RLJ Lodging Trust: Undervalued With The Potential For Increased Dividends

Summary

- RLJ Lodging Trust is a full-service hospitality REIT with a portfolio of 96 hotels in 23 states, affiliated with premium brands like Marriott and Hilton.

- The company has an impressive liquidity position, low-interest rates on its debt, and has increased its dividend three times since 2022, making it an attractive investment.

- The company's shares are also undervalued at present, further adding to its appeal.

Andrii Yalanskyi

Introduction

I have written about several hospitality REITs recently, most recently on Apple Hospitality REIT (APLE). Similarly, the focus of this article, RLJ Lodging Trust (NYSE:RLJ) is a hospitality REIT. With the release of the company's Q2 earnings at the start of this month, I will evaluate the company to determine if it is an attractive investment at its current prices.

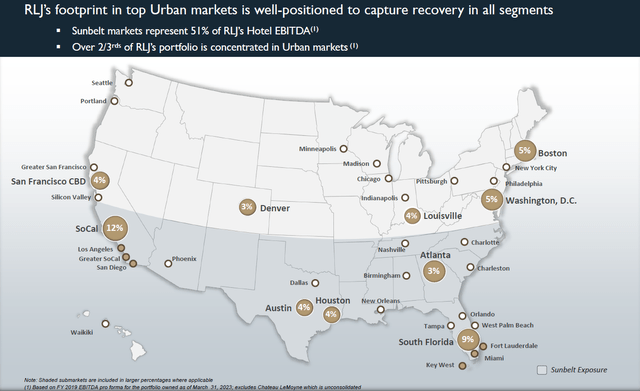

The Portfolio

RLJ Lodging Trust is a full-service hospitality REIT. As of Q2 2023, the company's portfolio encompasses a total of 21,239 rooms in 96 hotels. These hotels are spread across the 23 states, ensuring geographic diversification. Nevertheless, there are some specific areas of focus - over two thirds of the company's portfolio is concentrated in urban markets, with approximately half of the company's EBITDA coming from sunbelt markets. The company's portfolio of hotels are affiliated with premium brands owned by international franchisors such as Marriott, Hilton and Hyatt, with close to 90% of its hotels having such affiliations. This allows the company to leverage on the strength of these brands, as well as their worldwide reservation systems and guest loyalty programs, to name a few.

RLJ Jul 2023 Investor Presentation

Q2'23 Performance

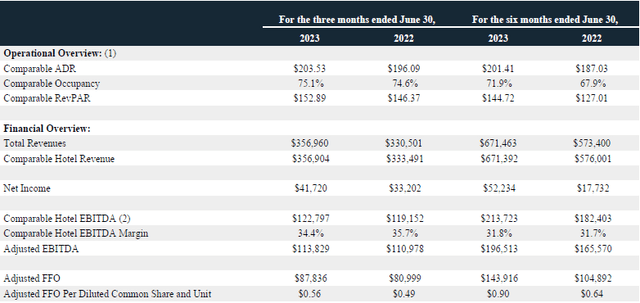

At the start of the month, the company announced its results for Q2 2023. Net income attributable to common shareholders came in at $35.1 million, or $0.22/share, a substantial increase of over 30% from the corresponding period the previous year, which saw a net income of $26.7 million or $0.16/share. Looking at its adjusted funds from operations (AFFO), the company posted an AFFO of $0.56/share, an impressive 14% uptick in comparison to the $0.49/share reported in Q2 2022. Looking at the first half of the year as a whole paints an even more promising picture, with the AFFO of $0.90/share representing a remarkable 40% increase from the $0.64/share reported in the first half of 2022.

Zooming in on the more granular details, the company's revenue per available room (RevPAR) saw an increase of 4.5%. Crucially, this growth was attributed to a well-balanced combination of an increase in the company's average daily rate (ADR) and an increased occupancy rate. Looking solely at the company's urban markets, the main focus of its portfolio, saw an increase in RevPAR of 7.7%. This is particularly noteworthy as the company's RevPAR for its urban markets reached pre-pandemic levels (i.e. 2019) for the first time and is testament to the company's recovery from the pandemic.

Balance Sheet

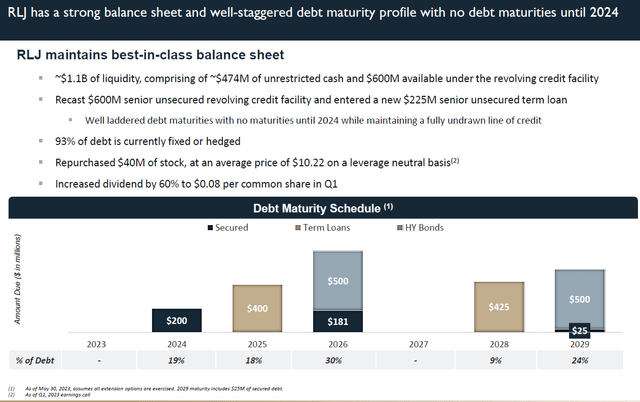

Turning our attention to the company's financial health, the company has an impressive liquidity position of $1.1 billion as at the end of Q2 2023. This amount comprises $477 million in unrestricted cash and a further $600 million secured via the company's revolving credit facility. Before moving further, I should highlight that the image below predates the Q2 results, thus there may be some slight differences in the figures, though the general idea remains the same.

The company's debt portfolio currently stands at approximately $2.2 billion, with a weighted average interest rate of 3.98%. Moreover, an impressive 93% of the company's debt is effectively fixed rate, making the interest rate even more appealing. In the current economic landscape, with the Federal Reserve recently saying they were prepared to raise rates further, an interest rate of less than 4% is a very attractive one.

