Never Forget: REITs Own Property Run By People

Summary

- REIT stocks have not performed well this year, but the quality of the management team is an important factor in determining the success of a REIT.

- Examples of REITs with strong management teams include Realty Income, Prologis, Alexandria Real Estate, Rexford Industrial, Mid-America Apartment, and Camden Property Trust.

- These REITs have experienced positive AFFO growth and have strong balance sheets, making them attractive investment opportunities.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

ImageGap

I know the title of this article is somewhat basic. It’s also a far cry from some of my other click-bait titles like “My, Oh My, Another Strong Buy.”

However, I decided to use it anyway because it centers around a powerful concept that too many people ignore.

We in the investing world – and many outside of it – know certain names of certain company CEOs and former CEOs. These legends include Apple’s (AAPL) late Steve Jobs, Microsoft’s (MSFT) former CEO, Bill Gates, Amazon (AMZN) founder Jeff Bezos, and Meta’s (META) Mark Zuckerberg.

All tech personalities, I know. So how about Bob Iger over at Disney (DIS) or Jamie Dimon at JPMorgan Chase (JPM)?

Slightly less well known, it’s true, but they’re still big enough names compared to the vast majority of business leaders.

In such cases, it’s easy to see how important certain people are to the company. But the truth is that every business is dependent on its leadership.

That’s not meant to be a slight against employees. It’s only to say that corporate culture is created by management – that employees get their motivation and inspiration from the men and women who determine their roles and the resources to make the roles work.

That’s why I always make sure to know a thing or two about the C-suites running any recommendation I make.

Brad’s C-Suite interviews at iREIT® on Alpha

A Thing or Two About REITs

Based on both the article’s title and opening segment, I’m sure you already understand. I’m going to recommend real estate investment trusts ("REITs") based – at least in part – on the personalities driving them.

In which case, I should probably address the elephant in the room first. So here goes…

I am very well aware that REIT stocks aren’t performing well this year.

Not even close.

For those of you who don’t know what a REIT (pronounced REET) is, let me quote my new book, REITs For Dummies – due next month!

“REITs, by law, have to pay out at least 90% of their taxable income to their shareholders in the form of dividends… this allows them to avoid taxes themselves.”

So:

“When you invest in income-producing real estate by buying up shares of REITs, you’re buying (portions of) portfolios in high-quality, well-placed real estate operated by professional, ethical management teams. That’s the ideal, anyway, and the ideal is very often true. But it’s not a guarantee, so you do have to research and analyze what you find.”

Take careful note of those last few lines. I’ll be getting back to that thesis shortly, though not before re-addressing REITs’ painful stock market performance.

Let’s start with Innovative Industrial Properties, Inc. (IIPR), a cannabis REIT, as an example:

Is anyone else wincing at that image?

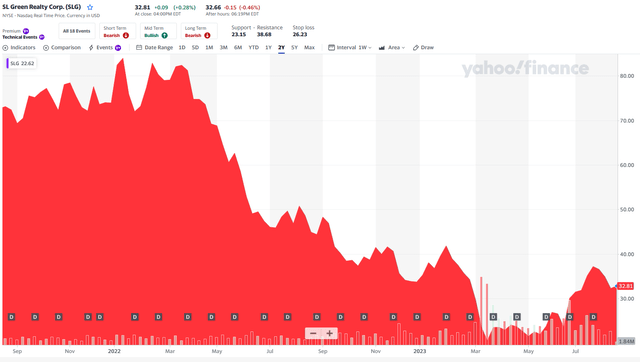

Another sector that’s seen tremendous volatility is the office sector, especially those REITs with exposure to New York City. And unfortunately for SL Green Realty (SLG), that exposure is enormous:

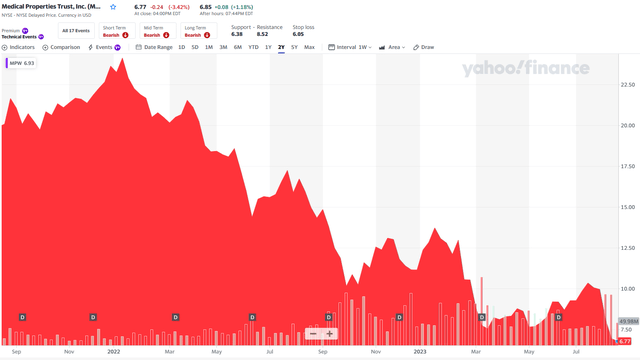

Or how about the hospital sector, where Medical Properties Trust (MPW) has been taken to the woodshed:

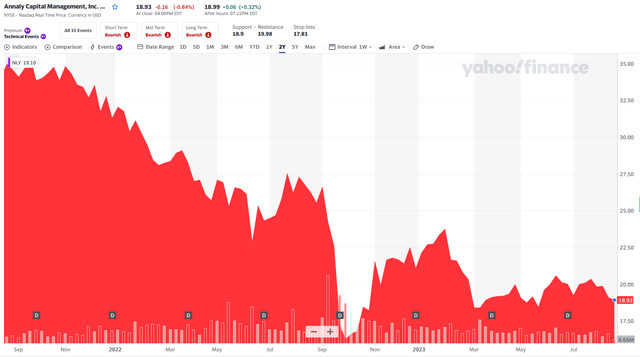

Finally, here’s a picture of mortgage REITs by way of Annaly Capital Management (NLY):

Ouch. Ouch. Ouch.

