3M: Low Valuation Justified By Weak Financials

Summary

- 3M Company is facing slight revenue declines due to temporary challenges in various industries.

- The conglomerate has a wide range of products and frequently changes its offering through acquisitions and divestitures.

- As the company has no acquisitions in the recent past, 3M's organic figures start to show as the operating margin has deteriorated and revenues have trailed.

- Although 3M seems cheap on a price-to-earnings basis, I have a hold-rating for the stock because of the weak financials.

josefkubes

3M Company (NYSE:MMM), the conglomerate that sells products and services to industrial, electronical, and other industries, is facing slight revenue declines as the industries are facing temporary challenges. I believe the stock is currently fairly priced considering 3M’s history of stable earnings, constituting a hold-rating.

The Company

As a conglomerate, 3M has a very wide offering of products ranging from abrasives to products in the medical field:

The company seems to be changing up its offering quite frequently, as 3M’s cash flow statement has acquisitions and divestitures on most of the years in the company’s recent history.

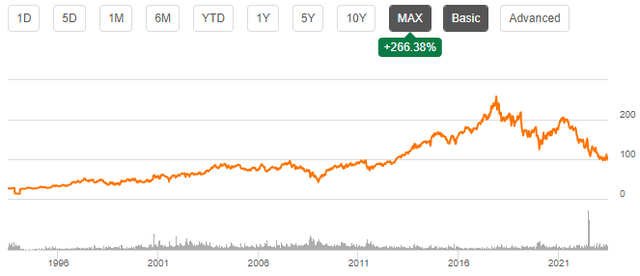

3M’s stock price has had a decent performance, as the stock has appreciated at a compounded annual rate of around 4.4% from 1993:

3M 30-year Stock Chart (Seeking Alpha)

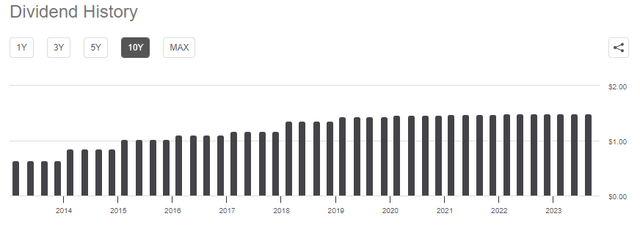

Although the appreciation of 4.4% alone doesn’t sound like a good return, the company has also had a fairly high dividend yield. 3M currently has quarterly dividends of $1.5, making the company’s dividend yield 6.06% at the current price. Historically, the company has had growing dividends, but as the company’s earnings have had a rough period from 2018, the dividend has largely stayed stable:

Financials

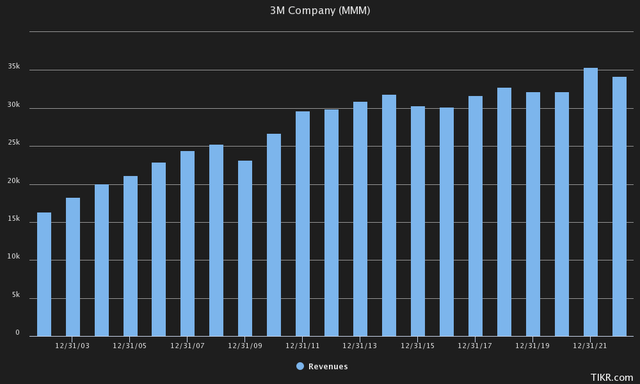

3M’s revenues have grown at a compounded annual rate of 3.8% from 2002 to 2022:

As the growth is largely driven by the conglomerate’s constant acquisitions, 3M’s organic growth has been quite lacking in the years.

On the other hand, 3M’s operating margin has been quite strong throughout its history – the company’s margin has fluctuated between a range of 16.3% and 23.7%, with most years being more close to the higher figure. The margin has been deteriorating for 3M in the recent past, though – in 2018, the company had an operating margin of 23.7% and an EBIT of $7.77 billion, compared to the current trailing level of a 17.1% margin and $5.64 billion EBIT – as 3M had its most recent acquisition in 2019, the company hasn’t been able to keep a very good operating run organically.

3M’s balance sheet reveals long-term debts totalling $16.1 billion, of which $3.0 billion is in the current portion to be paid off within a year. As the company has a market capitalization of around $54.6 billion, the debt level doesn’t seem unhealthy to me. The conglomerate has also only had around $488 million in interest expenses in the trailing twelve months, representing only 8.6% of 3M’s EBIT; the debt makes 3M’s cost of capital lower, which is why I believe the debt is reasonable to have. 3M also holds a cash balance of $4.3 billion, making dividend payments secure for the coming quarters.

