Flutter Entertainment: High-Growth Betting And Gaming Leader Winning In The U.S.

Summary

- Flutter Entertainment is a global sports betting and gaming company with a strong presence in the growing US online sports betting and iGaming market.

- The company's US division has a multi-year growth pathway and is the most important value creation driver for Flutter. In 2023, FanDuel is turning a positive EBITDA.

- Flutter's solid performance in mature and other markets, along with its diversified business model, contribute to its attractive investment case.

Hispanolistic/iStock via Getty Images

We present our note on Flutter Entertainment (OTCPK:PDYPY) (OTCPK:PDYPF), a global sports betting, gaming, and entertainment company, with a Buy rating. We are drawn by Flutter’s strength in the growing US online sports betting and iGaming market, high earnings growth driven by US expansion, solid fundamentals in mature markets, and attractive embedded returns. We will provide a brief overview of the company, briefly discuss its recent performance, analyze FanDuel’s business model and growth trajectory, and lay out our investment case and valuation.

Introduction to Flutter Entertainment

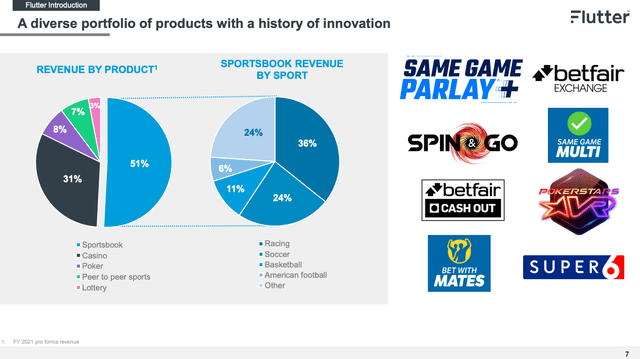

Flutter Entertainment is an international sports betting and gambling company, created in 2016 through the merger of Paddy Power and Betfair. The group operates in more than 20 regulated markets and has a global presence. The company has four geographical divisions: US, UK&I, Australia, and International, representing respectively 34%, 28%, 16%, and 22% of the group’s net revenue in FY2022.

Its US division consists of FanDuel, TVG, FOX Bet, etc. It is important to note that FanDuel is the leading online sportsbook and casino operator in the US. Flutter’s UK & Ireland division includes some of the best-known brands in the market such as Sky Betting & Gaming, Paddy Power, Betfair and Tombola. While the UK&I brands operate mostly online, there are more than 600 Paddy Power retail betting shops. The company’s Australian division consists of Sportsbet, the market leader in online betting across Australia. Flutter’s International division contains operations in more than 100 countries including the largest online operator in Italy: Sisal, and the world’s largest poker site: PokerStars.

Flutter is listed on the London Stock Exchange and has a current market capitalization of £25 billion. It is a FTSE100 index constituent. Underpinned by strong fundamentals, Flutter has had a robust financial performance since 2017 with an EBITDA CAGR of 22%.

FanDuel CMD

Multiyear Growth Pathway For FanDuel

We believe that the most significant value-creation driver for Flutter going forward is FanDuel. After the repeal of PASPA by the US Supreme Court, in 2018, Flutter acquired a controlling stake in FanDuel to capitalize on the enormous US online sports betting and iGaming opportunity opening up. Flutter brings its tech stack and expertise from the mature European markets in which it operates in addition to a multibillion capital commitment into the US. Founded as a fantasy sports provider, FanDuel had an initial advantage thanks to brand recognition and an extensive database. FanDuel is by far the market leader in online sports betting with an estimated market share of ~47% as per the latest results report, leaving DraftKings and BetMGM behind, and leading in 15 out of 18 states. While it traditionally has not been a leader in online casino gaming, FanDuel has impressively increased its market share to 23% by the end of Q2.

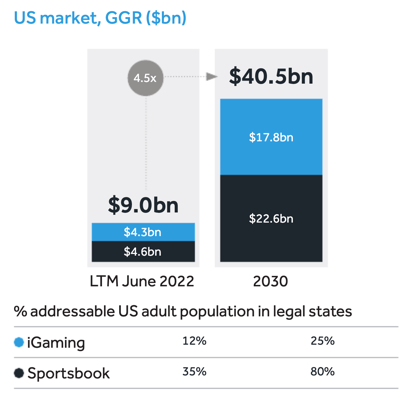

Flutter expects that the total addressable market in the US will expand to more than $40 billion by 2030: or $22.6 billion in online sports betting driven by expansion to 80% of the population and penetration in line with mature markets such as Australia; and $17.8 billion in iGaming driven by expansion to 25% of the population and penetration levels similar to the sportsbook. As previously discussed in our note on Flutter’s competitor Entain, which owns a 50% stake in BetMGM, sell-side analyst estimates vary between $35-$45 billion, while BetMGM itself expects a TAM of $37 billion. Flutter expects a pathway for FanDuel revenue to 4.5-5x by 2030 vs. 2022 levels and long-term EBITDA margins to be within the range of 25-30%.

