Powell Pushes Pause

Summary

- U.S. equity markets snapped a three-week skid while benchmark interest rates steadied following a rapid ascent after closely-watched commentary from central bank officials were less hawkish than some investors feared.

- Federal Reserve Chair Powell emphasized that officials would “proceed carefully” future rate increase, which followed PMI data showing that the mid-year reacceleration in global economic activity lost momentum by late-summer.

- Posting its first positive week of the month, the S&P 500 rebounded by 0.8% this week, while the tech-heavy Nasdaq 100 rallied 1.6%, lifted by strong earnings results from Nvidia.

- Real estate equities - which have been among the hardest-hit segments by the mid-summer surge in benchmark interest rates - were among the better-performers on week that saw a handful of notable M&A moves and dividend news.

- Realty Income - the largest net lease REIT announced its second major casino investment, reaching a deal to acquire a 22% stake in The Bellagio casino from Blackstone Real Estate in a $950M deal.

- Hoya Capital Income Builder members get exclusive access to our real-world portfolio. See all our investments here »

Anna Moneymaker

Real Estate Weekly Outlook

U.S. equity markets snapped a three-week skid while benchmark interest rates steadied following a rapid ascent after closely-watched commentary from central bank officials were less hawkish than some investors feared, while PMI data showed that the mid-year reacceleration in economic activity lost momentum by mid-summer. In a closely-watched speech at the Economic Policy Symposium in Jackson Hole, Federal Reserve Chair Powell emphasized that officials would “proceed carefully” on whether to raise interest rates again and passed on the opportunity to alter the market-implied expectations that the Fed would hold rates at current levels at least through September.

