Prudential Financial: Slight Discount Together With A Robust Dividend Profile

Summary

- Prudential Financial has experienced setbacks due to the regional bank meltdown, but now presents a good entry point with a solid dividend profile.

- The company has a strong asset base and a history of growing dividends, making it an attractive investment opportunity.

- PRU's expansion in Latin America and its position as the third largest life insurance company in Brazil suggest potential for future growth and a higher share price.

I going to make a greatest artwork as I can, by my head, my hand and by my mind.

Introduction

The share price of Prudential Financial (NYSE:PRU) has been largely trading within the $107 - $80 range for the last 12 months. The company experienced some setbacks earlier on in the year as the regional bank meltdown that happened seemed to not just have shook that industry but also many others in the broader financial sector as a whole. The company right now though sits at what I would consider a very good entry point as the divided profile is looking solid. An under 50% payout ratio and a history of growing it over the last 14 years add to my buy case for PRU right now substantially.

Risks are mostly associated with a drop in the portfolio value which could lead to a correction in the valuation hurting investments in the company. But I find this to be insufficient to make for a hold rating instead. I believe a solid 8 - 9% annual return is possible with PRU right now and will be issuing a buy rating for the company.

Company Structure

PRU is a well-covered stock here on Seeking Alpha as it has a market cap of over $33 billion right now. The share price has been in a steady decline for the last 12 months but right now I think the price is too good to pass up.

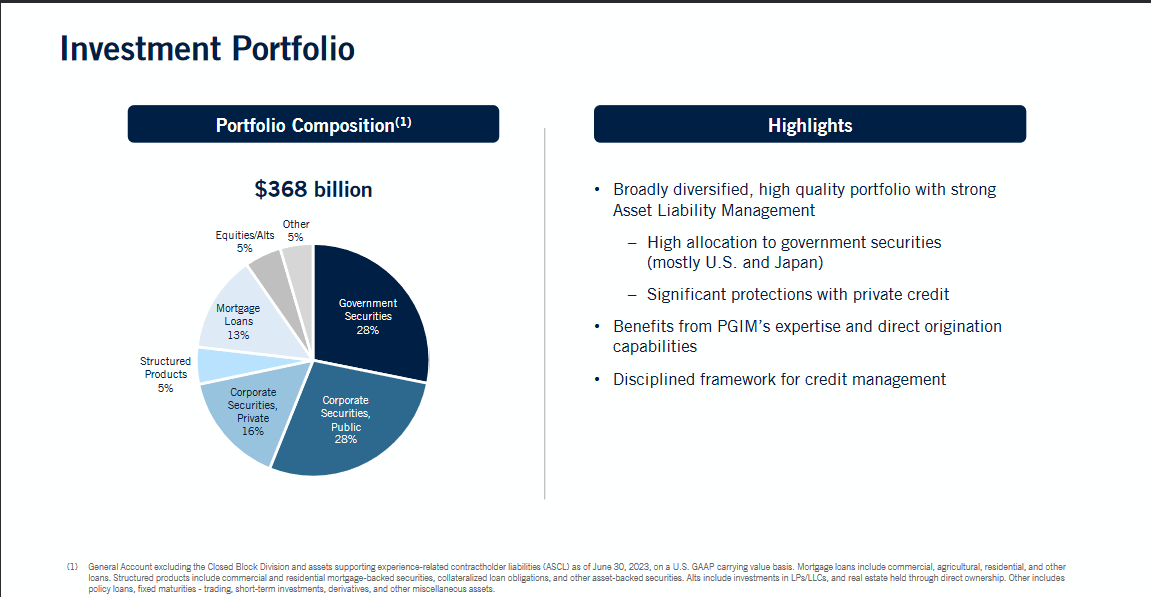

Investment Portfolio (Investor Presentation)

The company has a rich history that dates back to 1875 and it has during this time managed to build up an empire with an investment portfolio valued at $368 billion. With that size, PRU can leverage it into robust ROE margins and deliver an increase to the dividend consistently. The largest part of the portfolio is in government securities but close behind comes corporate securities too at 28%. Bonds have had a tough last 12 months and I do think the worst has passed looking at the long-term instead the picture is far brighter than it was some quarters ago. This should hopefully mean that PRU can grow its investment portfolio organically through appreciation and eventually deliver more returns to shareholders too.

