QQQX: A Poor Way To Get Exposure To The Nasdaq

Summary

- The Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX) is an equity buy-write fund with cash holdings that aim to mirror the Nasdaq 100 Index.

- QQQX gives up most of the upside due to its option overlay and tight deltas of the call options which cover 53% of the portfolio.

- The fund's strategy provides little downside mitigation and its performance lags behind the index and other technology-focused closed-end funds.

- With technology equity volatility extremely low, the CEF is a poor way to obtain exposure to the Nasdaq.

NicoElNino

Thesis

The Nuveen Nasdaq 100 Dynamic Overwrite Fund (NASDAQ:QQQX) is a closed-end fund. The vehicle falls in the buy-write category, designed to replicate the Nasdaq 100 Index, while overlaying call options on top of the portfolio. The fund managers have latitude in terms of written call options, being able to sell calls on 35%-75% of the notional value of the fund's portfolio.

QQQX gives up almost all the upside on the written notional, while having a downside profile similar to the replicated index. The fund has robust long-term results due to the historic Nasdaq outperformance in the past decade, but from a risk-reward perspective, QQQX is not an attractive way to take a view on the Nasdaq.

In this article we are going to show how QQQX replicates the downside of the index but only captures roughly 1/3 of the upside, while trying to monetize the index implied volatility via a covered call strategy. The article also presents a better alternative to extract dividend yield from technology equities.

QQQX Has the same downside as the Index but gives up most of the upside

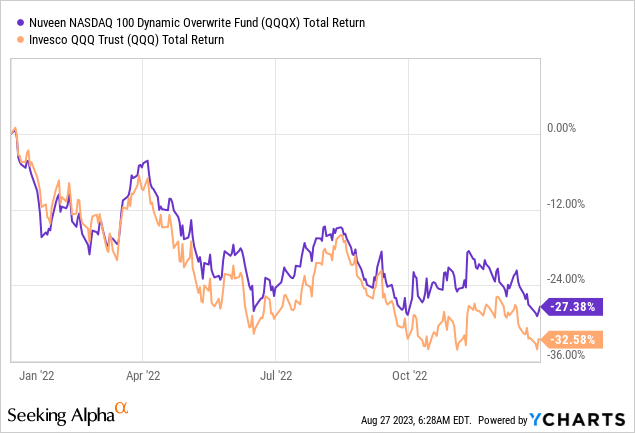

For starters, the fund's strategy provides for very little downside mitigation:

As we can observe from the above graph, the fund had very similar returns to the index during the significant risk-off scenario experienced in 2022. The total return paths are extremely similar, with QQQX recording an outperformance of only 5%. The outperformance is down to the premium received for the written calls given the fund's buy-write strategy. To note that 2022 was a year of elevated volatility, which makes the overall outperformance that much less spectacular.

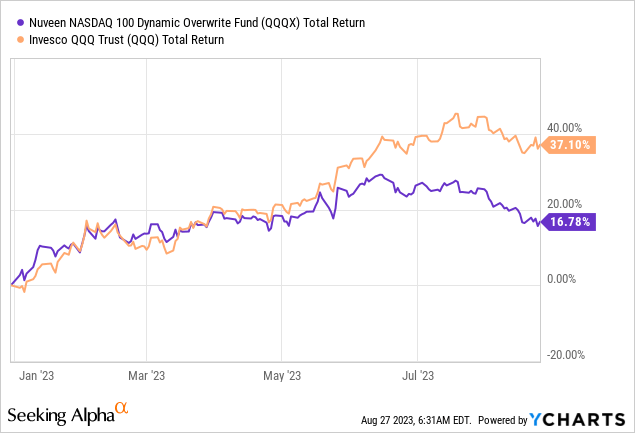

Conversely, during an up-market, the fund gives up most of the upside given the option overlay and the tight deltas of the call options:

The above graph highlights the year-to-date performance of the index and the contemplated fund. We can see the index posting a 2.5x return versus the Nuveen Nasdaq 100 Dynamic Overwrite Fund. By design, QQQX will give up very large portions of the upside due to its portfolio being covered more than half by call options with tight strikes.

We have observed this type of behavior during all bull market cycles in the past. What is unique about the Nasdaq 100 is the fact that it is a growth index. This translates into the underlying companies posting significant gains in short amounts of time when their underlying business model gets validated. By its nature the Nasdaq is going to be volatile, characterized by big swings both on the downside and upside. QQQX is hamstrung by its option overlay, and will always be impaired in capturing the explosive index upside, while closely mirroring risk-off scenarios.

The only benefit you are getting here as an investor is a reduced standard deviation of returns. The Sharpe ratio is negatively impacted, while drawdowns are only modestly reduced.

QQQX Analytics

- AUM: $1.1 billion.

- Sharpe Ratio: 0.42 (3Y).

- Std. Deviation: 17.6 (3Y).

- Yield: 7.3%.

- Premium/Discount to NAV: -4%.

- Z-Stat: -2.7.

- Leverage Ratio: 0%.

- Composition: Nasdaq Buy-Write.

- Duration: n/a.

- Expense Ratio: 0.92%.