Down but Not Even Close to Being Out

None of the four examples given above are examples of sleep well at night ("SWAN") investments. That might seem like a stupidly obvious statement but hear me out.

SWAN investments have solid track records of sustainability thanks to experienced CEOs worth their salt (and then some). This is a very specific title that takes quite a bit of time and even more effort to achieve.

IIPR, for one, just hasn’t been around that long. And it’s deliberately built on a volatile business.

So while I have recommended it before, netting subscribers quite the pretty penny too in the past, I never pretended it was a SWAN-safe bet. I didn’t even pretend it was a SWAN-a-Be.

Because it wasn’t.

Had you invested $25,000 in it and the other three REITs mentioned two years ago, you would be sitting on an unrealized loss of around 55%:

- IIPR: -67%

- SLG: -55%

- MPW: -60%

- NLY: -44%.

The dividends they’ve paid do help soften that blow, but only by so much. Those drops are significant, to say the least.

Let’s contrast them with another set of REITs – these ones with executives who have been around the block repeatedly, walking the walk and talking the talk the whole time. Here’s how Realty Income Corporation (O) and Agree Realty Corporation (ADC), two net-lease REITs; Prologis, Inc. (PLD), a data center REIT; Alexandria Real Estate Equities, Inc. (ARE), a California-based landlord that rents properties to the life-science industry; Rexford Industrial Realty, Inc. (REXR), which owns warehouses; the single-family home operator Mid-America Apartment Communities, Inc. (MAA), and Camden Property Trust (CPT), an apartment REIT; have all done in the last two years:

- O: -19%

- PLD: -10%

- ARE: -45%

- REXR: -16%

- MAA: -26%

- CPT: -26%

- ADC: -17%.

They’ve all still clearly sold off, with ARE suffering the most because of its “office” associations. Yet I have no qualms about recommending them.

There, we provide our members with a research tool that helps screen for the highest-quality REITs. And that model lists Realty Income, Prologis, and the rest of this gang of seven as very high-quality portfolio picks.

In which case, we’re looking at quite the buyable opportunities run by quite the remarkable managers. As I’m more than happy to describe…

Realty Income: 97 Quality Score

Property:

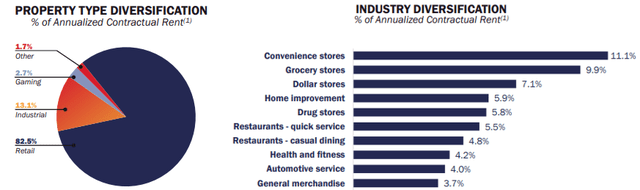

Realty Income has a portfolio of over 13,100 commercial properties covering approximately 255.5 million leasable square feet which are located in all 50 U.S. states, the United Kingdom, Italy, Spain, and Ireland. 82.5% of their portfolio is made up of retail properties, 13.1% are industrial, and 2.7% are gaming properties.

Realty Income’s properties are leased on a long-term, triple-net basis to more than 1,300 tenants operating in 85 different industries that are largely resistant to e-commerce. Their 3 largest industries are convenience stores, grocery stores, and dollar stores.

They receive 11.1% of their contractual rent from convenience stores, 9.9% from grocery stores, and 7.1% from dollar stores. As of the end of the second quarter, their portfolio had a weighted average remaining lease term of 9.6 years and a 99.0% occupancy rate.

Fundamentals:

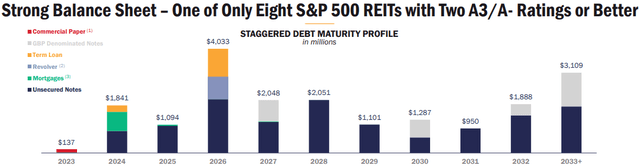

Realty Income has an A- credit rating and a strong balance sheet with a net debt to pro forma adjusted EBITDAre of 5.3x and a fixed charge coverage ratio of 4.6x. Their debt is 96% unsecured and 92% fixed rate and has a weighted average term to maturity of 6.7 years.

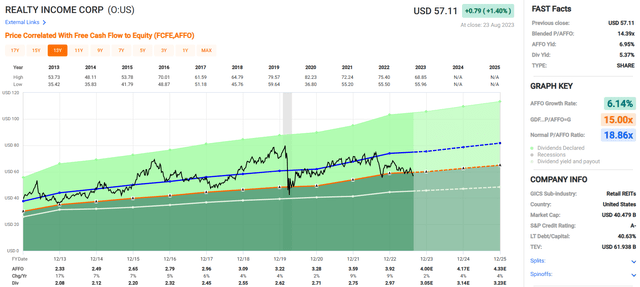

Over a 10-year period they have had an average adjusted funds from operations (“AFFO”) growth rate of 6.99% with AFFO projected to increase by 4% in both 2024 and 2025. They pay a 5.37% dividend yield with a 75.69% AFFO payout ratio and have had an average dividend growth rate of 5.76% over the last 10 years.

The stock is trading at a blended P/AFFO ratio of 14.39x verses its 10-year average P/AFFO ratio of 18.86x.

People:

Realty Income is led by Sumit Roy who has been their Chief Executive Officer (“CEO”) since October 2018. He joined the company in 2011 and was promoted to Chief Investment Officer in 2013 and then served as their Chief Operating Officer (“COO”) from 2014 to 2018.

