QDEF: Unconvincing Low-Beta Variant Of QDF

Summary

- FlexShares Quality Dividend Defensive Index Fund ETF holds 126 dividend stocks selected with a proprietary quality score and low-beta optimization.

- The QDEF ETF has outperformed a number of dividend ETFs in the last 12 months, but historical performance is underwhelming.

- QDEF is a variant of QDF, aiming at reducing volatility, but the two funds have very close fundamental, performance and risk metrics.

- Quantitative Risk & Value members get exclusive access to our real-world portfolio. See all our investments here »

champpixs/iStock via Getty Images

QDEF strategy and portfolio

FlexShares Quality Dividend Defensive Index Fund ETF (NYSEARCA:QDEF) started investing operations on 12/14/2012 and tracks the Northern Trust Quality Dividend Defensive Index. It has 129 holdings, a distribution yield of 2.71% and an expense ratio of 0.37%. Distributions are paid quarterly.

As described in the prospectus by FlexShares, the fund seeks to

...provide exposure to a high quality income-oriented universe of long-only U.S. equity securities, with an emphasis on long-term capital growth and a targeted overall beta that is generally between 0.5 to 1.0 times that of the Northern Trust 1250 Index.

Eligible stocks must be in the Northern Trust 1250 Index, pay a dividend and not be in the lowest quintile regarding a proprietary quality score.

The Index Provider then uses an optimization process to select and weight eligible securities in order to (1) maximize the overall quality score relative to the Parent Index; (2) attain an aggregate dividend yield in excess of the Parent Index; and (3) achieve the desired beta target.

The fund's strategy is almost identical to FlexShares Quality Dividend Index Fund ETF (QDF), reviewed here. The main difference is a lower beta target that justifies its "defensive" denomination.

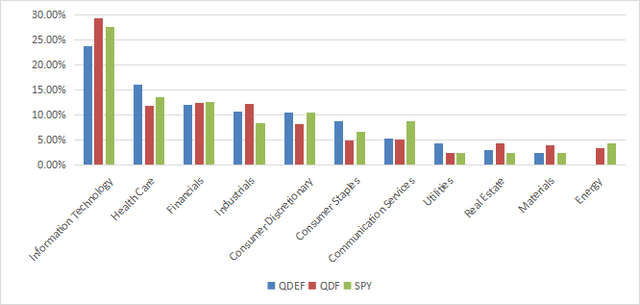

The turnover rate in the most recent fiscal year was 47% (vs. 40% for QDF). The fund is exclusively invested in US companies, mostly in the large capitalization segment (about 71% of asset value). The next chart compares the sector breakdowns of QDEF, QDF and the large-cap benchmark S&P 500 (SPY). Technology is the heaviest sector with 23.7% of asset value, but not as heavy as it is in QDF (29.4%). Compared to SPY and QDF, QDEF moderately overweights healthcare, consumer staples and utilities, which is not a big surprise: these are the traditional defensive sectors. It underweights mostly technology and totally ignores energy.

Sector breakdown (chart: author; data: FlexShares, SSGA)

The top 10 holdings, listed in the next table with weights and fundamental ratios, have an aggregate weight of 35.9%. Apple and Microsoft weigh about 13% together. Risks related to other individual companies are moderate.

Ticker | Name | Weight | EPS growth % ttm | P/E ttm | P/E fwd | Yield % |

Apple, Inc. | 7.72% | -1.68 | 30.28 | 29.76 | 0.53 | |

Microsoft Corp. | 5.51% | 0.42 | 33.43 | 29.47 | 0.84 | |

Broadcom Inc. | 3.87% | 56.85 | 27.21 | 20.48 | 2.14 | |

Procter & Gamble Co. | 3.18% | 1.65 | 26.07 | 24.02 | 2.45 | |

The Home Depot, Inc. | 3.16% | -1.61 | 20.35 | 21.45 | 2.57 | |

Cisco Systems, Inc. | 2.73% | 9.02 | 18.28 | 13.84 | 2.78 | |

The Coca-Cola Co. | 2.64% | 9.95 | 25.04 | 22.91 | 3.04 | |

AbbVie, Inc. | 2.53% | -31.10 | 30.28 | 13.35 | 4.02 | |

McDonald's Corp. | 2.45% | 33.85 | 26.12 | 24.52 | 2.14 | |

Comcast Corp. | 2.11% | -48.53 | 29.16 | 12.14 | 2.52 |

Ratios from Portfolio123.

QDEF is much cheaper than the S&P 500 regarding valuation ratios, except price-to-book, as reported in the next table. The difference with QDF is not really significant.

QDEF | QDF | SPY | |

Price/Earnings TTM | 18.49 | 16.84 | 23.32 |

Price/Book | 3.98 | 4 | 4.1 |

Price/Sales | 1.85 | 2.04 | 2.62 |

Price/Cash Flow | 12.71 | 12.12 | 16.37 |

Source: Fidelity

Performance

QDEF has underperformed SPY by about 2 percentage points in annualized return since 1/1/2013. It is almost tie with QDF. Risk measured in drawdown and standard deviation of monthly returns ("volatility" in the next table) is a bit lower (just a bit, really: about one percentage point in maximum drawdown and volatility). Regarding risk-adjusted performance (Sharpe ratio), it is behind SPY and a low-beta benchmark, iShares MSCI USA Min Vol Factor ETF (USMV).