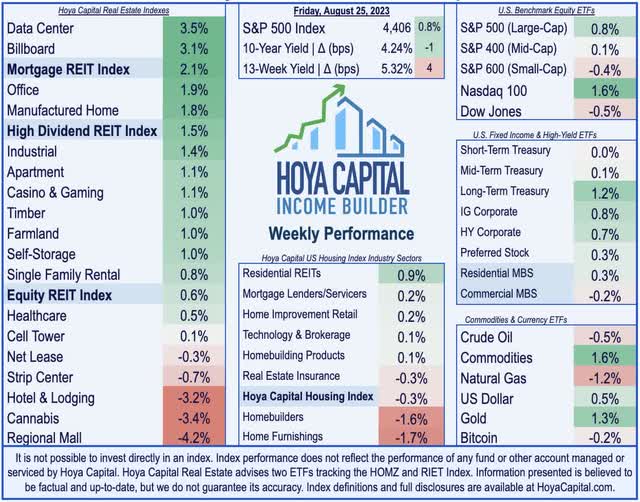

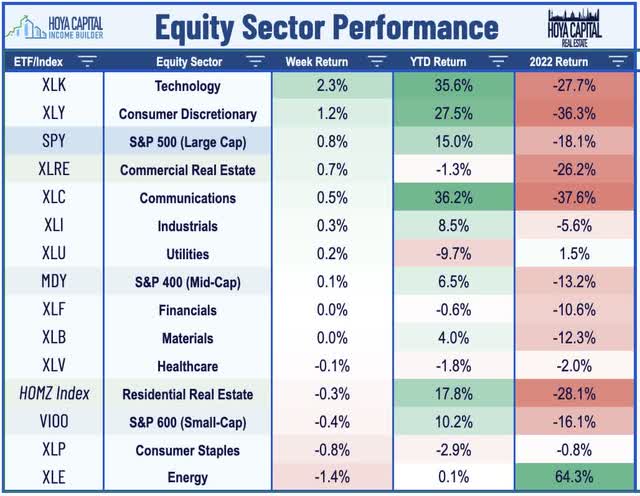

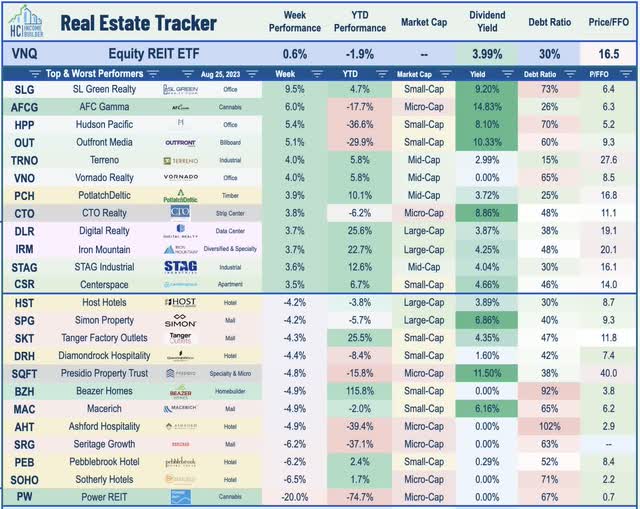

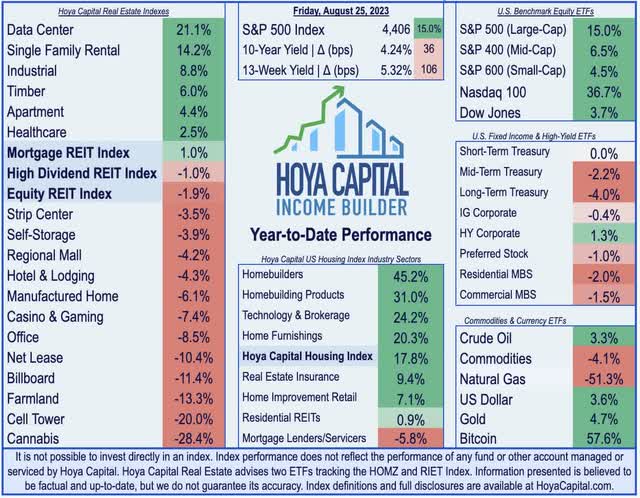

Posting its first positive week of the month, the S&P 500 rebounded by 0.8% this week, while the tech-heavy Nasdaq 100 rallied 1.6%, lifted by strong earnings results from chipmaker Nvidia. The gains were notably top-heavy and tech-focused, however, as the Mid-Cap 400 edged higher by 0.1% on the week, while the Small-Cap 600 declined 0.4%. Real estate equities - which have been among the hardest-hit segments by the mid-summer surge in benchmark interest rates - were among the better-performers on week that saw a handful of notable M&A moves and dividend news. The Equity REIT Index advanced 0.6% on the week, with 13-of-18 property sectors in positive territory, while the Mortgage REIT Index rebounded by 2.1%.

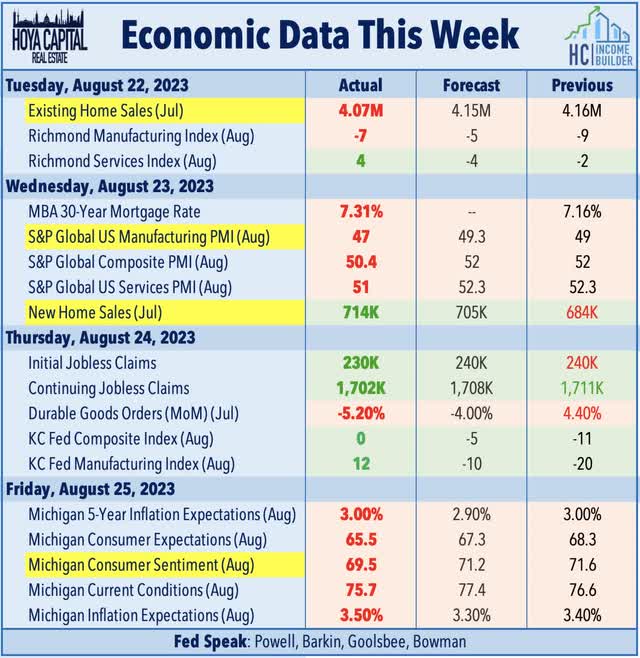

After ascending to the highest levels since 2007 in the prior week, benchmark interest rates on the long-end of the curve steadied this week, responding to "status quo" Fed commentary and mixed economic data. S&P Global's PMI data showed that business activity stagnated in August with its U.S. Composite PMI dipping to a 6-month low. The downturn in European activity was even worse, with its Eurozone Composite dipping to 33-month lows of 47 in August. The 10-Year Treasury Yield finishing lower by one basis point to 4.24%. The policy-sensitive 2-Year Yield was more buoyant, however, jumping by fifteen basis points to close at 5.08%, lifted by a relatively strong slate of weekly employment data showing few visible signs of cracks in labor markets. The US Dollar strengthened for a sixth-straight week while WTI Crude Oil posted a second-straight weekly loss. Seven of the eleven GICS equity sectors finished in the green this week with Technology stocks leading on the upside.

