Apollomics: A Taiwanese-Origin Company With Late Stage Pipeline

Summary

- Apollomics is a small company with a pipeline of c-Met targeting small molecule TKIs for various cancers.

- Their lead candidate, Vebreltinib, is in phase 2 trials for NSCLC, GBM, and other solid tumors.

- They also have a second asset, APL-106, which is a specific E-Selectin antagonist being explored as a therapeutic target in certain types of cancer metastasis.

- Looking for more investing ideas like this one? Get them exclusively at The Total Pharma Tracker. Learn More »

FrankRamspott/E+ via Getty Images

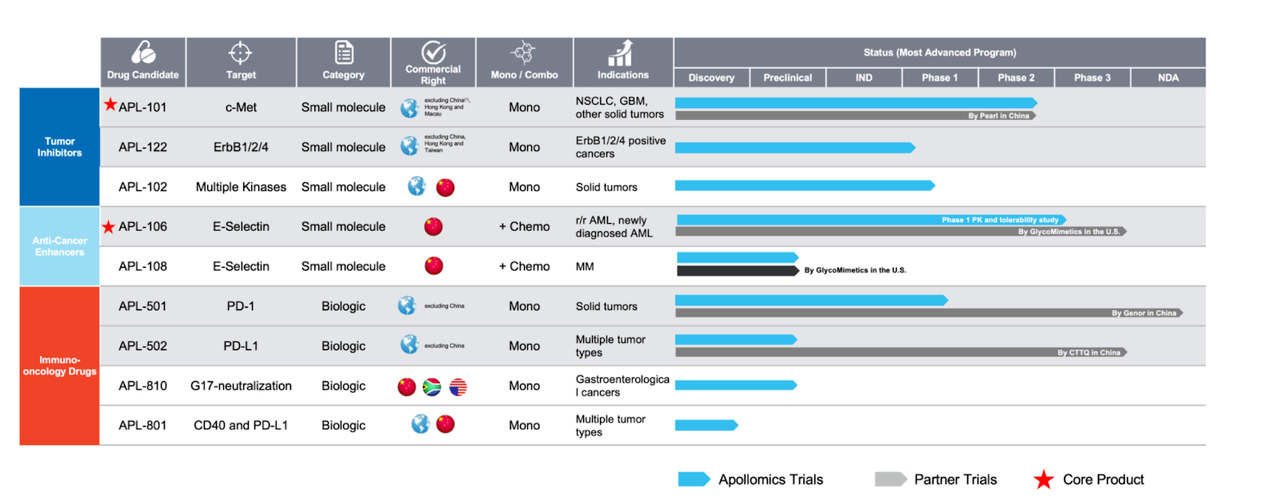

Apollomics (NASDAQ:APLM) is a small company with a big pipeline that just launched recently. It came to the market through a Taiwan-based SPAC called Maxpro Capital Acquisition Corp. It licensed assets from various entities, including Uproleselan from GlycoMimetics. Here’s a look at its pipeline:

Lead candidate Vebreltinib (APL-101) is a c-Met targeting small molecule TKI in phase 2 monotherapy trials for NSCLC, GBM and other solid tumors.

c-Met, also known as MET (Mesenchymal-Epithelial Transition factor), is a protein that plays a crucial role in various cellular processes, particularly in cell growth, survival, migration, and differentiation. It is a receptor tyrosine kinase, which means it is a type of cell surface receptor that activates intracellular signaling pathways when it binds to its specific ligand.

The ligand for c-Met is hepatocyte growth factor (HGF), also known as scatter factor (SF). When HGF binds to c-Met, it triggers a cascade of intracellular events that promote cell proliferation, survival, and motility. These activities are important during normal development, tissue repair, and wound healing. However, dysregulation of c-Met signaling has been implicated in various diseases, particularly cancer.

Aberrant activation of c-Met signaling can lead to uncontrolled cell growth, invasion, and metastasis in cancer cells. This has made c-Met an important target for cancer therapy, and there have been efforts to develop drugs that specifically inhibit c-Met activity. Inhibiting c-Met can potentially slow down the progression of certain cancers by blocking the signals that promote tumor growth and spread.

In preclinical studies, APL-101 has demonstrated inhibitory effect in a number of xenograft models of human primary c-Met amplified gastric, hepatic, pancreatic and lung cancer. A phase 1 trial done in China demonstrated not only safety and tolerability, but also showed preliminary anti-tumor activity. This was seen in exon 14 skipping mutations and/or MET amplification, two of the common ways in which dysregulation of c-MET signaling may occur.

The company, along with its partner Caris MPI, Inc., developed an RNA-based companion diagnostic system using whole transcriptome sequencing for patient selection in clinical trials of APL-101.

An international multicenter, open-label study evaluating the safety, pharmacokinetics, and preliminary efficacy of APL-101 is currently ongoing in the following target Indications:

Non-small cell lung cancer (NSCLC) with MET exon 14 skipping alterations

Glioblastoma multiforme with MET amplifications and fusions

Solid tumors with MET amplifications and fusions

Their second asset is APL-106, or Uproleselan, a specific E-Selectin antagonist. E-Selectin, also known as endothelial-selectin or CD62E, is a cell adhesion molecule that plays a crucial role in the process of inflammation and immune response. It is a type of selectin, which is a family of adhesion molecules involved in mediating interactions between white blood cells (leukocytes) and the inner lining of blood vessels, known as endothelial cells.

