VNQ: The Good, The Bad, And The Ugly

Summary

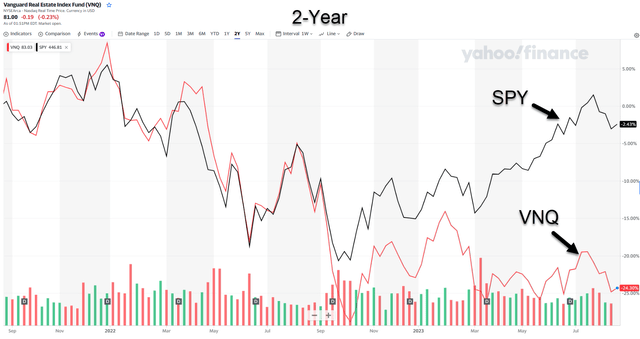

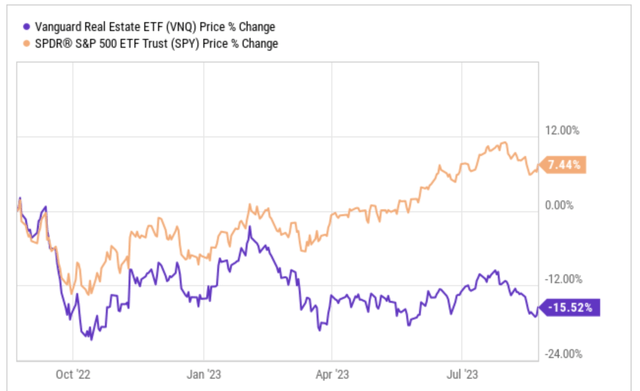

- The Vanguard Real Estate ETF has underperformed the S&P 500 over the past year, making it a potential value investment in the real estate sector.

- The real estate sector has struggled due to rising interest rates, but the Federal Reserve's hiking cycle is nearing an end.

- VNQ is a diversified REIT ETF with a low expense ratio and a dividend yield of 4.7%, and it includes top holdings such as Prologis, American Tower, and Equinix.

nonnie192

I’m sure some of you (like me) remember the epic western film, The Good, The Bad, and The Ugly, featuring Clint Eastwood as “the Good”. It’s one of my favorite westerns in a tale that chases the riches and leads the cast of characters to a cemetery known as the valley of the dead.

Now today I’m not providing you with a critique on the famous western, but instead I’m going to tell you about a REIT ETF that also has some elements of “the good, the bad, and the ugly”.

In addition, this REIT ETF also has some “grave dancing” elements as evidenced by the price chart below.

Over the past 12 months, the Vanguard Real Estate Index Fund ETF Shares (NYSEARCA:VNQ) has drastically underperformed the S&P 500 (SPY), so if you are a value investor, the Real Estate sector is a good place to look.

The stock market has had an incredible run through the first 7+ months of the year, and much of that is thanks to the technology sector pulling the majority of the weight. Year-to-Date, here is a look at the sector performances within the S&P 500

- Communication Services +41%

- Information Technology +40%

- Consumer Discretionary +30%

- Industrials +9%

- Materials +4%

- Financials -1%

- Energy -1%

- Real Estate -2%

- Health Care -2%

- Consumer Staples -2%

- Utilities -10%

As you can see, half of the sectors are still in negative territory and the S&P 500’s surge higher in 2023 has largely been related to three sectors. One of those negative sectors has been Real Estate, a sector that has struggled during this rising interest rate period.

However, that hiking cycle that we have endured over the past 18 months from the Federal Reserve seems to be nearing an end. The end seemed even closer a few weeks back, but with core CPI still remaining sticky above 4%.

The Fed is set on bringing core CPI down to their goal of 2%, which still seems a ways away, especially as the consumer continues to remain strong and spending.

As such, the Real Estate sector as a whole could continue to remain under pressure for a few more months, but we are still closer to the end of the cycle than the beginning.