Notwithstanding the low interest rates, the company has taken steps to further enhance the strength of its balance sheet. During the quarter, the company refinanced its loans to provide it with additional flexibility, giving the debt a weighted average maturity of 3.5 years, with no debt due for the rest of the year. Moreover, the projected debt obligations until 2026 can almost be fully covered by the company's existing liquidity. This gives the company the financial flexibility to pursue any opportunistic acquisitions which arise, thereby furthering the company's growth.

RLJ Jul 2023 Investor Presentation

Dividend

As with other hospitality REITs, the company saw a substantial impact on its dividends during the pandemic. From 2020 to 2022, the company's dividends remained nominal, with a quarterly dividend of $0.01/share. For dividend-seeking investors, many REITs were not an attractive investment purely from a dividend standpoint.

Beginning in 2022, however, the company began to increase its dividends. The company first increased its dividends to $0.05/share, and subsequently to $0.08/share. Most recently, during the earnings call, the company announced a 25% increase to its dividend, raising the quarterly dividend to $0.10/share. This also marks the third dividend increase since 2022. At its current share price of $9.57, this translates to dividend yield of 4.18% based on an annualized dividend of $0.40/share. While this isn't a very high dividend yield considering the current risk-free rate, the company's future dividend potential should be considered.

To explore the company's future dividend potential, two key aspects come into play - inclination and capability. During the earnings call, management said the company was "committed to returning capital to shareholders through a combination of both share repurchases and dividends". Additionally, the company's consistent dividend increases over the past year does bode well for future increases as well.

Looking at the company's capability to increase its dividends, the AFFO is a key metric to consider. With an AFFO of $0.90/share for the first half of the year, the company is able to comfortably cover its existing dividend payout of $0.10/share. Looking ahead to Q3, the company has projected an AFFO of between $0.37/share and $0.44/share. This gives the company a dividend payout ratio of, at worst, 27% and indicates the potential for further dividend increases. Although a return to the pre-pandemic dividend of $0.33/share might be too ambitious for the company, the company has significant room to increase its dividends. Even if the company doubles its dividends to a rate of $0.20/share, the dividend payout ratio will remain at only 54%. Hence, it appears likely that the company will continue its streak of dividend increases.

Valuation

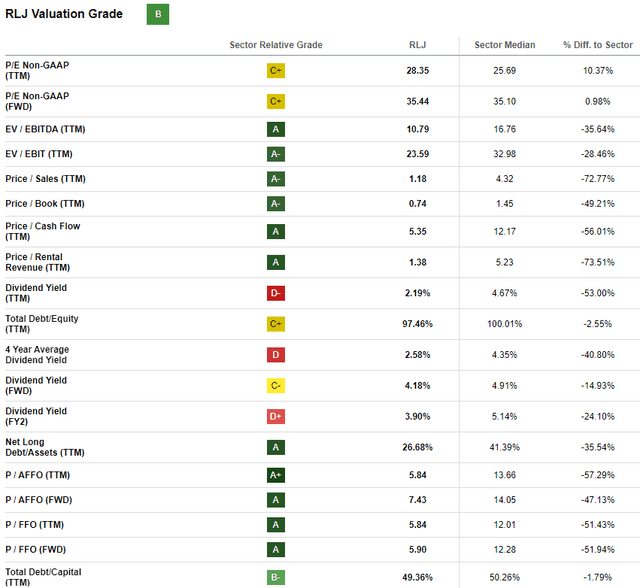

Looking at the company's valuation, the Seeking Alpha quant system gives the company a "B" rating. The main factor dragging down the company's rating is its dividend yield, which receives a "D" rating from the quant system. However, looking at other valuation metrics such as the company's price-to-book (P/B ratio) and its forward price-to-AFFO ratio (forward P/AFFO ratio) paint a promising picture - the quant system gives an "A" rating for both metrics. Compared to its peers in the industry, the company has both a lower P/B ratio and a lower forward P/AFFO ratio by a significant margin, indicating its shares are undervalued at present.

This sentiment is one that is shared by the company's management. Throughout 2023, the company has repurchased approximately 5.3 million shares at an average price of $10.22/share, for a total of $54.2 million. Additionally, during the second quarter, the company approved a new $250 million share repurchase program, indicating the company believes its shares remain undervalued and further buybacks are on the horizon.

Risks

As with every investment, there are always risks to consider. One of the reasons I view the company favourably is that I believe the company will increase its dividends in the near future. However, it is entirely possible that management chooses not to do so. This could be due to an underperformance in the company, or if management decides to allocate more money to share repurchases. If so, the company would be paying a dividend yield of around 4%. Given that current T bills are paying over 5%, a yield of 4% would not be worth it considering that you would also be exposing yourself to the risk of capital losses.

This brings me to my next point - valuation. As observed above, the company's share price is certainly undervalued based on various valuation metrics. Nevertheless, there is no guarantee that the share price will increase. Additionally, a look at the company's share price over the past year shows that it has been at its lowest in over a year. In fact, since it reached a post-COVID high of close to $17 in March 2021, the stock has been on a downward trend ever since. It is entirely possible that the share price will continue to decrease in the near future.

That being said, as I have highlighted above, the company has a very healthy balance sheet. Moreover, the company has shown both the inclination and the capability to raise its dividends, and its shares are substantially undervalued as well. Thus, in terms of risk to reward, the shares look attractively priced at present it is a risk worth taking.

Conclusion

The company has a very healthy balance sheet, and its shares are undervalued at present. While its current dividend yield may not be the highest at present, the company has shown both the inclination and the capability to increase its dividends. Thus, all things considered, I believe the company is an attractive investment at its current price point, and I rate the company a "Buy".

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in RLJ over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.