During his tenure as COO, he managed many aspects of the business including acquisitions, dispositions, and portfolio management. Before joining the company Sumit Roy was an Executive Director at UBS Investment bank where he worked in real estate capital markets and advisory transactions. He has multiple degrees, including a master's degree in computer science and a master's in business administration in finance and economics.

Sumit Roy’s tenure as CEO has been a trial by fire as he had less than 2 years under his belt before the pandemic hit in 2020. Under his leadership the company grew AFFO per share by 2% in 2020 and increased the dividend by 3.08% that year.

Since that time, Realty Income’s AFFO per share increased by 9% in both 2021 and 2022. In 2021 Sumit Roy oversaw the merger with VEREIT which more than doubled their asset base, going from approximately $20.7 billion as of the end of 2020, to $43.1 billion as of the end of 2021.

Additionally he had the foresight to spin-off their office properties into a new publicly traded REIT in 2021 before the “work-from-home” movement really took hold. As of March 23, 2023, Sumit Roy had a beneficial ownership in 208,760 shares of Realty Income’s stock which amounts to approximately $11.9 million as of yesterday’s closing price.

We rate Realty Income a Buy.

Prologis: 99 Quality Score

Property:

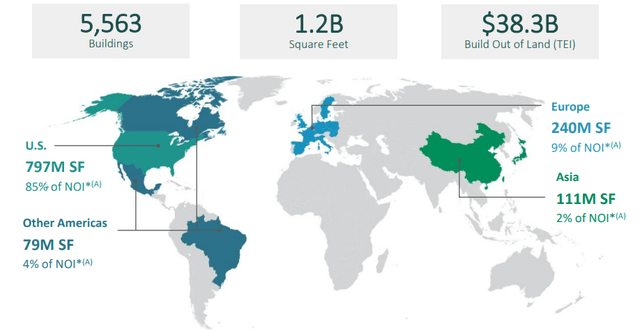

Prologis is by far the largest industrial REIT with a portfolio of 5,563 industrial properties covering 1.2 billion square feet which are located in 19 countries spread across 4 continents. The majority of their net operating income (“NOI”) is derived from the U.S. at 85%, followed by Europe at 9%, Other Americas at 4%, and Asia at 2%.

PLD leases their properties to approximately 6,700 tenants which primarily use their logistics facilities for business-to-business transactions and online retail fulfillment. PLD has a very strong tenant roster with some of their top tenants including Amazon, FedEx, DHL, UPS, and Home Depot and they are well diversified with only 19% of their net effective rent coming from their top 20 tenants.

PLD’s global economic impact cannot be overstated as $2.7 trillion, or 2.8% of the world’s GDP, flows through their distribution centers each year. As of the end of the second quarter, PLD’s portfolio had an average occupancy of 97.5% and a weighted average remaining lease term of approximately 4.0 years.

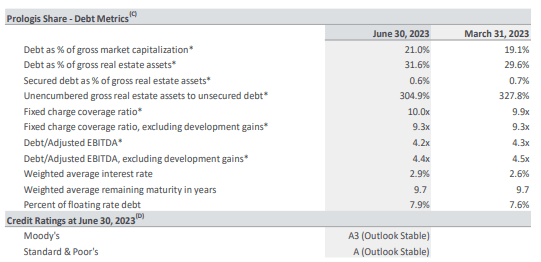

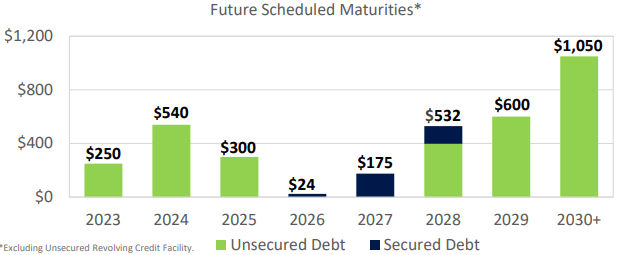

Fundamentals:

Prologis has an A credit rating and excellent debt metrics with a debt to adjusted EBITDA of 4.2x and a fixed charge coverage ratio of 10.0x. Approximately 92% of their debt is fixed rate with a weighted average interest rate of 2.9% and a weighted average term to maturity of 9.7 years.

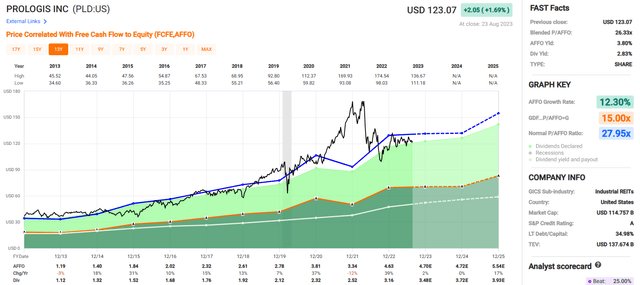

Since 2013 PLD has delivered an average AFFO growth rate of 12.30% and an average dividend growth rate of 11.13%. They pay a 2.83% dividend yield with a 68.27% payout ratio and currently trade at a P/AFFO ratio of 26.33x, which is slightly below their 10-year average P/AFFO ratio of 27.95x.

PLD - IR

People:

Prologis has arguably one of the best CEOs in the world.

