JD.com Targets Double-Digit Return With Strong Balance Sheet And China Recovery

Summary

- JD.com's commitment to quality appeals to China's growing affluent class.

- JD.com leverages vertical integration and is aiming to achieve a scaled economy advantage similar to Amazon.

- JD.com has a fortress balance sheet, with a significant percentage of the market capitalization in cash.

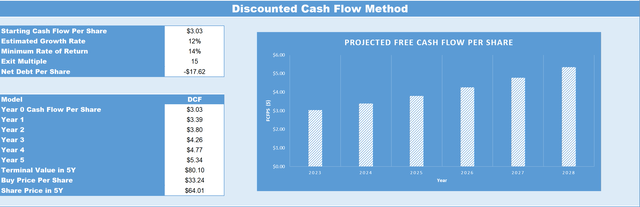

- JD.com's estimated 5-year price target is $64.01, yielding a 14% CAGR.

Andrew Burton

Investment Thesis

I'm of the opinion that JD.com, Inc. (NASDAQ:JD) is a buy, given its robust fundamentals and advantageous market positioning. The company's emphasis on high-quality products and exceptional service has made it a preferred choice among China's expanding middle and upper classes, setting it apart from competitors such as Alibaba (BABA) and Pinduoduo (PDD). JD.com's strategy of vertical integration not only guarantees stringent quality control and rapid delivery but also aligns it to achieve a competitive advantage through economies of scale, akin to Amazon's success. On the financial front, JD.com boasts a sturdy balance sheet, with a considerable amount of its market cap backed by cash reserves. This financial strength offers a safety net for future expansion and minimizes risk. Additionally, based on prudent financial estimates, I think that JD.com has a promising 5-year price target of $64.01, which translates to a 14% compound annual growth rate. All these factors collectively make JD.com an attractive long-term investment opportunity.

Company Overview

I believe JD.com to be a leading Chinese e-commerce company, where we have seen the platform grow to become one of the largest online retailers in the world, rivalling the likes of Alibaba and Amazon (AMZN). JD.com operates through a business-to-consumer (B2C) model, offering a wide range of products including electronics, apparel, home goods, and groceries. What I believe differentiates JD is that, unlike many other e-commerce platforms that act as intermediaries between buyers and sellers, JD.com controls the entire supply chain, from procurement to delivery, ensuring high-quality products and fast shipping times.

Strategic Alignment with the Expanding Middle and Upper Classes

I believe JD.com's focus on quality and premium service sets it apart from competitors like Alibaba and Pinduoduo in appealing to China's middle and upper classes. While Alibaba's Taobao platform is known for its vast selection, it has faced challenges with counterfeit goods, which can be a significant concern for affluent consumers seeking authenticity. Pinduoduo, on the other hand, initially gained traction as a platform for discounted and bulk-purchase items, targeting price-sensitive consumers rather than those looking for premium products. I think this focus allows JD.com to command higher average order values and attract brands that are keen to engage with a wealthier, quality-conscious consumer base.

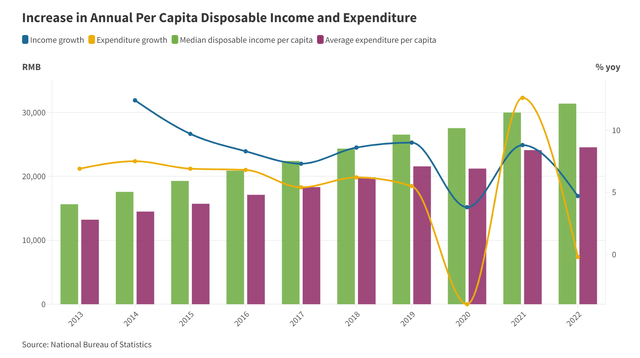

In its latest 2023 report on the future of Chinese consumers, the Boston Consulting Group forecasts significant growth in China's middle and upper classes. Between 2022 and 2030, BCG anticipates that around 80 million more individuals will join these affluent groups, making up nearly 40% of the country's total population by the end of the period. Interestingly, the majority of this new middle-class expansion - over 70% - is expected to emerge from cities that are third-tier or below, typically smaller provincial capitals and prefecture-level locations. In my opinion, this suggests that these lower-tier cities are poised to become increasingly influential in terms of consumer spending over the next decade.

This demographic shift is accompanied by increasing disposable incomes and a growing appetite for quality, branded products - factors that I think align perfectly with JD.com's business model.