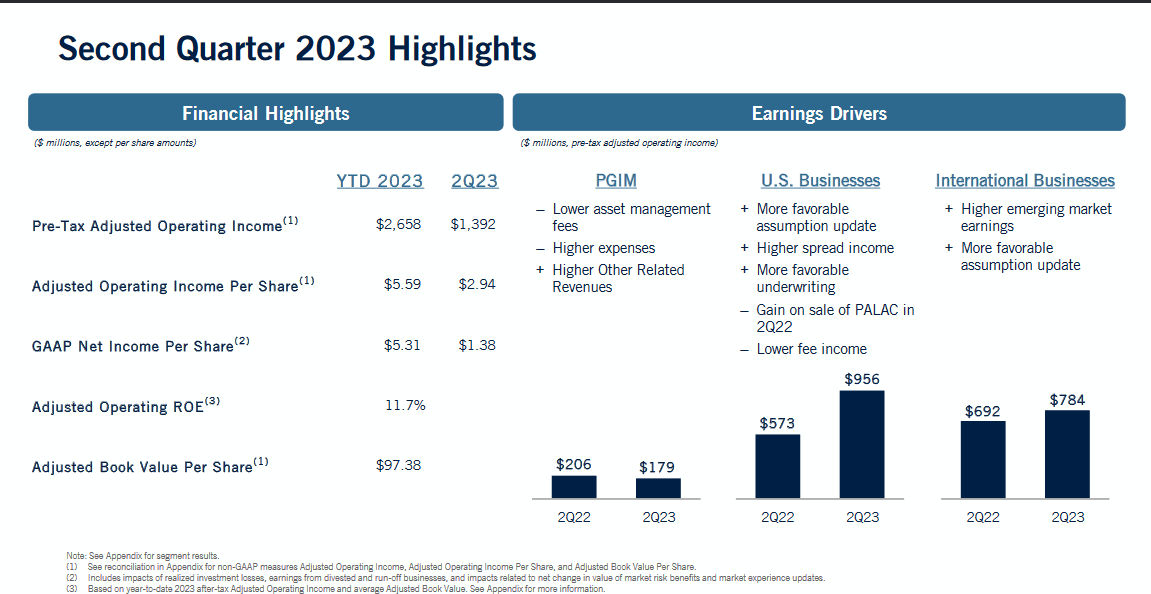

Q2 Highlights (Investor Presentation)

The company has divided its operations into various segments which right now are PGIM, Retirement Strategies, Group Insurance, Individual Annuities, Individual Life, Assurance IQ, and lastly International Business. Offering a variety of investment management solutions and services PRU has gathered up a broad set of customers and nurtured its relationship with the theme also to deliver satisfying returns for shareholders.