When it comes to the Real Estate, there is a broad range of REITs you could invest in that fall into a number of different sectors such as:

- Retail

- Hospitality

- Apartments

- Lumber

- Casino

- Office

- Industrial

- Warehouse

- Public Storage

- Data Centers

- Cell Towers

There are a number of great individual REITs, some of which we will look at below, but if you are not looking for single stock risk, you could invest in the entire sector through the Vanguard Real Estate ETF (VNQ).

Investing In The REIT Sector Through VNQ

The Vanguard Real Estate ETF was formed in May 1996 and currently has $31 billion in Assets Under Management. The ETF seeks to track the performance of the MSCI US Investable Market Real Estate 25/50 Index, by using full replication technique.

VNQ has a decently low expense ratio of 0.12%, which means you will pay $12 in fees for every $10,000 in value you have within the fund. Overall, VNQ has a dividend yield of 4.7%. The ETF has a total of 168 positions.

Here is a look at the top 10 positions and their weightings within the fund:

- Vanguard Real Estate II Index: 12.56%

- Prologis (PLD): 7.52%

- American Tower (AMT): 5.79%

- Equinix (EQIX): 4.95%

- Crown Castle (CCI): 3.07%

- Public Storage (PSA): 2.91%

- Realty Income (O): 2.63%

- Simon Property Group (SPG): 2.58%

- Welltower (WELL): 2.57%

- Digital Realty Trust (DLR): 2.25%

The top position within VNQ is a REIT Index Fund, which holds many of the top holdings within VNQ already, so your exposure is going to be even larger than what is stated above.

The top 10 positions within VNQ make up 47% of the ETF. Let’s take a closer look at the remaining 9 individual REITs within the fund.

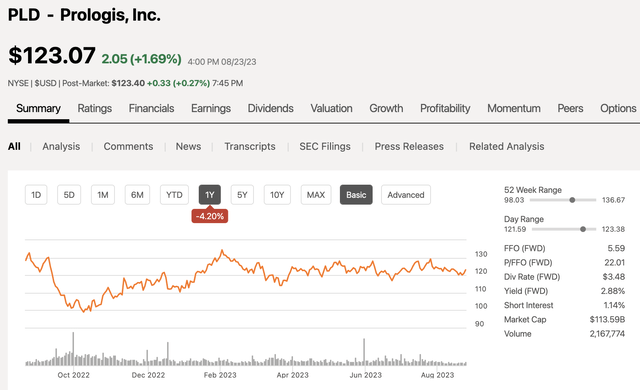

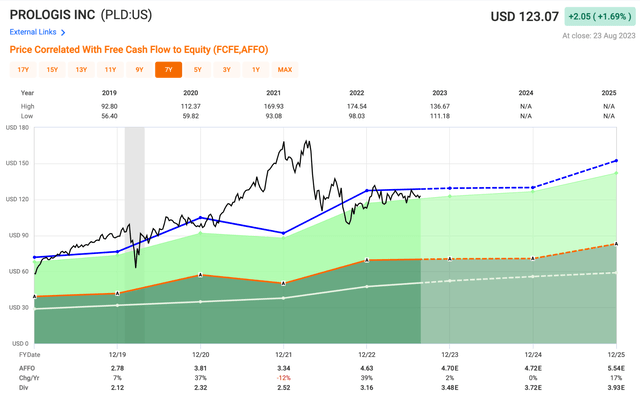

Prologis

Prologis is the premiere industrial and warehouse REIT on the market with a market cap of $114 billion. Over the past 12 months the stock has fallen 4%. PLD has a dividend yield of 2.9%.

Shares of PLD currently trade at a forward P/AFFO 26.1x. Over the past five years, shares of PLD have traded at an average AFFO multiple of 27.5x.

