Carlyle Group: Actually A Bit Cheap

Summary

- Carlyle has the issues of all PE firms right now, which is large pre-2022 outlays that are not primed for great exits as the interest environment is tough.

- Larger-ticket PE is especially affected by the funding conditions.

- Nonetheless, the conditions are returning for new deal flow and for new cohorts of investments with a shot at supernormal returns to restore distributable earnings.

- Moreover, principal investments that will eventually be realised as exits can finally speed up cover a lot of the market cap. CG is cheap relative to the broader market, perhaps too cheap.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

ra2studio

Carlyle Group (NASDAQ:CG) is a leading PE firm. There are challenges across the industry. Massive outlays in 2021, higher than in previous years, were all investments at market highs, now with the value of that large cohort of investments quite thoroughly impaired by higher rates and more difficult economic environment. There is dry powder, but things are going to take time to come back up again and for new and large cohorts of strong performing investments to fill the pipes again for PE. Nonetheless, CG is cheap on normal operating earnings after stripping out their principal investments. We're not buyers, but we are going to start watching the sector a little more closely.

The CG Case

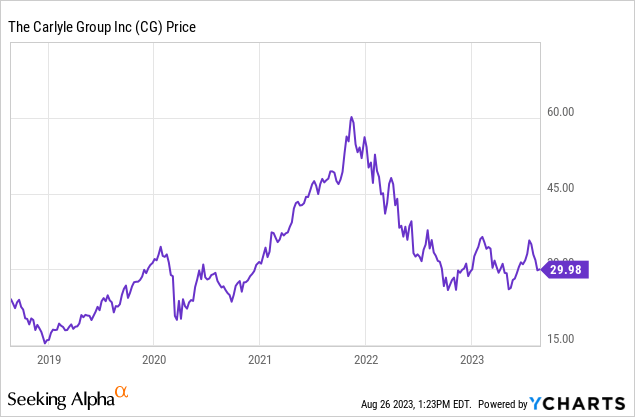

Besides the fact that they are one of the most vaunted PE firms, let's focus on some details that can create initial interest in the stock. The first is that the stock price is languishing a fair bit, and is trading at around pre-COVID levels.

Interim dividends of around 5% yield have been paid, so a historical price comparison isn't rock-solid, but there is indication that the markets are leaving stocks like CG behind in the market rally.

As said, there are reasons for this. The sponsor environment, especially for larger sponsors that rely on outperformance and on leverage, has been severely impacted by the current rate regime and the long-term rate expectations connected to the long-term inflation rate outlook. This isn't going to go back to normal anytime soon.

Currently, the lack of carried interest being earned is weighing on results, and the market environment is also deferring carried interest already earned and backed into the principal investment book values for the company further into the future where they are less valuable. Net income is run-rate negative for the time being, but things will be inflecting upwards at some point soon.

Firstly, across our advisory coverage, we are seeing the fact that there are greenshoots in the M&A markets and sponsor activity as the situation around rates and interest rates is becoming easier to map. Dry powder can be deployed again at a more rapid rate, and new cohorts can be built up in the pipeline. Furthermore, nearing greater certainty in private markets is allowing for sellers and buyers to agree, where buyers were being disciplined this last year while sellers were still holding out hope of a return to higher multiples. Deals that hit required returns that these companies are capable of carving out are beginning to come back. Also, the pickup in private credit seems to be salving any worries around credit availability from banks, and allowing for the LevFin markets to come back online after almost a year of deep slumber.

Bottom Line

Distributable earnings are down because the rate of exits is falling. Carried interest has plummeted. But there is a case to be made for CG and its relative valuation. If you strip out the principal investments and value CG on a multiple of normalised earnings from its carried interest and AUM fixed fees, you don't get an especially expensive multiple of around 11.5x in PE. Cash, accrued performance allocations and the consolidated fund values net of NCIs cover the majority of the market cap. Also, it's pretty clear that CG is lagging the general market in terms of PE and price in its recent rally. While it will be some time before CG digests the investments that are not going to be especially profitable from 2021, those investments should broadly break even soon and the new cohorts are likely to continue to generate abnormal returns to generate carried interest. CG shouldn't be lagging the broader market quite this much, especially as the PE industry remain cyclically supported, and the conditions for a resumption in activity are coming.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.