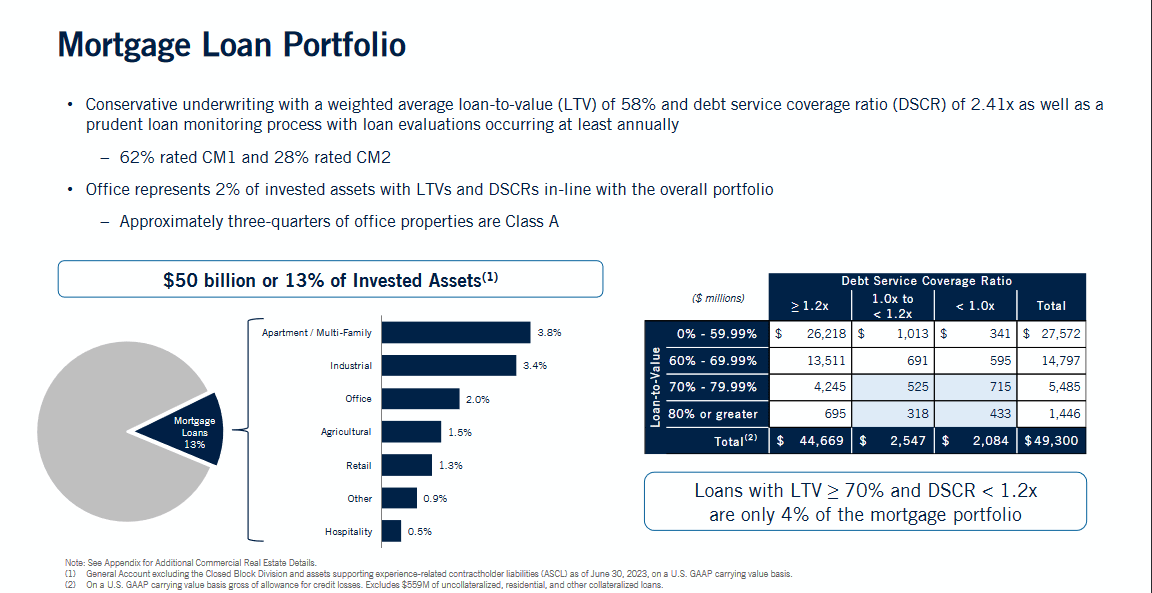

Loan Portfolio (Investor Presentation)

One of the key things to watch right now with PRU I think is the mortgage loan portfolio which is in a healthy state with the LTV value being 58% and the DSCR at 2.41x giving the company a stable position to operate from in my opinion. Asset quality is crucial with companies of this size and right now I think PRU accentuates a high-quality asset base worthy of investing in.

Earnings Transcript

Let's look at some comments from the last earnings call by the company to get an idea of what the management thinks of their recent performance. The CEO Charlie Lowrey said the following:

“In Latin America, we continued to expand our distribution through the Mercado Libre platform and added 150,000 new customers last quarter. Also, Prudential of Brazil achieved a record sales quarter, driven by strong performance by Life Planner and continued expansion of the third-party distribution channel. Prudential of Brazil is now the third largest life insurance company in the country, growing at twice the market average and reaching more than 3.5 million customers”.

With strong growth in Latin America, I think PRU is getting the incentives to expand the customer base intentionally at a fast rate right now to computer existing demand and drive deposits higher. Being the third largest life insurance company in Brazil right now does put them in a quite dominant position that I think will be able to be maintained for a lot more years. If we continue to see momentum in these markets I think that the share price will follow for PRU and perhaps earnings multiple in line with the sector is possible in the coming quarters, leaving a decent upside potential of about 15 - 20%.

Valuation & Comparison

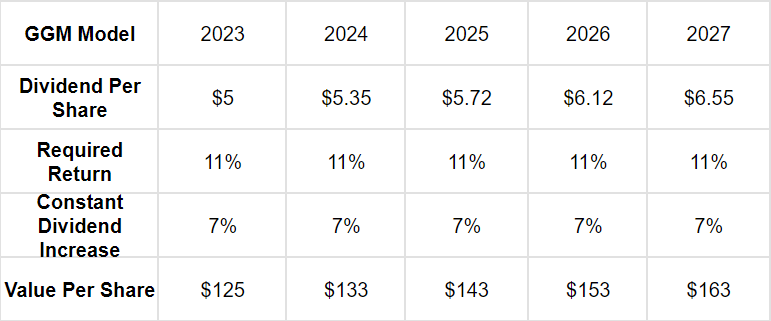

GGM Model (Author)

The price target I have for PRU right now to get a decent return is above the current share price by a fair bit, which is highlighting why I view it as a buy. With a history of growing the dividend by nearly 8% yearly over the last 5 years, I think it is likely to continue at a similar rate as the company hopefully can generate stronger earnings from its investment portfolios if bonds appreciate more. I have a required return of 11% which accounts for some margin of safety as well which I find important for companies in the sector. That being said, PRU has a very clear-cut asset base that accentuates quality and I am happy investing in that right now.

