AppLovin: AdTech Solutions Going From Strength To Strength

Summary

- AppLovin's Software Platform is experiencing rapid growth, supporting a return to solid profitability and healthy cash flow generation.

- APP's upgraded AXON recommendation engine and improved market conditions appear to be driving a growth reacceleration.

- Much of this is already priced into the stock, but AppLovin should still do well if it can successfully expand into areas like CTV and on-device advertising.

Urupong

AppLovin's (NASDAQ:APP) Software Platform continues to grow rapidly, and this, combined with stabilizing market conditions, has returned AppLovin to solid profitability and healthy free cash flow generation. These improvements are already reflected in AppLovin's valuation though, with the stock up around 300% off the lows at the end of 2022. There could still be further upside as Software Platform growth appears to be accelerating, particularly if success can be replicated in new areas like CTV.

Market

AppLovin has stated that its markets have been steady over the last few quarters, and that strong software growth is coming from market share gains. This commentary is broadly in line with most companies that have exposure to digital advertising. While markets have generally stabilized, many advertisers remain cautious due to uncertain economic conditions, and brand advertising appears to be particularly impacted. This is not homogeneous though, with the impact varying across ad verticals and by region, format and channel.

Supply growth is also generally outpacing ad spend growth, which is placing downward pressure on ad pricing. Given the focus of many companies on more effectively monetizing users, this situation is likely to persist for some time. Lower pricing is pressuring growth and margins for many adtech companies.

AXON

AppLovin recently upgraded its AXON recommendation engine, and this is reportedly driving current growth as well as creating future growth opportunities. AppLovin's strong software growth on the heels of AXON 2's release appears to have caused a shift in investor sentiment towards the stock. AppLovin's software business has generally been performing well over the past 3 years though, and the impact of AXON 2 is not really clear.

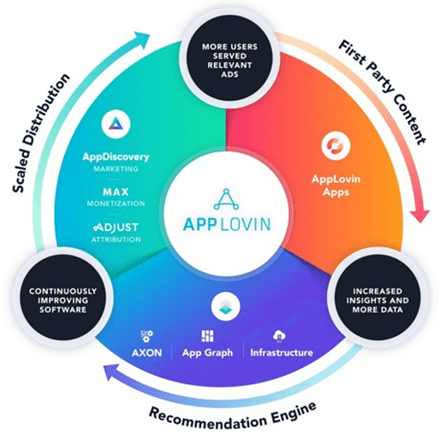

AXON 2 leverages AppLovin's App Graph to connect users with relevant advertising content and has reportedly made AppLovin's platform more accurate for advertisers. AXON 2 is not limited to mobile gaming applications though, and AppLovin is now focused on extending AXON 2 to its Wurl and Array businesses. If AXON 2 is genuinely improving performance for advertisers, AppLovin could stand to benefit significantly by extending this advantage across advertising surfaces.

Wurl & Array

On-device advertising and CTV are large growth opportunities for AppLovin, although the company's efforts in these areas are still nascent. AppLovin offers Wurl for CTV and Array for on-device advertising.

Wurl is a CTV platform which primarily distributes video content for streaming companies, in addition to providing solutions for maximizing advertising revenue and attracting consumers. AppLovin is working on adding CTV supply to its mobile user acquisition platform, AppDiscovery, and charging for it on a cost-per-install basis rather than based on impressions. While AppLovin believes early signs in this area are positive, its CTV business is not yet material.

Array extends AppLovin's marketing solutions to carriers and OEMs. It is an end-to-end app management suite that can be used for:

- Targeting app installs

- On-device app discovery

- App store discovery

Array moves AppLovin's business in the direction of Digital Turbine's (APPS) core business.

Figure 1: AppLovin's Flywheel (source: AppLovin)

MAX

AppLovin's MAX mediation product is another important contributor to the business' performance. Ad mediation enables publishers to manage multiple ad networks with a single SDK integration. AppLovin believes that the majority of the mobile gaming market is on its MAX mediation product and that it is seeing better growth than peers in mediation.

Prior to in-app bidding, the waterfall method was generally used in mobile advertising. In-app bidding makes programmatic advertising available to mobile publishers with ad mediation platforms providing real-time yield optimization. Programmatic buying helps publishers to maximize the value of their inventory and will likely to lead to ad network consolidation, which should be beneficial for AppLovin.

In addition, the supply side of the adtech industry is becoming increasingly important, due to privacy initiatives reducing the availability of data. The aggregation of supply provides pricing insights that are more valuable in a privacy focused era where it is more difficult to obtain user level data. SSPs have visibility of all submitted bids, information that is unavailable to demand partners and advertisers. Bids should be representative of the LTV of a user that an advertiser hopes to attract, which is of value to demand side partners in the current environment, assuming that bid data accurately reflects the true value of ad inventory. AppLovin's acquisition of MoPub and Unity's (U) merger with ironSource both provide access to SSP data that can be used to benefit advertisers.

