What The $2.2 Billion BYD Deal Means For Jabil Shareholders

Summary

- JBL is selling its Mobility China business to BYD for $2.2 billion.

- That equates to an estimated 16% of Jabil's entire market cap and an estimated ~15% of Jabil's entire enterprise value.

- Even if the company decides to allocate only 50% of the proceeds to buybacks, it will more than double the existing authorization to an estimated $1.9 billion.

- All that said, Jabil continues to trade at a significant discount to the S&P 500, even as the company will continue to grow EPS and free cash flow per share faster than revenue.

- I reiterate my BUY recommendation on Jabil and have a $125 price target by year-end.

Jabil's Silicon Valley Manufacturing Facility.

Sundry Photography

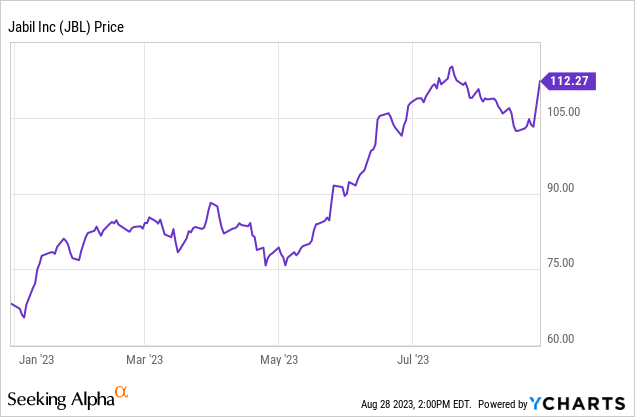

On Sunday, August 27, Jabil (NYSE:JBL) announced it was selling its Mobility business in China to BYD Company (OTCPK:BYDDY) (OTCPK:BYDDF) for $2.2 billion. The stock responded very positively to the deal, and at pixel time is currently trading +$9.05/share to $112.27 (+8.7%) today. I'll explain why such a big move makes sense, and why there is likely more to come.

As my followers know, I have been banging the table on Jabil because the stock has been significantly undervalued as compared to its free-cash-flow profile (see JBL: Treat Yourself And Buy The 10% Dip). Yet today, and even after the big move higher, Jabil still sells at a significant discount to the S&P 500:

| TTM P/E | Forward P/E | |

| Jabil | 15.9x | 12.1x |

| S&P 500 | 25.3x | 19.9x |

Market Cap

The big jump in the stock price was because the size of the deal, $2.2 billion, equates ~16% of Jabil's entire $13.5 billion market cap (and that is after the big move up today).

If we consider long-term debt ($2.87 billion) and cash ($1.50 billion), Jabil's total enterprise value is an estimated $14.87 billion. And even on that basis, the deal still equates to ~15% of Jabil's EV.

So, as the (relatively new) CEO Kenny Wilson said in the announcement:

This transformational deal would represent the largest transaction in the history of our company, and I am thrilled to be able to work with a reputable company like BYD to drive this business successfully forward.

Share Buybacks / Valuation

Now, as I have been reporting on my coverage of JBL, the company has been using its strong free-cash-flow profile to emphasize share buybacks because the company (and I) consider shares to be substantially undervalued.

My followers might think I am being a hypocrite here, considering I have been lambasting the big oil companies because they significantly over-emphasizing buybacks as compared to dividends directly to shareholders. But this is different. Energy companies typically over-emphasize buybacks during commodity price up-cycles (when their stock prices are high) and suspend them during down-cycles (when their stocks actually represent good value). Jabil has been generating increasing FCF straight through the cycles. Indeed, as I have documented in my articles on Seeking Alpha, JBL actually increased its FCF on a yoy basis during the pandemic.

For the quarter ended in June (JBL's Q3), the company repurchased 1.9 million shares for $154 million. That left $821 million remaining on its current repurchase authorization (as of May 31).

So, even if JBL allocates only half of the $2.2 billion toward stock repurchases (the other half would likely go toward debt reduction and cap-ex growth/expansion), that would still more than double the existing stock buyback authorization (i.e. to ~$1.9 billion).

And that is exactly why the stock is currently up 8.7% today. In fact, I would say the stock has further to climb because an estimated $1.9 billion in stock repurchases equates to ~12.8% of the current EV. And that doesn't even take into account any potential interest expense savings if the company retires, say, $500 million in debt (leaving $600 million for cap-ex expansion).