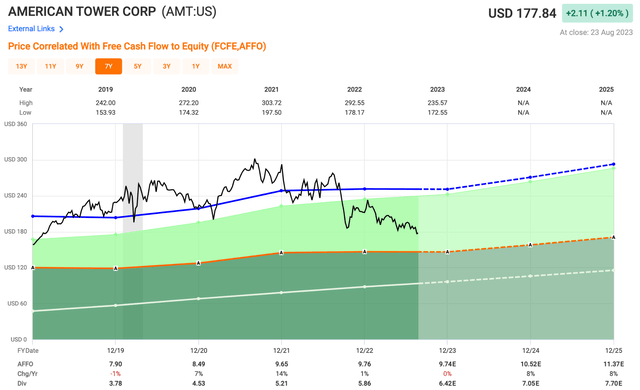

American Tower

American Tower is the largest cell tower REIT on the market today with a market cap of $82 billion. Over the past 12 months, shares have been under intense pressure with the stock down over 30%. Telecom companies, which are the REITs largest tenants, have dealt with issues as well as the competition from satellite providers. AMT has a dividend yield of 3.6%.

Shares of AMT currently trade at a forward P/AFFO 18.3x. Over the past five years, shares of AMT have traded at an average AFFO multiple of 25.7x.

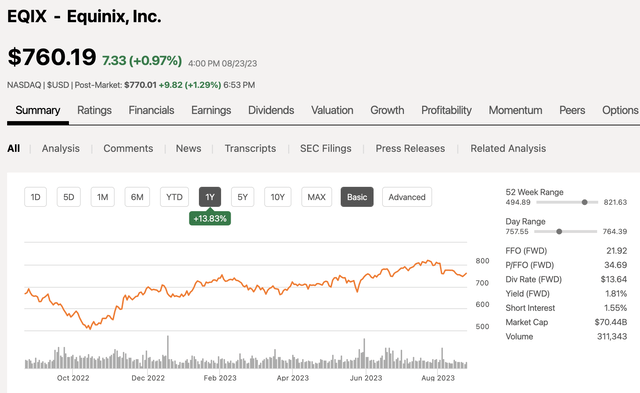

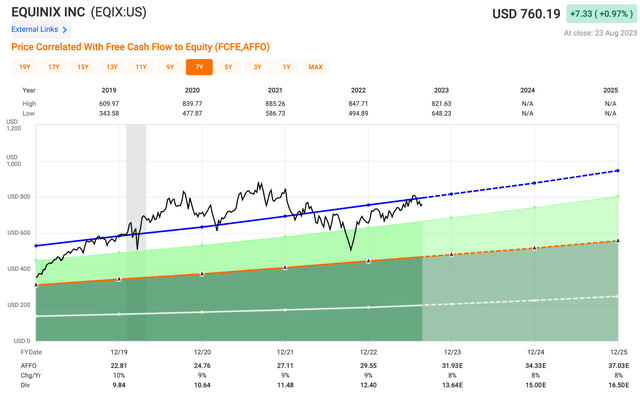

Equinix

Equinix is the largest data center REIT with a market cap of $70 billion. Data centers have become more popular over the years with more and more business moving to the cloud, which means a greater need for data centers. Over the past 12 months, shares are up 14%, as data centers have been a bright spot within the sector. EQIX pays a dividend of 1.8%.

Shares of EQIX currently trade at a forward P/AFFO 23.8x. Over the past five years, shares of EQIX have traded at an average AFFO multiple of 25.5x.