In 1983, Hamid Moghadam co-founded PLD’s predecessor, AMB Property Corporation, which he took public in 1997 before the company’s merger with Prologis in 2011. In 1997 PLD’s predecessor reported total assets of $2.5 billion, which grew to $27.7 billion after the merger in 2011 and stood at $92.4 billion as of PLD’s latest earnings release.

When PLD’s predecessor was first formed, the company invested in office properties, industrial properties, and shopping centers. By 1987 the company divested its office properties and in 1999 they divested their shopping center properties to focus solely on industrial properties.

After the merger in 2011, the combined company took the name Prologis and became the preeminent global industrial REIT. Since that time Hamid Moghadam has led PLD through multiple mergers and acquisitions including the acquisition of KTR Capital Partners’ real estate assets in 2015, the acquisition of DCT Industrial in 2018, the acquisition of Industrial Property Trust and Liberty Property Trust in 2020, and the acquisition of Duke Realty in 2022.

Bottom line is that the company Hamid Moghadam co-founded in 1983 has become the world’s largest publicly traded industrial REIT with a market cap of over $100 billion and its CEO has been there every step of the way. As of March 7, 2023, Hamid Moghadam had a beneficial ownership in 2,133,278 shares of Prologis’ stock which amounts to approximately $262.5 million as of yesterday’s closing price.

We rate Prologis a Buy.

Alexandria Real Estate: 99 Quality Score

Property:

Alexandria owns, operates, and develops Class A/A+ life science real estate and has a portfolio of 414 operating properties that cover 41.1 million rentable square feet (“RSF”). In addition to their operating properties, ARE has 5.3 million RSF of properties undergoing construction, 9.4 million RSF of near and intermediate-term development projects, and 19.1 million square feet of future development projects.

In total they have an asset base in North America of 74.9 million square feet as of the end of the second quarter. ARE targets AAA innovation cluster locations to promote collaborative environments and has properties located in Boston, San Francisco, New York City, San Diego, Seattle, Maryland, and the Research Triangle.

Their laboratory space is leased approximately 825 tenants and they have several prominent names listed in their top 20 including Bristol-Myers, Moderna, Eli Lily, Alphabet, Harvard University, Pfizer, and Merck. As of their most recent update, ARE’s operating properties have an occupancy rate of 93.6% and a weighted average lease term of 7.2 years.

Fundamentals:

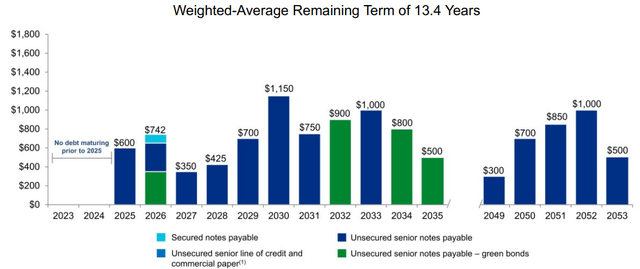

Alexandria has a BBB+ credit rating and a very strong balance sheet with a net debt and preferred stock to adjusted EBITDA of 5.2x and a fixed charge coverage ratio of 4.7x. Their debt is 99.2% fixed rate with a weighted average interest rate of 3.69% and a weighted average term to maturity of 13.4 years.

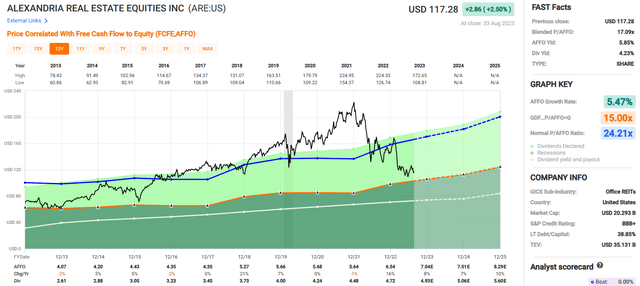

Since 2013 they have had an average AFFO growth rate of 5.47% and analysts expect AFFO to grow by 7% in 2024 and 10% in 2025. ARE pays a 4.23% dividend yield with an AFFO payout ratio of 72.17% and has an average dividend growth rate of 8.62% over the last 10 years.

Currently the stock is trading at a blended P/AFFO ratio of 17.09x, which is a significant discount to their 10-year average AFFO multiple of 24.21x.

People:

Alexandria is led by their Executive Chairman, Joel Marcus, JD, CPA, who co-founded the company in 1994. He is a visionary and was way ahead of the times when he formed ARE which pioneered life science real estate and turned it from a specialty niche into a major asset class.

Other REITs in the office sector have been following suit, including Boston Properties, Inc. (BXP), which dedicates entire sections of their presentations to their increasing exposure to life science properties. Joel Marcus co-founded the company with $19 million in capital and has since transformed Alexandria into an S&P 500 company with a market capitalization of approximately $20 billion.

Joel Marcus is highly educated and received his Juris Doctor degree from the University of California. Prior to co-founding ARE, he had a legal career in corporate finance where he specialized in venture capital and mergers and acquisitions and was also a certified public accountant where he specialized in the financing and taxation of REITs.

From early on in his career he has been very involved in the biopharmaceutical industry and currently serves on the board of directors of Applied Therapeutics (APLT) and Intra-Cellular Therapies (ITCI). As of March 27, 2023, Joel Marcus had a beneficial ownership in 388,729 shares of Alexandria’s stock which amounts to approximately $45.6 million as of yesterday’s closing price.

