3M Company: I Still Believe The Dividend Is Safe, For Now

Summary

- 3M stock has experienced significant declines in the past few years, with a 52% drop in the last 5 years.

- The company has faced multiple legal issues, including a $10.3 billion settlement and a large number of cases related to defective combat earplugs.

- The recent news of a $5.5 billion settlement for the earplug cases provides some relief for investors and improves the outlook for MMM's dividend.

jetcityimage

3M Company's (NYSE:MMM) stock has been under pressure for quite a while as can be seen in the stock's price, which is down:

- 52% in the last 5 years

- 30% in the last year

- 20% YTD

- 9% in the last 6 months

A vast majority of this pressure is attributed to the company's legal blues. Let's run down a few:

- the $10.3 billion "forever chemicals" settlement

- the self-reported and much-smaller anti-bribery violation

- and the elephant in the room, the earplug settlement, which was and is still threatening to be huge in terms of the number of cases and the settlement amount.

The main trigger for this article is the news that broke out on Seeking Alpha that 3M has agreed to pay $5.5 billion to resolve over 300,000 (yes, 300K) cases that claim the company sold defective combat earplugs to the United States Military. This news should come as a relief to investors on many counts:

- Better visibility, if not complete removal, of the massive cloud hanging over the company.

- The settlement amount of $5.5 billion is much smaller than the initial speculation of $100 billion, which is twice the company's current market cap.

- 3M has reportedly been incurring about $5 million/week in costs associated with the lawsuit, with almost half-a-billion dollars spent on attorneys alone as of January 2023.

- 3M has lost 10 out of the first 16 cases that went to trial in this regard.

One of the biggest questions has been about the company's ability to sustain its dividends amidst the legal onslaught. With the clouds clearing and concrete dollar amounts being thrown behind the major lawsuits, let us evaluate how safe 3M's dividend appears now. Before that, a bit of history about the company's dividend.

3M Dividend History

- It won't be an understatement to say 3M considers its dividend sacred. It takes a lot of cash, operating discipline, and most important of all, commitment to shareholders to have increased dividends for 64 straight years.

- 64 years means 3M has been through Black Monday (1987), Dotcom Bubble (2000), Financial Crisis (2008/09), and most recently, the 2020 COVID crash without feeling the need to eliminate or even reduce its dividend. In fact, since 1989, the dividend has gone up almost ten-fold from 16 cents a share/quarter to $1.50 a share/quarter.

Since 2020, 3M's dividend growth rate has slowed down drastically, with the last three increases being by a cent/quarter. Despite that but more as a result of the stock's sell-off, 3M yields more than 6%, its highest level handily in at least the last 20 years as shown below.

3M 20 year yield (macrotrends.net)

But Is The Dividend Safe?

As venerable as that history maybe, the more important question is whether the company can at least maintain its dividend through this legal storm. Let's find out using some of my favorite metrics.

- Total shares outstanding: 552 million

- Current quarterly dividend: $1.50/share

- Quarterly Free Cash Flow [FCF] needed to cover dividends: $828 million

- 3M's average quarterly FCF over the last 5 years: $1.35 billion

- That means, 3M has nearly $525 million "cushion" in quarterly FCF after paying its dividends.

Now, the "Forever Chemicals" settlement for $10.3 billion is expected to be spread out over 10 years while the earplug settlement is expected to be over 5 years according to this Seeking Alpha news item. Let's find out what that means per quarter.

- $10.3 billion spread over 13 years means $198 million/quarter

- $5 billion spread over 5 years means $250 million/quarter

Obviously, the two settlements may not coincide 100% but let's find the maximum pain point by adding the two numbers above: $198 million + $250 million = $448 million, which is below 3M's current "cushion" in quarterly FCF based on the 5-year average.

Clearly, this is just basic, back-of-the-envelope calculation as I can see many things that can be in 3M's favor and many that could be against the company. For example, if the settlements go through as proposed, 3M's recent legal and other lawsuit related expenses will go down, improving the FCF. If the settlement amount goes up or if more lawsuits are added, the cushion in FCF will get tighter by the lawsuit. And so on.

Another area of concern was the expectation that the company may need to up its debt level to be able to afford its settlement dues and dividends at the same time. To the company's credit, its debt level has increased by only 8% in the last 5 years, when many companies took advantage of the low interest rate environment. In the two 2023 quarters so far, 3M has paid an average of about $130 million in interest payments. I am pointing this out explicitly because interest payments are not deducted from FCF, presenting a healthier than actual picture.

Overall, I expect 3M to handle the settlement dues through a combination of taking a hit on earnings and FCF and increasing its debt load. The company also has about $4 billion in cash and short-term equivalents to cushion the blow and help its interest payments. While I expect the company to barely break-even in this scenario for the next few years (other things being equal), it is still a much better prospect than talks of bankruptcy.

Conclusion

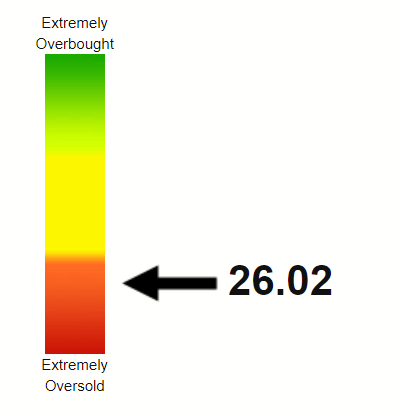

I believe the dividend is safe, for now. Any addition to the company's woes (legal or economic or China specific or company specific) will make me re-evaluate this call. The stock has been punished long and far enough to get my attention here. I recall 3M having a yield well below 3% in all my years of following the stock and find the 6% deal unbelievable. From a technical perspective as well, the stock is in the time-out box with a Relative Strength Index [RSI] of 26 indicating extremely oversold levels. In short, the contrarian in me is licking his chops to initiate a position here, fully knowing that the stock's future or even the company's future is still at risk here.

MMM RSI (Stockrsi.com)

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in MMM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.