Microchip Technology: A Growth Stock With Upcoming Challenges

Summary

- Microchip Technology is a diversified analog and mixed signal semiconductor company focused on designing and manufacturing chips and sensors for various industries.

- The company's current strategy, Microchip 3.0, emphasizes organic growth, total system solutions, and shareholder returns.

- Q1 FY24 posted record revenue of $2,288.6 million and gross margins of 68.4% hit an all-time high.

- Negative guidance for the next two quarters due to macro headwinds could present a buying opportunity once the timing is right.

Editor's note: Seeking Alpha is proud to welcome Matthew Roever as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Editor's note: Seeking Alpha is proud to welcome Matthew Roever as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

katerinasergeevna/iStock via Getty Images

Investment Thesis

Microchip Technology (NASDAQ:MCHP) is a diversified long-term growth play poised to benefit from secular growth trends in analog and mixed signal semiconductors. Economic weakness in manufacturing and its significant exposure to China present headwinds that will be felt in the coming quarters. The company has continued its aggressive deleveraging plan while its plans for increasing shareholder returns present an opportunity in the future.

Sectors that use Microchip products (Microchip - Q1 Fiscal 24 Presentation)

Driving Growth - Microchip 3.0

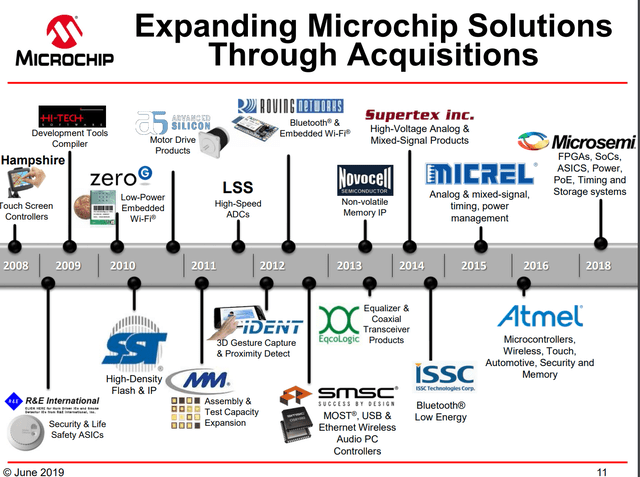

Microchip has matured rapidly in the last couple of years. Most of their existence was defined by growth via acquisition. This has been called the Microchip 1.0 strategy. The goal was to build a company with sufficient scale to be able to provide all components a product designer would need. This way the company would be able to compete against larger competitors such as Texas Instruments (TXN), NXP Semiconductors N.V. (NXPI), or market leader Renesas Electronics (OTCPK:RNECY).

Microchip Acquisition History (Microchip - June 2019 Bank of America Conference)

Acquisitions were targeted at high growth fields where they could buy companies at a reasonable valuation. Using the accretive revenue flows from the acquisition, they would pay down debt and repeat. MicroSemi was the last major acquisition, closing in May of 2018.

The Microchip 2.0 strategy was a bridge between the acquisition heavy model and today's strategy of focusing on high growth areas while providing a wholistic suite of resources and products.

The company's current strategy is called Microchip 3.0 and it was announced on Analyst Day in 2021. The strategy is defined by doubling down on organic growth, supporting customers with total system solutions, investing in trailing edge manufacturing, and increasing shareholder returns substantially.

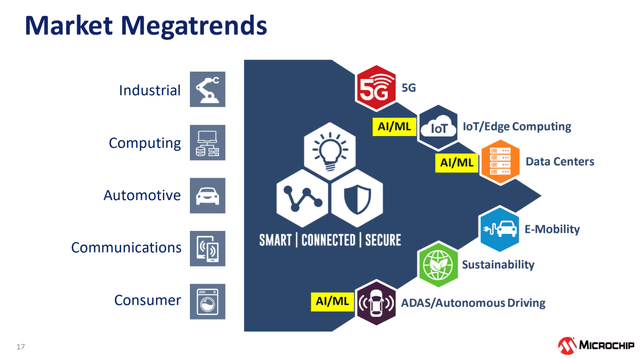

Growth is primarily driven by "Market Megatrends," a collection of six areas where demand is expected to be the highest in the coming years. In order to maintain organic growth, extra emphasis has been placed on designing new products, creating software, and providing reference designs to serve these categories.