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

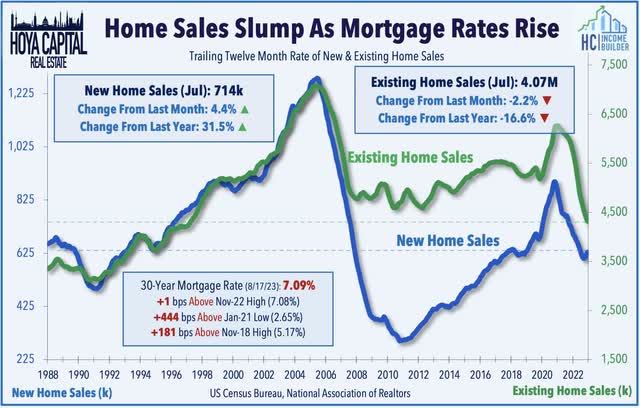

Pressured by a resurgence in mortgage rates to fresh fifteen-year highs, data this past week showed that housing market activity - at least on existing homes - has cooled once again over the past several weeks following a modest revival in late Spring and early Summer. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 7.09% last week, which is now above the prior November 2022 highs of 7.08%. Existing Home Sales data this week showed that sales of previously owned homes dropped to the slowest July pace since 2010, dipping to an annualized rate of 4.07 million, which was 16.6% lower than a year ago. Inventory levels remain near historic lows with just 1.1 million homes for sale at the end of July, which is 15% fewer than July 2022 and the lowest since 1999. Limited supply - resulting in part from a "lock-in effect" on existing homeowners - has provided a floor for home values in the face of the stiff interest rate headwinds, and has helped to usher in a period of "normalization" in home prices. The median sales price in July was $407k - down 1% from the prior month, but roughly 2% higher than a year ago.

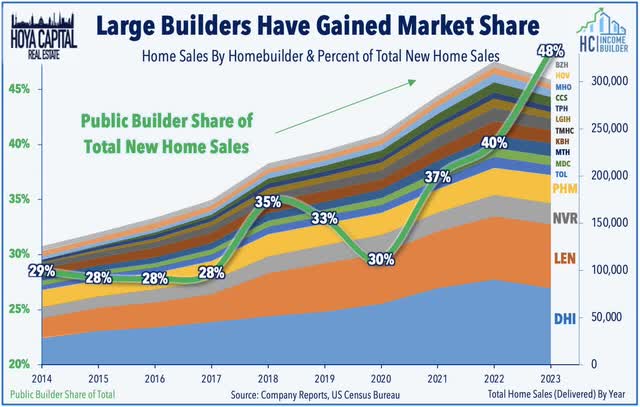

Limited inventory of existing homes has also provided a base level of demand for newly constructed homes. Data this week showed that New Home Sales rose in July to the highest sales pace in seventeen months. Meanwhile, Toll Brothers (TOL) gained 1.5% this week after the luxury builder reported strong results and raised its full-year earnings outlook, citing tailwinds from "historically low levels of resale inventory, favorable long-term demographic trends, and the persistent underproduction of homes." TOL now expects to deliver roughly 9.6k units this year - up from its prior forecast of 9.3k - and raised its home sales margin to 28.5% from 27.8% and favorably revised its expectations for overhead. In our Homebuilder report last month, we noted that large public homebuilders have gained substantial market share over the past year, explaining some of the sector's surprising resilience. Higher mortgage rates have delayed - but not permanently altered- the existing secular fundamentals supporting the single-family market: a "lost decade" of single-family construction ahead of a wave of demographic-driven demand.

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

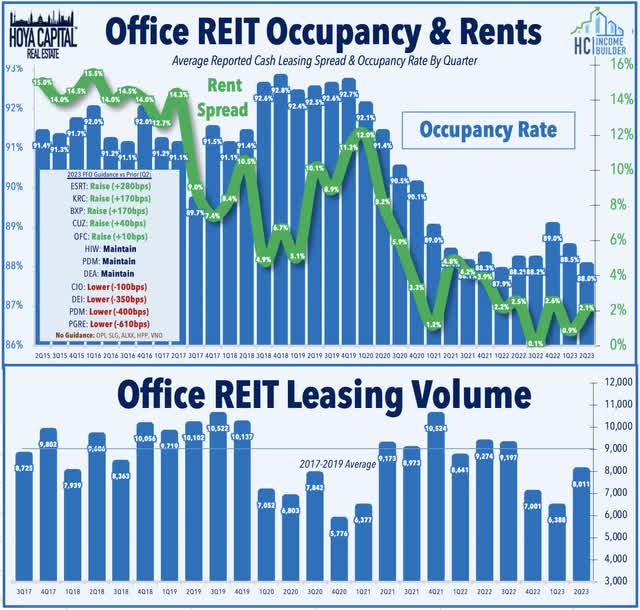

Office: Several of the most battered coastal office REITs were among the leaders this week on additional signs that the long-awaited return to office ("RTO") is starting to pick up some steam as Goldman Sachs (GS) rolled-out enhanced enforcement of its five-day-per-week office attendance policy for most employees. The move follows similar RTO actions from a handful of its peers in recent weeks, including a three-day mandates from Citigroup (C) and JPMorgan (JPM) alongside RTO updates from major tech companies Zoom (ZM), Meta (META), and Amazon (AMZN). NYC-focused SL Green (SLG) and Vornado (VNO), along with West Coast-focused Hudson Pacific (HPP) posted strong gains on the week. HPP also announced that it sold through separate transactions two Los Angeles office properties - 604 Arizona and 3401 Exposition - for aggregate gross proceeds of $72.5 million. The two transactions will result in approximately a $22 million gain to be recognized in the third quarter. The company noted that it plans to use net proceeds to repay amounts outstanding on its unsecured revolving credit facility. In our Earnings Recap, we noted that the office REIT sector has led the gains since the start of earnings season on the heels of a slate of surprisingly solid reports showing that leasing activity and pricing trends appear to have stabilized, with total volume trending toward levels that are only slightly below the pre-pandemic averages after two historically weak quarters.

