Eagle Materials: Good Growth And A Reasonable Price

Summary

- Eagle Materials is expected to benefit from strong demand in the infrastructure market and from the reshoring of manufacturing to the U.S.

- The company's revenue growth in the first quarter of 2024 was driven by robust demand in its cement business and effective price realization.

- Despite some weakness in the residential market, the company is expected to offset it with strength in other end markets.

- Valuation is reasonable.

Denis Torkhov/iStock via Getty Images

Investment Thesis

Eagle Materials' (NYSE:EXP) should benefit from good demand in the infrastructure market which is benefiting from the Infrastructure Investment and Jobs Act (IIJA). Further, the company's non-residential business is also going strong as the companies are reshoring their manufacturing to the U.S. While the residential market is showing some weakness due to high interest rates, the company should be able to offset it thanks to the strength in other two end markets. Further, the company's margin prospects also look good with it focusing on pricing opportunities and improving operational efficiency. This coupled with a reasonable valuation makes the company a good buy.

Revenue Analysis and Outlook

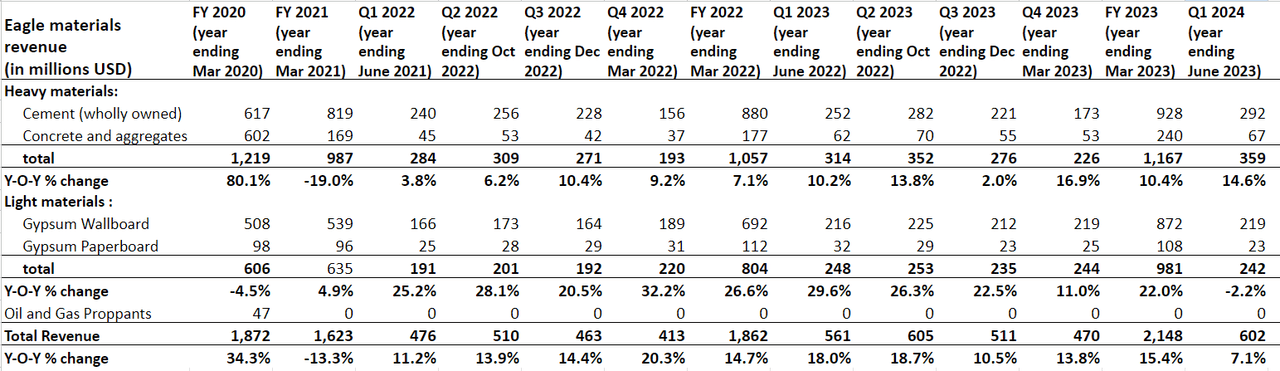

In the first quarter of 2024, EXP's revenue growth benefited from robust demand in its cement business and effective price realization across its Heavy Materials and Light Materials sectors, which resulted in a ~7% Y/Y increase in revenue to $602 million. In the Heavy Materials sector, which includes cement and concrete and aggregates segments, revenue grew 15% Y/Y to $359 million, driven by the increase in cement sales prices implemented earlier this year and the contribution from the recently acquired cement import terminal in Northern California. However, the inclement weather conditions in the western part of the U.S. negatively impacted the cement sales volume in the quarter. In the Light Materials sector, which includes gypsum wallboard and paperboard, revenue fell ~2% Y/Y to $242 million due to a decline in wallboard sales volume, partially offset by an increase in wallboard sales prices.

EXP's Historical Revenue Growth (Company Data, GS Analytics Research)

Looking forward, I am optimistic about Eagle Materials growth prospects. The company's revenue outlook is positive as it is poised to benefit from combinations of factors, including robust infrastructure spending, strong growth in industrial and manufacturing construction and exposure to sunbelt markets in residential construction which are relatively stable.

The cement business is set to capitalize on the surge in infrastructure awards which have reached multi-decade highs benefiting from the Federal funding from Infrastructure Investment and Jobs Act (IIJA) as well as strong state and local government spending. Furthermore, non-residential spending remains at elevated levels driven by the strength in manufacturing projects as the companies reshore production back to the U.S. The Federal Government's CHIPS and Science Act funding is also helping catalyze this reshoring trend. The company's aggregate business has similar end-markets as cement business and is benefiting from these trends as well. Further, the company has started selling construction-grade aggregates from its Kentucky facility to third parties. Earlier this facility's production was used only for in-house requirements. So, this should also help sales.