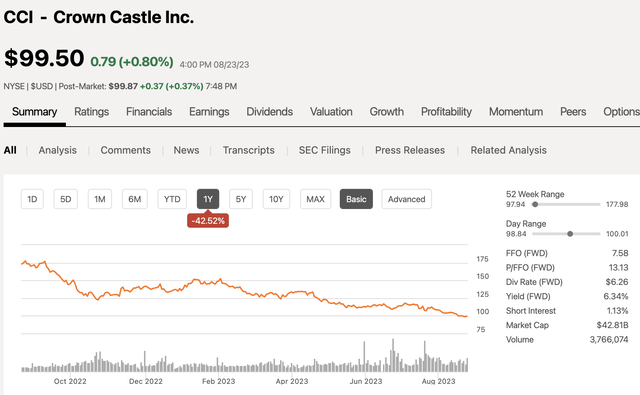

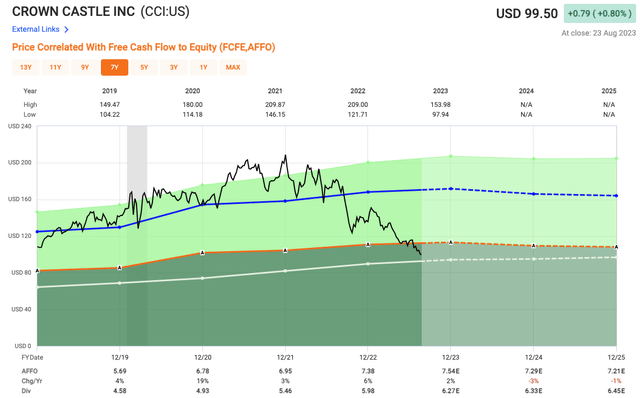

Crown Castle

A few positions higher we saw the largest cell tower REIT, now we follow that up with the second largest cell tower REIT. CCI has a market cap of $43 billion, and like AMT, shares have been under pressure over the past year, with the stock down over 40%. Crown Castle is trading at levels last seen in 2017. CCI has a high dividend yield of 6.3%.

Shares of CCI currently trade at a forward P/AFFO 13.3x. Over the past five years, shares of CCI have traded at an average AFFO multiple of 22.7x.

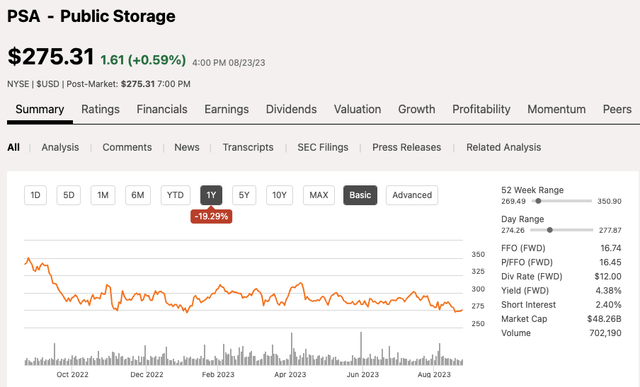

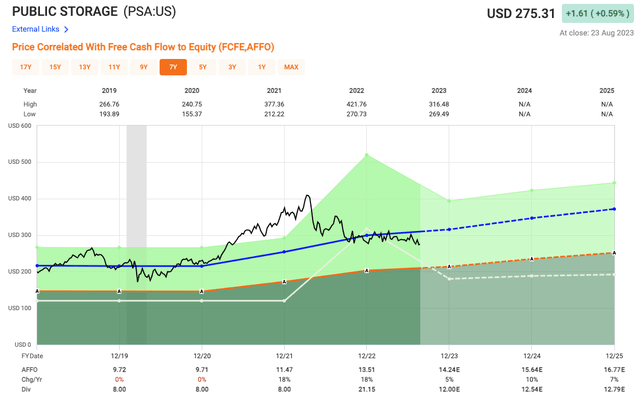

Public Storage

If there is one thing true in the US, it's the fact that Americans like to hoard things. Regardless of the economic backdrop, the self-storage sector is one that is as consistent as they come. Public Storage is the largest self-storage REIT with a market cap of $48 billion. Over the past 12 months, shares have fallen nearly 20%. PSA has a high dividend yield of 4.4%.

Shares of PSA currently trade at a forward P/AFFO 19.3x. Over the past five years, shares of PSA have traded at an average AFFO multiple of 22.1x.