For the purposes of our valuation exercise, we will use Flutter’s TAM estimates which are largely in line with consensus. However, as referenced in our Entain note, we believe the market may be underestimating iGaming TAM in the long run. Our variant view on iGaming upside is not a driver of our investment thesis either for Entain or for Flutter, but we believe it remains a valuable option.

We would like to point out the market structure of the gambling industry which tends to have a winner takes most dynamic, whereby the market leader continuously strengthens its moat. The dominant market player, with higher marketing spend, tends to have better brand recognition and more effective advertising resulting in lower customer acquisition costs. In addition, higher tech spending results in a technological advantage leading to better UX, liquidity, and choice. In turn, margins and client retention are driven up. This creates a flywheel effect that compounds Flutter’s strength in the US. The dynamic should lead to above-market growth and higher earnings quality and hence a valuation premium for the “winner”.

FanDuel had an EBITDA of $100 million in H1, and the company can now offset new customer acquisition through the income coming from existing customers. This earnings inflection is an important catalyst for Flutter.

Flutter Annual Report

Solid Performance In Mature & Other Markets

Flutter’s ex-US business, representing 64% of FY2022 revenue is well-positioned in many appealing markets and continues to drive growth and generate cash that is invested into FanDuel, in inorganic growth through M&A, or returned to shareholders. The business is well-diversified and benefits from economies of scale. The company expects a top-line growth range of 5-10% for its ex-US businesses and higher EBITDA margins. The ex-US global betting and gaming market is estimated to be worth £263 billion in 2022, with 30% online. A CAGR of 9% is estimated in the online market in the next five years.

The UK&I division is in a solid position and outperforming its peers in terms of growth as a result of product improvements and earlier self-imposed implementation of safer gambling measures. The publication of the DCMS gambling reform white paper after a long waiting period removes a regulatory overhang and represents another key catalyst for Flutter. The Australian division has been a bit softer with growth slightly below expectations in H1, but the long-term opportunity remains attractive and Flutter continues to invest while competitors pull back. Moreover, the International division has a significant runway for growth that could be achieved inorganically through M&A.

Investment Case And Valuation

We use a Sum of the Parts analysis to value Flutter. We believe this is the most appropriate methodology given the profiles of the divisions. We value UK&I, Australia, and International at 9x EV/EBITDA with 6x for UK&I retail, and we value FanDuel on 2030 mature estimates discounted back to the present. We forecast a £1.7 billion EBITDA FY24e for the ex-US division (excluding UK retail), arriving at an EV of £15.3 billion. We forecast an EBITDA of £45 million for UK retail, arriving at an EV of £270 million. We forecast £120 million of central cost, to which we apply a multiple of 9x as well, resulting in a negative EV of £1.1 billion.

We assume a US TAM of $40 billion, a market share of 40%, and a bonus rate of 30%, hence a 70% conversion of gross to net gaming revenue. We arrive at a 2030 NGR of $11.2 billion. We assume a 30% EBITDA margin in line with the upper end of its range, arriving at a 2030 EBITDA of $3.4 billion. We apply a multiple of 12x EBITDA arriving at an EV of $40.3 billion and discount back using an 8% cost of equity. We arrive at a present value of $25.4 billion for FanDuel or £20.1 billion.

The total EV we get is £34.6 billion. After removing net debt and making other EV adjustments we arrive at an equity value of £30 billion, implying 19% upside and a share price of 17020p per share or $215 per share for PDYPF. We believe the secondary listing in the US, as well as continued earnings growth, are the main catalysts for the stock.

Risks

Risks include but are not limited to deteriorating macroeconomic conditions leading to a decline in business activity, lower online sports betting and gambling adoption in the US, higher than expected competition in the US leading to a decline in market share or a decline in profitability, unexpected regulatory restrictions, and value destructive M&A activity in international markets.

Conclusion

Given the high earnings growth and reasonably attractive valuation, we recommend building a long position in Flutter shares.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.