Broadridge: Accelerating Growth Makes Shares A Buy

Summary

- Broadridge Financial Solutions is the dominant player in the proxy services market.

- Broadridge is a compelling dividend growth story and just gave investors another double-digit increase this month.

- The company is developing a range of ancillary services that support its core proxy and shareholder communications business.

- Looking for a helping hand in the market? Members of Ian's Insider Corner get exclusive ideas and guidance to navigate any climate. Learn More »

YinYang

Broadridge Financial Solutions (NYSE:BR) is a financial services company that primarily focuses on investor communications and record-keeping.

The firm began as a spin-off from Automatic Data Processing (ADP). ADP had created Broadridge as a proxy service processing company, but ultimately Broadridge grew beyond being just a side operation for ADP, so they elected to make it into a separate publicly traded company.

Automatic Data Processing is a Dividend Aristocrat, and Broadridge has, by extension, become a quasi-Dividend Aristocrat of its own, as Broadridge has increased its dividend every year since becoming a distinct company in its own right. Broadridge still controls a near monopoly on its original proxy services business and in recent years, it has expanded its business into related functions such as recordkeeping and back office support for brokerages and money management firms.

I've been a BR stock shareholder for more than four years now and have enjoyed its steady operating results over that time. I last covered the company in November 2020, saying at that time that the firm was no longer cheap, but still excellent. Let's check in on how the thesis for the company has evolved since then.

Strong Quarterly Earnings

Earlier in August, Broadridge reported its fiscal Q4 2023 earnings. In it, the firm reported revenue growth of 9%, which was near the top of the firm's guidance range. What really stood out, however, was the massive 21% jump Broadridge's adjusted earnings growth.

This came about in due to both Broadridge's disciplined cost control efforts and a sizable increase in recurring revenues. These results were particularly impressive as Broadridge saw a lower than normal amount of event-driven revenues. For Broadridge to hit the high end of its revenue forecast and see much margin expansion even amid weakness in a core business speaks to how well the firm's ancillary divisions are performing.

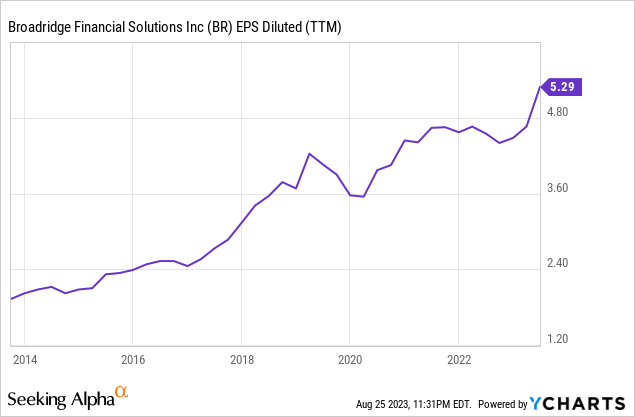

Here is Broadridge's GAAP earnings per share growth over the past decade. As you can see, after a period of flat results, earnings per share have now moved decisively higher this year:

Note that there is a meaningful difference between Broadridge's GAAP earnings (shown in the chart above) and its non-GAAP earnings. Its non-GAAP earnings are, at the moment, significantly higher and include addbacks for things such as purchase amortization costs, Russian business winddown expenses, and one-time charges restructuring charges. It's common for companies to report adjusted earnings to account for these sorts of non-recurring expenses, I simply note the disparity here since Broadridge has a fairly wide gap between reported and adjusted earnings at the moment. Regardless of which metric you prefer, earnings are growing steadily and have inflected solidly higher in recent quarters.

Longer-Term Considerations

Broadridge earnings can be a bit bumpy from quarter to quarter due to the impact of event-driven revenues. For example, when an activist investor launches a campaign against a company, this can drive a large amount of proxy voting as shareholders decide on how to proceed with those corporate governance decisions. Broadridge also sees increased revenues when equity markets are full of M&A activity and other such events that trigger the disclosure of material information to shareholders.

