Instacart Begins U.S. IPO Push

Summary

- Maplebear Inc. aka Instacart has filed for a U.S. IPO, with potential gross proceeds of up to $1 billion.

- The company has seen growing revenue, gross profit, and operating profit.

- However, its order volume growth has slowed significantly since the end of the pandemic, posing a potential challenge for future growth.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

JHVEPhoto/iStock Editorial via Getty Images

A Quick Take On Instacart

Maplebear Inc. (CART), known as Instacart, has filed to raise $100 million in an IPO of its common stock, according to an SEC S-1 registration statement.

The firm primarily provides last-mile grocery delivery services to the U.S. and Canadian grocery markets.

Instacart grew well during the pandemic, but since the end of the pandemic, its order volume growth has slowed to a very low rate.

I'll provide a final opinion when we learn more IPO details from management.

Instacart Overview

San Francisco, California-based Instacart was founded to deliver online grocery orders to consumers in the United States and Canada.

Management is headed by president and CEO Fidji Simo, who has been with the firm since 2021 and was previously Head of the Facebook App at Meta and as Strategy Manager at eBay.

The company's primary offerings include the following:

Product discovery.

Merchandising.

Personalization.

Multiple payment models.

Range of fulfillment options.

AI-powered smart carts.

As of June 30, 2023, Instacart has booked fair market value investment of $3.75 billion from investors, including Sequoia Capital and D1 Capital Partners.

Instacart Customer/User Acquisition

The firm partners with over 1,400 grocery store chains and independent grocers throughout the United States.

It provides a mobile app for consumers to add in their product discovery efforts and integrates with grocer IT systems.

Sales and Marketing expenses as a percentage of total revenue have trended higher as revenues have increased, as the figures below indicate:

Sales and Marketing | Expenses vs. Revenue |

Period | Percentage |

Six Mos. Ended June 30, 2023 | 22.2% |

2022 | 25.9% |

2021 | 21.5% |

(Source - SEC)

The Sales and Marketing efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Sales and Marketing expense, remained stable at 1.1x in the most recent reporting period, as shown in the table below:

Sales and Marketing | Efficiency Rate |

Period | Multiple |

Six Mos. Ended June 30, 2023 | 1.1 |

2022 | 1.1 |

(Source - SEC)

Instacart's Market & Competition

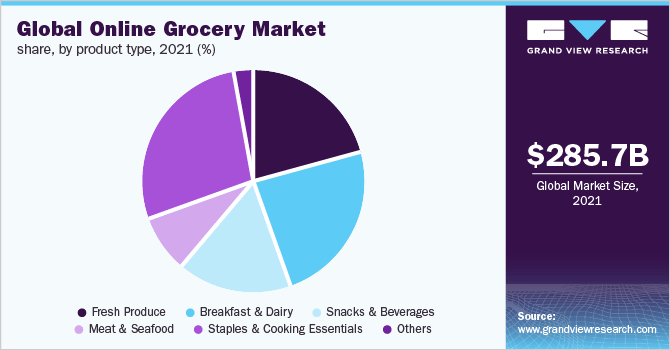

According to a 2022 market research report by Grand View Research, the global market for online grocery purchases was an estimated $286 billion in 2021 and is forecasted to reach $2.18 trillion by 2030.

This represents a forecast CAGR (Compound Annual Growth Rate) of a whopping 25.3% from 2022 to 2030.

The main drivers for this expected growth are changing consumer purchasing preferences, improved fulfillment technologies and last-mile delivery reliability.

Also, below is a pie chart showing the global online grocery market by product type in 2021:

Global Online Grocery Market (Grand View Research)

Major competitive or other industry participants include the following:

Veeve.

Criteo.

Quotient.

Amazon.

Target.

Walmart.

Uber.

Blue Apron.

Misfits Market.

Fresh Direct.

Getir.

Gopuff.

DashMart of DoorDash (DASH).

Others.

Instacart Financial Performance

The company's recent financial results can be summarized as follows:

Growing top line revenue.

Increasing gross profit and gross margin.

Sharply increasing operating profit and cash flow from operations.

