Dropbox Set For High Teens Returns Through AI, Remote Work, And Share Buybacks

Summary

- Dropbox's freemium model and AI investments aim to convert its 700 million users into paying customers.

- Work-from-home trend likely to boost demand for Dropbox's services.

- 80% of paid users adopt Dropbox for business purposes, making Dropbox resilient in a recessionary environment.

- Dropbox's aggressive share buyback program mitigates share dilution.

- Projected 10% annual growth suggests DBX's 5-year target at $62.48.

Drew Angerer

Investment Thesis

In my opinion, Dropbox, Inc. (NASDAQ:DBX) presents a strong buy opportunity for a variety of reasons. The company's freemium business model and focus on AI technology position it well to convert a large portion of its 700 million registered users into paying subscribers. The sustained trend of remote work, fueled by the COVID-19 pandemic, is likely to boost the need for Dropbox's cloud storage and collaboration tools. Furthermore, with 80% of its paying users being business clients, the company seems well-insulated against economic downturns. Its proactive share buyback program also serves to mitigate the dilution from stock-based compensation, enhancing value for shareholders. Taking into account a conservative 10% annual growth rate in TTM Cashflow per Share, the stock has an encouraging five-year price target of $62.48. If these estimates hold, investing in DBX at its current market price could yield a CAGR of 18% over the next half-decade.

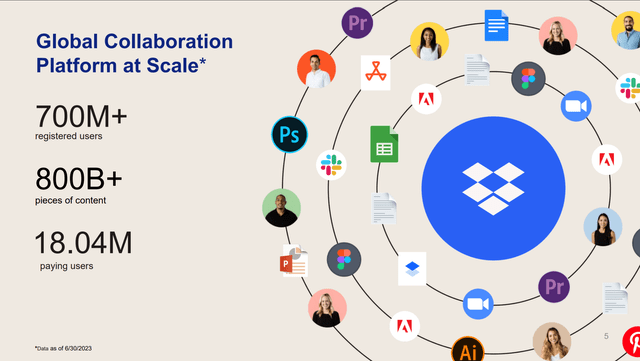

Opportunity to Leverage a Massive User Base

Dropbox adopts an "open garden" strategy, enabling smooth integration with various third-party apps and services, which provides users greater flexibility in their cloud storage and collaboration needs. On the other hand, Google (GOOG) (GOOGL) Cloud and Microsoft (MSFT) OneDrive typically function within "walled gardens," focusing on integration with their own product ecosystems, thereby potentially restricting users to their specific platforms. As a result, Dropbox has successfully amassed over 700 million registered users through its freemium business model, which offers basic cloud storage and collaboration features for free, with premium features available through paid plans. In my view, the 700 million registered users are a testament to Dropbox's ability to attract a broad audience, thanks in part to its freemium model. This massive user base serves as a fertile ground for potential conversions to paid plans, which is where the real revenue opportunity lies for the company. As Dropbox continues to innovate and improve its product offerings, it has the chance to make its premium plans more compelling, thereby increasing the likelihood of conversions.

Dropbox Q2 Earnings Presentation

The company has been investing in AI technologies to improve its core services and introduce new features. For example, AI algorithms can be used for smarter file organization, enhanced search capabilities, and even real-time collaboration features. By integrating AI into its platform, Dropbox aims to make data management more intuitive and efficient, which is particularly important for business users who deal with large volumes of data. I think this may drive future acquisitions of new paying users, if Dropbox can be successful in its implementation.