Risk Associated

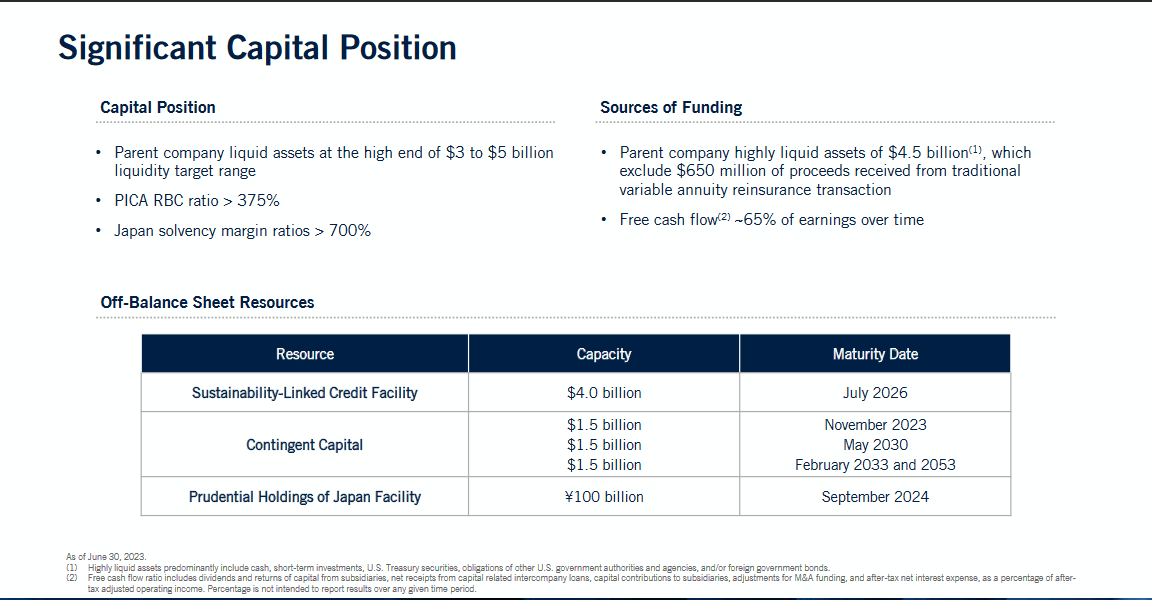

Distinguishing itself from traditional banks, PRU operates with a distinct focus on managing retirement accounts for insurance policyholders rather than being reliant on a multitude of customer deposits. However, this unique positioning doesn't render the company immune to the potential challenges that can affect its investment portfolio. The company also maintains a solid capital position which is helping it offset some of the risks and create a leaner and more efficient financial position to operate from.

Capital Position (Investor Presentation)

While PRU may not have the same deposit-driven concerns as banks, its investment performance remains a critical factor. The company's investment portfolio, composed of assets managed on behalf of its policyholders, is vulnerable to shifts in market dynamics. A series of challenges could undermine the value of these assets, posing significant financial considerations. A significant drop in the portfolio value of the company would make it look more expensive on a p/b metric and that might cause a drop in valuation eventually. For those that are looking at PRU as a long-term addition though, I think this worry is unwarranted and the potential ROI investors far outweigh the risks currently.

One such challenge is the impact of rising interest rates. As interest rates climb, the valuation of certain assets in the PRU portfolio may be adversely affected. Moreover, clients withdrawing funds from their retirement accounts can disrupt the stability of the portfolio, potentially leading to fluctuations in its overall value.

Investor Takeaway

The asset base for PRU is solid and the company has managed to deliver an impressive dividend in the last several years the yield is appealing to get exposure to. Right now the valuation hasn't recovered to the previous highs and this opens up an investment opportunity in my opinion. An earnings discount of over 15% makes it a good risk/reward play and constitutes me issuing a buy rating for PRU right now.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)