We rate Alexandria a Strong Buy.

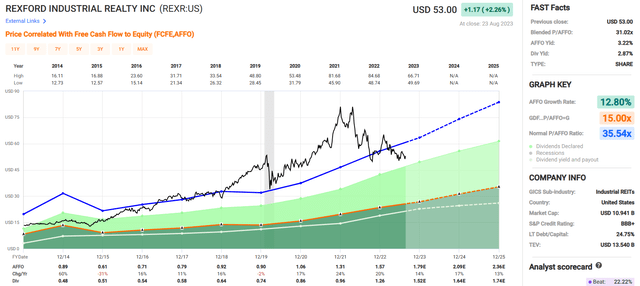

Rexford Industrial: 99 Quality Score

Property:

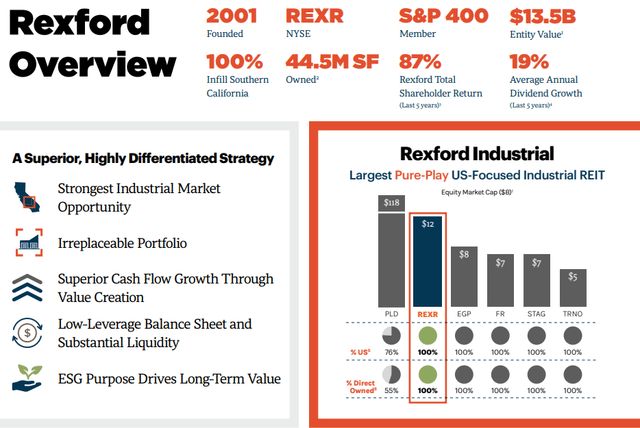

In terms of quality, Rexford Industrial is neck and neck with Prologis but the two REITs have very different investment strategies. Prologis has a global footprint with industrial properties around the world whereas Rexford is exclusively focused on investing in industrial properties throughout infill Southern California, which is the world’s 4th largest industrial market and has the highest demand and lowest supply of any market within the United States.

Infill Southern California has such low supply due to the scarcity of developable land, which is the result of permanent natural barriers (mountains / oceans) and restrictive zoning regulations that constrain supply.

Rexford’s portfolio consists of 367 industrial properties that covers approximately 44.5 million rentable square feet and had a same property portfolio occupancy of 98.1% as of the end of the second quarter.

Fundamentals:

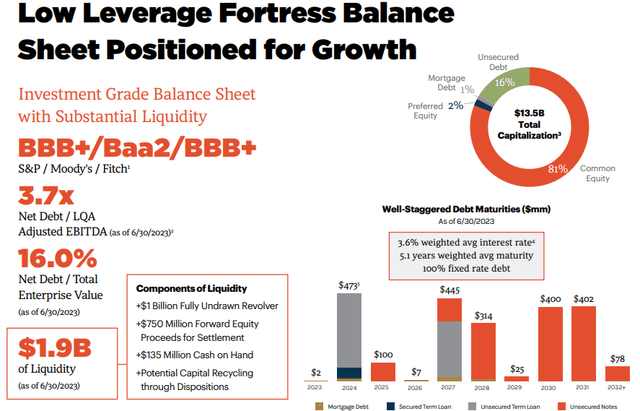

Rexford Industrial has a BBB+ credit rating and excellent debt metrics including a net debt to adjusted EBITDA of 3.7x and a fixed charge coverage ratio of 4.5x. Their debt is 100% fixed rate with a weighted average interest rate of 3.6% and a weighted average term to maturity of 5.1 years.

Since 2014, REXR has delivered an average AFFO growth rate of 12.80% with expected AFFO growth of 17% in 2024 and 13% in 2025. They pay a 2.87% dividend yield with an AFFO payout ratio of 80.25% and have an average dividend growth rate of 17.01% over the last 5 years. REXR’s stock is currently trading at a P/AFFO ratio of 31.02x compared to their normal AFFO multiple of 35.54x.

People:

Rexford is led by Howard Schwimmer and Michael Frankel, who have both been Co-Chief Executive Officer since 2013.

Prior to his current role, Howard Schwimmer was the co-founder and senior managing partner of Rexford’s predecessor business and served as the President of Rexford Industrial Realty & Management since 2001.

Howard Schwimmer is a licensed California real estate broker and served as executive vice president for DAUM Commercial Real Estate before joining Rexford.

His entire career has been dedicated to industrial real estate in Southern California and he has extensive experience in acquisitions, management, leasing, and dispositions of industrial properties within the region.

As of April 3, 2023, Howard Schwimmer had a beneficial ownership in 1,100,782 shares of Rexford’s stock which amounts to approximately $58.3 million as of yesterday’s closing price.

Michael Frankel began his career as Vice President for a European-based firm where he managed U.S. – Asia operations and spent extensive time working in China and France. He later worked at a private equity firm managing investments and also served with LEK Consulting where he provided advisory services to leading investment institutions.

In 2005 he took on the role of Chief Financial Officer of Rexford Industrial Realty & Management and became Co-CEO of Rexford Industrial in 2013. Michael Frankel is a licensed California real estate broker and is currently a member of the Urban Land Institute.

