Brinker International: Attractively Valued With Good Growth Prospects

Summary

- Brinker International's revenue growth is expected to benefit from price increases, improved menu mix, and the launch of the It's Just Wings menu in restaurants.

- The company's sales growth in the fourth quarter of fiscal 2024 was driven by price increases and a reduction in promotions, offset by negative guest traffic.

- Brinker International plans to sustain top-line growth through price increases, menu improvements, virtual brand expansion, increased advertising, and enhanced guest satisfaction.

Tim Boyle

Investment Thesis

Brinker International’s (NYSE:EAT) revenue growth should benefit from price increases, mix improvement through lower promotions, and new offerings. Furthermore, the company's sales should also benefit from the launch of the virtual brand It's Just Wings in the bar and dine-in menu, increased advertising and marketing efforts, as well as enhanced guest satisfaction. On the margin front, the company should benefit from moderating inflation, price increases, and a favorable mix. So, the company’s growth prospects remain encouraging. Moreover, the stock price has recently corrected along with the broader restaurant industry making the company’s valuation even more compelling. This combined with the growth prospects ahead, make it a buy.

Revenue Analysis and Outlook

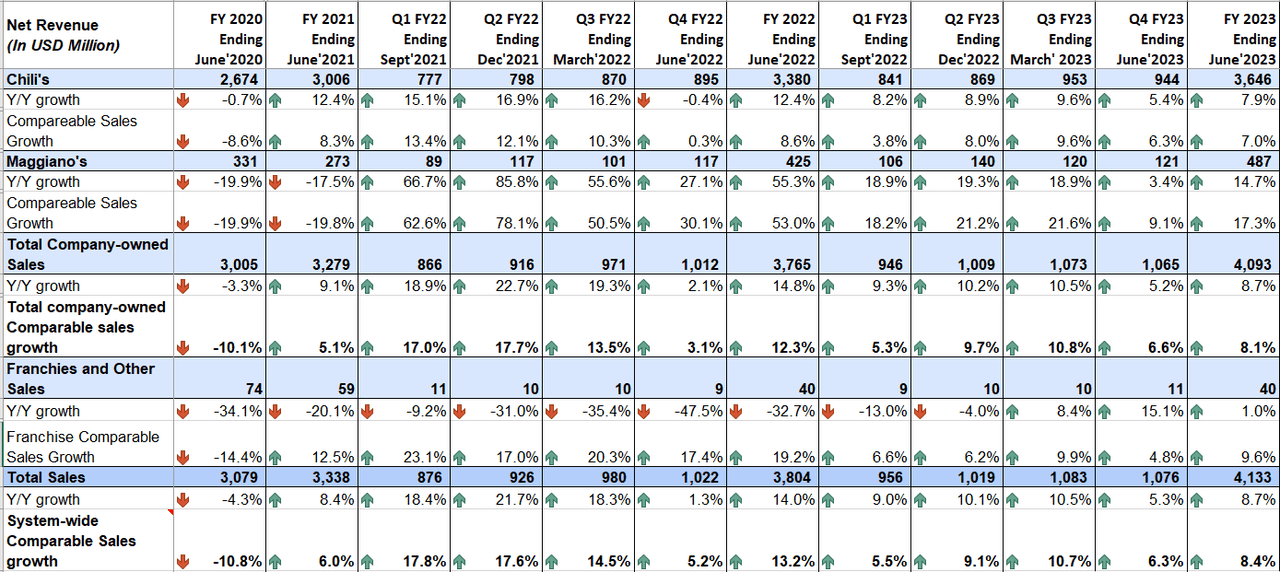

In my previous article, I talked about Brinker International’s growth prospects benefiting from price increases, a favorable mix, an increase in advertising, and improving guest satisfaction. The company reported its fourth quarter of fiscal 2023 since then and similar dynamics were seen there as well.