The company has a healthy balance sheet with net debt of ~$1,133.4 mn and trailing twelve month EBITDA of $751.9 mn giving it a net leverage of ~1.5x. This should enable it to do opportunistic M&As to boost revenue especially on the aggregate side of the business.

While things aren't as strong on the wallboard side of the business which derives ~80% of the revenues from residential construction, the project activity is still healthy despite high interest rates. The multifamily units under construction are near all-time highs and the trends in housing markets are much stronger than what many feared at the beginning of the year.

There is a structural shortage of housing supply due to over a decade of underbuild post the great recession. The limited inventory of existing homes necessitates increased new home construction, providing a potential avenue for sustained demand in the wallboard sector. So, the long term housing fundamentals are solid and once the interest rate cycle reverses, I expect this segment to see strong multi-year growth. Meanwhile Eagle Materials' exposure to sunbelt region which has been relatively resilient should help it do better than the broader housing markers in the near term.

Overall, I believe the company should be able to more than offset a slight slowdown in the wallboard side of the business with strength in cement and aggregate business in the near term. Once the interest rate cycle turns, the growth should further accelerate in the medium to long term.

Margin Analysis and Outlook

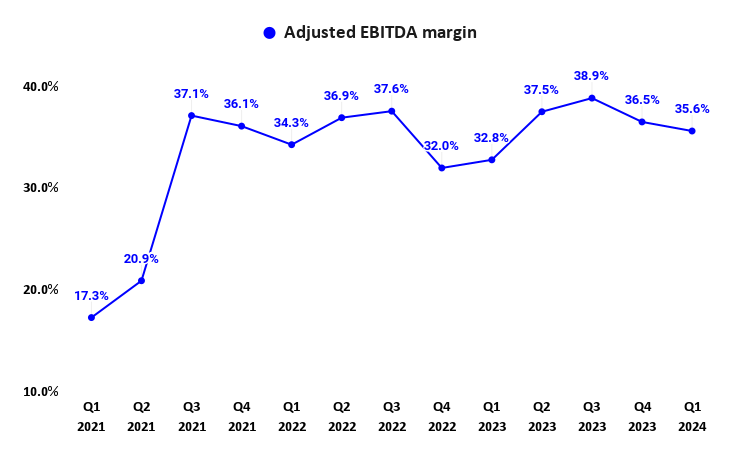

In the first quarter of FY24, the company's adjusted EBITDA margin increased 280 bps Y/Y to 35.6% helped by the price increases and lower input costs for recycled fiber, freight and energy which more than offset the increase in operating expenses due to high maintenance costs. An extended outage at the company's joint venture in Texas and pull-forward maintenance programs at two of the cement facilities were to blame for the increase in maintenance costs.

EXP's Adjusted EBITDA margin (Company Data, GS Analytics Research)

Looking forward, the company's margin outlook is positive as it capitalizes on pricing opportunities, manages input costs and enhances operational efficiencies. The demand condition in the cement market remains strong and the company recently announced pricing increases for its products which should help margins. The company is also benefiting from moderating inflationary headwinds, particularly energy costs. Further, the company's strategic transition to Portland Limestone Cement (PLC) which is cost effective to produce and help reduce the carbon footprint as well should benefit margins in the medium to long run.

Valuation and Conclusion

EXP is trading at 13.16x FY23 consensus EPS estimates and 12.01x FY24 consensus EPS estimates. This is a discount versus the Company's 5 year average forward P/E of 14.43x.

The stock is also trading at a significant discount to other construction material companies like Martin Marietta Materials (MLM), Vulcan Materials (VMC) which are trading at 24.68x and 31.02x FY23 consensus EPS estimates, respectively.

The company has good revenue and margin growth prospects driven by the federal funding which is catalyzing investment in infrastructure and manufacturing in the U.S. I believe the stock is a good buy at current levels given solid growth prospects and a reasonable valuation.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Saloni V.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.