As of April 3, 2023, Michael Frankel had a beneficial ownership in 813,141 shares of Rexford’s stock which amounts to approximately $43.1 million as of yesterday’s closing price.

We rate Rexford Industrial a Strong Buy.

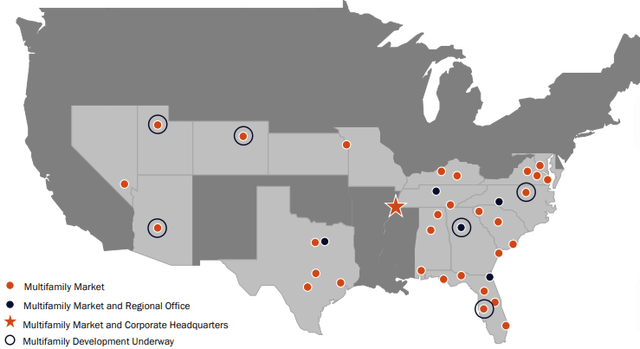

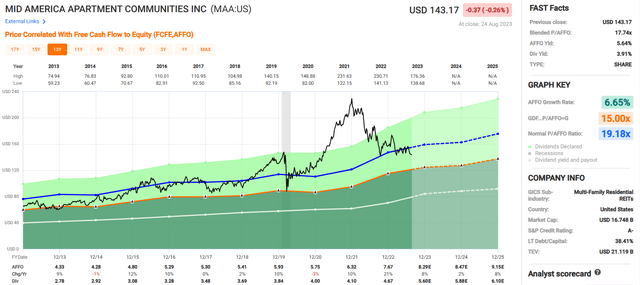

Mid-America Apartment: 99 Quality Score

Property:

Mid-America develops, acquires, manages, and owns apartment communities primarily across the Sunbelt region of the U.S. They own or have an ownership interest in 101,986 apartment homes which are located in 16 states and the District of Columbia. While MAA targets properties in the Sunbelt, they have no exposure in California.

Their highest concentration is in the Southeast, the Mid-Atlantic, and Texas. As a percentage of Same Store NOI, their top 5 markets are Atlanta, GA at 12.6%, Dallas, TX at 9.7%, Tampa, FL at 6.9%, Orlando, FL at 6.5%, and Austin, TX at 6.4%.

MAA builds and owns multiple types of apartment communities including high-rise, mid-rise, and garden style. 63% of their apartment communities are garden style, which they define as 3 stories or less, while 33% of their apartments are mid-rise, which they define as 4 to 9 stories. Only 4% of their portfolio consists of high-rise apartments. As of the end of the second quarter, MAA reported average physical occupancy at 95.5%.

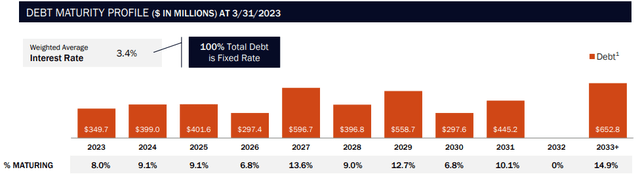

Fundamentals:

MAA has an A- credit rating and a very strong balance sheet with a historically low net debt to adjusted EBITDAre ratio of 3.41x and an EBITDA to interest expense ratio of 8.23x. Their debt is 100% fixed rate with a weighted average interest rate of 3.4% and a weighted average term to maturity of 7.7 years.

Since 2013 MAA has delivered a blended average AFFO growth rate of 6.65% with AFFO projected to grow by 2% in 2024 and by 8% in 2025. They pay a 3.91% dividend yield with an AFFO payout ratio of 60.95% and have an average dividend growth rate of 5.92% over the last 10 years.

Currently the stock is trading at a P/AFFO ratio of 17.74x verses their 10-year average P/AFFO ratio of 19.18x.

People:

MAA is led by H. Eric Bolton Jr. who joined the company in 1994 as Vice President of Development. He was named Chief Operating Officer in 1996 and was promoted to President later that year. In late 2001 H. Eric Bolton Jr. became the Chief Executive Officer and a year later he was named Chairman of MAA.

Before joining MAA, he worked in the commercial banking industry and then spent several years with the Trammell Crow Company where he served as Executive Vice-President and Chief Financial Officer for their asset management services.

In addition to his role with MAA, H. Eric Bolton Jr. also serves as a Director for EastGroup Properties (EGP), which is a publicly traded industrial REIT, and serves on the Advisory Board of Governors of the National Association of REITs.

H. Eric Bolton Jr. has been the CEO of MAA for a little over 20 years, and over that time he has led company through the Great Recession in 2008-2009 and more recently the covid pandemic.

MAA did not cut their dividend during the Great Recession and raised it during the pandemic. As a matter of fact, since he joined the company in 1994, MAA has paid 118 consecutive quarterly dividends and has never suspended or cut the dividend.

Additionally, as of May 31, 2023, MAA has delivered an annual compounded total shareholder return of 13.8% over the last 20 years. As of March 10, 2023, H. Eric Bolton Jr. had a beneficial ownership in 405,659 shares of MAA’s stock which amounts to approximately $58.1 million as of yesterday’s closing price.

We rate Mid-America a Buy.