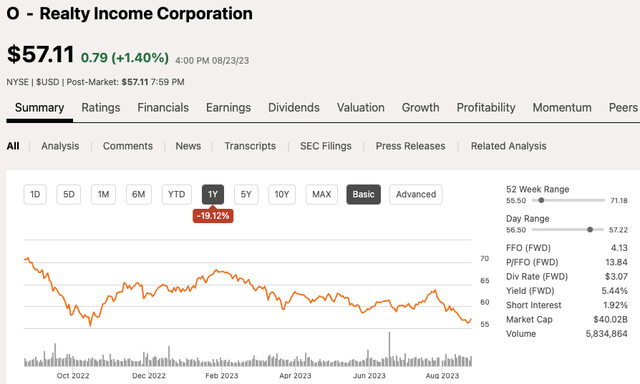

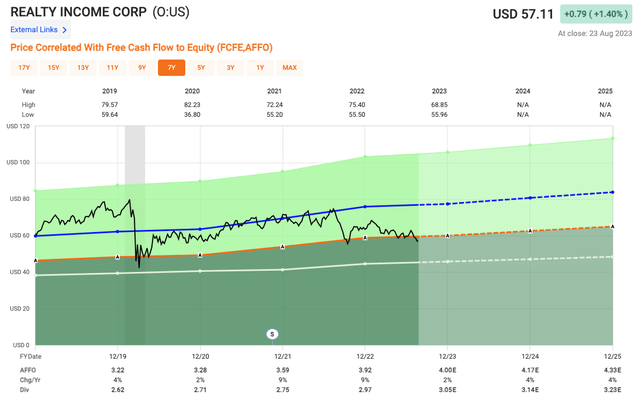

Realty Income

Realty Income is one of the most popular REITs on the market today, popular due to not only their consistency, but also popular among the retail crowd for their monthly dividend. The company has coined themselves “The Monthly Dividend Company.” Realty Income is a net lease Retail REIT with a market cap of $40 billion. Over the past 12 months, shares have fallen nearly 20%. O has a high dividend yield of 5.4%.

Shares of O currently trade at a forward P/AFFO 14.3x. Over the past five years, shares of O have traded at an average AFFO multiple of 19.3x.

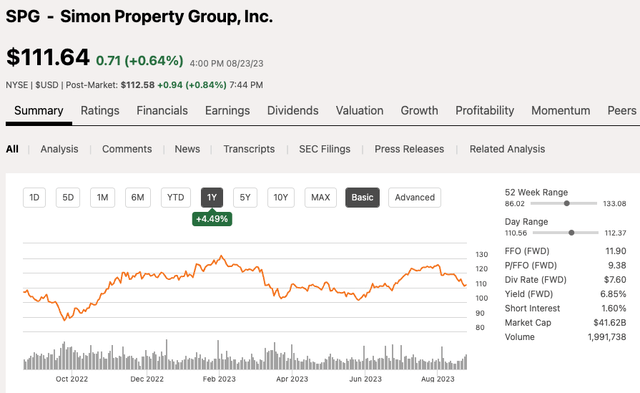

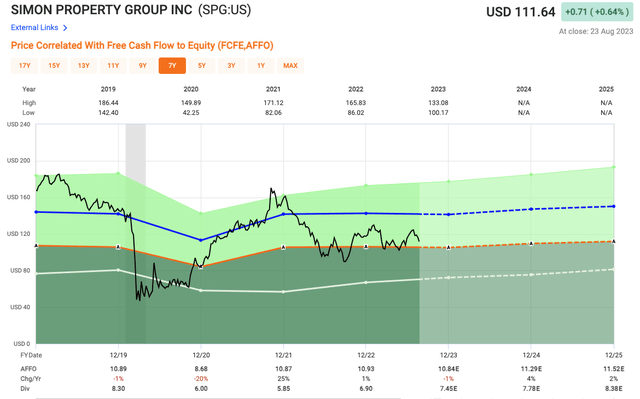

Simon Property Group

Simon Property Group is the premiere mall landlord with an A rated portfolio. This day in age we have seen many malls go under, but those tend to be C or D rated malls, which are classified based on sales per square foot. Simon Property Group has a market cap of $42 billion and over the past 12 months, shares of SPG are up 5%. After having to slash their dividend during the pandemic, SPG has quickly raised it back up and now has a high yield of 6.9%.