Financial Analysis

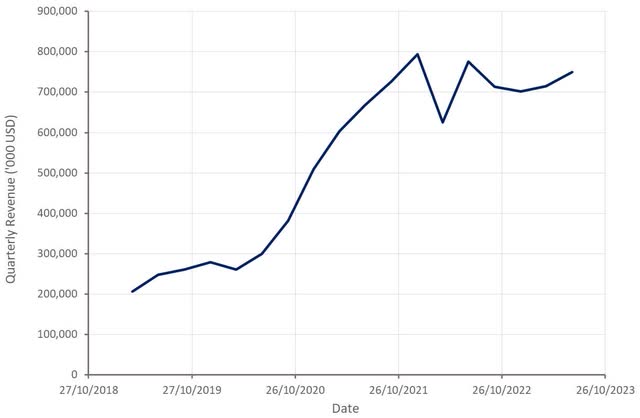

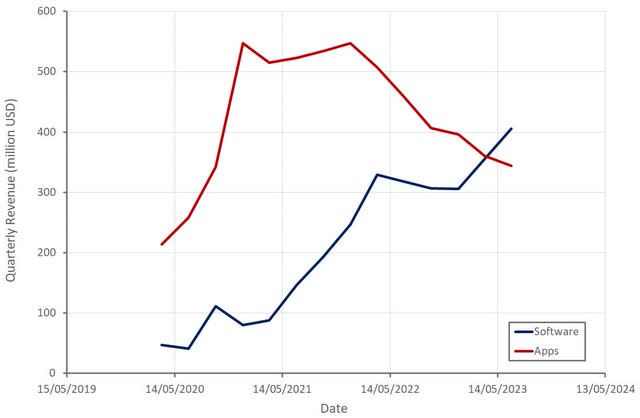

AppLovin's revenue declined by roughly 3% YoY in the second quarter. Growth was driven by AppLovin's Software Platform segment, which grew 28% YoY. This strength was offset by AppLovin's App segment, which declined 25% YoY.

AppLovin is guiding for roughly 10% revenue growth YoY in the third quarter driven by the first full quarter of revenue contribution from AXON 2.0, as well as steadier Apps performance. This suggests that Software Platform segment revenue growth is likely to be in the 40-50% YoY range in the third quarter.

Figure 2: AppLovin Revenue (source: Created by author using data from AppLovin) Figure 3: AppLovin Revenue by Segment (source: Created by author using data from AppLovin)

With AppLovin's shift in focus away from Apps gathering steam, the company's profitability is beginning to recover. Gross profit margins are returning towards pre-pandemic levels and should continue to edge upwards, provided the macro environment remains stable.

Figure 4: AppLovin Gross Profit Margins (source: Created by author using data from AppLovin)

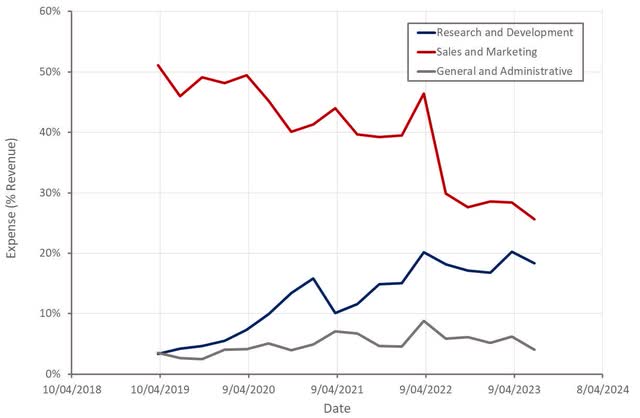

AppLovin's operating profit margin was approximately 18% in the second quarter and should continue to improve as the business scales. AppLovin has been achieving solid improvements in sales and marketing and general and administrative expenses, which has been somewhat offset by R&D investments.

Figure 5: AppLovin Operating Profit Margins (source: Created by author using data from AppLovin) Figure 6: AppLovin Operating Expenses (source: Created by author using data from AppLovin)

AppLovin has a history of generating strong free cash flows and its free cash flow margin in the second quarter was approximately 30%. While the company has a lot of debt, it has been using free cash flow to repurchase stock. AppLovin repurchased 507 million USD of stock during the quarter and still has 107 million USD of authorization remaining under its repurchase program. This appears to have been a reasonable use of cash given the company's share price in recent months.

Valuation

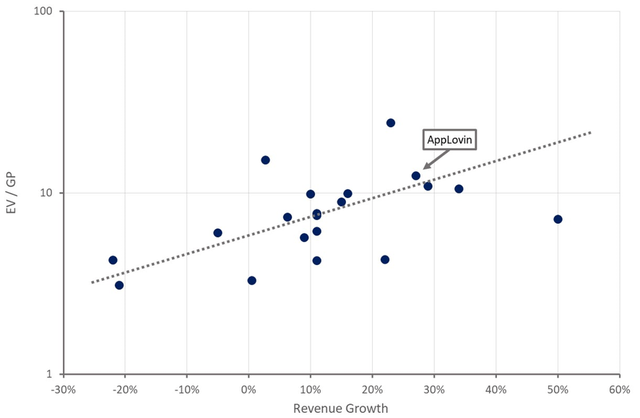

AppLovin's Software Platform segment is performing well and will determine the company's value in the long run. The shift in focus away from Apps has been hiding some of this strength but this should change in coming quarters. Attributing a modest value to AppLovin's App segment and removing this from the company's enterprise value to compare its value to peers indicates that AppLovin's Software Platform is priced broadly in line with comparable companies. Software Platform growth appears to be accelerating though and AppLovin has demonstrated an ability to improve margins with scale.

How much of AppLovin's current performance is due to favorable market conditions versus a competitive advantage remains to be seen, but if AppLovin can continue to gain market share and expand into areas like CTV, the stock should do well.

Figure 7: AppLovin Software Platform Relative Valuation (source: Created by author using data from Seeking Alpha)

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.