Haoxi Health Technology Readies Plans For U.S. IPO

Summary

- Haoxi Health Technology Limited has filed for an IPO to raise $13.5 million.

- The company provides online short-form video marketing solutions to healthcare advertisers in China.

- Due to its small size, thin capitalization, operational risks, low margin, and regulatory uncertainties, my outlook on the IPO is to Sell [Avoid].

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

B4LLS

A Quick Take On Haoxi Health Technology Limited

Haoxi Health Technology Limited (HAO) has filed to raise $13.5 million in an IPO of its Class A ordinary shares, according to an SEC F-1 registration statement.

The firm provides online short video and other marketing solutions to primarily healthcare advertisers in China.

Given Haoxi Health Technology Limited’s tiny size, operational risks, low margin and regulatory uncertainties in China, my opinion on the IPO is to Sell [Avoid].

Haoxi Health Overview

Beijing, China-based Haoxi Health Technology Limited was founded to develop customized marketing content and solutions for online advertisers in China seeking to acquire and retain customers on various online media platforms.

Management is headed by Chairman and CEO Mr. Zhen Fan, who has been with the firm since September 2022 and was previously a media specialist at Sohu and Director of Content at ifeng dot com of Phoenix New Media Limited.

The company’s primary offerings include the following:

Video development

Bidding Compass ad placement system.

As of December 31, 2022, Haoxi Health has booked fair market value investment of approximately $2.2 million from investors.

Haoxi Health Customer Acquisition

The company procures advertising slots from media partners and sells them to clients seeking mostly short-form video advertising placements.

The firm has served around 2,000 advertisers since its inception, and the strong majority of these clients have been in the healthcare industry.

Selling expenses as a percentage of total revenue have remained stable as revenues have increased, as the figures below indicate:

Selling | Expenses vs. Revenue |

Period | Percentage |

Six Mos. Ended Dec 31, 2022 | 0.2% |

FYE June 30, 2022 | 0.2% |

FYE June 30, 2021 | 0.3% |

(Source - SEC.)

The Selling efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling expense, has risen sharply to 123.1x in the most recent reporting period, as shown in the table below:

Selling | Efficiency Rate |

Period | Multiple |

Six Mos. Ended Dec 31, 2022 | 123.1 |

FYE June 30, 2022 | 88.3 |

(Source - SEC.)

