Realty Income Makes A Splash In Vegas Acquiring Part Of The Bellagio

Summary

- Realty Income announces a $950 million investment in The Bellagio Las Vegas, diversifying its real estate footprint.

- Realty Income is a reliable income investment with a 54-year track record of monthly dividends and consistent dividend growth.

- The recent decline in share value makes Realty Income an attractive investment compared to its peers in terms of valuation metrics.

PM Images

Realty Income (NYSE:O) is what I consider a forever-hold real estate investment trust (REIT) as its properties are quintessential to society. Realty Income owns over 13,100 commercial properties and is the landlord to more than 1,300 clients, including Dollar General (DG), Walgreens (WBA), 7-Eleven, FedEx (FDX), Walmart (WMT), and Lowe's (LOW). No matter where you shop, you're stepping into one of Realty Incomes properties more often than you realize. Shares of Realty Income have continued to sell off and are hovering around the 52-week lows. This has pushed its dividend yield to 5.47%, and if the Fed hikes again, the pain for shareholders could continue. Realty Income just made a splash in Sin City as it was recently announced that they agreed to invest $950 million in a joint venture that owns 95% of The Bellagio. I am excited to dollar cost average into my position as shares of Realty Income continue to decline. I don't know where the bottom is, but I think Realty Income shares represent tremendous long-term value at these levels considering we're headed to the end of a Fed tightening cycle.

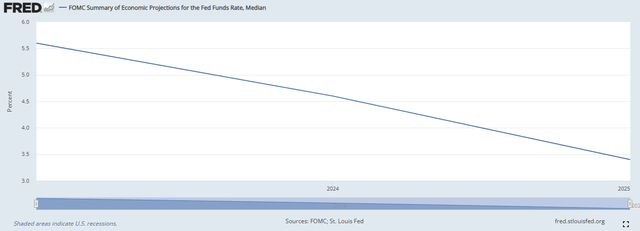

Why I am more bullish on Realty Income than I previously was

The last time I covered Realty Income was July 14th (click here to read), and since then, shares have declined by -7.15% compared to the S&P 500, falling by only -1.8%. Realty Income has gone from the low $60s to trading in the mid $50s, causing the dividend yield to increase to 5.46%. Jerome Powell hinted at the idea that rates would be higher for longer in his speech from Jackson Hole, and when the numbers are released on Thursday, 8/31, on personal income and core PCE, the data could show that the economy is not cooling and entice the Fed to raise rates at the September meeting. Whether the Fed hikes one more time or holds rates where they are, we’re at the end of a tightening cycle rather than the beginning of one. The St. Louis Fed still projects that rates will fall to 4.6% in 2024 and 3.4% in 2025.

Increasing rates by 25 basis points will give investors another round of grabbing risk-free assets with a yield north of 5%, but they won’t last long. Eventually, the Fed will start to cut rates, and non-risk assets will lose their appeal. As CDs and T-bills mature in 2024 and 2025, I feel that a portion of that capital will find its way into the market as lower rates will make risk-free assets less attractive. The potential rate hike won’t crush Realty Income. I believe this REIT is undervalued and will be a strong candidate for income investors to gravitate to with fresh capital, provided its dividend track record and the latest investment in The Bellagio. I think shares of Realty Income have become more interesting due to the combination of its latest investment, dividend increase, and reduced share price. I am happy to add to my position at these levels, and if shares continue to fall, I will continue adding shares on the way down.

Realty Income announced a $950 million investment in the iconic Bellagio Las Vegas

The Bellagio is one of the most iconic Las Vegas casinos, and Realty Income is now a partial owner. Realty Income signed a definitive agreement to invest $950 million to acquire common and preferred equity from Blackstone Real Estate Income Trust (BREIT) in a new joint venture that will own a 95% stake in The Bellagio. The deal is expected to close in Q4 2023, and Realty Incomes investment will include $300 million of common equity in the joint venture, and they will also invest $650 million to acquire a yield-bearing preferred equity interest in the joint venture. Realty Income will acquire a 21.9% indirect interest in The Bellagio, while BREIT will retain a 73.1% indirect interest. The remaining 5% will be retained by MGM Resorts International (MGM).

