Global Tech Industries: Losses Are Expanding And Pivot Into AI Seems Risky

Summary

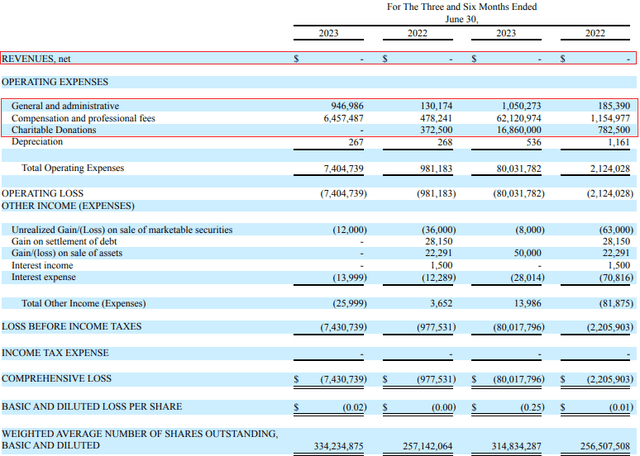

- Global Tech Industries booked an operating loss of $80 million for H1 2023, which is over 37 times higher than a year ago.

- Also, working capital is getting deeper into the red and the share count rose by over 80 million during the period.

- Global Tech Industries has just announced the purchase of AI-focused e-commerce aggregator AI Commerce Group and I see the deal as a negative development.

- This appears to be an early-stage company and Global Tech Industries could be on the hook for significant earn-out payments, with the sellers having the option to buy back 90% of the shares for just $13.5 million.

- Microcap Review members get exclusive access to our real-world portfolio. See all our investments here »

da-kuk

Introduction

I've been following Global Tech Industries Group (OTCPK:GTII) closely and my latest article about the company was published in early April. Back then, I said that the business wasn’t worth much and that the company was unlikely to become profitable anytime soon.

In my view, this could be a good time to revisit Global Tech Industries as the company released its H1 2023 financial results on August 14 and it announced a purchase agreement for an artificial intelligence (AI) firm on August 21. I think the financials were underwhelming as the operating loss soared to more than $80 million and I don’t like the acquisition due to the buyback clause as well as terms for the earn-out payments. My rating on the stock is still a strong sell. Let’s review.

Overview of the recent developments

If you aren’t familiar with Global Tech Industries or my earlier coverage, here's a brief description of the business. The company was founded in 1980 and according to its website, it’s a "mini conglomerate" that specializes in "the pursuit of acquiring new and innovative technologies". Its subsidiaries at the moment include Classroom Salon, and Gold Transactions International.

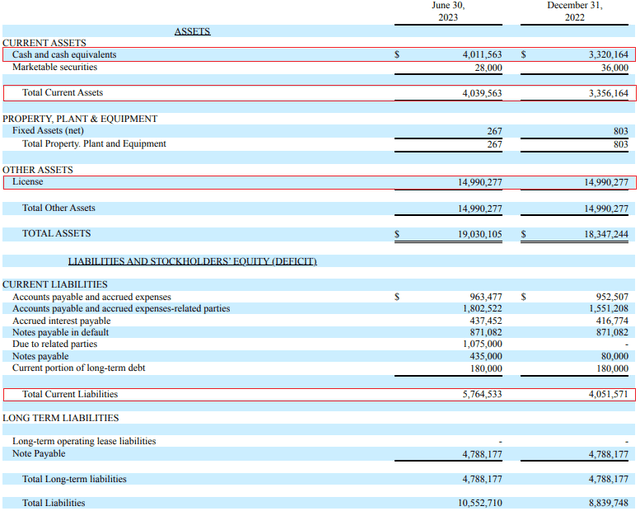

Classroom Salon was bought in February 2022, and it has developed software solutions in partnership with Carnegie Mellon University that use interfaces, workflows, and algorithms to help teach and assess coursework. Gold Transactions International, in turn, was acquired in June 2022 and its main asset was a network that purchases gold from artisan miners internationally and then provides transportation, assaying, refining, and storage services to a free trade zone in Dubai. The company booked revenues of $0.13 million and a net income of $0.07 million in 2021. Yet, looking at the H1 2023 financial results of Global Tech Industries, we can see that there were no revenues while the operating loss increased over 37 times year on year to $80 million due to a significant boost in professional services including investor relations, IT, legal, accounting and consulting and directors' fees. In addition, the company donated 11 million shares valued at $16.9 million to a 501c charitable organization. Most of the operating expenses were paid in shares at Global Tech Industries issued a total of 52,223,221 shares with a fair market value of $79 million for services rendered during H1 2023 (see page 14 here).

In April, Global Tech Industries issued 31 million shares as a stock dividend and the number of shares outstanding thus soared from 262,251,320 in December 2022 to 345,501,402 at the end of June 2023 (see page 5 here).

