Invesco: Headwinds From Passive Shift And Risks Of Shift To Deposits

Summary

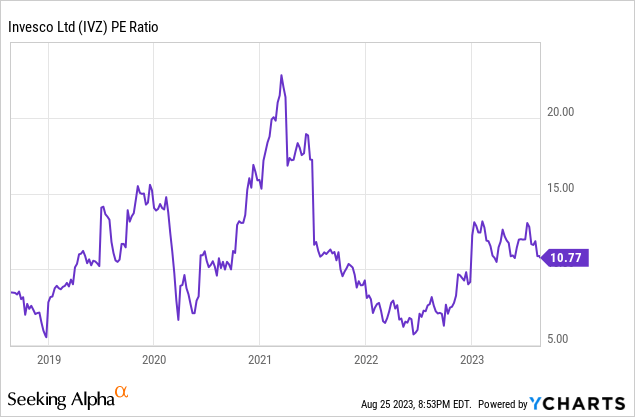

- Invesco's relative valuation compared to the market is at an outlying discount, but its performance shouldn't necessarily track the market.

- The shift to passive investing is a secular problem, and can drive differentials especially as the broader market is driven in performance by a narrow segment.

- Inflation and the potential for a recession pose further challenges for Invesco's performance and bottom line which is levered to broad-based equity performance.

- Long-term rates and the end of TINA are a problem as well, since savings will be donated to deposit institutions, or at least growth prospects will be limited.

- Ultimately, there are market concerns which can affect performance fees, and there are additional concerns for Invesco where passive continues to grow in the mix.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

JHVEPhoto

There is somewhat of a case to be made for Invesco (NYSE:IVZ) purely on the basis that its relative valuation compared to the market is at an outlying discount right now and hasn't been tracking the general market closely since the beginning of 2023. On the other hand, drivers in the market have been pretty narrow, and Invesco fundamentals benefit more from broad-based improvements primarily in the equity environment. We don't think things are going to work out that well for Invesco over the next 6-12 months due to continued concerns around broad macroeconomic factors, and also due to the fact that with where long-term rates are being priced by the bond market, the secular picture for equities doesn't look that good. While there might be inflows into fixed income funds to mitigate that, the banking sector and savings deposits are going to win share, with the overall passive shift also being an income and mix problem for Invesco. Not terribly compelling given the ambiguous picture.

Q2 Breakdown and Comments

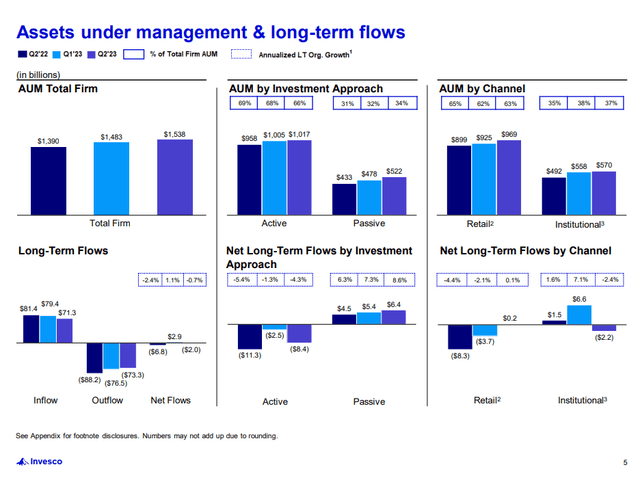

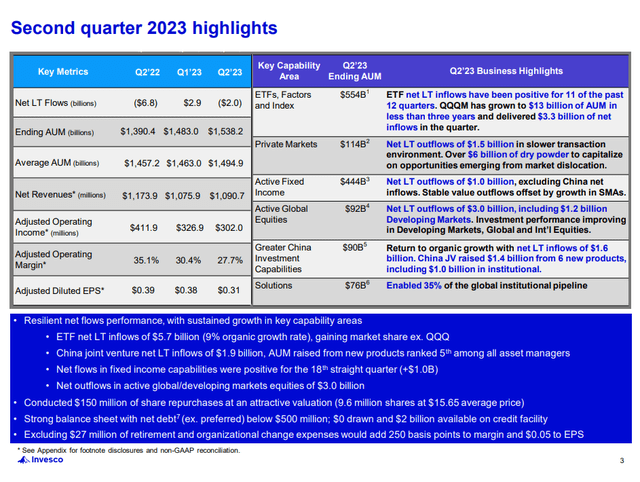

The Q2 breakdown shows slight revenue pressure due to mix effects despite growing AUMs. Reduced performance fees due to poor general asset class performance has not helped either. But primarily, the issues are that there is a shift to passive where Invesco will suffer meaningful mix effects.