Market Megatrends Driving Growth (Microchip - Q1 Fiscal 24 Presentation)

At the moment, there are six megatrends being targeted. 5G, IOT/Edge Computing, Data Centers, E-Mobility, Sustainability, and ADAS/Autonomous Driving. Each of these sectors can benefit from Microchip's deep product catalog and consistent release of new products aimed at capturing market share. The megatrends are expected to grow at roughly twice the rate of other fields.

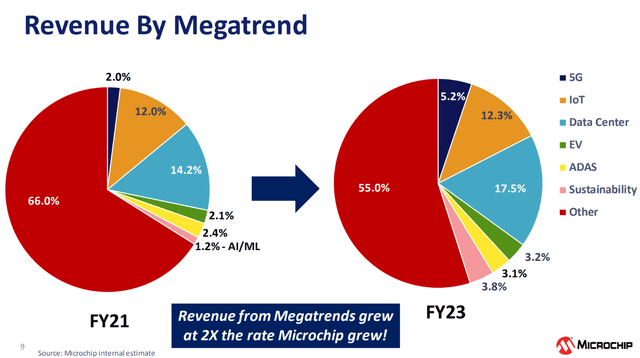

Revenue by Megatrend (Microchip - May 2023 Bernstein Conference Presentation)

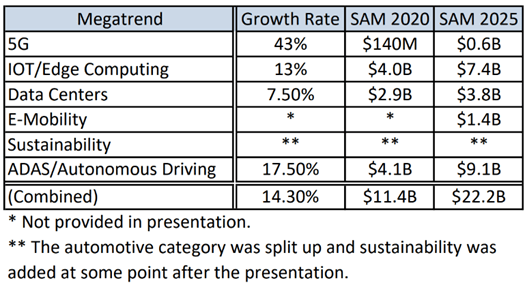

Management guides for long-term growth of 10% to 15% per year which is twice the 6% to 8% expected for the analog and mixed-signal portion of the semiconductor industry. As shown in the chart above, a significant portion of that growth is derived from the megatrends. Below is the expected growth rate per megatrend and the expected serviceable available market (SAM is a subset of TAM focused on the areas the company provides products for).

Growth rates by Megatrend ((Microchip - 2021 Investor & Analyst Day)

Though I don't like TAM or similar metrics because they can paint an overly rosy picture, it does provide useful trend information. 5G has the highest growth rate at 43% annually, but it is also the smallest category and is projected to remain the smallest by 2025. The true growth drivers are automotive, IOT/edge computing, and data centers with a combined expected growth rate of 13.2%.

Profitability

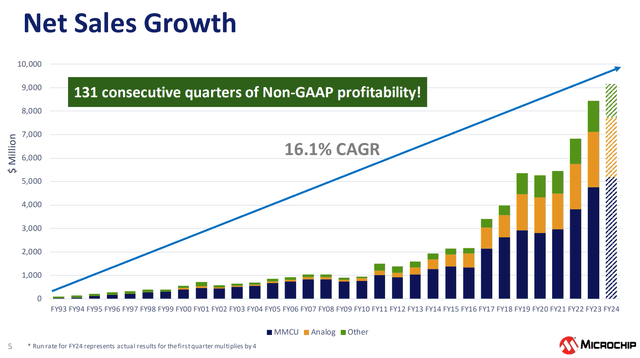

Revenue has steadily grown over time, with a lifetime CAGR of 16.1%. Margins are also at all-time highs. Gross margin was 67.8% and operating margin was 46.9% in the last quarter. This is inline or better than the long-term margins the company is aiming for. I provide a detailed summary of the quarterly results vs. long-term goals later in the article.

Net sales growth (Microchip - Q1 Fiscal 24 Presentation)

Microchip is an exceptionally well run company that has had consistent management since inception. The company has maintained profitability for 30 years and with record margins I expect it will continue to be profitable into the future.

The company benefits from long product lifetimes inherent in legacy node technologies. Some of their products have been sold for over 20 years and counting. The long product lifetime allows more revenue to be generated per product and reduces the need for continuous high R&D spending that AMD (AMD) or Intel (INTC) have.