2022, for example, saw some weakness in Broadridge's core results as activity diminished in several financial market categories. Things should be on the upswing now with the rebound in stock prices, the reopening of the IPO window, and other such barometers of financial market strength. Regardless, investors should be prepared for another downturn in this sort of activity at some point.

That said, Broadridge has been quite successful in building out more businesses that diversify its operations and reduce its reliance on the core proxy and communications operations. Things such as risk management, portfolio attribution, equity and FX processing, market data, and post-trade services are attractive businesses that should provide strong amounts of recurring revenue.

I'd also note Broadridge's securities financing operations provide it with a substantial amount of cash float; in fact rising interest rates are a net positive for Broadridge's earnings as its gains on higher rates with its float more than offset increased interest expense on the company's debt.

A longer-term risk for Broadridge is the continuing rise of passive investing. While Broadridge is diversifying its internal operations, most of its revenues are still tied to either direct communications with investors, or from institutions and fund managers that actively deploy their funds. If passive continues to eat market share and drive down fees overall, this will threaten to shrink the available pie that Broadridge is going after.

That said, Broadridge is working on iteratives to increase its role in the ETF marketplace such as pilot programs in pass-through voting, which could give shareholders the ability to vote shares they own of companies that are held within an ETF.

Finally, I'd highlight that Broadridge is quite innovative and pursues many new opportunities. This is often good for unlocking new revenue categories, but some skeptics have attacked the company for pursuing initiatives such as blockchain that may seem rather speculative compared to other potential uses of the company's energy and capital.

BR Stock Bottom Line

Aside from the occasional burst of unexpected news, such as when short sellers launched a fairly uneventful report against Broadridge in 2022, the company tends to be an under-the-radar one. Broadridge has its effective monopoly in the proxy services space, and is quietly developing numerous other attractive ancillary businesses adjacent to that.

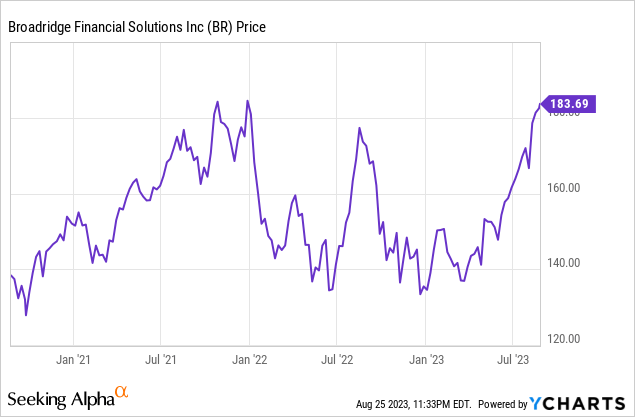

Broadridge had a not especially remarkable couple of years, and it's not surprising that BR stock topped out at around $180 on various occasions since 2021:

That said, as shown above, Broadridge's earnings per share growth has meaningfully inflected upward in 2023. Broadridge just gave investors a juicy 10.3% dividend increase on August 8th. And the company is continuing to rollout new growth initiatives, such as pilot programs with four of the top five ETF managers in the country to help give ETF shareholders a voice in the management of the firms that they own shares in through their ETFs.

This combination of rapidly-growing earnings, attractive growth prospects, and a compelling dividend story make BR stock one with favorable long-term prospects.

Shares are at 24 times non-GAAP forward earnings. That's not a screaming bargain, but it's a fair price for a firm where analysts see greater than 10% earnings growth coming in future years. This is an above-average business selling at a fair price today, and as such I assign this a buy rating even with shares at 52-week highs. And for folks that don't want to chase at the highs, Broadridge is one to watch if there's any sort of September swoon this fall.

If you enjoyed this, consider Ian's Insider Corner to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.

This article was written by

Ian worked for Kerrisdale, a New York activist hedge fund, for three years, before moving to Latin America to pursue entrepreneurial opportunities there. His Ian's Insider Corner service provides live chat, model portfolios, full access and updates to his "IMF" portfolio, along with a weekly newsletter which expands on these topics.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)