In the fourth quarter of fiscal 2024, the company’s sales growth momentum continued. The sales growth was attributed to price increases over the past couple of quarters. In addition, an improved menu mix due to the reduction of promotions and discounting also helped the sales growth. The company also saw good traction gained on the company’s advertising campaign including returning to national TV. These positives were partially offset by negative traffic in an inflationary environment and the discontinuation of Maggiano's unprofitable virtual brands. This resulted in a 5.3% Y/Y increase in sales growth to $1.08 billion. On a comparable same-restaurant basis, total company-owned sales increased by 6.6% Y/Y, reflecting a 940 bps benefit from price increases, and a 410 bps from mix shift, offset by a 690 bps headwind from guest traffic decline.

EAT’s Historical Revenue (Company Data, GS Analytics Research)

Looking forward, I believe the company should be able to sustain its top-line growth as it benefits from price increases, improving menu mix, the launch of virtual brands in restaurants, accretive advertising, and guest satisfaction improvements.

Over the last fiscal year, the company has taken multiple price increases to offset inflationary headwinds. This has benefited its comparable sales growth through increasing average check growth. On the Q4 FY23 earnings call, management commented that it would take two additional rounds of price increases in FY24. This will be incremental to 4 percentage points of carryover impact of price increases taken over the last year, resulting in a mid-single-digit contribution to the comparable sales growth in FY24. So, price increases should continue to support the top-line growth moving forward.

In addition, the company is also focused on improving the menu mix to further drive comparable sales growth. This approach signifies a shift from a focus on short-lived promotions and discounts that might temporarily boost sales by attracting customers by giving heavy discounts. Instead, the company aims to enhance its menu offerings to better cater to customer preferences and encourage higher-value orders over the long term. This should foster a more loyal customer base and sustained growth in the future periods. So, EAT plans to continue to reduce promotions and discount offers moving forward as well, which should also contribute to average check growth and hence the comparable sales growth.

While the benefits from price increases and a favorable menu mix should more than offset declining guest traffic, however, the company is also focused on gradually recovering its guest traffic in FY24. For this purpose, the company is launching its virtual brand ‘It’s Just Wings’ in the real world, that is, the complete menu of It’s Just Wings will be available on the company’s bar menu and in the dine-in menu which adds a whole bunch of chicken wing appetizers to the company’s offering. The company launched Its Just Wings virtually during the pandemic, which helped it increase off-premise sales and was well received by the customers, helping sales growth. Now, I expect the availability of the company’s chicken wings in the company’s bars and dine-in restaurants should help attract customers to the restaurants as these have already become popular through the online delivery platforms. This should help in recovering guest traffic. It should also drive the average check higher through an increase in add-ons to the orders.

Moreover, the company also returned to national TV advertising after three years in FY23. This helped the company gain good traction on its core menu as well as value offerings in the second half of fiscal 2023, helping in widening the traffic gap with the industry and also helping gain market share. The company is now accelerating on-TV advertising from four weeks in FY23 to 21 weeks in FY24. This increase in the national advertisement should further support the guest traffic over the coming quarters. Further, the company is also planning to be on-air during the football and other major sports events in the year and focus its on-TV advertising commercials on It’s Just Wings. This should also drive incremental guest traffic, given the good demand for chicken wings and similar appetizers during sports events.

Furthermore, the company is also upgrading its bar menu, which is expected to launch later in August, and includes happy hour specials, premium drinks, and a completely new food lineup with an emphasis on crispers and chicken wings. This should also help in recovering guest traffic moving forward. In addition, as I mentioned in my previous article, the company is taking initiatives to improve guest experience and increase loyalty to the brands. The company reintroduced bussers, additional cooks, and table cleaners in the third quarter, reducing the workload of table servers and leading to better customer engagement, fewer complaints, improved order accuracy, and faster table turns. So, improvements in the guest satisfaction score should also help in increasing guest traffic moving forward due to an increase in brand loyalty given the improved service.

