Occidental Petroleum: Warren Buffett And WTI Crude To The Rescue (Rating Upgrade)

Summary

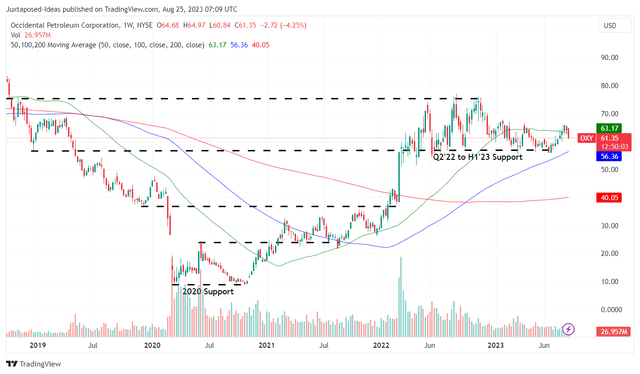

- It is apparent that the OXY stock remains well-supported at H1'23 floor of $56s, nearing Berkshire Hathaway's average purchase price of $57s.

- The recent rally is also attributed to the recovery in WTI Crude Oil and Natural Gas spot prices, potentially boosting the producer's average realized prices in H2'23.

- This is an important development indeed, since OXY's last quarter production capacity is split evenly between Crude Oil and Natural Gas.

- Combined with the intensified redemption of Berkshire's $10B investment and common share repurchases, shareholder returns have been more than decent as well.

- Due to its relative undervaluation at Enterprise Value to Proven Reserve ratio of 21.88x compared to its peers, we are finally following Warren Buffett' cue for OXY.

Viktor Aheiev/iStock via Getty Images

We Are Still Not Too Late To The OXY Investment Thesis

We previously covered Occidental Petroleum (NYSE:OXY) in June 2023, discussing the stock's uncertain prospects attributed to the decline in the crude oil spot prices, despite the OPEC+ cuts at that time.

This had contributed to the stock price's decline below its critical support level, previously supported by Berkshire Hathaway's (BRK.A)(BRK.B) average purchase price of $57s since March 2022.

We had been previously skeptical about whether Berkshire's increasing stake in OXY had justified the highly buoyant stock prices from $30s to over $70s. Accordingly, we had rated the stock as a Hold (Neutral) then, preferring to err on the side of caution.

For now, it appears that Warren Buffett has come to OXY's rescue again, by purchasing 2.14M shares at an average price of $57.25 in June 2023, putting a floor to the stock's previous decline.

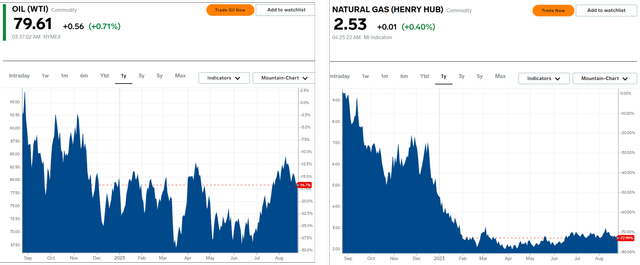

The recent price movement has also mirrored the recovery of WTI Crude Oil and Natural Gas spot prices, both of which are important to OXY's average realized prices, and eventually top/ bottom line.

OXY 5Y Stock Price

Recovery In Commodity Prices

Thanks to the even tighter OPEC+ cuts through 2023 (and potentially through 2024), the commodities' spot prices have recovered tremendously for the WTI Crude Oil by +16.9% to $79.61 per barrel and for Natural Gas by +20.4% to $2.53 per Mcf. This is compared to the May 2023 bottom, going against the previous downtrend.

These spot prices are highly encouraging indeed, higher by +8.1% compared to OXY's average FQ2'23 realized prices of oil at $73.59 per barrel and by +86% to the average realized gas price at $1.36 per Mcf.

This is an important development, since the producer's last quarter production capacity of 1.21K MBOE/D (inline QoQ/ +6.1% YoY) is split quite evenly between Crude Oil at 628 MBBL/D (-4.7% QoQ/ +2.7% YoY) and Natural Gas/ Natural Gas Liquids at 590 MBOE/D (+5.1% QoQ/ +10% YoY).