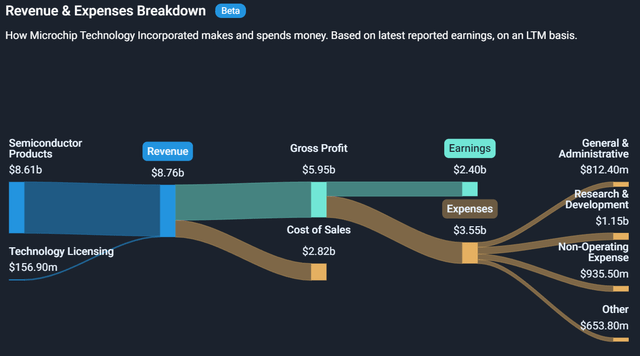

LTM revenue & expense breakdown (Simply Wall St.)

Revenue growth is primarily driven by selling more products and introducing new products and services. During the latest earning call, management clarified that they do not intend to boost revenues by increasing prices on existing products, though they had to raise prices due to inflation over the past few years. Instead, the price of a product is determined during design and remains stable over the duration of its availability, which can be decades.

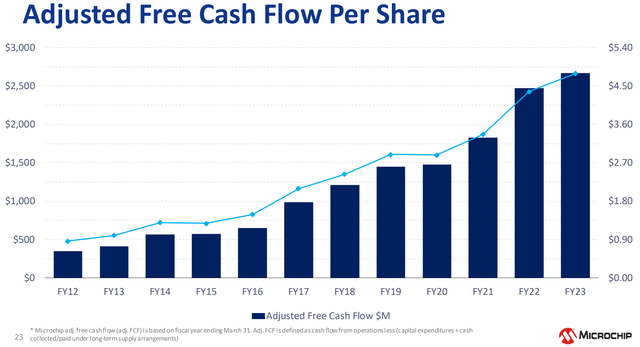

The amount of cash flow the company produces has consistently increased over time. Through a combination of increasing margins and greater sales volume, free cash flow generation has increased almost every year. Adjusted free cash flow is the main metric management uses when making and explaining the decisions they made for the company. Adjusted FCF is the GAAP cash flow from operations minus CAPEX and cash received under long-term service agreements (which will eventually convert into product sold).

Adjusted free cash flow per share (Microchip - May 2023 Bernstein Conference Presentation)

Shareholder Returns

Shareholder returns will be a defining feature of owning Microchip shares going forward. With the transition to the Microchip 3.0 Strategy, the company has become increasingly focused on returning as much of its free cash flow as possible.

Shareholder returns as a percentage of adjusted free cash flow are 72.5% this quarter. The percentage returned will increase by 500 basis points per quarter as long as the net leverage ratio is below 1.5x. The return is expected to reach 100% in Q4 FY 25 (quarter ending March 2025) which is 6 quarters from now.

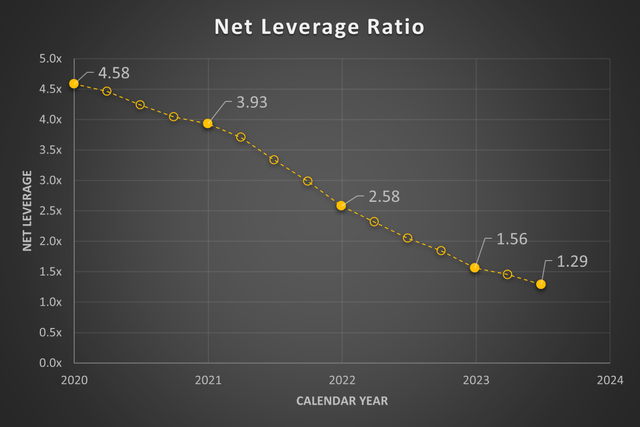

The net leverage ratio is defined as the gross debt less cash and short-term investments divided by adjusted EBITDA. Shown in the graph below, the net leverage ratio has decreased rapidly over the past few years.

Net leverage ratio (Microchip Filings, Author's Chart)

Since acquiring MicroSemi in May 2018, debt paydown has been the primary use of all free cash flow not paid to shareholders. In total, $6.8 billion has been paid off since FY 2019 for an average paydown of $340 million per quarter. With $6.05 billion in long-term liabilities, all debt won't be eliminated prior to the shareholder payout rate reaching 100%. The balance sheet is robust, and the company is unlikely to releverage going forward. The only risk I see that could increase the net leverage ratio is a significant drop in revenue.