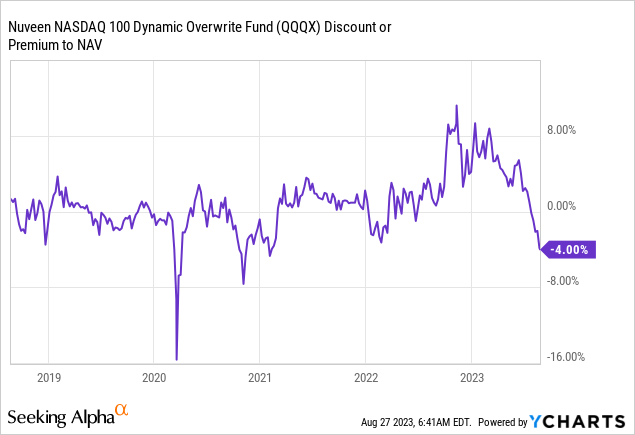

QQQX Discount to NAV - A tight range

The fund usually trades flat to its net asset value:

When looking at its historic premium/discount to NAV we can see the CEF trading fairly flat to net asset value. There are only a couple of historic instances where there are significant divergences, namely the Covid crisis in 2020 and the post October 2022 recovery.

Due to the short nature of the overwritten call options and straightforward and liquid structure, the fund does not experience long periods of time with distortions in market value versus NAV.

QQQX Collateral

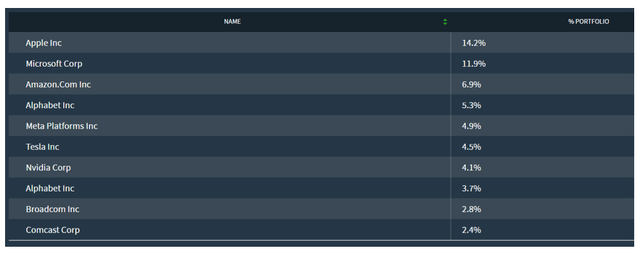

The fund contains 256 holdings, aiming to replicate the index equity positions. The largest positions currently in the fund are tech mega-caps:

The portfolio is the classic buy-write one, where the cash holdings in the fund tend to mirror the index holdings. The particulars of this fund reside with the options overlay structure:

Around half of the portfolio is currently covered by call options (53% to be exact), and the average strike level on the options side is very close to the spot levels (99% average call strike versus spot price). This translates into a very conservative take on the underlying portfolio, with the underlying stocks, on average, needing to lose value in order for the fund's options to not attach.

This type of positioning is good for a risk-off scenario, but gives up the entire upside if the market moves up even 1%. What is interesting to note is the fact that call options on the Nasdaq are priced with an extremely low level of implied volatility:

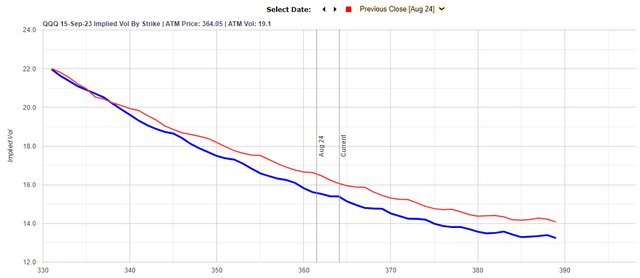

Implied Volatility QQQ (MarketChameleon)

The blue line in the above graph is the implied volatility skew for September 15, 2023, Nasdaq options. The numbers on the left side of the graph are implied volatility levels. We can see that call options around the current spot levels trade with extremely small implied volatilities of only 16.

Implied volatility is the most important input in terms of options premium. The higher the implied volatility, the higher the option premium, and thus the benefit realized by the QQQX fund. Right now the CEF is getting paid very little for giving up all the upside on its overwritten portfolio. The biggest rewards are obtained by option call writers when implied volatility is extremely high, and the option premium reflects a high level of uncertainty regarding the next leg in the market.

QQQX Historic Performance - robust but severely lagging

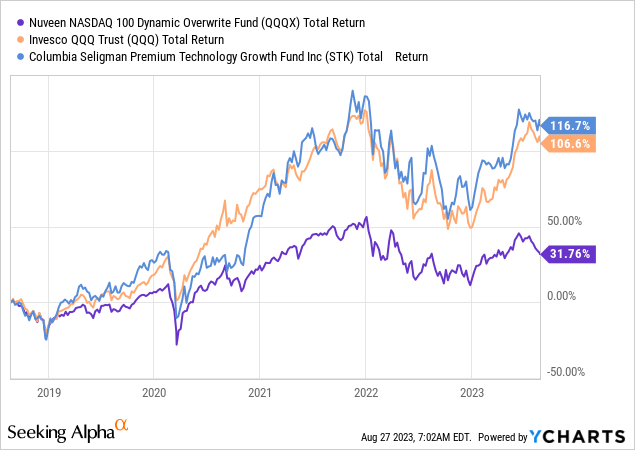

The CEF lags both the index and a premier CEF in the technology space, namely the Columbia Seligman Premium Technology Growth Fund (STK):

We can see that while QQQX offers a low standard deviation of returns, the fund lags the market. STK is not a buy-write fund, and we covered this CEF here, but the CEF offers a compelling yield with a full upside capture for the Nasdaq.

A retail investor needs to understand that the underlying yield is not the only analytical aspect to look at, with total return being the correct metric to use in this instance.

Conclusion

QQQX is a closed-end fund from the equity buy-write category. The vehicle aims to replicate the Nasdaq 100 Index via equity cash holdings, while also applying a covered call options overlay strategy. Writing calls is profitable in high volatility environments. Today we are witnessing extremely low implied volatility levels for the Nasdaq, with volatility for the tenor of the CEF's options hovering around 16. This translates into low options premiums and a reduced buffer for the fund during a risk-off scenario. The market is also of the same view, with the CEF now trading at a slight discount to net asset value after recording a significant premium late last year.

QQQX at this juncture is not an appropriate tool to use to extract dividends from the Nasdaq since it only records a third of the index upside while closely mirroring the downside index path. With volatility extremely low, the CEF's structural issues are exacerbated currently. A retail investor looking for yield from the Nasdaq index is better served to consider the Columbia Seligman Premium Technology Growth Fund covered here.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)