Arbor Realty Trust: Sustained Superior Performance

Summary

- Arbor Realty Trust is an attractive investment for income-seeking investors, with a focus on stable and attractive multi-family and single-family sectors.

- ABR has shown strong financial performance, with net income growth of 6% year-over-year and a growing servicing portfolio focused primarily in the fast-growing sun-belt region.

- ABR outperforms its peers in the mortgage REIT industry, with 11 straight years of dividend growth and a positive total return over the last year.

- I expect the FED to cut interest rates in the first half of 2024. In my opinion, this will boost overall market sentiment as investors rotate back in the market.

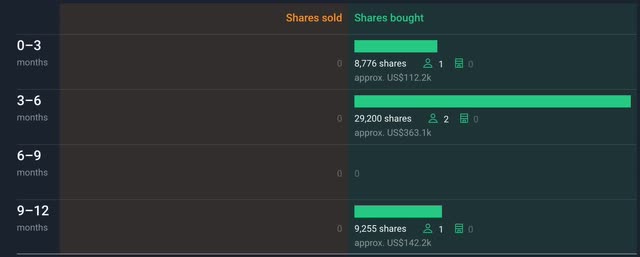

- ABR has seen some insider buying over the past 12 months and recently had its price target raised to $17.

HAKINMHAN

Introduction

As a new investor, I'll admit I got caught up in chasing yields like a lot of dividend investors do. I was one of those guys who saw a shiny object and ran towards it. That shiny object was the dividend yield. My goal was to build a huge stream of income from several dividend stocks that I could live off of sooner rather than later. But as I continued on my investment journey I realized if I was going to invest for the long-term, I needed to switch my strategy and not worry about chasing the highest paying dividend stocks I could find. I can be get very excited at times when I see something I like so I often have to take a step back, collect my thoughts, and ask myself, "Is this something I want to deal with?" or "Do I need this stress right now?" I've never taken a dividend cut so far and I don't want to either. The closest I came was when I held a position in Medical Properties Trust (MPW). I sold out of my position a while back before the dividend cut was announced. I also held a position in Arbor Realty Trust (NYSE:ABR) to focus more on stocks that I felt were better picks at the time. I liked ABR and didn't see anything wrong with the mortgage REIT. I know that the sector is considered risky but I think ABR is a safe investment for investors, especially if you are looking for income. Someone wrote me a personal message asking me what I thought of the stock. So let's revisit what I like about this mortgage REIT and why I think it's an attractive investment right now.

Portfolio Structure

One thing I like about Arbor Realty is that they are internally managed and focus on the stable and attractive Single and Multifamily sectors. I also like their geographic location. They have a high concentration in fast-growing states like Florida and Texas. Both have seen their growth rates increase over the last several years. Texas by 20% and Florida by 18.92%. The company considers itself different than other mortgage REITs. They focus on building long-term client partnerships and have a results-oriented approach that produces innovative & efficient financial solutions. And Although I consider the company's portfolio to be well-structured, the overall real estate sector will face risks in the coming quarters with the potential for further rate hikes and inflationary pressures.

Financial Performance

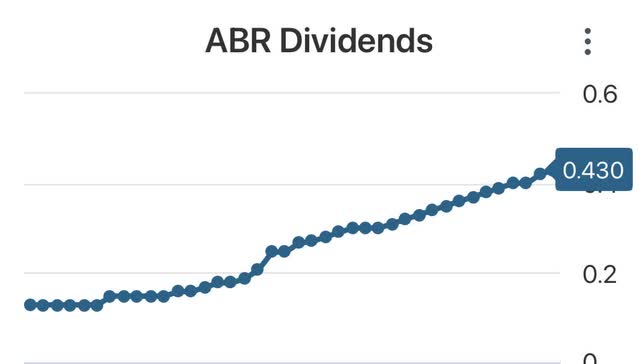

ABR grew their net income by 6% year over year from $308 million to $326 million while decreasing their debt balance. They also managed to grow their servicing portfolio from $27 billion to $28.9 billion over the same period. Since I view my stocks as forever holds, unless fundamentals change, or I see a better opportunity elsewhere, I like to look at least 5 years' worth of dividend growth and financial data when reviewing a stock for a possible position. And ABR passes the test with flying colors. I'm usually a little skeptical when investing in mortgage REITs as I have a longer-term outlook, and I feel like the sector can be tricky in that regard. I mean look at popular peer AGNC Investment Corp (AGNC). They've cut their dividend 4 times since 2016! I mean that's why we're all here right? Most of us don't hold these vehicles expecting the growth of Apple (AAPL) or Microsoft (MSFT). We hold them to collect the dividends every month, or in ABR's case, every quarter. We look forward to those dividends hitting our brokerage accounts and if you're lucky to get some growth to go along with it, then that's icing on the cake. And Arbor Realty has done just that. They have delivered 11 straight years of dividend growth, and have given shareholders 40% (dividend growth) with 11 increases in the last 13 quarters alone! They also maintain one of the lowest payout ratios in the industry at 75%. This was at 68% before the stock conducted its last dividend increase of 2.4% to $0.43 a share.