Leveraging Vertical Integration and Diversification for Long-Term Success

In my opinion, JD.com's vertical integration strategy serves as a key differentiator in the competitive e-commerce landscape, offering a host of advantages that collectively enhance its market position. By controlling its entire supply chain, JD.com ensures stringent quality control, thereby building trust and retaining a loyal customer base. This focus on quality is particularly appealing to discerning consumers who prioritize authenticity. Additionally, the company's ownership of the supply chain enables rapid delivery services, often within the same day. I see this as a major selling point for consumers and contributes to high levels of customer satisfaction.

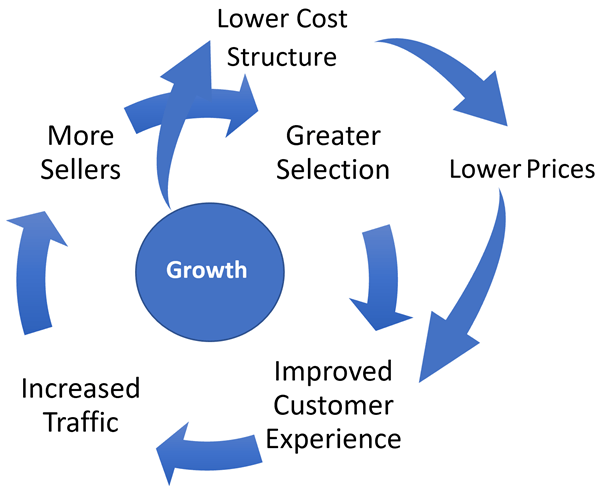

Much like Amazon, I believe JD.com is well-positioned to achieve a scaled economy-shared competitive advantage through its diversified business units, including JD Logistics, JD Health, and JD Cloud & AI. I think these subsidiaries can leverage the company's extensive supply chain and technological infrastructure to optimize their operations, leading to cost reductions which then drive further traffic to the platform and create higher customer satisfaction, which causes a flywheel effect. This flywheel effect can eventually lead to mass scale and a very strong competitive advantage as other smaller businesses cannot compete with the lower cost structure.

Incremental Economics

Financial Analysis

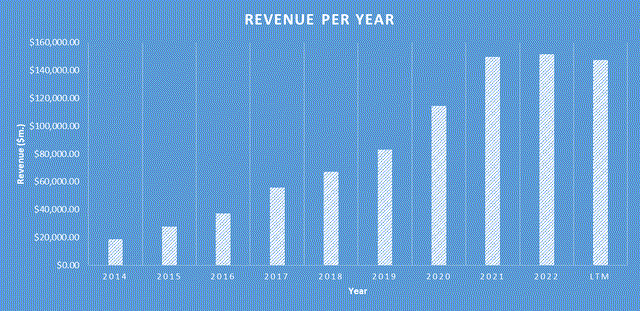

Over the past 5 years, the company has demonstrated strong financial performance. Its revenue has shown a consistent and strong growth, increasing from $67,168.68 million in 2018 to $147,452.07 million in the last 12 months in 2023, representing a compound annual growth rate (CAGR) of approximately 17%. It should be noted that revenue growth has slowed in the past few years, mainly driven by Covid-19, government regulations, and China lockdowns, though these headwinds on the business are starting to ease, therefore, growth should resume, though likely not at the same pace as pre-Covid. Earnings per share (EPS) has been equally impressive, growing from being unprofitable as a business in 2018 with an EPS loss of -$0.25 in 2018 to an EPS of $1.88 in the last twelve months, reflecting the company's ability to translate revenue growth into bottom line success as the company has reached scale. The book value has seen a consistent upward trend, growing from $11,169.32 million in 2018 to $39,595.08 million, indicating a CAGR of approximately 28.8%. This suggests that the company has been successful in increasing its intrinsic value over the period.

As of the most recent quarter, the company reported cash and cash equivalents of $32,405.01 million. The company's total debt stands at $4,419.15 million, a modest amount that reflects the company's conservative approach to leverage. The business also has long-term investments of $8,909.82 million. This means, if we combine JD's cash and cash equivalents and long-term investments and subtract the long-term debt, we arrive at $36,895.68 million. Given that the current market capitalization is roughly $52,000 million, this means that approximately 71% of the current market cap is made of the net cash position as seen on the balance sheet.

I expect JD's upcoming quarterly earnings results to be positive with revenue and earnings to improve compared to the previous year due to an improving macro environment in China and Chinese Government stimulus. For at least the next 12 months, the macro environment to improve compared to the prior year, driven by a recovery in consumer sentiment in China.

Valuation

When considering valuation, I always consider what we are paying for the business (the market capitalization) versus what we are getting (the underlying business fundamentals and future earnings). I believe a reliable way of measuring what you get versus what you pay is by conducting a discounted cash flow analysis of the business as seen below.