Shares of SPG currently trade at a forward P/AFFO 10.3x. Over the past five years, shares of SPG have traded at an average AFFO multiple of 13.0x.

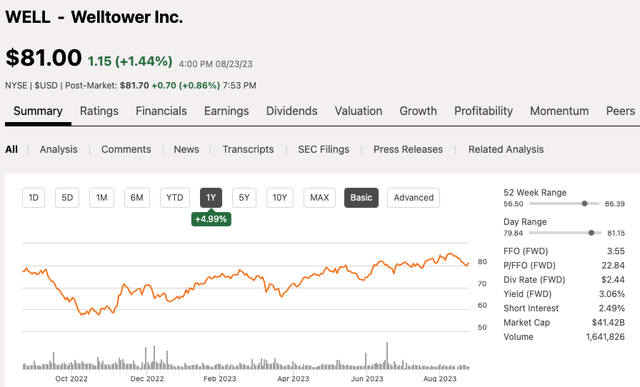

Welltower

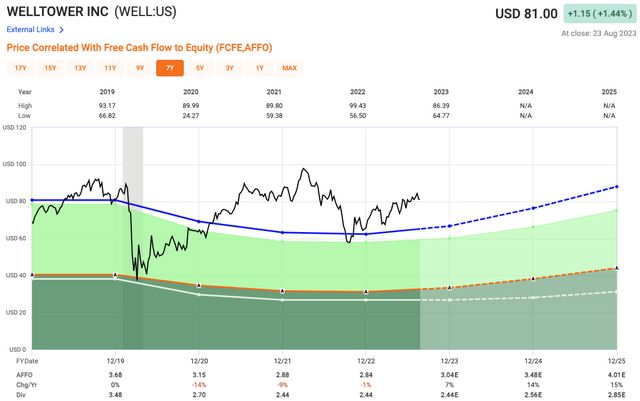

Welltower is the largest health care REIT as they have a large portfolio of senior housing properties. The REIT has a market cap of $41 billion and over the past 12 months, shares of WELL have climbed 5%. The REIT was hit pretty badly during the pandemic, and like SPG, they too were forced to slash their dividend. However, unlike SPG, we have not seen WELL increase their dividend since the pandemic. WELL currently yields a dividend of 3.1%.

Shares of WELL currently trade at a forward P/AFFO 26.6x. Over the past five years, shares of WELL have traded at an average AFFO multiple of 21.9x.

