ADC Therapeutics: Slowly Moving Toward Solvency

Summary

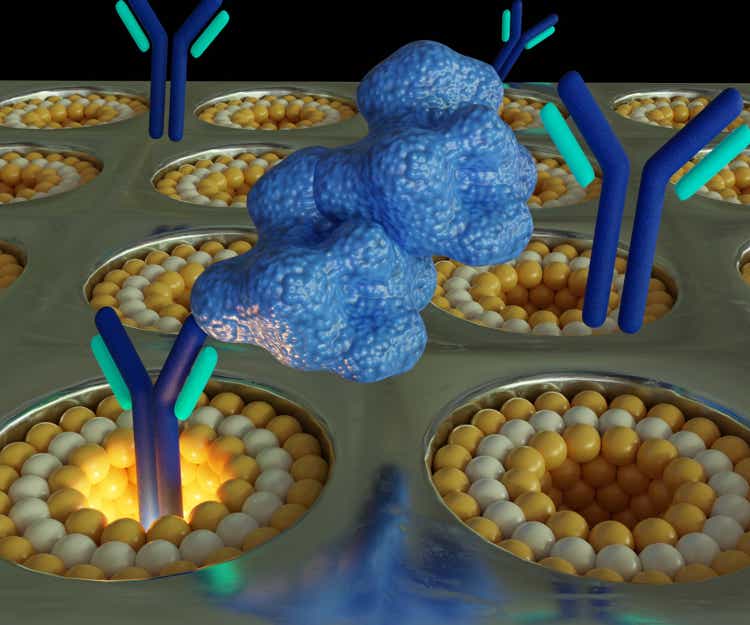

- ADC Therapeutics is a small-cap biotech with an approved antibody-drug conjugate in lymphoma.

- The company has faced setbacks but has cash on hand and promising clinical data outside of their flagship product.

- They are trading below their enterprise value, making them a potentially strong opportunity for risk-tolerant investors.

Love Employee/iStock via Getty Images

Topline Summary

ADC Therapeutics (NYSE:ADCT) is a small-cap commercialized biotech with an approved antibody-drug conjugate in lymphoma. While they've had many setbacks, their cash on hand and recent encouraging clinical data outside of their main flagship product provides some direction for the future and time to accomplish it. They are also trading below their enterprise value, making this a potentially strong opportunity for risk-tolerant investors.

Pipeline Overview

ADCT currently has one approved agent on the market, an antibody-drug conjugate (ADC) called loncastuximab tesirine, which targets CD19 that's expressed on B cells in patients with relapsed or refractory large B-cell lymphoma. This agent was granted accelerated approval based on findings from LOTIS-2, a single-arm study. This approval, as with all accelerated approvals, is contingent on positive findings from a larger, randomized phase 3 trial. This would be LOTIS-5, a study investigating loncastuximab tesirine in combination with rituximab for patients with relapsed or refractory large B cell lymphoma.

That's what's old. ADCT is also trying to push this agent in other directions, with recent negative news. On July 20, ADCT announced that LOTIS-9, a trial investigating loncastuximab tesirine plus rituximab in patients with previously untreated DLBCL, was going to be discontinued due to an uneven balance of risk to benefit. No further details regarding what results led to this decision, but

As of right now, there's not a lot else going on for loncastuximab tesirine. ADCT is conducting a phase 1b trial in patients with non-Hodgkin lymphoma after relapse, and they anticipate results in 2024. Still, this is early days for that other arm of their project, so loncastuximab is probably going to sit in a bit of a holding pattern for a while. The company is continuing to push the indication to other markets, with a registrational effort in China ongoing.

Camidanlumab tesirine

This CD25-targeted ADC is designed to exploit CD25, a marker expressed on various cancers. The company has conducted a "pivotal" phase 2 trial in relapsed/refractory Hodgkin lymphoma, and the positive findings were presented at EHA 2022. In this heavily pretreated group of patients, 70.1% had a response to therapy, and median progression-free survival was 9.1 months.

Although promising, ADCT guided that it would not seek accelerated approval based on these findings, since they do not yet have a confirmatory trial underway and enrolled.

ADCT is currently not developing camidanlumab tesirine further, indicating that a partner would likely need to be brought on board to push this confirmatory trial forward without completely undermining ADCT's financial solvency.

ADCT-601

The company is also working on an ADC directed against the AXL receptor tyrosine kinase, which has been implicated (though never successfully exploited) in cancer. ADCT sees a lot of promise with this target, as it can potentially impact areas of unmet need like pancreatic cancer and sarcoma.