Below are relevant financial results derived from the firm's registration statement:

Total Revenue | ||

Period | Total Revenue | % Variance vs. Prior |

Six Mos. Ended June 30, 2023 | $1,475,000,000 | 31.0% |

2022 | $2,551,000,000 | 39.1% |

2021 | $1,834,000,000 | |

Gross Profit (Loss) | ||

Period | Gross Profit (Loss) | % Variance vs. Prior |

Six Mos. Ended June 30, 2023 | $1,109,000,000 | 44.2% |

2022 | $1,831,000,000 | 49.3% |

2021 | $1,226,000,000 | |

Gross Margin | ||

Period | Gross Margin | % Variance vs. Prior |

Six Mos. Ended June 30, 2023 | 75.19% | 6.9% |

2022 | 71.78% | 7.4% |

2021 | 66.85% | |

Operating Profit (Loss) | ||

Period | Operating Profit (Loss) | Operating Margin |

Six Mos. Ended June 30, 2023 | $269,000,000 | 18.2% |

2022 | $62,000,000 | 2.4% |

2021 | $(86,000,000) | -4.7% |

Net Income (Loss) | ||

Period | Net Income (Loss) | Net Margin |

Six Mos. Ended June 30, 2023 | $27,000,000 | 1.8% |

2022 | $97,000,000 | 3.8% |

2021 | $(73,000,000) | -4.0% |

Cash Flow From Operations | ||

Period | Cash Flow From Operations | |

Six Mos. Ended June 30, 2023 | $242,000,000 | |

2022 | $277,000,000 | |

2021 | $(204,000,000) | |

(Source - SEC)

As of June 30, 2023, Instacart had $1.96 billion in cash and $774 million in total liabilities.

Free cash flow during the twelve months ending June 30, 2023, was $387 million.

Instacart IPO Details

Instacart has filed to raise $100 million in gross proceeds from an IPO of its common stock, although the final figure may be as high as $1 billion.

Potential new shareholder Pepsi has agreed to purchase Class A common shares of up to $175 million in the aggregate at the IPO price in a concurrent private placement at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

We intend to use the net proceeds we receive from this offering, together with existing cash and cash equivalents, if necessary, to satisfy all of our anticipated tax withholding and remittance obligations related to the settlement of certain outstanding RSUs, the repurchase and cancellation of shares of restricted stock related to the vesting of such restricted stock in connection with this offering, and the net exercise of certain outstanding stock options.

We intend to use any remaining net proceeds from this offering as well as the net proceeds from the concurrent private placement for general corporate purposes, including working capital, operating expenses, and capital expenditures.

(Source - SEC)

Management's presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, the firm has accrued a legal reserve balance of $65 million relating to the possibility of losing a California lawsuit "alleging unfair competition claims related to contractor misclassification," or the "San Diego Action." The firm has since settled with the city for $46.5 million, pending the outcome of a challenge to Proposition 22 regarding classification of "gig workers."

The company is also the subject of other "putative" class action lawsuits related to the same contractor classification issue.

Should the company lose these putative class action lawsuits, it could increase the firm's costs and potentially result in a material adverse effect on its financial condition and operations and lead to unionization efforts by formerly classified "gig workers."

The listed book runners of the IPO are Goldman Sachs, J.P. Morgan, BofA Securities and numerous other investment banks.

Commentary About Instacart's IPO

CART is seeking U.S. public capital market investment to fund its tax obligations and for general working capital purposes.

Instacart's financials have produced increasing top line revenue, higher gross profit and gross margin and growing operating profit and cash flow from operations.

Free cash flow for the twelve months ending June 30, 2023, was $387 million.

Sales and Marketing expenses as a percentage of total revenue have trended higher as revenue has increased; its Sales and Marketing efficiency multiple remained constant at 1.1x

The firm currently plans to pay no dividends and to retain future earnings, if any, for reinvestment back into the company's growth initiatives and working capital requirements.

CART's recent capital spending history indicates it has spent lightly on capital expenditures as a percentage of its operating cash flow.

The market opportunity for delivering groceries is very large and expected to grow at a quite strong rate of growth in the coming years, so the firm enjoys strong industry growth dynamics but significant competition from a wide variety of competitors.

Goldman Sachs is the lead underwriter, and the eight IPOs led by the firm over the last 12-month period have generated an average return of 14.1% since their IPO. This is a middle-tier performance for all major underwriters during the period.

Business risks to the company's outlook as a public company include slowing order growth after a pandemic-era period of rapid growth.

For example, the firm's order growth rate in the full year of 2022 was 18% over 2021, while the first half of 2023's order growth rate was only 0.45% over the same period in 2022.

Slowing order volume growth after the end of the pandemic is something that may require management to spend more operational cash on reigniting if the firm is to have a successful growth story for investors.

The company also faces worker reclassification risks, which may add significant costs if the firm loses lawsuits.

When we learn more about the Instacart IPO's pricing and valuation assumptions, I'll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.