The Bellagio has an existing triple net lease with MGM, which includes 2% rent escalators over the next 6 years. In years 7-16, the lease calls for 2% rent escalators or CPI based up to 3%, whichever is higher on an annual basis. In years 17-26, there are 2% rent escalators as well, but the CPI base is 4% compared to 3% in years 7-16. Realty Income's common equity ownership interest will be subordinate to its $650 million preferred equity investment in the joint venture with BREIT.

The deal that Realty Income just entered into is interesting. This helps diversify their real estate footprint, and the house always wins in Vegas. No matter the economic cycle, Sin City is consistently a top destination. I look forward to seeing how this story unfolds and the underlying impacts of this deal in 2024 regarding Realty Incomes earnings. Realty Income has a long history of generating shareholder value and increasing its dividend, so I believe this deal will help fuel future growth.

Realty Income continues to be an income investor's dream

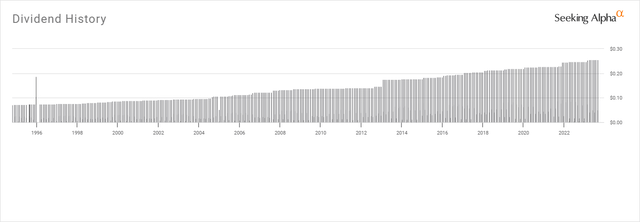

Realty Income has become a symbol of dividend excellence, establishing a 54-year track record of providing investors with monthly dividend income. Not all REITs are made equal, and while Realty Income doesn't have the largest dividend yield, it provides one of the highest quality dividends you will find. Realty Income is part of the renowned Dividend Aristocrat club and currently has the 4th largest yield of these S&P 500 companies that have increased their dividend for at least 25 consecutive years. No matter what Realty Income has endured, from the financial crisis to the pandemic and the rising rate environment, maintaining its growing dividend has been front and center.

At the end of Q2 2023, Realty Income had declared 637 consecutive monthly dividends and provided 103 consecutive quarterly increases. Realty Income has 29 years of annual dividend growth under its belt and is approaching and will soon be working on its 4th decade of growing dividends. Since its 1994 listing, Realty Income has had a 4.4% compound annual dividend growth rate and a 14.2% compound annual total return rate.

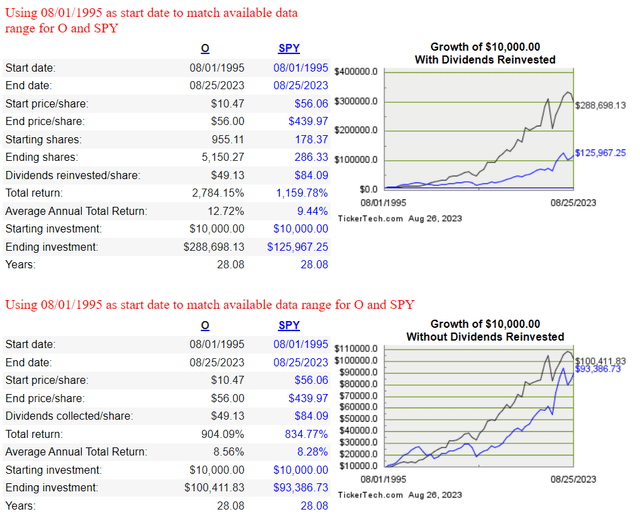

Many investors compare stocks against the S&P 500 because if they are going to take on individual equity risk, they want to beat the average return of the market. Going back to 1995, Realty Income has provided more value for shareholders than investing in the SPDR S&P 500 Trust (SPY) without dividends being reinvested and when the dividends were reinvested, the total return skyrocketed. As of 8/1/95, an investment of $10,000 SPY would have turned into $93,386.73, while the same $10,000 would have appreciated to $100,411.83 in Realty Income without investing the dividends.

