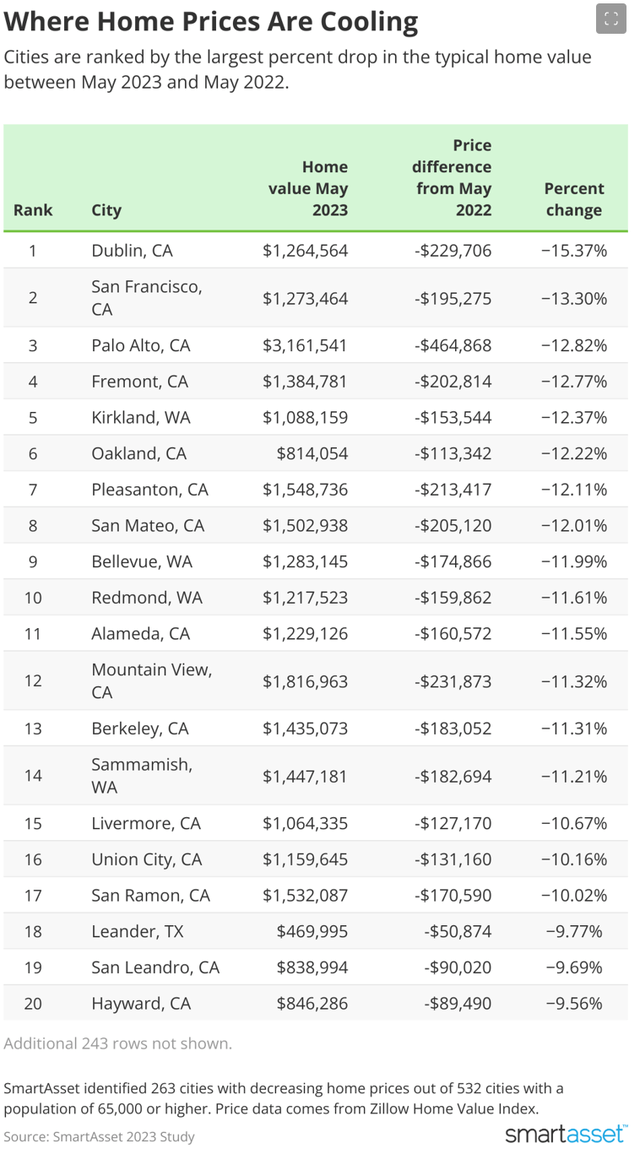

Which cities saw the biggest drop in home prices?

MSN

You might reasonably assume some connection between home prices and apartment prices as both would be related to demand. If so, you would probably think that MAA should be doing well. They own residential real estate (apartments), and they don't own it in the state with most of the biggest decliners.

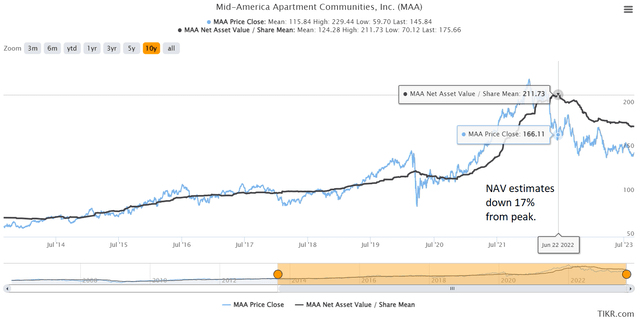

However, the consensus forecast disagrees.

TIKR.com

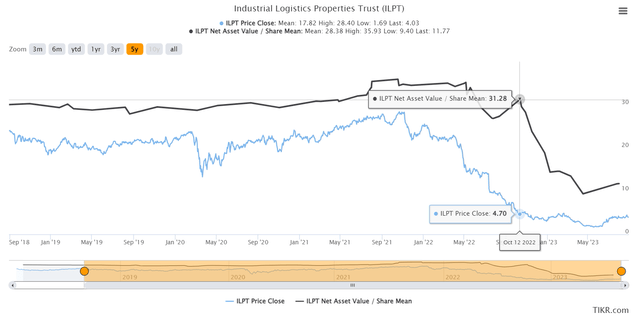

ILPT

Want to see the most insane chart? Of course. Industrial Logistics Properties Trust (ILPT) leveraged up for a big acquisition right before rates ripped higher. Terrible timing and a bad REIT. Combine those two and you can get this beauty:

TIKR.com

How terrible was that? Consensus NAV at $31.28 with a share price at $4.70. Leverage made forecasting hard, but it's pretty obvious analysts were just way behind on updating for the impact of leveraged declines.

Conclusion

Do I like any of these REITs? Sure. I think MAA and TRNO are attractive. I'll take bullish outlooks on MAA at $146.35 and TRNO at $61.04.

Expect new apartment supply in 2024 to put pressure on MAA's leasing spreads, but that issue should reverse by some time in 2026. In the meantime, I still think it's a very good or great REIT and it trades at a material discount to the consensus figure. That consensus may even be a bit low. However, we don't want to be blind to the difficulty they will face next year.

Terreno is one of my larger positions. I expect industrial rents to grow significantly over the next decade. Higher interest rates are creating a further headwind to new supply. There was more supply hitting the market in 2023, but that should dry up significantly. As more sales shift to e-commerce, which requires far more industrial real estate per dollar of sales, we expect demand for industrial real estate to continue increasing. When supply grows slower than demand, it pushes rents higher.

This article was written by

You’ll find several reports on The REIT Forum that don’t get posted to the public side of Seeking Alpha. Many of our public reports are dramatically reduced versions of subscriber articles. If you enjoy our public articles, you’ll love the content we keep for subscribers.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TRNO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I might enter a position in MAA, depending on share price movements throughout the stocks we cover and my available cash.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.