WSFS Financial Corporation: Regional Bank With Reputation For Quality

Summary

- WSFS is a leading regional bank with a reputation for quality.

- The market is still sorting out the firm's 2021 acquisition of Bryn Mawr Trust as it pertains to growth expectations.

- Target: $39 per share.

helen89/iStock Editorial via Getty Images

Investors should hold shares of WSFS Financial Corporation (NASDAQ:WSFS).

WSFS is a small cap regional bank that has established a foothold across Northern Delaware, Southern New Jersey, and Southeastern Pennsylvania. The equity markets have generally been bullish on WSFS, with the stock up 100% over the past ten years. However, investor sentiment has soured since 2018. WSFS is down 20% over the past five years, and is down 11% YTD.

The key event in the firm's recent history was its 2021 acquisition of Bryn Mawr Trust. Not only did this improve the firm's branch network, but it supplemented existing service lines via a renewed focus on wealth management. WSFS has also been engrossed in a quasi-Fintech initiative via its proprietary Cash Connect platform, and still relies heavily on traditional consumer and commercial banking.

Catalysts

It is helpful to evaluate key business components to understand the various rationales that are underlying the market's view of a firm. WSFS has a few interesting initiatives that are worth a deeper dive.

1. Cash Connect

WSFS identifies Cash Connect as an individual business segment. This service is essentially a cash logistics operation that WSFS has offered since 1998. Cash Connect has been a source of growth for the firm, and has given it a footprint in every U.S. State. However, the segment's growth has gone relatively flat in recent years, and increasing threats from Fintech competitors will likely continue to reduce both market share and profit margin. It is still compelling that the firm has innovated in this space and found ways to monetize an area that its direct competitors have generally avoided.

WSFS Financial Corporation 2Q 2023 Investor Presentation

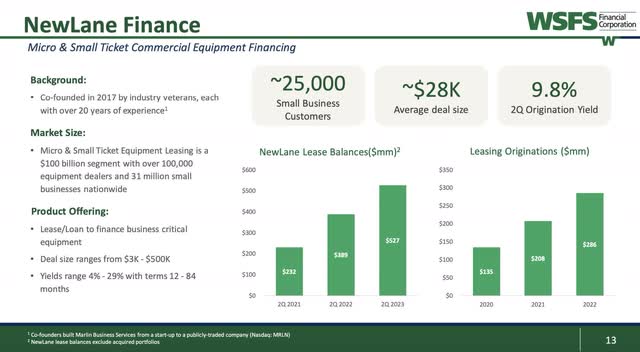

2. NewLane Finance

NewLane Finance is essentially the microlending arm of WSFS. Microlending, extending loans to small-businesses who may not be eligible for conventional financing terms, is a concept that gained significant traction via Muhammad Yunus's Grameen Bank. By reworking conventional lending standards, Yunus found success matching small-scale investors and savers. WSFS has experienced similar results, with rising new originations and rising lease balances. The firm has stated its intentions to capitalize on this growing sector, but profitability is mixed. It is likely that this area has already piqued investor interest, and WSFS's innovation is currently being priced into its equity shares.

WSFS Financial Corporation 2Q 2023 Investor Presentation

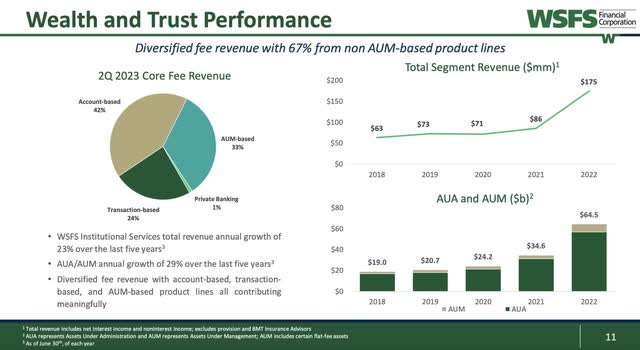

3. Wealth and Trust Management

The highlight of WSFS's recent history is its acquisition of Bryn Mawr Trust. Not only did this add fee revenue to the firm, but it removed a major competitor in the process. This segment has experienced annual revenue growth of 23% over the past five years, with much of that tied to the acquisition. The firm has clearly benefited from this process, but it is likely that margins will shrink and AUM growth will start to slow. The Greater Philadelphia region is a wealthy area, and WSFS competes against a host of both public and private firms jostling for business from potential clients. The market likely recognizes this and is looking for WSFS to manufacture additional organic growth in this segment.