When the dividends were invested, Realty Income's 13 consecutive quarterly dividend increases generated a compounding effect that crushed the market. An investment in SPY with the dividends invested grew to $125,967.25, adding an additional $32,580.25 to the investment compared to not reinvesting the dividends. When Realty Income's dividends are reinvested, the end value jumps 187.51% from $100,411.80 to $288,698.10. In addition to the end value increasing, the amount of projected forward dividend income increases dramatically. The initial investment in Realty Income purchased 955.11 shares, and at the 1995 dividend rate of $0.87, the forward projected annual income was $832.09. The annualized dividend grew by $2.19 to $3.06, and the initial share count increased to 5,150.27. There would be $15,759.83 of projected annual dividend income being generated from the investment, which is an increase of 1,794% ($14,927.73).

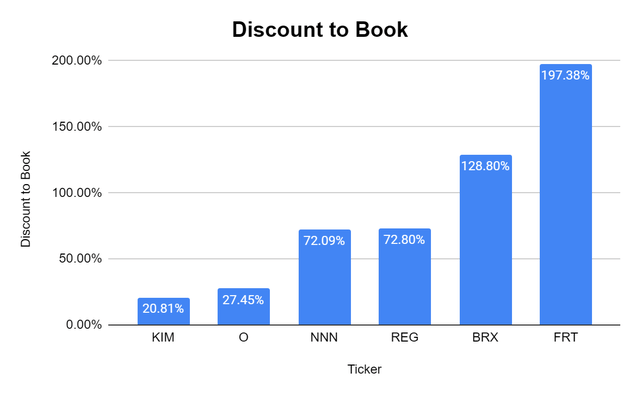

Realty Income looks attractive compared to its peers

The recent price decline that Realty Income has endured has made its valuation much more attractive. After updating my spreadsheets, I am excited to pick up more shares when I compare Realty Income to its peers.

- Kimco Realty Corp (KIM)

- Regency Centers Corp (REG)

- National Retail Properties (NNN)

- Brixmor Property Group (BRX)

- Federal Realty Investment Trust (FRT)