Hence, I believe the company should be able to recover guest traffic as we progress forward in the year. So, price increases and a favorable mix should help the company sustain the top line in FY 24 and recovery in guest traffic should also add support to the sales growth. Management has guided revenue between $4.27 billion to $4.35 billion for FY24, implying a 3% to 5% YoY, with a mid-single-digit comparable sales growth. I believe the guidance is achievable and there is also a possibility of the company beating the guidance if the steps to attract guest traffic gain traction. So, I am positive about the revenue growth prospects ahead.

Margin Analysis and Outlook

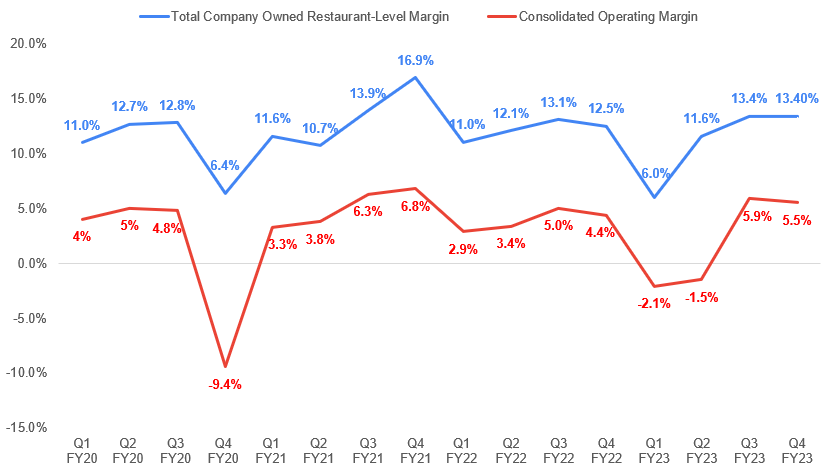

In the fourth quarter of fiscal 2023, Brinker International continued to grapple with challenges stemming from rising costs in commodities, which presented a 4% year-over-year headwind, and labor expenses, which posed a 5% year-over-year headwind.

However, the company managed to counter these obstacles by reducing discounts and promotional offers during the quarter, thereby improving the menu mix. Furthermore, price increases implemented over the past few quarters also contributed to margin growth. This resulted in a 90 basis points year-over-year increase in the restaurant-level operating margin for company-owned restaurants, to 13.4%. The consolidated operating margin also saw growth, increasing by 110 basis points year-over-year, reaching 5.5%.

EAT’s Historical company-owned Restaurant Operating Margin and Consolidated Operating Margin (Company Data, GS Analytics Research)

Looking forward, I believe the company should continue to deliver margin growth. As mentioned in the revenue analysis, the company plans to take incremental price increases in fiscal 2024. These price increases ahead, in addition to the carryover impact of price increases from last fiscal year, should continue to support the margins of the company. In addition, the company is also experiencing moderating inflation. The company faced a 9% YoY headwind from inflationary commodity costs in the third quarter of fiscal 2023, which declined to 4% YoY in the fourth quarter. Moving forward, management expects inflation to be a 1% YoY headwind for the full fiscal year 2024, implying further moderation of inflation. So, this should be less of a drag on margins as compared to the previous year.

Moreover, the mix improvement should also benefit margins. As the company keeps reducing the discounts and promotions, the menu mix should also support margins.

So this improving mix, price increases, and moderation in overall commodity inflation should help the company’s margins moving forward and help the company offset wage inflation and higher advertising investments. Hence, I remain optimistic about the company's margin growth prospects ahead.

Valuation and Conclusion

Brinker International is trading at a 9.68x FY24 consensus EPS estimate of $3.36, and an 8.58x FY25 consensus EPS estimate of $3.79, which is at a discount to its historical 5-year average FWD P/E of 13.87x. I believe the company has improving growth prospects and management's ability to deliver performance better than the industry on certain key metrics like guest traffic is positive. The company should sustain its top-line and bottom-line growth despite macroeconomic uncertainty. Moreover, the recent correction in the stock price in line with the broader restaurant industry stocks has made the valuation compelling. Hence, I have a buy rating on the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Saloni V.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)