Valuation

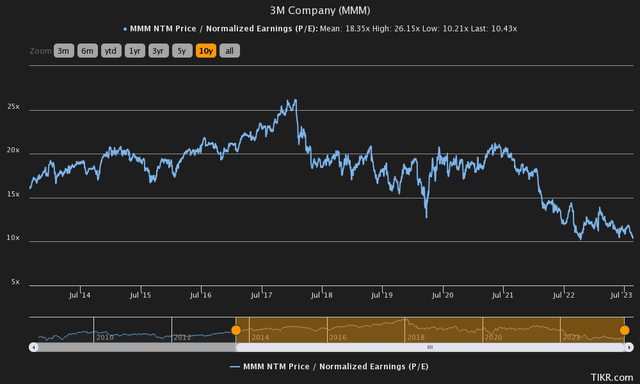

As 3M’s stock price has plummeted from 2018 highs, the company seems to trade at a vast discount when looking at its historical forward price-to-earnings ratio – currently, the forward P/E is only 10.43, compared to the 10-year average of 18.35:

The lower valuation is justified in my opinion, as 3M’s organic growth seems to be in a bad condition, and as higher interest rates raise investors’ required rate of return. I constructed a discounted cash flow model to further illustrate the valuation.

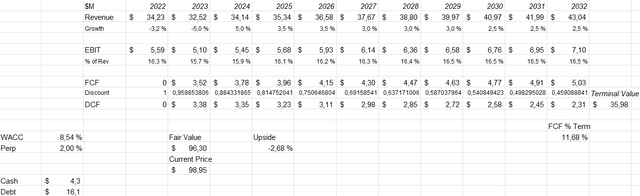

In the model, I estimate 3M to hit the lower limit of the current year’s guidance, corresponding to decreasing revenues of 5%. The estimate would put the remaining quarters in line with the first half of 2023, as revenues decreased by 9.0% in Q1 and 4.3% in Q2. Going forward, I estimate 3M to have a slight bounce back in 2024 as the estimated growth is 5%. Beyond 2024, I estimate the conglomerate to have growth of 3.5% for a couple of years, with the growth slowing into a perpetual rate of 2%. I believe the rate is slightly above 3M’s historical organic rate, but as further acquisitions could create value, I believe the estimate is justified.

For the current year, I estimate 3M’s EBIT margin to be 15.7%, slightly below previous year’s 16.3%. As the company’s margin has deteriorated from 2018 levels, I don’t have too high expectations for the margin going forward. I do estimate in the model, that 3M manages to get a hold of the margin, with the EBIT margin scaling back into 16.5% in a few years. If 3M proves that it can achieve a margin near historical levels of over 20%, the stock could have upside compared to my DCF model estimate, but I don’t currently see such margins as a base scenario.

These estimates along with a weighed average cost of capital of 8.54% craft the following DCF model, with an estimated fair value of $96.30, around 3% below the current price:

DCF Model of 3M (Author's Calculation)

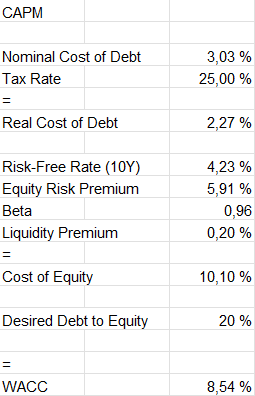

The used cost of capital of 8.54% is derived from a capital asset pricing model with the following assumptions:

CAPM of 3M (Author's Calculation)

3M has trailing interest expenses of $488 million – with the current amount of long-term debt, this comes up to an interest rate of 3.03%; 3M has an outstandingly low interest rate, as the United States’ bonds trade at clearly higher yields. I expect 3M to keep its debt-to-equity ratio at near current levels at 20%.

I use the United States’ 10-year bond yield as the risk-free rate on the cost of equity side, with the yield currently being 4.23%. The used equity risk premium of 5.91% is Professor Aswath Damodaran’s latest estimate made in July. Tikr estimates 3M’s beta at 0.96. Finally, I add a small liquidity premium of 0.2% into the cost of equity, making the cost of equity 10.10%. The WACC ends up at 8.54% with these estimates, used in the DCF model.

Takeaway

Although 3M trades significantly below the S&P 500 on a price-to-earnings basis, I don’t believe the stock is a screaming buy even on the significantly lower stock price compared to 2018 levels – 3M’s organic growth seems to be almost non-existent, and the company’s margins have gone lower than the company’s historical level. As such, I have a hold-rating for the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.