Haoxi Health’s Market & Competition

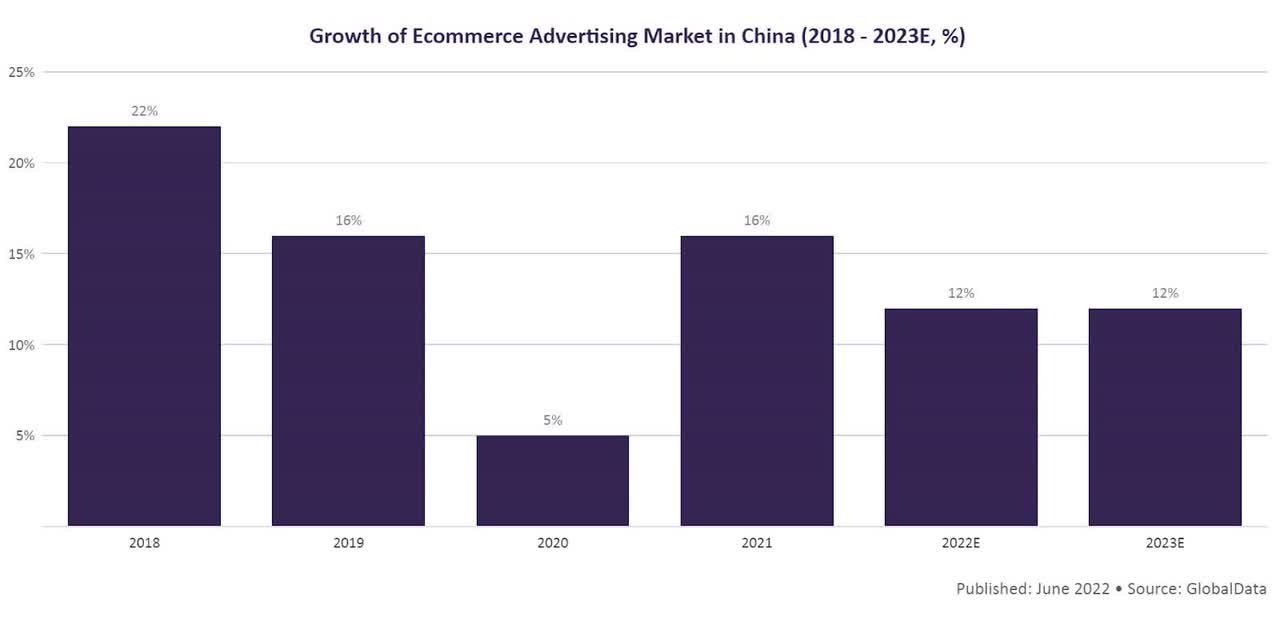

According to a 2022 market research report by GlobalData, the Chinese market for digital advertising is expected to slow its growth rate as business confidence has recently dropped.

The Chinese eCommerce advertising market's growth results and projection is shown below:

Ecommerce Advertising Growth In China (GlobalData)

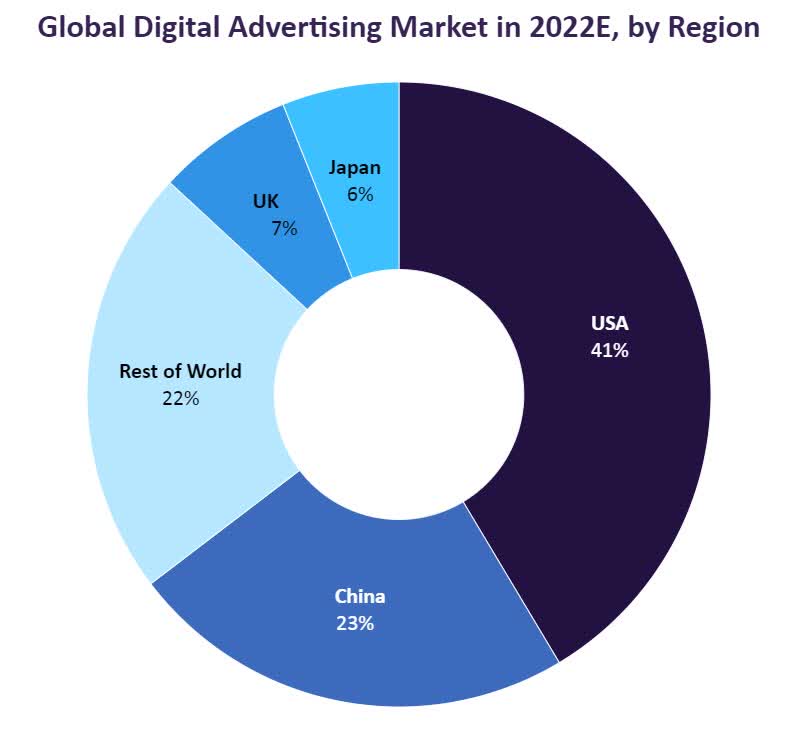

The global digital advertising market by region, as shown in the pie chart below, shows the U.S. in the lead with China in second:

Global Digital Advertising Market Share By Region (GlobalData)

Also, China's digital advertising market was an estimated $97.9 billion in 2022, and the country is still recovering from the effects of extensive COVID-19 lockdowns.

The firm competes against a variety of small and mid-sized players in a highly fragmented industry.

Haoxi Health Technology Limited Financial Performance

The company’s recent financial results can be summarized as follows:

Growing top line revenue from a small base

Increasing gross profit but variable and low gross margin

Higher operating profit

A swing to positive cash flow from operations.

Below are relevant financial results derived from the firm’s registration statement:

Total Revenue | ||

Period | Total Revenue | % Variance vs. Prior |

Six Mos. Ended Dec 31, 2022 | $ 9,162,832 | 23.8% |

FYE June 30, 2022 | $ 16,156,865 | 25.8% |

FYE June 30, 2021 | $ 12,847,545 | |

Gross Profit (Loss) | ||

Period | Gross Profit (Loss) | % Variance vs. Prior |

Six Mos. Ended Dec 31, 2022 | $ 730,229 | 129.8% |

FYE June 30, 2022 | $ 648,721 | 7.1% |

FYE June 30, 2021 | $ 605,577 | |

Gross Margin | ||

Period | Gross Margin | % Variance vs. Prior |

Six Mos. Ended Dec 31, 2022 | 7.97% | 3.7% |

FYE June 30, 2022 | 4.02% | -14.8% |

FYE June 30, 2021 | 4.71% | |

Operating Profit (Loss) | ||

Period | Operating Profit (Loss) | Operating Margin |

Six Mos. Ended Dec 31, 2022 | $ 492,791 | 5.4% |

FYE June 30, 2022 | $ 268,768 | 1.7% |

FYE June 30, 2021 | $ 330,554 | 2.6% |

Comprehensive Income (Loss) | ||

Period | Comprehensive Income (Loss) | Net Margin |

Six Mos. Ended Dec 31, 2022 | $ 512,575 | 5.6% |

FYE June 30, 2022 | $ 307,624 | 1.9% |

FYE June 30, 2021 | $ 131,586 | 1.0% |

Cash Flow From Operations | ||

Period | Cash Flow From Operations | |

Six Mos. Ended Dec 31, 2022 | $ 205,039 | |

FYE June 30, 2022 | $ (675,361) | |

FYE June 30, 2021 | $ 2,648,895 | |

(Source - SEC.)

As of December 31, 2022, Haoxi Health had $2.4 million in cash and $2.0 million in total liabilities.

Free cash flow during the twelve months ending December 31, 2022, was $297,877.

Haoxi Health Technology Limited IPO Details

Haoxi Health intends to raise $13.5 million in gross proceeds from an IPO of its Class A ordinary shares, offering three million shares at a proposed midpoint price of $4.50 per share.

Class A ordinary shareholders will be entitled to one vote per share and Class B ordinary shareholders will be entitled to ten votes per share.

The S&P 500 Index (SP500) no longer admits firms with multiple classes of stock into its index.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $55.2 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 19.72%. A figure under 10% is generally considered a "low float" stock which can be subject to significant price volatility.

As a foreign private issuer, the company can choose to take advantage of reduced, delayed or exempted financial and senior officer disclosure requirements versus those that domestic U.S. firms are required to follow.

Management says the firm qualifies as an ‘emerging growth company’ as defined by the 2012 JOBS Act and may elect to take advantage of reduced public company reporting requirements; prospective shareholders would receive less information for the IPO and, in the future, as a publicly-held company within the requirements of the Act.

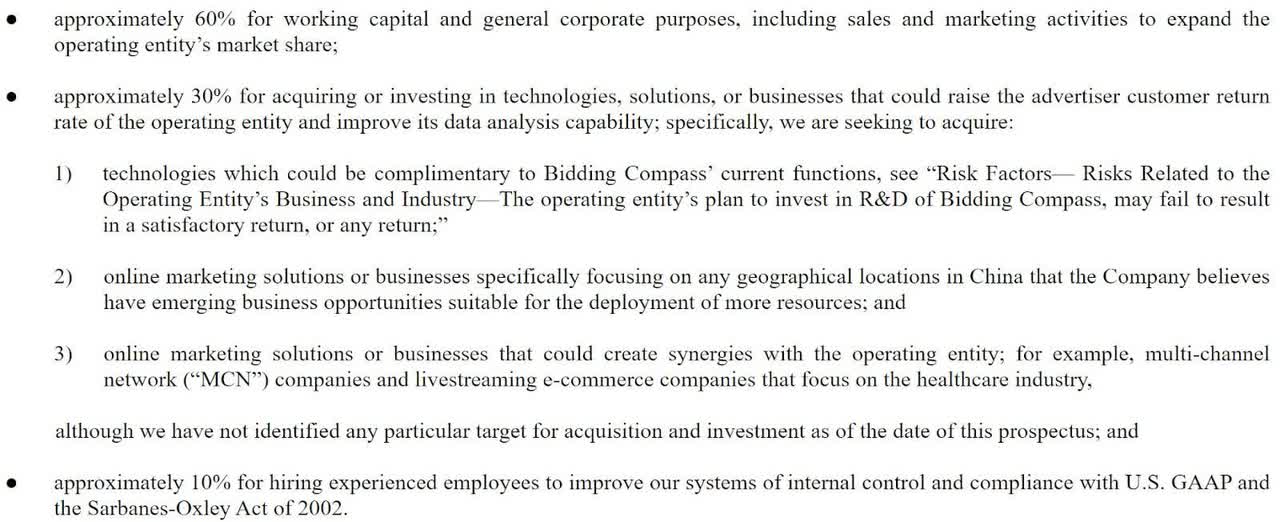

Management says it will use the net proceeds from the IPO as follows:

Proposed Use Of IPO Proceeds (SEC)

The firm currently has no equity compensation incentive plan in place.