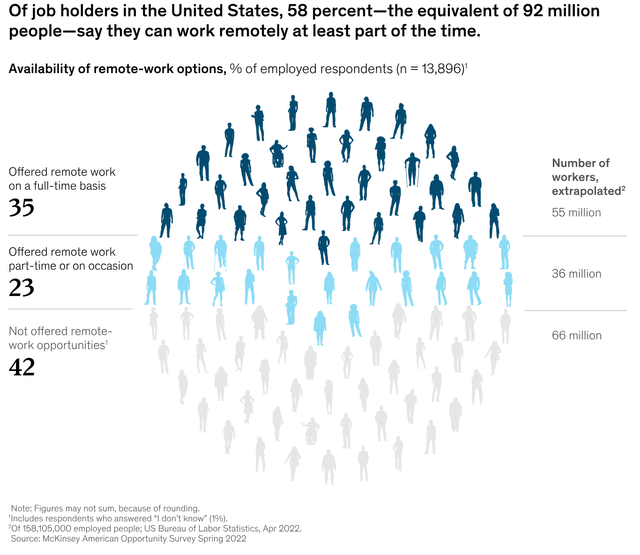

Capitalizing on the Long-Term Shift to Remote Work

The work-from-home trend, accelerated by the COVID-19 pandemic, shows signs of becoming a long-term shift in how businesses operate. As seen in the figure below, 58% of employed survey participants work remotely at least part-time, which when extrapolated equates to an estimated 92 million individuals across various job sectors and employment types, indicate that they have the flexibility to work remotely either full-time or part-time. The study found that after over two years of monitoring the remote work landscape and forecasting that flexible work arrangements would persist beyond the critical stages of the COVID-19 pandemic. Therefore, I believe Dropbox will benefit from the work-from-home trend as this will increase the demand for cloud storage and collaboration tools.

Dropbox to Stand Resilient Amid Recessionary Risk

In my opinion, Dropbox has smartly positioned itself as an essential tool for a wide range of business owners. The fact that 80% of its users employ the platform for work-related activities speaks volumes about its importance in professional settings, from small businesses to large enterprises. Given this widespread business use, I believe that Dropbox is likely to be resilient in recessionary conditions. During economic downturns, many businesses may cut discretionary spending, but tools like Dropbox, which are integral to daily operations, are often considered non-negotiable expenses. This leads me to think that the company's revenue stream could be relatively stable and less vulnerable to economic headwinds. Furthermore, Dropbox benefits from minimal customer concentration, which in my view, adds another layer of economic resilience. The revenue isn't overly dependent on a handful of large clients, reducing the financial risk associated with the potential loss of any single customer or sector. Overall, I believe that Dropbox's role in diverse business operations and its balanced customer base make it well-positioned to weather economic downturns.

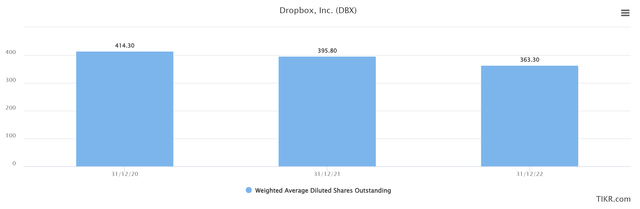

Dropbox's Aggressive Share Buyback Program

In the second quarter of 2023, Dropbox repurchased a total of 6.99 million shares at an average price of approximately $22.25 per share. The company started the quarter with the ability to purchase up to $516.15 million worth of shares under its publicly announced programs. By the end of June, the approximate dollar value for future repurchases was reduced to $418.06 million. This indicates an active share buyback strategy, with the company spending roughly $98 million on share repurchases during the quarter.

As seen in the graph below, from 2020 to 2022, Dropbox has been actively involved in share buyback programs. In 2021, the company repurchased and subsequently retired 41.1 million of its Class A common stock for an aggregate amount of $1.1 billion. This included $200 million in repurchases of 8.6 million shares outside of their stock repurchase program. In February 2022, Dropbox's Board of Directors authorized the company to repurchase up to an additional $1.2 billion of its outstanding shares of Class A common stock. As a result, the total share count over this period has decreased by 12.3% to 363.30 million shares outstanding.

One common argument against Dropbox has been its stock-based compensation, which can dilute shareholder value. However, in my opinion, the company's aggressive share buyback programs serve to offset this dilution.

Financial Analysis

Over the past 5 years, the company has demonstrated remarkable financial performance. Its revenue has shown a consistent and strong growth, increasing from $1,391.70 million in 2018 to $2,423.40 million in the last 12 months in 2023, representing a compound annual growth rate (CAGR) of approximately 12%. The earnings per share (EPS) has been equally impressive, growing from being unprofitable as a business in 2018 with an EPS loss of -$1.35 to a positive EPS in the last twelve months of $1.50, reflecting the company's ability to expand operating margins as the business has gained considerable scale. The management team projects that by Fiscal Year 2024, the company will reach $1 billion plus in annual free cash flow. This projection, however in my opinion will depend on the macro environment looking forward given that if we fall into a major recession in the next 12 months, Dropbox will likely miss their guidance.

