ITA: Gray Swan Protection Protocol

Summary

- The "Gray Swan" is a known and possible event that is assumed unlikely to occur, while the "Black Swan" is an unknown and unlikely event.

- China's increasing rhetoric about reunification with Taiwan poses a potential gray swan event that could disproportionately impact the semiconductor industry and also bring down the S&P 500 as a whole.

- Investing in the iShares U.S. Aerospace & Defense ETF could provide a gray swan hedge against a worst-case scenario and minimize the drawdown on an investor's portfolio.

- If Russia's attack is taken as a litmus test, this ETF has been able to pass the test with flying colors.

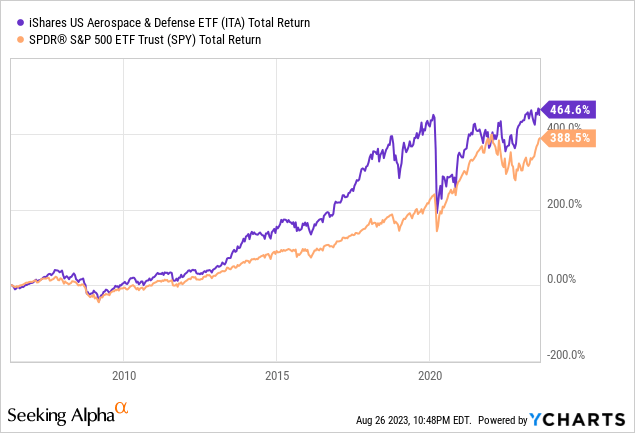

- The ETF has also performed remarkably well over the long term outperforming the S&P 500 without any "big" events.

guvendemir

While many investors are familiar with the term "Black Swan", I would say the "Gray Swan" is its less popular cousin and is an extension of the black swan concept. What is the key difference between the terms then?

Black Swan: An event that is unlikely and unknown

Gray Swan: An event that is known and possible to happen, but is assumed unlikely to occur

Most investors confuse the gray swan with the black swan by attributing unlikely events to the unknown. But what does all of this have to do with investing?

In fact, the very origin of the Black Swan term was popularized by Nassim Taleb who in his book The Black Swan said how unlikely and unknown events have the biggest impact on your portfolio and he has also complained when investors wrongly attribute the term to known but unlikely events which deserved its own categorization that eventually gave birth to the term "Gray Swan".

Gray swan or black swan both will impact your portfolio and it's extremely hard to protect your portfolio from either event. But as I was thinking about one of the gray swans that could likely affect the stock market as a whole but possibly spare one of the sectors, the exposure of which could potentially minimize the drawdown on an investor's portfolio.

The China Problem

There has been increasing rhetoric from China about its reunification with Taiwan. There could be many investors ready to dismiss this threat as something immediate but this exactly proves the point of Gray Swan. Intentions of China with respect to Taiwan surfaced many years ago and it has been building up great momentum these last two years.

Recent news has seen China's military activity around Taiwan escalating as 32 aircraft and nine navy vessels were detected within a day. Around 20 of these aircraft breached Taiwan's air defense zone. Taiwan responded with its own military measures. This tension arises from China's increased military exercises near Taiwan, fueled by political events, including Taiwan's vice president's U.S. visit. The U.S. even approved a $500 million arms sale to Taiwan, causing China to strongly oppose it as interference. China urged the U.S. to uphold its commitment against supporting Taiwanese independence.

Many sectors would be potentially decimated if China fully moves toward realizing its unification plan. It is all well-known about the world's exposure to Taiwan when it comes to semiconductors. Taiwan produces over 60% of the world's semiconductors and over 90% of the most advanced ones. The semiconductor industry is called Taiwan's "silicon shield", which gives the world a big reason to defend the island. Companies like Apple (AAPL), Tesla (TSLA), and Nvidia (NVDA) have direct exposure to China itself and would have to pull out their business entirely akin to what happened when Russia invaded Ukraine. Many of these companies are significant enough to bring down the S&P as a whole.

I don't like its location, and I've reevaluated that. I feel better about the capital that we've got deployed in Japan than Taiwan. I wish it weren't so, but I think that's the reality, and I've reevaluated that in the light of certain things that were going on

- Warren Buffett on selling his conglomerate's shares of TSMC

The Defense Industry ETF

Following the logic, it makes sense that the defense industry would stand to gain the most in a worst-case scenario. A good way to gain exposure to the defense industry is through the iShares U.S. Aerospace & Defense ETF (BATS:ITA). The ETF exposure takes the worst out of investment by distributing the risk between multiple companies but at the same time providing potential upside if the industry stands to benefit as a whole due to an event.