Business Impact

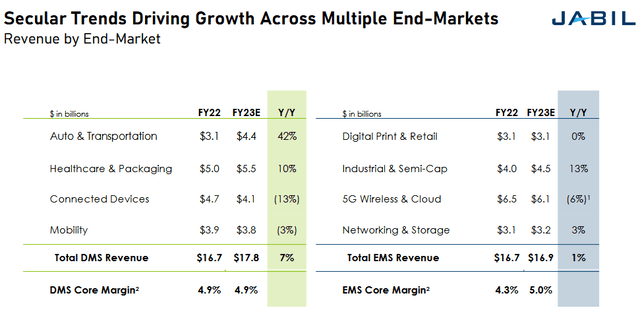

One of the big criticisms of Jabil is the low-margin its Mobility business has achieved in the past. The chart below shows Jabil's operating results per segment (slide taken from the Q3 presentation) for FY22 and estimated results for FY23 (only one quarter left):

Jabil

As you can see, revenue for the Mobility segment is expected to decline 3% yoy. And, Apple (AAPL) is known for being a very tough negotiator on suppliers like Jabil. Indeed, part of the reason that Jabil has been such a great investment over the past few years is because the company has been diversifying operations away from its over-dependence on Apple: new business verticals like Autos (think EVs) and Healthcare & Packaging have delivered strong revenue growth and higher margins for the company.

Note that EMS segment core margins were up 70 basis points yoy in Q3, while the DMS segment core margin (home of the Mobility business) stayed at 4.9%. That's despite the fact that the higher margin EV and Healthcare businesses are also in the DMS segment as well.

Still, Mobility - in total - is expected to be $3.8 billion in revenue this year, and it is not clear to me exactly what percentage of that comes from "Mobility China". But let's say, hypothetically, that it's 100% of it: that would equate to only an estimated 11% of Jabil's total FY23 estimated revenue. That's certainly a significant chunk of the company. However, what shareholders are likely to see for what is left in the company are: a significant increase in overall core margin and therefore an overall higher free-cash-flow margin.

In addition, if the company buys back stock anywhere near my estimate discussed earlier, net-income and free-cash-flow per share are both going to rise significantly faster than revenue growth going forward.

Meantime, one could argue that Jabil's risk profile is significantly stronger now that investors don't have to worry about the CCP taking over Jabil's Mobility manufacturing facilities in Chengdu and Wuxi, China - which, if this deal is ultimately consummated, will be sold to BYD.

Summary & Conclusion

Considering new CEO Kenny Wilson has only been in that role since May of this year, he certainly wasted no time putting his stamp on the company by significantly increasing shareholder value. It will be interesting to see what the additional commentary around the deal will be - specifically, how JBL plans to allocate the $2.2 billion in proceeds. Yet as Wilson said in the press release:

If completed, the proceeds from this transaction will enable us to enhance our shareholder-centric capital framework, including incremental share buybacks. Additionally, it will provide opportunities for further investment in electric vehicles, renewable energy, healthcare, AI cloud data centers, and other end-markets.

So, in my opinion, shareholders can expect one heck of a planned "incremental" share buyback program to be announced relatively soon.

All in, JBL still looks significantly undervalued to me and, if the 2H of this year proceeds as expected, the stock could easily hit $125 by year-end (+11% from here).

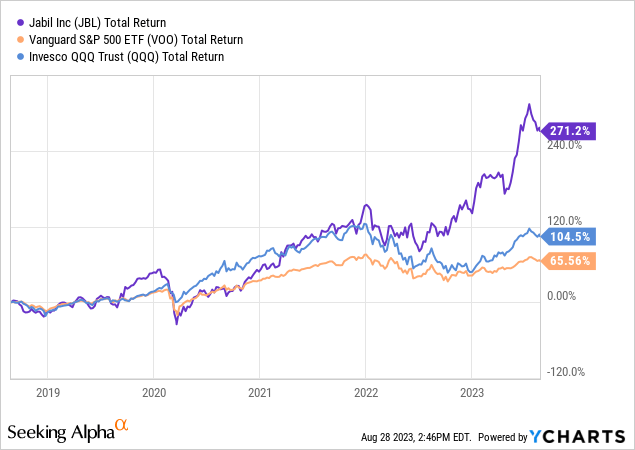

I'll end with a 5-year total returns comparison of Jabil versus the Vanguard S&P 500 ETF (VOO) and the Invesco Nasdaq-100 Trust (QQQ):

As you can see, Jabil has robustly outperformed both of the broad market averages, and yet still trades at a significant discount to both. The result: JBL is a BUY.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JBL, VOO, QQQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am an electronics engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (11)

DMS: Diversified Manufacturing ServicesSince you appear to be new to the company, I suggest you review the Q3 presentation to get a better idea of their operations:static.seekingalpha.com/...For more detailed info, consider going to the JBL summary page here on Seeking Alpha and clicking on and reading some of my past articles on the company:seekingalpha.com/...

On 135 million shares, that equates to 4.05 million shares.Today, JBL traded 3.75 million shares (average is only 1.05 million). So, I suspect there are still some shorts out there wishing they were not ...

I hate to see China getting valuable assets

I would love to see Jabil re-establish these assets in Mexico, Vietnam, or best of all, the United States