JD's current TTM cash flow per share, etc., as of Q2 2023 is $3.03. Based off structural tailwinds such as China's growing middle class as well as a relief from Covid-19 lockdowns, I believe that JD's TTM cash flow per share should grow conservatively at 12% annually for the next five years. Therefore, once factoring in the growth rate by 2028 JD's TTM cash flow per share is expected to be $5.34. If we then apply an exit multiple of 15, which is based off a conservative multiple and accounting for a 'China discount' as well as accounting for the cash on the balance sheet as mentioned earlier in the article, this infers a price target in five years of $64.01. Therefore, based on these estimations, if you were to buy JD at today's share price of $32.96, this would result in a CAGR of 14% over the next five years.

Risks

I believe one of the most prominent risks is regulatory scrutiny in China, where the government has been tightening its grip on tech companies for various reasons, including antitrust concerns and data security. For example, new e-commerce laws in China, brought into effect in 2019, have imposed stricter requirements on e-commerce platforms, particularly in areas like consumer protection and product quality. The Chinese Government has also pushed back on anti-competitive business practices. For example, in April 2021, China's State Administration for Market Regulation (SAMR) imposed a record $2.8 billion fine on Alibaba for anti-competitive practices.

Another risk is the intense competition in the Chinese e-commerce market, where giants like Alibaba and emerging platforms like Pinduoduo are vying for consumer attention. While I can see that JD.com has carved a niche for itself, maintaining this competitive edge requires constant innovation and significant investment in technology and logistics.

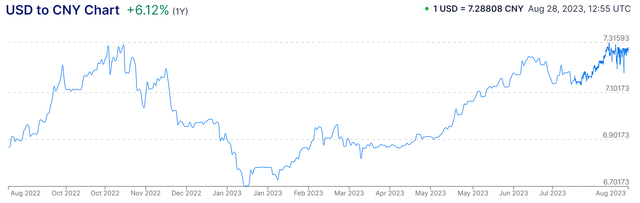

I think investors should also consider currency risk, as the company's financials could be affected by fluctuations in the exchange rate between the Chinese yuan and the U.S. dollar. Currently, the US dollar has presented a headwind to JD.com's revenue in USD as the yuan has fallen 6% against the US dollar in the past 12 months. I expect this trend to continue until the macro-economic environment improves and the US Fed pivot on their hawkish stance on US interest rate. Once, the Fed pivots, I expect this trend to reverse as cash will flow back into 'riskier' foreign currencies such as the yuan.

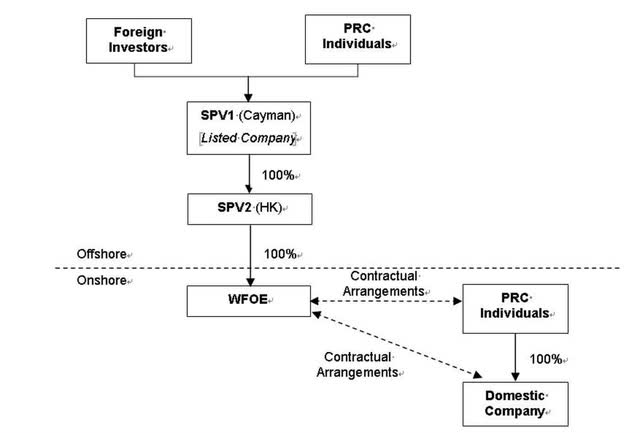

I also see the Variable Interest Entity (VIE) structure as another significant point of contention and risk when it comes to investing in Chinese companies like JD.com. The VIE structure is a complex arrangement that allows foreign investors to indirectly invest in Chinese companies, especially in sectors where foreign ownership is restricted or prohibited by the Chinese government. While VIE contracts give foreign investors economic benefits, they don't confer actual ownership rights. I see this distinction as potentially problematic in situations where the CCP's interests don't align with those of foreign shareholders.

Conclusion

In my opinion, JD.com stands as a compelling investment opportunity for several key reasons. Firstly, the company's unwavering commitment to quality uniquely positions it to attract China's rapidly growing affluent class, setting it apart from competitors like Alibaba and Pinduoduo. Secondly, JD.com's strategic focus on vertical integration offers a host of advantages, from quality control to speedy delivery, and sets the stage for achieving a scaled economy-shared competitive advantage akin to Amazon's. This multi-faceted approach enhances its market position and potential for increased sales and profitability. Thirdly, JD.com's robust balance sheet, where a significant portion of its market capitalization is held in cash, provides a strong financial foundation for future growth and risk mitigation. Lastly, my personal conservative estimates project a 5-year price target of $64.01 for JD.com, translating to a 14% compound annual growth rate. It is for these reasons that I see JD.com as a strong contender for long-term investment.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)