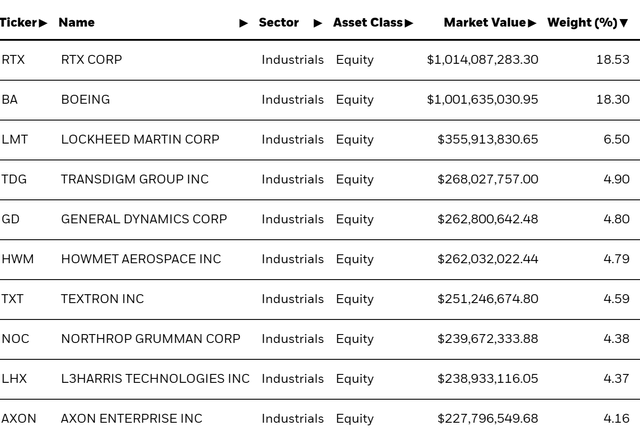

The iShares U.S. Aerospace & Defense ETF is an exchange-traded fund (ETF) offered by BlackRock's iShares. It is designed to track the performance of an index composed of U.S. companies in the aerospace and defense industry. This ETF provides investors with exposure to a diversified portfolio of companies engaged in the manufacturing, development, and distribution of products and services related to aerospace, defense, and national security.

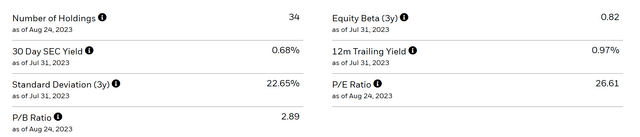

The fund's expense ratio is 0.4%, was formed in 2006, and presently has about 34 holdings. The top 10 holdings comprise almost 75% of the fund and are all in the mega-cap space.

Top 10 Holdings of ITA (iShares)

Valuation wise it is slightly above the SP500 (25.15). What I like the most is its lower beta of 0.8 which indicates that it does not move as much as the market. Its 12-month trailing yield is also attractive at close to 1%.

Gray Swan Hedge

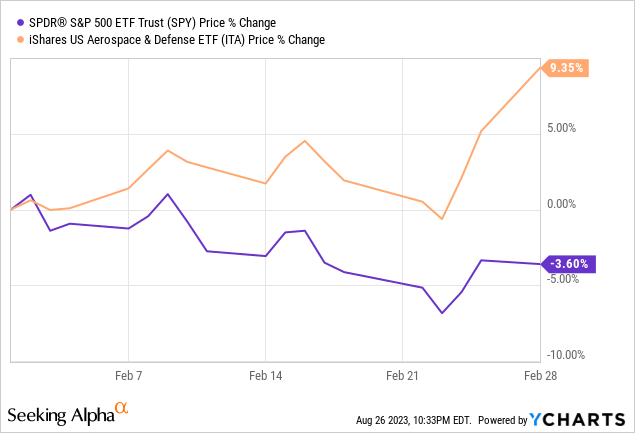

Logically, in terms of a war event, the direction of this ETF should diverge from a typical S&P500 portfolio. But is there any data to support this? This is where it gets difficult. Wars are not an "everyday" scenario, so naturally, finding this type of data is hard. And since this ETF was founded only in 2006 this makes it almost impossible to at least check its behavior under the threat of a serious war. But it's not all bad news. I checked the timeline of Russia's first full-blown attack on Ukraine. This is when the market was not exactly sure how far things would escalate and how much the world would be involved. This is probably the biggest event that could serve as a litmus test for our ETF.

- I have considered the returns for February when there was increasing rhetoric of escalation to war and the launch of a full-scale invasion

- While the returns for S&P were negative, our ETF performed extremely well returning more than 9% for the month

What if nothing big happens?

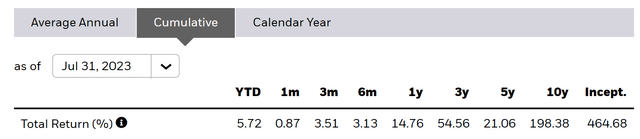

This would obviously be good for the world and also for our portfolio. But it also doesn't mean you would lose your money on the investment if you don't time it right (which let us admit nobody can but that is not the point of this article). One thing you can definitely count on is the US's love of defense spending. Last year alone the Senate authorized $858B in annual defense spending for purchases of weapons, ships, and aircraft. The legislation also grants additional funds for the advancement of hypersonic weaponry and the procurement of weapon systems, which encompass Lockheed Martin's (LMT) F-35 fighter jets and vessels manufactured by General Dynamics (GD) (These companies are components of this ETF). This means the tap is never turned off for defense and in effect, money will continue to flow into these companies. A quick look at the performance of this ETF reflects this fact. As of July End, the total return since its inception has been more than 460% with a ten-year return of close to 200%

It is truly impressive to see this outperform the SP500 so well.

Closing Commentary

The amount of gray swan protection this ETF could provide for your portfolio obviously depends on the exposure. But at the very least you could take some solace in the fact that certain corners of your portfolio would mitigate the drawdown on your portfolio in a worst-case scenario. For a much more sophisticated investor, long-dated far OTM call option exposure of this ETF would provide an asymmetric effect on the portfolio and would truly act as the China-Taiwan war gray swan hedge. It has to be mentioned that options are a risky investment and a play of this nature is highly likely to lose the full extent of the capital involved in this investment.

In summary, I like the plain ETF exposure to ITA for the following reasons -

1. Returns could potentially match or exceed that of S&P 500

2. It has lower volatility than S&P 500

3. In a situation where we see China moving forward with its plans, its positive divergence would minimize the drawdown on my portfolio.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ITA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.