E-Selectin is expressed on the surface of endothelial cells, which line the blood vessels. It is primarily responsible for capturing and tethering leukocytes, particularly neutrophils and some other types of white blood cells, to the endothelium at sites of inflammation. This interaction is a crucial step in the immune response to infections and tissue injury.

In certain types of cancer metastasis, where leukocyte adhesion and migration mediated by e-selectin play a significant role, targeting e-selectin is being explored as a therapeutic target.

As the company states:

In many hematologic cancers, E-Selectin plays a critical role in binding cancer cells within vascular niches in the bone marrow, which prevents the cells from entering the circulation where they can be more readily killed by chemotherapy. As supported by studies in animal models, we consider that APL-106 has the potential to improve chemotherapy response rates, duration of remission and, ultimately, survival in patients with hematologic cancers such as AML.

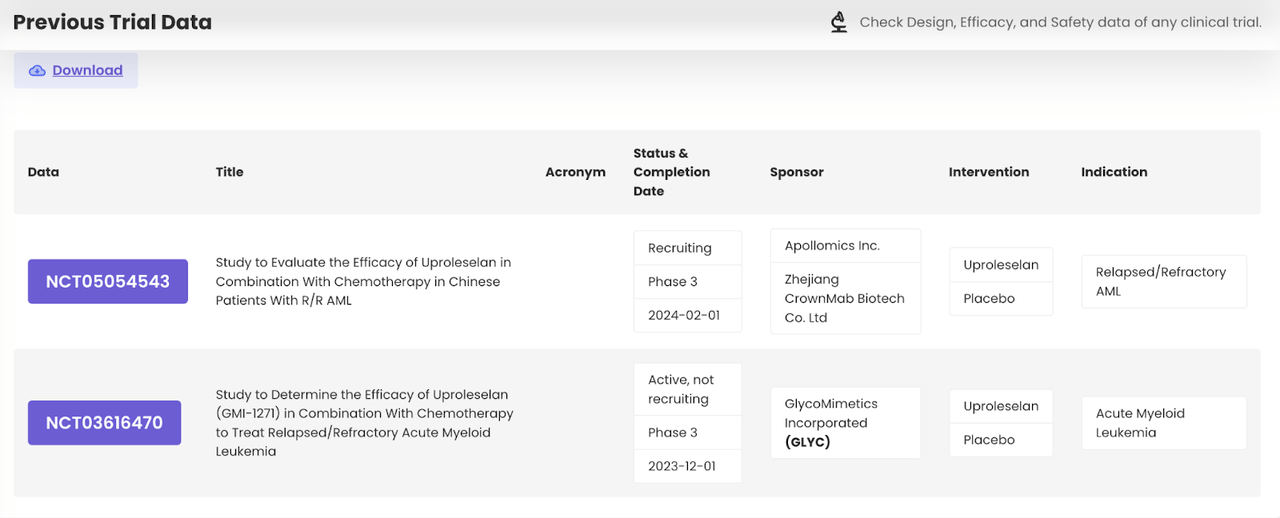

Uproleselan has been run through a number of trials by GlycoMimetics, and APLM is currently running it through a phase 3 trial in Chinese patients in r/r AML. GlycoMimetics did a similar study in the US. See the data on TickerBay.com:

Uproleselan trials (TickerBay)

GlycoMimetics published data from these trials at ASH last year, which showed that “the combination of Cladribine + LDAC with Uproleselan was overall well tolerated with few treatment-related AEs. The combination produced an ORR of 62% in a high-risk, refractory population whose prognosis is very dismal.” In r/r AML and newly diagnosed AML, median overall survival was 8.8 months and 12.6 months respectively.

Financials

APLM has a market cap of $422mn and a cash balance of $56mn and a debt of $516mn according to Seeking Alpha. However, the company has not released any earnings this year, so it is not possible to get updated data on these figures or on expenses.

The retail public holds nearly 43% of the company, while PE/VC firms and pvt corps hold 20% each. Key holders are George Kaiser Family Foundation and OrbiMed.

Risks

As with any China/Taiwan origin companies, there’s always the risk of data bridging across populations. Being a relatively new company, there’s also a dearth of data. Moreover, they have not released earnings recently, so there is no clarity on financials.

Bottomline

Nothing stands out here except the Taiwan angle. We don’t see a lot of Taiwanese companies trading in the USA. We will continue to cover APLM as and when there’s data, but have no investing interest.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

This article was written by

Dr Dutta is a retired veterinary surgeon. He has over 40 years experience in the industry. Dr Maiya is a well-known oncologist who has 30 years in the medical field, including as Medical Director of various healthcare institutions. Both doctors are also avid private investors. They are assisted by a number of finance professionals in developing this service.

If you want to check out our service, go here - https://seekingalpha.com/author/avisol-capital-partners/research

Disclaimer - we are not investment advisors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important: My Hold rating only means "I will not Buy now." I am not telling *you* to hold, because I see some risks here. But I am also not telling you to *sell*, because, a) the risks are not insurmountable, and b) you may have bought at such a low price that your risk-benefit ratio is acceptable to you. Thus, my “Hold” is a bearish rating, but it is not as bearish as a “Sell” rating.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.