Camden Property Trust: 97 Quality Score

Property:

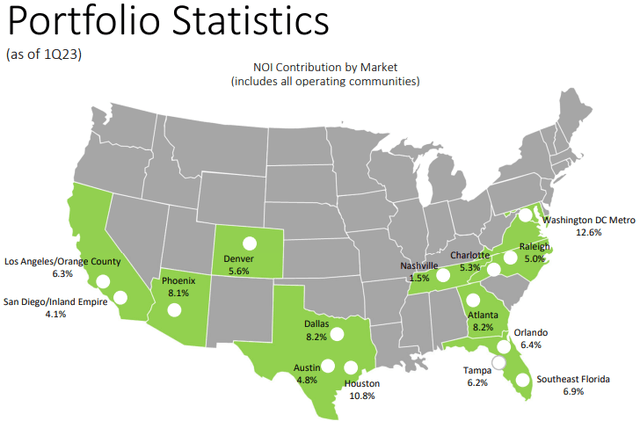

Camden Property Trust has a portfolio of multifamily apartment communities which consists of 172 properties that contain 58,961 apartment homes. In addition to their operating properties, CPT has 5 properties under development that is expected to add an additional 1,553 apartment homes to their portfolio upon completion.

CPT has a large presence in the Sunbelt and most of their major markets are located in this region. As a percentage of NOI, Washington, D.C. is their largest market at 12.6%, followed by Houston, TX at 10.8%, and Dallas, TX at 8.2%.

Class B properties make up 63% of their portfolio while Class A properties makes up 37%. The majority of their portfolio consists of low-rise apartments at 60%, followed by mid-rise at 28%. Their portfolio has an average property age of 15 years and ended the second quarter with an occupancy rate of 95.4%.

Fundamentals:

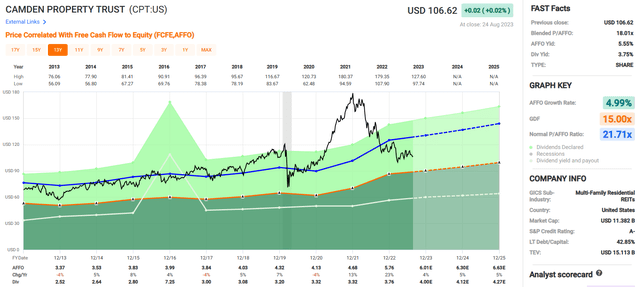

Camden Property has an A- credit rating and excellent debt metrics including a net debt to adjusted EBITDAre of 4.3x and an EBITDA to interest expense ratio of 7.02x. Their debt is 82.4% fixed rate with a weighted average interest rate of 4.1% and a weighted average term to maturity of 6.0 years.

Since 2013 CPT has had an average AFFO growth rate of 4.99% and analysts expect AFFO to increase by 5% in both 2024 and 2025. They pay a 3.75% dividend yield with an AFFO payout ratio of 65.28% and when excluding the special dividend they paid in 2016, they have an average dividend growth rate of 5.40% over the last 10 years.

Currently the stock is trading at a blended P/AFFO ratio of 18.01x compared to their 10-year average AFFO multiple of 21.71x.

CPT - IR

People:

Camden Property Trust is led by Ric Campo who co-founded CPT’s predecessor companies in 1982 and has been Camden’s Chief Executive Officer since the company was publicly listed in 1993.

Under his leadership, CPT has grown from a Texas-based firm with approximately $200.0 million in assets in 1993, to one of the largest publicly traded apartment REITs in the United States with total assets listed on their balance sheet of $9.3 billion as of the end of the second quarter in 2023.

In addition to leading Camden Property, Ric Campo also serves on the NAREIT Advisory Board of Governors and previously served as Chair of the National Multifamily Housing Council. Additionally, CPT’s recent track record has been solid with positive AFFO growth in 11 out of the last 16 years and the dividend has either been maintained or raised each year since 2011.

One other thing I would like to point out is that for 16 consecutive years Camden Property has been recognized as one of the 100 Best Companies to Work For by FORTUNE magazine, which speaks volumes about the tone set by its leadership.

As of March 16, 2023, Ric Campo had a beneficial ownership in 740,070 shares of CPT’s stock, which amounts to approximately $78.9 million as of yesterday’s closing price.

We rate Camden Property Trust a Buy.

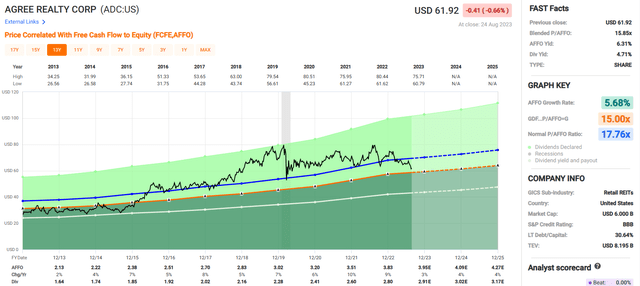

Agree Realty: 96 Quality Score

Property:

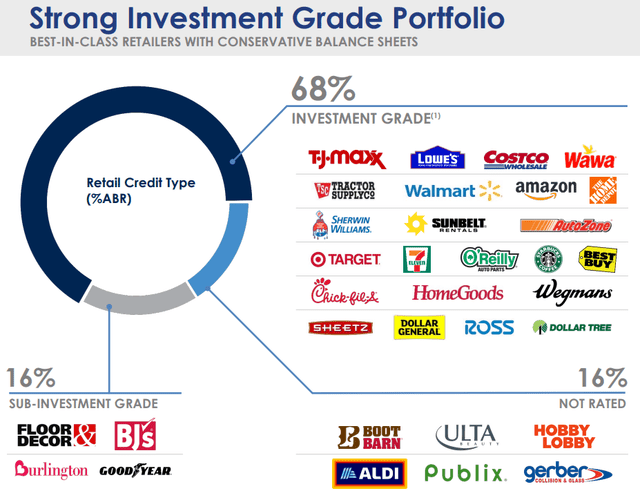

Agree Realty invests in commercial real estate that is net-leased to retail tenants. They have a portfolio that consists of over 2,000 commercial properties located across 49 states that covers approximately 41.7 million gross leasable square feet. Agree Realty has a very strong tenant roster that includes well-known names such as Walmart, Best Buy, Kroger, CVS Pharmacy, Lowes, AutoZone, and Home Depot.

Additionally, 67.9% of ADC’s annualized base rents come from investment grade retail tenants. They target properties that are leased to tenants operating in e-commerce resistant industries such as convenience stores, pharmacies, dollar stores, home improvement and grocery stores.

As a percentage of their annualized base rent, grocery stores make up their largest tenant sector at 10.1%, followed by home improvement stores at 8.9% and tire & auto service at 8.7%. As of the end of the second quarter, ADC’s portfolio was 99.7% leased and had a weighted average remaining lease term of roughly 8.6 years.

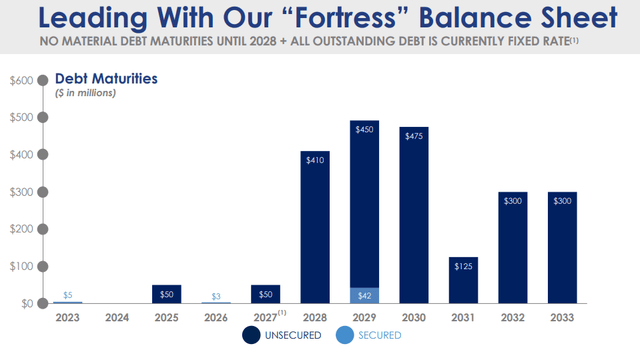

Fundamentals:

Agree Realty has a BBB credit rating and a strong balance sheet with a net debt to EBITDA of 4.5x and a fixed charge coverage ratio of 5.1x. All of their debt is fixed rate and they have no significant debt maturities until 2028. Since 2013, ADC has had a blended average AFFO growth rate of 5.68% and are projected to increase AFFO per share by 4% in both 2024 and 2025.

They pay a 4.71% dividend yield with an AFFO payout ratio of 73.24% and have an average dividend growth rate of 5.79% over the last 10 years. Currently the stock is trading at a blended P/AFFO ratio of 15.85x verses their 10-year average P/AFFO ratio of 17.76x.

People:

Agree Realty is led by Joey Agree who was appointed President and Chief Operating Officer in 2009 before becoming the company’s Chief Executive Officer in 2013. Over his tenure as CEO, ADC’s total assets have increase from $462.7 million in 2013 to over $7 billion as of June 30, 2023, and AFFO has increased from $2.13 per share in 2013 to $3.83 per share as of the end of 2022.

Agree Realty has had positive AFFO growth each year since Joey Agree became CEO and the dividend has been increased each year as well. Additionally, Joey Agree recently changed the company’s distribution from a quarterly dividend to a monthly dividend, which I see as a positive for shareholders.

He is highly educated with a BA in Political Science and a Juris Doctorate degree from Wayne State University Law School and is currently a member of the State Bar of Michigan.

Joey Agree led his company through the pandemic without missing a beat. AFFO per share increase by 6% and the company raised its dividend by 5.48% in 2020 while maintaining a conservative payout ratio.

As of March 17, 2023, Joey Agree had a beneficial ownership in 514,303 shares of ADC’s stock, which amounts to approximately $31.8 million as of yesterday’s closing price.

We rate Agree Realty a Buy.

In Conclusion...

Thank you for reading this article, which I know is exhaustive at over 5,000 words (3x more content than our average article).

However, I think it's critical for readers to understand that the quality of a REIT is based upon many factors, such as property diversification, the strength of the balance sheet, quality of earnings, and the overall safety of the dividend.

In addition, the people running the REIT are another measure of quality, and of course these three factors are correlated. You can't have a quality portfolio with a quality balance sheet without the work of a quality management team.

In fact, I decided to design and build my first ETF based upon this concept. Our index, the iREIT-MarketVector™ Quality REIT Index provides exposure to high quality US listed common and preferred equity securities of REITs while ensuring sector diversification.

I've always wanted to provide investors with a passive REIT ETF strategy that owns the highest quality REITs trading at a definitive margin of safety. And this is what our new REIT ETF will accomplish, utilizing our automated quality and value approach.

As always, thank you for reading and commenting. I look forward to your comments or questions.

Happy SWAN Investing!

Sign Up For A FREE 2-Week Trial

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Builders, Asset Managers, and we added Prop Tech SPACs to the lineup.

We recently added an all-new Ratings Tracker called iREIT Buy Zone to help members screen for value. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 168,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 110,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College, and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADC, ARE, CPT, MAA, MPW, O, PLD, REXR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.