Therefore, while OXY's FQ2'23 performance may have been underwhelming, we expect things to improve in FQ3'23 and maybe even through FQ4'23, if the OPEC+ cuts are as restrictive as intended.

This is on top of the producer's raised FY2023 production volume range to between 1.19M and 1.24M BOE/D, up by +1.6% at the midpoint, from the previous range between 1.175M and 1.215M BOE/D.

The higher crude oil prices above the minimum $75 per barrel criteria may also trigger OXY's intensified redemption of Berkshire's $10B investment. This is because the "8% annual dividend" translates to an annualized payout sum of $936M, comprising 63.5% of its overall payout in FQ2'23.

We may also see intensified common share repurchases, based on the $1.8B in available program as of FQ2'23, with $3.69B already exercised over the last twelve months while retiring 59.5M of common shares.

As a result of these developments, we believe that the producer's deleveraging may continue taking a back seat, though investors must also note that its long-term debts of $19.08B (inline QoQ/ -11.1% YoY) in the latest quarter has already been drastically moderated, compared to the peak levels of $48.39B in FQ3'19.

These efforts demonstrate the OXY management's excellent use of the hyper-pandemic windfall across strategic acquisitions, intensified capital expenditure for production growth, balance sheet deleveraging, and expanded shareholder returns.

So, Is OXY Stock A Buy, Sell, or Hold?

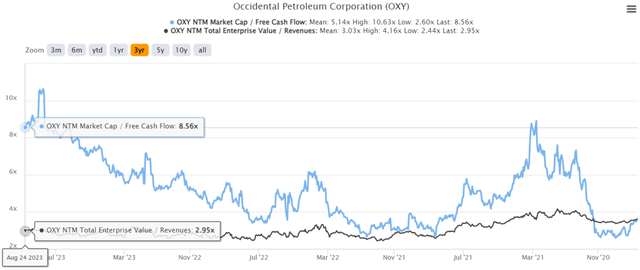

OXY 3Y EV/Revenue and Market Cap/ FCF Valuations

For now, OXY's valuations have also reflected Mr. Market's optimism, with NTM EV/ Revenues of 3.03x and NTM Market Cap/ FCF of 8.56x, compared to its 1Y mean of 2.83x/ 6.60x and the oil/ gas sector median of 1.65x/ 7.98x.

However, if we are to look at OXY's Enterprise Value to Proven Reserve ratio of 21.88x, based on its EV of $83.4B at the time of writing and the 2022 proven reserves of 3.81M barrels of oil equivalent [BOE], it is also apparent that OXY is still trading at a notable discount.

This is compared to its US oil/ gas peers, namely Exxon Mobil's (XOM) Enterprise Value to Proven Reserve ratio of 25.1x, Chevron (CVX) at 27.4x, and Devon (DVN) at 20.87x.

These ratios are based on XOM's Enterprise Value of $445.65B/ the 2022 proven reserves of 17.74M BOE, CVX's Enterprise Value of $307.78B/ the 2022 proven reserves of 11.22M BOE, and DVN's Enterprise Value of $37.78B/ the 2022 proved reserves of 1.81M BOE.

Since the WTI crude oil spot prices remain elevated, there are inherent risks that the OXY stock may eventually retrace once the Fed is successful in tamping down the inflation to ~2%, bringing the commodity's spot prices nearer to the pre-pandemic levels of $60s.

However, we are cautiously confident that the OXY stock may retain its support levels at $57s, attributed to Berkshire's growing ownership stake to over 25% by the end of June 2023, despite not planning to acquire the company.

Based on its annualized Free Cash Flow generation of $5.69B in the latest quarter, the shares outstanding of 958.80M, and its NTM Market Cap/ FCF valuation of 8.56x, the stock trades near to its current fair value of $50.85 as well.

Due to the attractive risk reward ratio, we are cautiously upgrading our rating for the OXY stock to a Buy, preferably between $57 and $60 in following Warren Buffett's cue.

Long-term investors may continue dripping as well, depending on their dollar cost averages.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)