Peer Superiority

Below I picked some of the most popular mortgage REITs: Annaly Capital Management (NLY), AGNC, Starwood Property Trust (STWD), and ARMOUR Residential REIT (ARR) here on Seeking Alpha by followers to make a comparison to Arbor Realty. Not only is ABR the superior REIT by price return over the last year, they also beat out their peers handily in total return over the last 5 years. While all are down double digits over the last year, ABR is up 3.54%. Furthermore, they and STWD are the only two REITs with a positive total return, and as you can see ABR more than doubles that of STWD!

Valuation

Although the company trades at a premium of 21% to its book value, I still think the stock is a buy. Quality stocks come at a premium, and as seen by the company's track record, this mortgage REIT deserves every bit of it. On July 28th the stock was trading at almost $18 and has seen its price fall to $15.05 and has since bounced back to a price of $15.80 currently. One of the reasons for this I believe is the double-downgrade the stock received 3 days later from Piper Sandler due to its rich premium. Because of this, the stock is now an attractive buy. Additionally, ABR's price target was recently raised to $17 from $16 less than a week ago.

Insider Buys

If the raising of the price target is not enough conviction for you, maybe this is. Over the past several months ABR has experienced some significant insider buying. This normally happens when management believes the stock is undervalued. As you can see there has been no selling of ABR shares over the past 12 months further showing the conviction in the company's future. When opportunity knocks on quality stocks, investors should answer the call. Insider buying shows investors that they are bullish and believe the stock will continue delivering positive returns to its shareholders.

Potential Risks

With interest rates likely to remain elevated over the near-term, ABR's structured business will likely remain challenged with low agency loan originations. The company also reported that their loan book did see an increase in delinquencies in the second quarter but stated that they are well-positioned for the current macro environment due to their strong balance sheet and liquidity of approximately $1 billion in cash. One thing of note is that all three non-performing loans were in the multifamily sector for a total of over $116 million. Additionally, ABR reported a $16 million provision for loan losses associated with the CECL. This brought their total to seven non-performing loans with a carrying value of $122 million, before loan loss reserves of $10.1 million. This is 3 more than Q1 and double the loan loss reserves at $5.1 million. With another potential rate hike next month, ABR could see a further rise in NPL's as borrowers continue to face inflationary pressures such as increased expenses and higher labor costs. But even with all of this, I think ABR will be fine as I suspect interest rates to be cut by the first half of next year. The mortgage REIT has shown resilience in the face of adversity and I see them continuing to reward shareholders with dividend increases as the economy finally stabilizes in the second half of 2024.

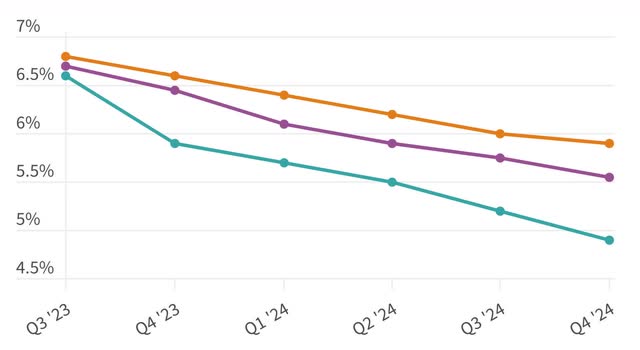

Look ahead

As stated earlier, I suspect rates will start to decline the first half of 2024 but nobody knows this for sure as it is hard to predict. Fannie Mae, the Mortgage Bankers Association, and Wells Fargo are all predicting rates will fall in the first half of '24. As rates decline, I believe this will boost economy & overall market sentiment driving stock prices higher, specifically in the real estate (VNQ) sector. Furthermore, many investors will most likely rotate back into the stock market as the prices of high-interest savings, money market, and CDs decline as well. This was a big reason I believe for lower stock prices over the last month as investors sought out safer investments with T-bills and bonds yielding over 5%. And with many stocks in the sector being undervalued, I believe ABR will see its price increase as it gets back to their normal operations of revenue and EPS growth in the second half of the year.

Investor Takeaway

ABR is trading at an attractive valuation and has a well-diversified portfolio that focuses on the growing Sun Belt region. I see ABR as a potential long-term buy as the stock has proved its resilience over the last few years. Management also seems shareholder friendly as seen by the 11 dividend raises in the last 13 quarters. The dividend is safely covered and ABR has one of the lowest payout ratios amongst its peers. They've also outperformed popular peers in price and total return over the near and long term. I predict interest rates will start to come down in the first half of next year and this will increase overall market sentiment as many rotate out of safer, high-yielding investments. Due to their recent decline, I think many stocks in the real estate sector will see their share prices appreciate, offering investors significant upside in the second half of '24. For those reasons, I rate ABR a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ABR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.