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management believes that any current legal proceedings would not have a material adverse effect on its financial condition or operations.

The sole listed bookrunner of the IPO is EF Hutton.

Valuation Metrics For Haoxi Health

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] | Amount |

Market Capitalization at IPO | $68,445,000 |

Enterprise Value | $55,155,780 |

Price / Sales | 3.82 |

EV / Revenue | 3.08 |

EV / EBITDA | 85.88 |

Earnings Per Share | $0.05 |

Operating Margin | 3.58% |

Net Margin | 4.09% |

Float To Outstanding Shares Ratio | 19.72% |

Proposed IPO Midpoint Price per Share | $4.50 |

Net Free Cash Flow | $297,877 |

Free Cash Flow Yield Per Share | 0.44% |

Debt / EBITDA Multiple | 0.60 |

CapEx Ratio | 25.18 |

Revenue Growth Rate | 23.80% |

(Source - SEC.)

Commentary About Haoxi Health’s IPO

HAO is seeking U.S. public capital market investment to fund its general corporate working capital requirements and further expand its business.

The firm’s financials have generated increasing topline revenue from a small base, growing gross profit but variable and low gross margin, higher operating profit and a swing to positive cash flow from operations.

Free cash flow for the twelve months ending December 31, 2022, was $297,877.

Selling expenses as a percentage of total revenue have been low and stable; its Selling efficiency multiple rose sharply in the most recent reporting period to 123.1x.

The firm currently plans to pay no dividends and plans to retain future earnings, if any, for reinvestment back into the firm's growth and working capital requirements.

Haoxi is subject to a variety of dividend controls under both Cayman Island and Chinese laws.

HAO’s recent capital spending history indicates it has spent lightly on capital expenditures as a percentage of its operating cash flow.

The market opportunity for online advertising in the Chinese market has experienced variable growth and decline due to recent pandemic lockdowns and economic uncertainty.

EF Hutton is the sole underwriter, and the twelve IPOs led by the firm over the last 12-month period have generated an average return of negative (61.8%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

Like other companies with Chinese operations seeking to tap U.S. markets, the firm operates within a WFOE structure or Wholly Foreign Owned Entity. U.S. investors would only have an interest in an offshore firm with interests in operating subsidiaries, some of which may be located in the PRC. Additionally, restrictions on the transfer of funds between subsidiaries within China may exist.

The Chinese government's crackdown on certain IPO company candidates combined with added reporting and disclosure requirements from the U.S. has put a damper on Chinese or related IPOs resulting in generally poor post-IPO performance.

Also, a potentially significant risk to the company’s outlook is the uncertain future status of Chinese company stocks in relation to the U.S. HFCA act, which requires delisting if the firm’s auditors do not make their working papers available for audit by the PCAOB.

Prospective investors would be well advised to consider the potential implications of specific laws regarding earnings repatriation and changing or unpredictable Chinese regulatory rulings that may affect such companies and U.S. stock listings.

The Chinese government may intervene in the company's business operations or industry at any time and without warning and has a recent history of doing so in certain industries.

Additionally, post-IPO communications from the management of smaller Chinese companies that have become public in the U.S. has been spotty and perfunctory, indicating a lack of interest in shareholder communication, only providing the bare minimum required by the SEC and a generally inadequate approach to keeping shareholders up-to-date about management’s priorities.

Business risks to the company’s outlook as a public company include its small size and thin capitalization against other much larger operators and platforms that may choose to bundle similar tools and functionalities.

As for valuation expectations, management is asking investors to pay an Enterprise Value/Revenue multiple of approximately 3.1x.

Given the firm’s small size, operational risks, low margin and regulatory uncertainties in China, my outlook on the IPO is to Sell [Avoid].

Expected IPO Pricing Date: To be announced.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.