Grayscale Digital Large Cap: Plenty Of Meat Still On The Bone

Summary

- Grayscale's ETF rejection has been vacated by a panel of judges, allowing the application for a conversion of the Grayscale Bitcoin Trust to proceed.

- If approved, it is widely believed the NAV discount in GBTC and possibly other Grayscale funds will re-rate closer to collateral value.

- Applying a discount adjustment to GDLC shares just based on current ETHE and GBTC discount rates implies 23% upside in GDLC.

baona/iStock Unreleased via Getty Images

Grayscale has won its lawsuit with the US Securities and Exchange Commission. In a ruling on August 29th, a panel of judges vacated the agency's ETF rejection and the application for a conversion of the Grayscale Bitcoin Trust (OTC:GBTC) is back on the table:

The Commission failed to adequately explain why it approved the listing of two Bitcoin futures ETPs but not Grayscale's proposed Bitcoin ETP. In the absence of a coherent explanation, this unlike regulatory treatment of like products is unlawful. We therefore grant Grayscale's petition for review and vacate the Commission's order

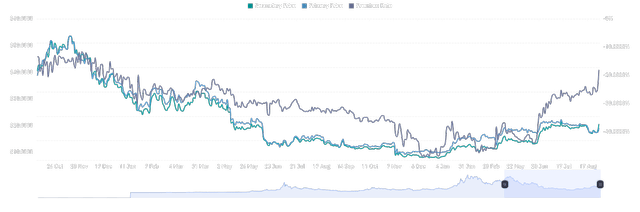

The response from Bitcoin (BTC-USD), GBTC, and just about every crypto-proxy public equity since the ruling can best be described as "elevator up." At the end of the August 29th session, the NAV discount in GBTC closed at 18% - which is the closest GBTC shares have been to NAV since December 2021.

When I last covered GBTC for Seeking Alpha in early August, I explained why I believed the tea leaves were indicating a sentiment shift toward Bitcoin in traditional finance and that the positions of regulators like the SEC were losing in court. This ruling reaffirms that belief.

Keeping It In Perspective

While this court ruling for Grayscale is a very good sign, I do think it's important to point out that GBTC is not actually approved for ETF conversion yet. But I'll reiterate that I do believe GBTC will ultimately be approved for conversion and likely in close proximity to approvals of spot Bitcoin ETF applications from other institutions like BlackRock (BLK). With that as my base case, I'm not personally fading the broad rally in the Grayscale funds like GBTC or Grayscale's Ethereum Trust (OTCQX:ETHE).

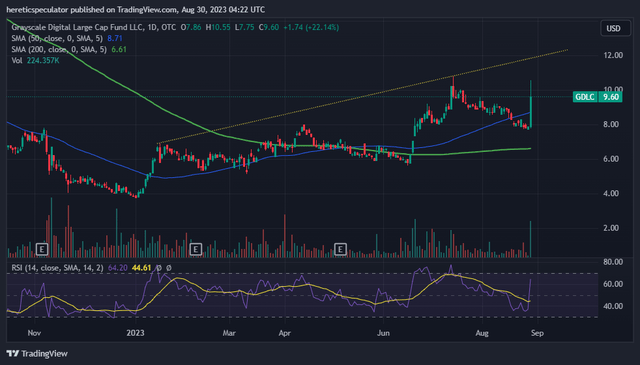

Back in late June, I hypothesized that the better play for NAV arbitrage in the event of a Grayscale GBTC conversion may actually be the Grayscale Digital Large Cap (GDLC) fund. I continue to believe that to be true and have added to my long GDLC position since that article was published.

Meat On The Bone

The core thesis from that June article was that the GDLC fund's allocation methodology is so poor, that it makes GDLC an interesting arbitrage option for crypto traders. At the time, the fund shares traded at a staggering 50% discount to net asset value. Given the fund's current 38% discount to NAV as of article submission, there has been improvement, but I believe there is still plenty of meat left on the bone here for traders who may feel they have missed the GBTC trade.