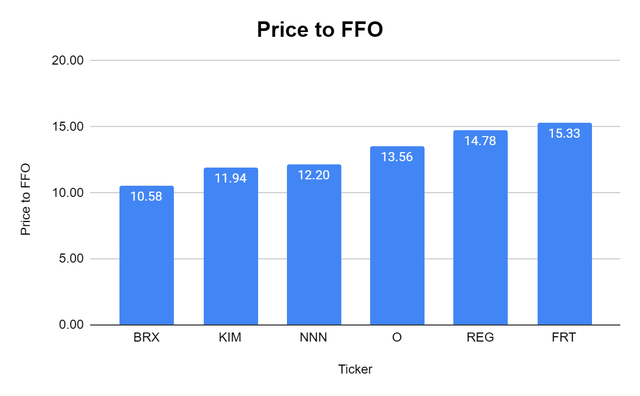

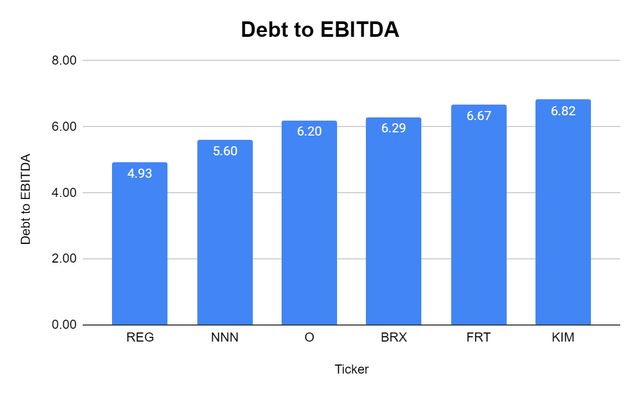

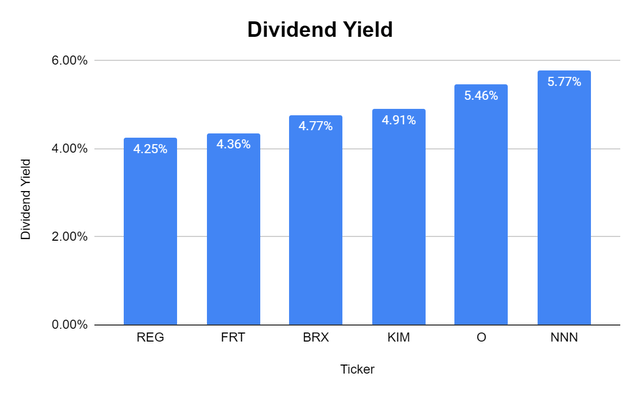

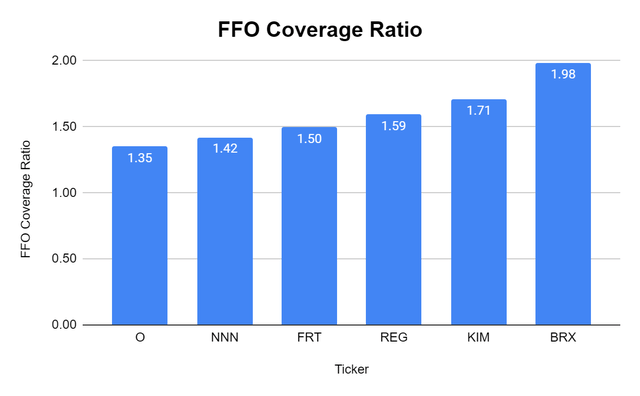

I look at 5 main metrics, the price to funds from operations (FFO), debt to EBITDA, discount to book, dividend yield, and FFO dividend coverage ratio to determine how companies are valued compared to their peers. Below are the metrics for each company that I pulled from the financials on Seeking Alpha.

Steven Fiorillo, Seeking Alpha

The peer group trades at a price to FFO range of 10.58x – 15.33x with an average of 13.07x. Realty Income trades at a price to FFO of 13.56x, just above the peer group average. I like paying the lowest multiple possible, but for quality companies, I am happy to pay a bit of a premium.

Steven Fiorillo, Seeking Alpha

When I look at the book value and share value, none of these companies trade at a discount. The peer group average is a premium of 86.56%, with FRT trading at almost 3x its book value. Realty Income trades at a 27.45% premium to book value, and given the rest of its peers, this doesn't seem that steep given the quality of the company.

I look at

Steven Fiorillo, Seeking Alpha

I look at the debt to EBITDA ratio because I want to see if a REIT has taken on significantly more debt than their peers compared to the EBITDA their assets are generating. The peer group has a debt-to-EBITDA ratio that ranges from 4.93x to 6.82x. Realty Income has a debt-to-EBITDA ratio of 6.2x compared to the peer group average of 6.08x. I am comfortable with this level as Realty Income has a long history of generating shareholder value.

Steven Fiorillo, Seeking Alpha

Lastly, I am looking at the dividend yield and dividend coverage ratio from FFO. Since REITs are income investments for me, I want to get paid a good premium and make sure that the dividend is safely covered. Realty Income has a dividend yield of 5.46% compared to the peer group average of 4.92%. Their dividend also has a dividend coverage ratio of 1.35x, which is below the 1.59x peer group average. Provided that Realty Income has 29 years of annual dividend increases and has paid a dividend for 54 years, being at the lower end of the FFO coverage spectrum doesn't concern me.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

Conclusion

The recent decline in share value is presenting investors with an opportunity to own shares of Realty Income at roughly the same valuation as 5 years ago. I plan on taking this opportunity to dollar cost average into my position as Realty Income is one of my favorite REITs. I have no idea where the bottom is, and if shares continue to decline, I will continue to add shares. REITs could experience additional downside, but I think the ones that survive the upward rate cycle will experience a bull cycle in 2024 and 2025 as rates decline. Realty Income doesn't often exceed a 5% yield, so when it does, I enjoy adding to my position.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of O, NNN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)