Near-term Outlook

Microchip is facing multiple headwinds going forward. Due to deteriorating macro-economic conditions globally, especially in China and Europe, more businesses and distributors are pushing out or cancelling orders. Over half of all backlogged orders come from large clients and distributors that have signed long term service agreements as part of the Preferred Supply Program (PSP). In order to help their customers, Microchip has been delaying product shipments which has resulted in additional product inventory being added to the balance sheet. On the latest earnings call, it was confirmed by the CEO that pushout requests have begun stabilizing in July but will likely continue throughout the rest of the year.

Business conditions have been deteriorating internationally far more than they have in the United States. Deflation is impacting China's market where their CPI dropped by 0.3% in July while PPI prices are down 4.4% year over year. Chinese manufacturing has not recovered since COVID lockdowns released and the Lunar New Year holiday earlier this year. This has knock on effects on Europe, specifically the industrial sector in Germany which is heavily reliant on exports to China. The German economy is currently in a technical recession with France and Italy not far behind.

Executives reported three key areas of weakness they are seeing in the business.

First, Asian markets represented 48% of sales in Q1 FY 24. Weak product sell-through has resulted in increased distributor inventory, specifically in China. This has caused reductions in ordering and pushout requests of existing orders. During an analyst question, it was indicated that the situation in China has not seen any improvement in July. Additionally, impacts of US semiconductor restrictions are starting to be felt on sales. On the bright side, sales declines are caused exclusively by deterioration in consumption. Revenue loss was not attributed to local Chinese semiconductor manufacturing.

Second, the automotive and industrial sectors have pulled back due to high interest rates and uncertain product demand.

Lastly, European weakness started to show in June. Germany's industrial sector output declined 1.5% in June, led by automotive (-3.5%) and capital goods (-3.9%). Inflation rates and energy price uncertainty continue to plague Europe. Where year over year inflation was 6.4% for June in Germany and 7.9% for the UK.

Executives also expect seasonality to return to the business. Prior to COIVD induced supply chain disruptions, Microchip would normally see revenues drop slightly or remain flat in fiscal Q3 (quarter ending December 2023). During an analyst question in the last earnings call they stated seasonality would likely return to the business going forward as supply chains have largely worked themselves out. They also cautioned that this year's seasonality will likely be stronger than normal (implying greater downside) due to a tough macroeconomic environment abroad as outlined above.

Quarterly Results Highlights

In its latest release Microchip achieved record quarterly revenue of $2,288.6 million, up 16.6% YoY with gross margins of 68.4% on the high side of long-term expectations. Forward guidance for Q2 FY 24 (ending September 2023) forecasts margins to remain the same while revenue could contract by 1.0%.

Q1 FY24 result and guidance (Microchip - Q1 FY24 Presentation)

Source: Fiscal First Quarter 2024 Investor Presentation (Microchip)

The main takeaway from earnings has been guidance. I expect no growth for the rest of the year and a decrease in revenue is guided for Q2. Having listened to multiple quarters earnings calls, the tone they used when describing the return to seasonality makes me suspect a significant hit to revenue in Q3 is expected.

Valuation

Microchip's stock price has taken a beating since earnings with weakness predicted for the next two quarters. The stock reached its 52-week high of $94.30 per share just before earnings. The price dropped rapidly post earnings and has consolidated around $80 per share over the last week.

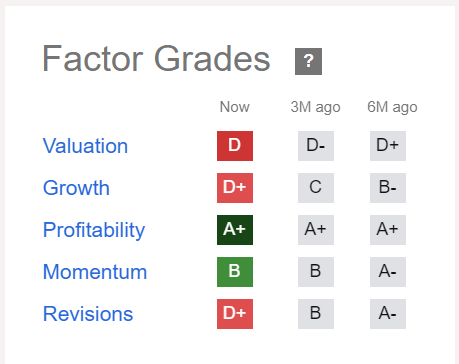

Quant Ratings (Seeking Alpha)

The Seeking Alpha Quant Rating favored Microchip prior to earnings, but things have shifted greatly as Wall Street analysts continue to downgrade earnings expectations for the coming quarters. This is to be expected given the poor guidance.