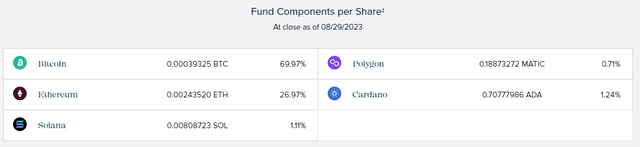

The core purpose of GDLC is to offer investors a diversified approach to digital assets. In the past, the fund has had as many as ten different holdings. However, given what I've previously criticized for what I believe to be a poor fund methodology, GDLC shares have become almost entirely dominated by Bitcoin and Ethereum (ETH-USD). Bitcoin now makes up 70% of GDLC shares, with Ethereum commanding another 27%. This means the remaining fund components make up just 3% of GDLC shares. From where I sit, this makes GDLC a Bitcoin and Ethereum fund, practically speaking.

Since Grayscale's GBTC and ETHE shares trade at smaller discounts to NAV than GDLC shares despite having very similar collateral, I calculated a discount adjustment for the GDLC shares that I felt represented fair value based on how Grayscale's larger funds were trading. Even after GBTC's discount arb has moved from 30% to 18% and ETHE's has gone from 45% to 30% since that time, GDLC still has quite a bit of catching up to do if we priced it the way Grayscale's other funds are priced:

| GDLC Assets | AUM | Discount Adjustment | Asset Value |

|---|---|---|---|

| BTC | $171,190,423 | 18% | $140,376,147 |

| ETH | $66,416,480 | 30% | $46,491,536 |

| Adjusted Discount Market Cap | $186,867,683 | ||

| Adjusted share price | $11.78 | ||

Source: Author Calculations based on Grayscale AUM and outstanding share data

In the table above, the adjusted share price is applying the 30% ETHE discount to the ETH portion of the GDLC shares and the 18% discount to the BTC portion of the GDLC shares. Again, even if we choose to be aggressive and zero out the balances of the three altcoins that are also held in the fund, GDLC shares should be trading closer to $12 than $10.

Risks

The same risks apply to this trade when I first mentioned it earlier this summer. Crypto is arguably the riskiest of the many risk asset classes. If the value of the collateral that is held by Grayscale for the GDLC shares declines, the price of GDLC shares will almost certainly decline as well. Furthermore, while advantageous for traders who wish to minimize tax liability, Grayscale's funds are not the same thing as self-storing crypto and shouldn't be viewed as real ownership as long as redemptions aren't possible.

There is also related party risk as Grayscale's parent company and sister companies own roughly 8% of the fund shares outstanding all while there are still ongoing financial issues between Digital Currency Group, Genesis Global, and Genesis's creditors.

An additional risk is my thesis could simply be wrong and the NAV discount in GDLC could move against arb traders and return back to the 50% level or lower. Finally, there is no guarantee that GBTC or any other Grayscale fund will end up being converted to spot ETFs even with the recent court ruling against the SEC. There are other ways the agency could theoretically deny applications using different justifications from what has historically been used.

Summary

In early August, I closed my GBTC article with this:

There has been a noticeable shift in sentiment toward the regulatory environment in the United States. Traditional financial firms like BlackRock and PayPal (PYPL) are now doing things that the SEC has previously indicated were problematic from more crypto-native businesses just a few months ago.

I stand by that and believe the latest developments from the courts only strengthen the argument that the NAV discounts in the Grayscale funds are likely going to move closer to the value of the underlying assets from this point on.

For GDLC specifically, it's still trading at a 38% discount to NAV even though 70% of the fund is Bitcoin. And what's interesting is when the news broke that Grayscale had won the case on August 29th, the initial reaction in the GDLC shares was a 34% intraday explosion from under $8 to $10.55 in a matter of just a few minutes. I believe the Grayscale funds go as GBTC goes. And if GBTC does indeed get converted to a spot ETF, I think we'll see NAV discount arbs largely close across Grayscale's entire line of funds. I'm not fading this move.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GDLC, GBTC, ETHE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not an investment advisor.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)