On top of that, inevitable inflation in the fixed cost structure continues to put pressure on the bottom line.

Performance Highlights (Q2 2023 Pres)

It is very likely that since the last quarter performance fees may be on track to improve, as the soft landing narrative has become more prevalent as the consensus view, but we are not sure if this will last for much longer, with the next several Fed meetings offering in our view a high probability of shifting expectations. The reason is that the last leg of inflation could be stubborn. Yes, the China troubles help general commodity deflation ease headline figures, and possibly rent inflation is slowing which is a major component of consumer prices. Still, retaliatory pricing and tit-for-tat dynamics between vendors and customers, as well as between unions, employees and corporations create a stubborn core component that will have to be defeated enough for inflation to fall below the 2%, non-negotiable mark.

Invesco is an indexer and a quasi-indexer in terms of the majority of its asset management strategies, and that means broad based factors like the rate situation matter. We are not certain yet of a soft landing or the arrival of peak rates in time to allow margin to stop a recession.

There are more concerns around the yield curve. Long-term rates are coming up in terms of expectations. This makes sense due to major secular trends like deglobalisation contributing to higher long-term inflation pressure. This could change the dynamics of savers and investors. While passive strategies grow in the mix, AUM could slow in growth if people decide that fixed income allocations are indeed more sensible. The TINA environment is over, and while Invesco has exposure to fixed income and money market funds, they will donate business to banks and their deposit accounts, so a shift away from equities is not a good thing, especially if poor performance accelerates the passive shift, as it always does.

There is also some meaningful ugly exposures in terms of the business mix at Invesco, which will likely see further fund outflows. Both the direct real estate, indirect real estate and China businesses are going to continue to decline, shifting more business to passive funds or to savings options outside of Invesco. For real estate it's both because of recession risk, long-term rate risk, maturity walls and of course office exposure and the continuing, definite danger of WFH being here to stay. Together these are possibly more than 10% of AUM.

Bottom Line

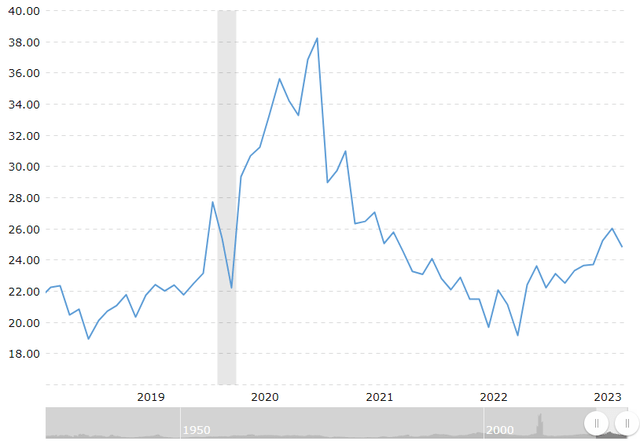

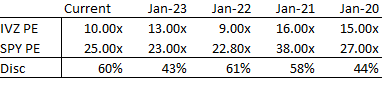

The upside in Invesco is the cheap valuation. 11x is not a lot, even though there are TTM figures and there are continuing margin pressures. Moreover, relative valuation compared to the broader market is also at a historic discount, referring to the charts and the table below.

PE of the SPY (macrotrends.net) Invesco discount in PE to the SPY (VTS)

The problem is that Invesco's performance doesn't track proportionately the market as a business, with mix effects being the major reason for differentials to grow permanently. Also, even if there is a relative case for Invesco's undervaluation, it doesn't change the headwind-rich business environment and the fact that the broader market may also be overvalued right now.

Plans to improve margins with cost savings initiatives are limited, even in the earnings call the forecasts for their $50 million savings initiative are not going to do much especially as inflation in the fixed costs continue to truck on. The organic problems are meaningful especially if you think that equity markets have jumped the gun by assuming soft landing.

I think investors can be more creative and more safe in the lower-multiple world with picks that are not Invesco.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.