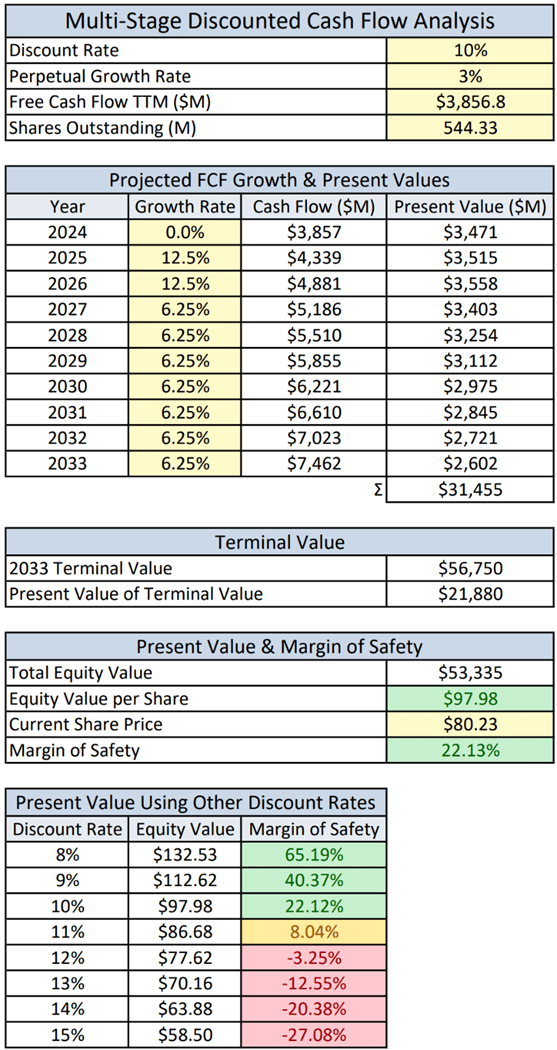

I used a discounted cash flow analysis to determine the fair value of Microchip. I am assuming no growth for 2024 because of the current economic uncertainties and guidance. For 2025 and 2026 I am using a growth rate of 12.5%. This is at the midpoint of growth guidance between FY22 and FY26 that management has presented. Lastly, I am assuming half as much growth through 2033 followed by a perpetual growth rate of 3%. Given Microchip's historic growth rate of 16.1% and the systemic increase in semiconductors going forward, I expect actual results will be higher than my current estimates once we pass the current rough patch.

Wall Street estimates for growth do not agree with me. Microchip is not well covered beyond the next two years. Consensus estimates predict no growth for the next two years followed by a return to growth thereafter (only 1 analyst).

Discounted cash flow analysis ((Author))

From this analysis, I get a fair value of $97.98 per share which implies a 22% margin of safety when buying shares today. I also included the analysis results for a discount rate of 8% through 15%.

A critical component not included in the DCF analysis are share repurchases. Share buybacks have become a core component of the returns the company provides and management has stated it intends to increase the number of share buybacks substantially in the coming quarters. To examine the maximum potential return once the payout rate has increased to 100% of adjusted free cash flow let's look at a hypothetical return using the latest quarter's results.

For Q1 FY24 the total adjusted free cash flow was $776.0 million. The return policy targets a 50/50 split between dividends and share buybacks though the exact mix has varied each quarter. Subtracting average quarterly stock-based compensation of $50 million (buybacks must first neutralize newly granted shares) would see $338 million used for buybacks. Assuming an $80 per share price, a total of 4.22 million shares could be repurchased which represents 0.77% of shares outstanding. Annualized, the total effective return would be 6.65% (3.55% as dividends and a 3.10% net share reduction).

Conclusion & Risks

I am investing in Microchip for the long-term. The semiconductor market is posed to grow significantly for at least the next decade and Microchip stands to benefit with its strong portfolio and focus on high growth areas.

As discussed in depth earlier, macroeconomic headwinds will likely hurt revenue for at least the next two quarters. Almost half of Microchip's sales are in the Asian region. It stands to reason that China represents most of the sales. Further economic deterioration in China could pressure sales. The potential for recession in the US or Europe is also not off the table yet, though I expect the US to be better poised for a soft landing. If revenue misses next quarter (Q2 FY24) or if the guidance is even worse for the December quarter (Q3 FY24) then the stock price could fall lower.

Because of these risks I am holding for now and plan to follow up after the next earnings release. I want to allocate 5% of my portfolio to Microchip, but I am in no rush to quickly allocate.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MCHP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.