The company announced in July 2022 that they'd initiated a phase 2 trial of ADCT-601 alone and in combination with gemcitabine in patients with advanced solid tumors, with a particular focus on enrolling patients with sarcoma. This comes after years of fits and starts related to trial holds. Now we'll get a chance to see what this agent can do, hopefully in the relatively near future.

Now, sarcoma could be a massive market opportunity. One of the last drugs to show signs of life here was olaratumab, which was removed from the market after a failed phase 3 trial, but was achieving sales exceeding $500 million per year before that. And if ADCT can make an impact on pancreatic cancer, it would be a watershed moment in that disease, which has marginal improvements coming every few years or so. Both of these are extremely grim, major unmet needs in cancer medicine.

As such, ADCT-601 should be viewed with both some measure of excitement but also skepticism. Most trials fail in these spaces, and it is reasonable to expect that this one could, as well.

ADCT is also working on a number of earlier-stage projects, none of which I expect to impact the near- or mid-term future more than their current later-stage pipeline and ongoing development of loncastuximab tesirine.

Financial Overview

In their Q2 2023 filing, ADCT disclosed product revenues of $19.3 million, up 11.5% from the same time last year. Operational expenses were also reduced year over year, from $86.7 million in Q2 2022 to $59 million in Q2 2023, for $39.8 million loss for the quarter. Their net loss after financial expenses was $47.1 million.

Meanwhile, they held $347.5 million in cash and equivalents, with total current assets reaching $412.8 million. At this burn rate, the company can absorb these losses for another 7 to 8 quarters, assuming operational costs are kept at pace with growth of loncastuximab tesirine sales.

Strengths and Risks

ADCT has guided their financial strategy to make their flagship drug into an agent commanding between $500 million and $1 billion in peak sales. At its face, this is not an unreasonable forecast, given that Seagen's polatuzumab vedotin, approved in the same disease, has over $500 million in global sales.

The company hopes to realize this potential through 3 tranches of growth. The first has been a reasonable success so far: get the drug approved in relapsed/refractory setting, third-line and beyond. However, they've stalled on the second "horizon," trying to move forward a chemotherapy-free combination in earlier lines of therapy. The failure of LOTIS-9 is a particular setback to note here.

Then their biggest grab will be to develop novel combinations, of which we have not seen any evidence to date as far as potential efficacy, so for now it's not something we can count on, and the company is probably going to be stuck trying to grow a relatively small market share for quite some time.

This situation is forward risk #1: ADCT has no guarantees of being able to push forward any more indications, which is inherent to any biotech project. Past success in relapsed/refractory large B cell lymphoma is no guarantee of success moving forward, as the negative results of LOTIS-5 attest.

Then there was the setback with camidanlumab and the FDA signaling that it would not be very cavalier with the accelerated approval. This is definitely one area of significant risk AND potential benefit, because they have essentially an approvable drug sitting on the shelf waiting to get a randomized trial enrolling. I don't usually count on partnerships to bail a company out, but that one seems like a strong opportunity.

But this underscores the major forward risk #2: ADCT's parallel efforts have not demonstrated conclusively that they belong in the standard of care for these diseases. There are a lot of outstanding treatment options for non-Hodgkin lymphoma, ranging from long-established multiagent chemoimmunotherapy to novel targeted agents to CAR T-cell therapy. If you listen to hematology/oncology professionals talk on these subjects, you'll see that there is a lot of confusion about how best to fit everything together. And that means that ADCT's drugs can get lost in the mix unless they demonstrate conclusive, compelling evidence of where to place them. So this is an inherent risk of biotech investing, and one that's particularly acute for ADCT, that their projects have no guarantee of success, and even if successful they can have trouble finding a real foothold in the market.

Beyond that, with hundreds of millions sitting in the coffer, ADCT has well over a year to figure out their direction, which definitely de-risks an investment, but this is absolutely contingent on them righting the clinical ship and beefing up their portfolio, because the one indication that they have for loncastuximab tesirine is not going to pull them to profitability.

Bottom Line Summary

ADCT is a company currently trading at almost half of its enterprise value, with a budding pipeline of agents that have the chance to make a difference in lymphoma. Couple that with a late-stage drug that has a clear direction forward vis-a-vis partnerships, and I think it's a reasonable case to make that ADCT is quite undervalued.

Therefore, by tentative sentiment is a buy, but with the caveat that it's contingent on them building out beyond the loncastuximab franchise, and that's a pretty large risk. However, a bit of good news, and there is a lot of upside here, if you take a look at similar biologic approvals in these indications.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ADCT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.