WSFS Financial Corporation 2Q 2023 Investor Presentation

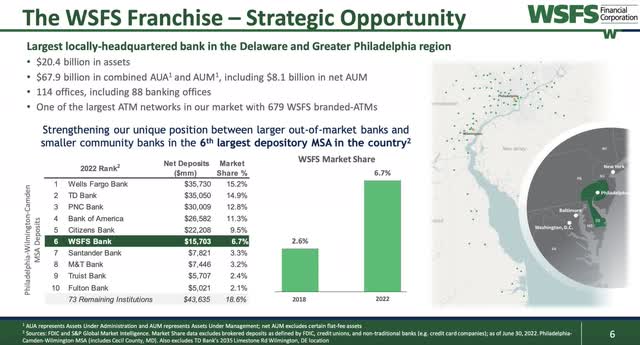

4. The WSFS Franchise

The greatest challenge to the firm's strategy is that it operates in a highly competitive market against many large and mega-cap firms that have more industry verticals and sub-verticals than WSFS. It is admirable that the firm has carved out small niche areas to improve profitability. However, the reality is that the firm only controls 6.7% of deposits in its area of operations. WSFS has outlasted this competition via an expectation of excellence whereby the firm has almost zero margin for error when it comes to customer service. This issue is not completely unique to them, but is still worth considering. Any management changes or negative scandals could affect WSFS to a much greater extent than Wells Fargo (WFC), Bank of America (BAC), The Toronto-Dominion Bank (TD), M&T Bank (MTB), or PNC Financial Services Group (PNC).

WSFS Financial Corporation 2Q 2023 Investor Presentation

5. Dividend payments

WSFS stands out against competitors because of its relatively low dividend yield. This is not a great thing if you are a short-term dividend investor, but it bodes well for the firm's long term prospects. Many banks (and other firms) seem to follow a cycle where they hit an upper bound where earnings growth alone can no longer prop up their valuation and they must add dividend payments to entice prospective investors. Banks are often valued based on their dividend payments, and the firm's valuation would rise if its management were to increase the amount of dividend payments to shareholders.

Valuation

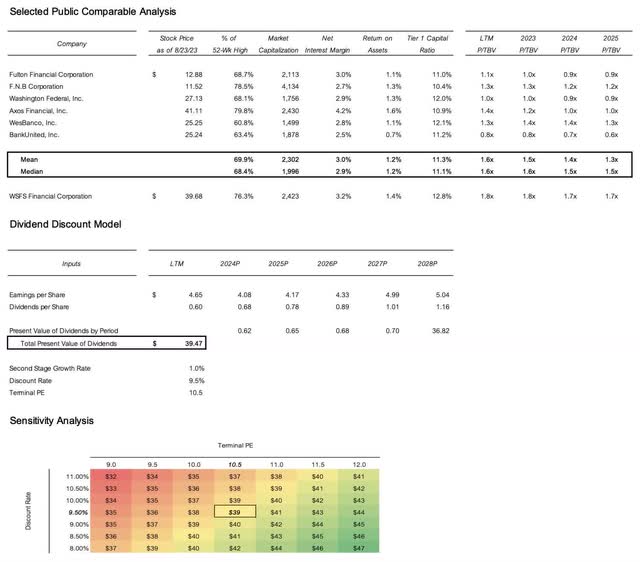

The first step in valuing WSFS was forming a peer group of public comparable companies. Several criteria were used in this analysis:

- Market capitalization (a firm's share price multiplied by its shares outstanding)

- Number of brick-and-mortar branches

- Total deposits

- Geographic coverage

The resulting peer group includes Fulton Financial Corporation (FULT), F.N.B. Corporation (FNB), Washington Federal (WAFD), Axos Financial (AX), WesBanco (WSBC), and BankUnited (BKU). An important advantage of multiples valuation as it pertains to regional banks is that there are a multitude of comps to choose from and their businesses are generally operationally identical.

S&P's Capital IQ database was instrumental in providing data on net interest margin, return on assets, tier 1 capital ratios, and price to tangible book value ratios. With respect to this particular group, net interest margin and return on assets are key profitability indicators, and were given particular consideration when valuing WSFS. As a final step, the averages and medians of these values (for the peer group) were calculated to provide a relative comparison to WSFS. The results indicate that WSFS is a bit overvalued. Based on a tangible book value per share of $21.54, the 1.6 times P/TBV peer multiple implies that WSFS shares are worth ~$34 instead of ~$40.

The firm's intrinsic value was found using a dividend discount model. WSFS has a history of distributing cash flows to shareholders via dividend payments. The inspiration for using a DDM was taken from David B. Moore, a CFA with Marathon Capital Holdings in San Diego, California. Mr. Moore published a guide on valuing community banks whereby he argues the merits of using a DDM to price bank stocks.

Based on the firm's future discounted dividends, Citizens has an intrinsic value of $39 per share. This can be further amended to a target range of $32 to $47 per share, which implies some upside and some downside. With respect to assumptions included in the base-case model, a 9.5% discount rate was used in addition to earnings and dividends estimates taken from CapIQ. Moreover, a second stage growth rate of 1% was used along with a terminal price to earnings ratio of 10.5. Please remember that these are estimates and are meant to illustrate a reasonable base case that does not consider a significantly positive or negative event.

Investment Summary

WSFS sits well beyond the bounds of its peer group with respect to many common valuation criteria. To growth investors, the firm represents a unique opportunity to match quality with strong future prospects. However, WSFS does not offer much hidden value for investors looking for depressed stock recovery stories. The firm's ability to be incrementally more efficient than its competitors has earned it well-deserved stock appreciation. Unfortunately, it is important to differentiate between a firm's stock and the firm itself. While WSFS is a great company, its shares are currently overvalued and could trade lower in the coming months.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.