Looking at the balance sheet, total assets stood at $19 million as of June 2023 and a license related to Gold Transactions International accounted for almost $15 million of this amount. Cash and cash equivalents were $4 million but the working capital got deeper into negative territory as current liabilities increased to $5.8 million. As there is no indication that operating expenses are likely to decrease below the current levels over the coming quarters, I think that more stock dilution is likely as Global Tech Industries continues to issue shares to preserve cash.

Moving on to the acquisition, the company announced on August 21 that it’s buying Puerto Rico-based AI Commerce Group which specializes in acquiring and operating e-commerce websites and brands. The latter aims to take advantage of inefficiencies in e-commerce by using AI technologies and the initial purchase consideration includes an amount in cash equal to 20 million shares, which was about $14.4 million on August 18, the last trading day before the deal was announced. The sum is payable upon AI Commerce Group achieving revenues of $4 million.

Looking through the corporate website of AI Commerce Group, I find it unclear how this company is any different from other e-commerce aggregators and where the AI part of the business is. In addition, there isn’t a single brand or e-commerce website mentioned. Looking through the terms of the deal, I’m concerned that the sellers have the right to buy back up to 90% of AI Commerce Group over a period of 18 months for $13.5 million or 90% of the shares received at their sole discretion. This means that if AI Commerce Group becomes financially successful, Global Tech Industries could be in a position where it has to sell back the vast majority of its shares without a profit. Looking through the other conditions of the transaction, Global Tech Industries could also owe significant additional payments for each dollar of revenue by the latter. If within 12 months of the closing date of the acquisition AI Commerce Group owns at least three e-commerce domains and books quarterly revenues of above $4 million, Global Tech Industries would have to issue three shares for each dollar of revenues above the $4 million mark. If the revenues during the 12-month earn-out period surpass $10 million, Global Tech Industries would have to issue another two million shares. For example, if AI Commerce Group generates revenues of $15 million during the earn-out period and quarterly revenues peak at $7 million, Global Tech Industries would have to issue a total of 11 million additional shares which are valued at $7.9 million based on the share price from August 18. And the sellers have the option to buy back 90% of the company for just $13.5 million. In my view, Global Tech Industries is taking a lot of risks here with an early-stage company and there are potential gains if everything goes well are very small. Therefore, I view this acquisition as a negative development.

So, how do you play this one? Well, I think that short-selling seems viable at the moment as data from Fintel shows the short borrow fee rate stands at 18.56% as of the time of writing. This is much lower than the 88.14% when I wrote my previous article about the company. In addition, the short squeeze risk seems low as the short interest is just 0.11% of the float and it takes just a day to cover. That being said, I think that the best course of action for risk-averse investors could be to avoid this stock as there are no call options available at the moment.

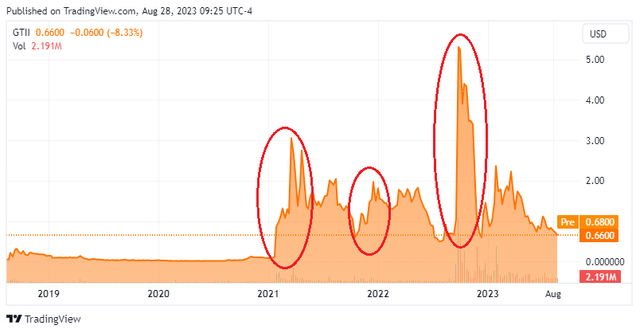

Turning our attention to the upside risks, I think that the major one is that the shares of Global Tech Industries could attract significant investor interest in the near future due to the high interest in AI stocks at the moment. In addition, microcap stocks can soar for spurious and unknown reasons, and this has happened several times over the past few years.

Investor takeaway

Global Tech Industries still has no revenues and it booked an operating loss of just over $80 million in the first half of 2023, which led to significant stock dilution. In addition, working capital is getting deeper into the red and I think there could be more stock dilution ahead. Regarding the pivot to AI, the acquisition of AI Commerce Group doesn’t look like a good deal as Global Tech Industries could be on the hook for significant earn-out payments and the sellers can buy back 90% of the company for just $13.5 million. Yet, short selling here seems dangerous as there are no call options available and there is a history of high share price volatility.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you like this article, consider joining Microcap Review. I post my portfolio and shortlist there and you can also find exclusive ideas from our community of investors. I like to focus on undervalued companies that the market is ignoring, like an island of misfit toys.

This article was written by

I have been investing in stocks since 2007. I have no preference for sectors or countries - I'm as comfortable owning a part of a cement miner in Peru as holding shares in a wheat farming firm in Bulgaria. If it's a value stock - great. If the dividend or share buyback yield is high - even better.

- Disclosure: I am not a financial adviser. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a financial adviser. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.