Dropbox Q2 Earnings Presentation

As of the most recent quarter, the company reported cash and cash equivalents of $1,227.50 million. The company's total debt stands at $1,375.90 million, a modest amount that reflects the company's conservative approach to leverage, especially when you also consider that Dropbox are already producing $750 million per year in free cash flow. Therefore, I do not see debt as a risk for Dropbox, even if a recession does end up arriving.

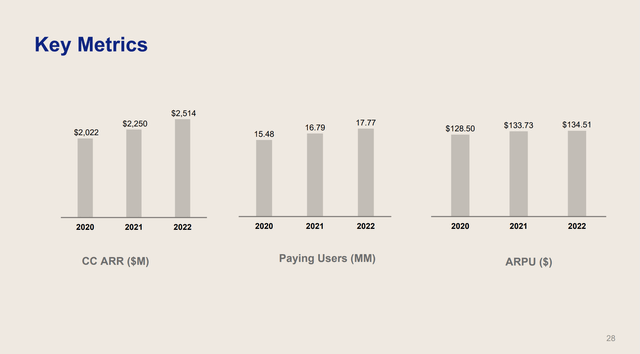

Between 2020 and 2023, Dropbox has experienced significant changes in its key performance indicators such as Annual Recurring Revenue, Paying Users, and Average Revenue Per User. As of June 30, 2023, Dropbox reported an ARR of $2.5 billion, representing a growth rate that suggest a 7.2% year over year growth rate. The number of paying users rose to 18.04 million as of June 30, 2023, marking a growth rate of approximately 3.9% from 17.37 million in June 2022. The ARPU also showed an upward trend, increasing from $134.63 in Q1 2022 to $138.97 in Q1 2023, a growth rate of about 3.2%. These metrics collectively indicate a positive trajectory in both user growth and revenue generation. The company has been successful in upselling to higher-priced plans, contributing to the ARPU growth. Additionally, the acquisition of FormSwift in Q4 2022 played a role in boosting both paying users and ARR. However, it's important to note that the overall growth rate in paying users has shown a decline, mainly due to a loss of a large university customer.

Dropbox Q2 Earnings Presentation

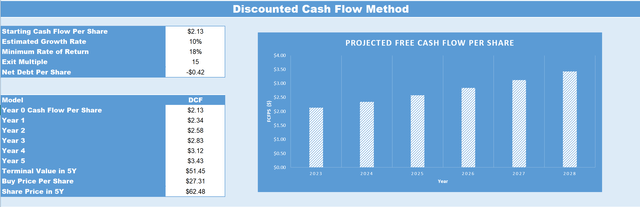

Valuation

When considering valuation, I always consider what we are paying for the business (the market capitalization) versus what we are getting (the underlying business fundamentals and future earnings). I believe a reliable way of measuring what you get versus what you pay is by conducting a discounted cashflow analysis of the business as seen below.

Dropbox’s current TTM Cashflow per Share as of Q2 2023 is $2.13. Based off the reasons discussed throughout this article, I believe that DBX’s TTM Cashflow per Share should grow conservatively at 10% annually for the next five years. Therefore, once factoring in the growth rate by Q2 2028 DBX’s cash flow per share is expected to be $3.43. If we then apply an exit multiple of 15, which is below DBX’s mean price to free cashflow ratio for the previous 5 years of 18, this infers a price target in five years of $62.48. Therefore, based on these estimations, if you were to buy DBX at today's share price of $27.89, this would result in a CAGR of 18% over the next five years.

Conclusion

In conclusion, Dropbox has strategically positioned itself to capitalize on multiple fronts. Its freemium model, coupled with investments in AI, aims to convert a significant portion of its 700 million registered users into paying customers. The enduring work-from-home trend is likely to further boost demand for Dropbox's cloud storage and collaboration tools. Moreover, with 80% of its paid users utilizing the platform for business, Dropbox appears well-suited to withstand economic downturns, adding a layer of resilience to its revenue streams. The company's aggressive share buyback program serves as a countermeasure to potential share dilution, enhancing shareholder value. Based on a conservative projection of 10% annual growth in TTM Cashflow per Share, the stock has a five-year price target of $62.48. If these estimations hold true, purchasing DBX at today's share price could yield an 18% CAGR over the next five years in my view.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DBX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.