Total Return | Annual Return | Drawdown | Sharpe ratio | Volatility | |

QDEF | 201.47% | 10.91% | -35.74% | 0.72 | 13.98% |

QDF | 202.00% | 10.93% | -36.67% | 0.71 | 14.90% |

SPY | 267.74% | 13.00% | -33.72% | 0.86 | 14.68% |

USMV | 208.76% | 11.16% | -33.10% | 0.85 | 12.05% |

Data calculated with Portfolio123.

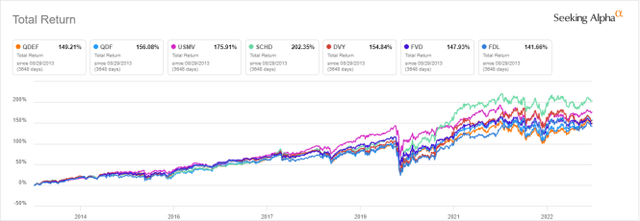

The next chart compares 10-year total returns of QDEF, QDF, USMV and four large-cap dividend funds:

- Schwab U.S. Dividend Equity ETF (SCHD).

- iShares Select Dividend ETF (DVY).

- First Trust Value Line Dividend Index Fund (FVD).

- First Trust Morningstar Dividend Leaders Index Fund (FDL).

QDEF is close to the bottom of the pack.

QDEF vs competitors, 10-year return (Seeking Alpha)

However, in the last 12 months QDEF and QDF are almost on par, and significantly ahead of their competitors.

QDEF vs competitors, 12-month return (Seeking Alpha)

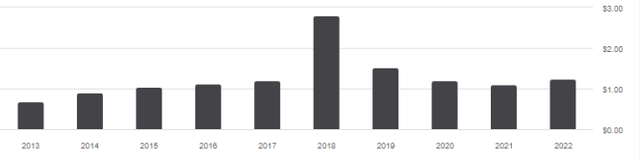

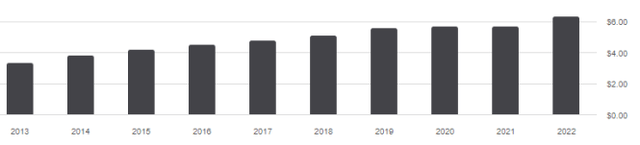

The annual sum of distributions has increased from $0.68 per share in 2013 to $1.25 in 2022. It is an 84% growth in 9 years, beating by far the cumulative inflation: about 27%, based on CPI. Nonetheless, it is behind the broad large-cap benchmark SPY (88.7%). Moreover, the distribution trend has been uneven. In fact, QDEF distributions have been decreasing since 2018, with a timid bounce in 2022. SPY dividend growth has been much steadier (see next charts).

QDEF distribution history (Seeking Alpha)

SPY distribution history (Seeking Alpha)

In previous articles, I have shown how three factors may help cut the risk in a dividend portfolio: Return on Assets, Piotroski F-score, and Altman Z-score.

The next table compares QDEF since 1/1/2013 with a subset of the S&P 500: stocks with an above-average dividend yield, an above-average ROA, a good Altman Z-score, a good Piotroski F-score and a sustainable payout ratio. The subset is rebalanced annually to make it comparable to a passive index.

Total Return | Annual Return | Drawdown | Sharpe ratio | Volatility | |

QDEF | 201.47% | 10.91% | -35.74% | 0.72 | 13.98% |

Dividend quality subset | 291.79% | 13.67% | -34.96% | 0.88 | 15.03% |

Past performance is not a guarantee of future returns. Data Source: Portfolio123.

QDEF lags the dividend quality subset by 2.8 percentage points in annualized return. A note of caution: ETF performance is real, and this subset is simulated. My core portfolio holds 14 stocks selected in this subset (more info at the end of this post).

Portfolio quality

QDEF holds 126 stocks, of which 7 are risky regarding my preferred quality metrics. These are stocks with at least two red flags among: bad Piotroski score, negative ROA, unsustainable payout ratio, bad or dubious Altman Z-score, excluding financials and real estate, where these metrics are unreliable. Risky stocks weigh only 3.1% of asset value, which is an excellent point.

According to my calculations reported in the next table, aggregate quality metrics are higher than for the S&P500. They point to a portfolio quality superior to the benchmark. In particular, the return on assets is very good. However, there is no material difference with QDF.

QDEF | QDF | SPY | |

Atman Z-score | 5.35 | 5.52 | 3.51 |

Piotroski F-score | 6.18 | 6.14 | 5.68 |

ROA % TTM | 11.65 | 12.35 | 7.1 |

Takeaway

FlexShares Quality Dividend Defensive Index Fund ETF has a portfolio of 126 dividend stocks selected with a proprietary quality score and low-beta optimization. Its sector breakdown is close to the S&P 500, but valuation and quality metrics are much better. QDEF has outperformed a number of dividend ETFs in the last 12 months, but historical performance measured in return and dividend growth is underwhelming. QDEF is a close variant of QDF aiming at reducing volatility, but there is no material difference between the two funds in historical return, drawdown, Sharpe ratio, valuation, and quality. The beta optimization doesn't bring a lot of additional safety to the quality filters already implemented in QDF. As the latter has much higher trading volumes, there is no strong argument to prefer QDEF.

Quantitative Risk & Value (QRV) features data-driven strategies in stocks and closed-end funds outperforming their benchmarks since inception. Get started with a two-week free trial now.

This article was written by

Step up your investing experience: try Quantitative Risk & Value for free now (limited offer).

I am an individual investor and an IT professional, not a finance professional. My writings are data analysis and opinions, not investment advice. They may contain inaccurate information, despite all the effort I put in them. Readers are responsible for all consequences of using information included in my work, and are encouraged to do their own research from various sources.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CSCO, KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)

What is the point of FlexShares creating 2 ETFs?