Digital Realty Trust

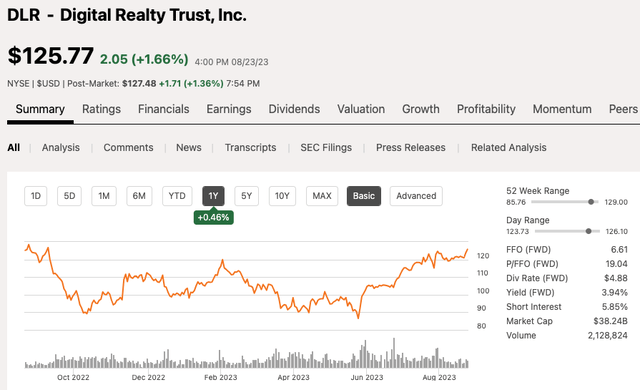

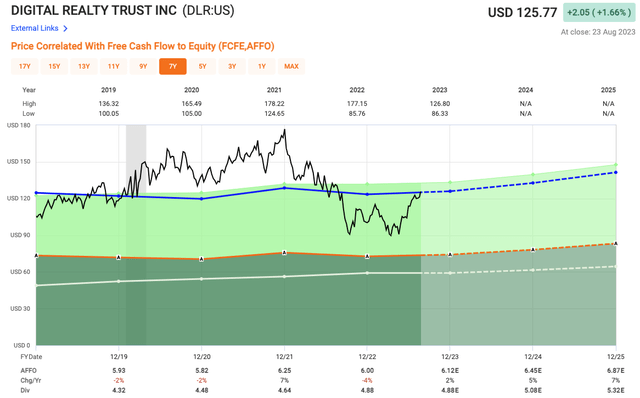

Like EQIX, which we looked at earlier, Digital Realty Trust played off the momentum of the high demand for data centers. DLR is a large data center REIT with a market cap of $38 billion. Over the past 12 months, shares are flat. DLR has a dividend yield of 3.9%.

Shares of DLR currently trade at a forward P/AFFO 20.5x. Over the past five years, shares of DLR have traded at an average AFFO multiple of 20.6x.

The Good, The Bad, and The Ugly

Now you with 168 positions, you can see why I refer to VNQ as “the good, the bad, and the ugly”. When you own shares in this REIT ETF you own just about every REIT in the US plus a few real estate companies like CBRE Group (CBRE) and Jones Lang LaSalle (JLL).

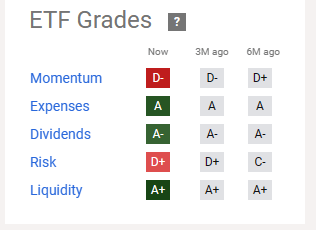

VNQ is now trading at $80.94 per share with a dividend yield of 4.7%. The expense ratio is just 12 basis points, which is one of the lowest in the REIT ETF sector.

Seeking Alpha

As most of my readers know, I recently launched a REIT ETF Index known as iREIT-MarketVector™ Quality REIT that provides exposure to high quality US listed common and preferred equity securities of REITs while ensuring sector diversification.

Our team plans to list this ETF this year and our strategy is unique in that the passive ETF selects the highest quality REITs (40 in the Index) based on the best overall quality and value scores.

In other words, this strategy is much less diversified than VNQ, yet it offers access to all property sectors and with constituents that are weighted equally with a tilt toward stocks selected in the Higher Quality REITs bucket.

What I do like about VNQ is that most of the top 8 names (yielding 4.3%) are all solid buys and you could simply build your own ETF by buying shares in these names:

- PLD: 2.9% yield

- AMT: 3.6% yield

- EQIX: 1.8% yield

- CCI: 6.3% yield

- PSA: 4.4% yield

- O: 5.4% yield

- SPG: 6.7% yield

- WELL: 3.0% yield

- Average: 4.3% yield

Our team is spending a lot more time researching ETFs. Over the last six months, we’ve written on the following funds:

- VanEck Morningstar Wide Moat ETF (MOAT)

- Schwab U.S. Dividend Equity ETF™ (SCHD)

- Vanguard Dividend Appreciation Index Fund ETF Shares (VIG)

- JPMorgan Equity Premium Income ETF (JEPI)

- iShares U.S. Real Estate ETF (IYR)

- InfraCap Equity Income Fund ETF (ICAP)

- Pacer US Cash Cows 100 ETF (COWZ)

- iShares Core High Dividend ETF (HDV)

- WisdomTree U.S. Quality Dividend Growth Fund ETF (DGRW)

- Invesco S&P 500 GARP ETF (SPGP)

- Vanguard Information Technology Index Fund ETF Shares (VGT)

- SoFi Weekly Dividend ETF (WKLY)

- SoFi Weekly Income ETF (TGIF)

iREIT

Sign Up For A FREE 2-Week Trial

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Builders, Asset Managers, and we added Prop Tech SPACs to the lineup.

We recently added an all-new Ratings Tracker called iREIT Buy Zone to help members screen for value. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 168,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 110,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College, and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMT, CCI, DLR, PLD, PSA, SPG, O either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)

It has been kind of a crummy investment for 8 years.