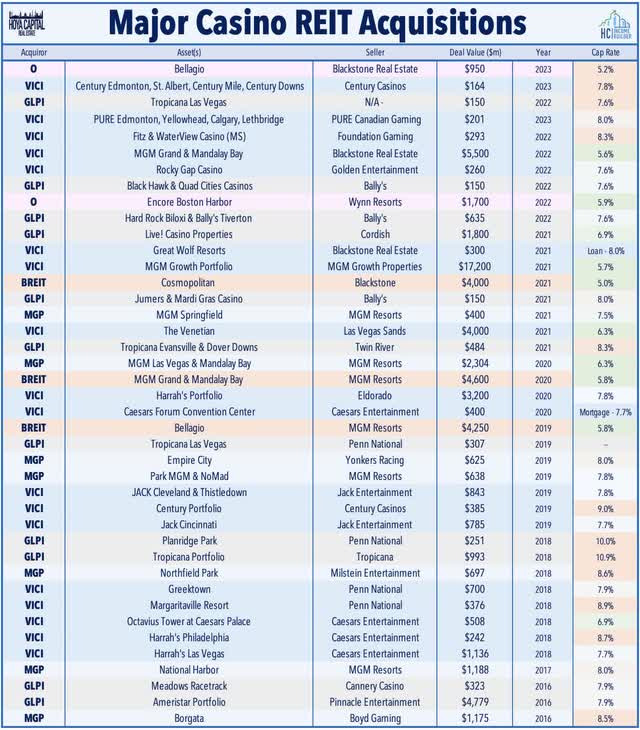

Casino: Realty Income (O) - the largest net lease REIT - finished lower by 2% this week after it announced its second major casino investment, reaching a deal to acquire a 22% stake in The Bellagio casino from Blackstone Real Estate in a $950M deal which values the property at $5.1B with an implied capitalization rate of 5.2%. BREIT had acquired the property in 2019 for $4.3B, representing a 5.8% cap rate. Realty Income will invest $300M of common equity in the newly-created joint venture along with $650M in an 8.1% yield-bearing preferred equity interest. The existing Bellagio triple net lease structure with MGM includes 2.0% annual rent escalators for the next six years, the greater of 2.0% or CPI (capped at 3.0%) in years 7-16, and the greater of 2.0% or CPI (capped at 4.0%) in years 17-26. BREIT will reduce its ownership in the casino from 95% to 73%, which follows its sale of MGM Grand and Mandalay Bay to VICI Properties (VICI) last year - part of a year-long asset sale that has been necessary to meet investor redemption requests out of its flagship nontraded fund. The transaction is Realty Income's first investment through its Credit Investments platform. Notably, VICI indicated in its earnings call that it had discussed a deal for The Bellagio but determined that the asking price representing a "dilutive yield."

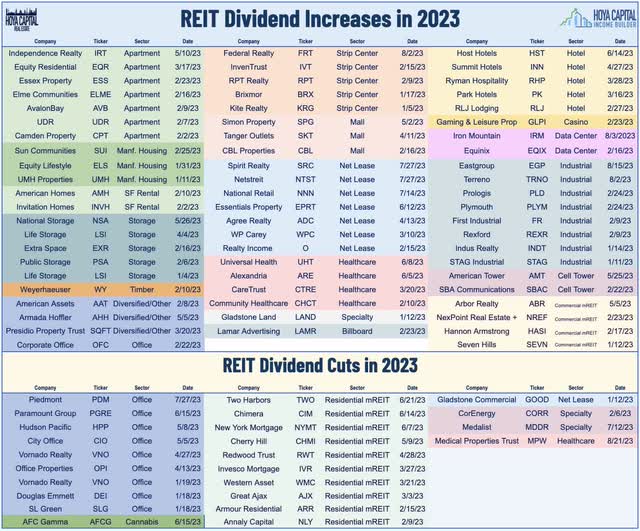

Healthcare: Embattled hospital owner Medical Properties Trust (MPW) gained 1% this week after it announced an updated capital allocation strategy - including a roughly 50% dividend cut - "designed to significantly strengthen its balance sheet, lower its cost of capital, and position MPT for long-term shareholder value creation." MPW - which was one of just a handful of REITs to raise its dividend during each year of the pandemic - cut its quarterly cash dividend to $0.15/share from $0.29/share and will "continue exploring refinancing, sales, and joint-venture opportunities that enable repayment of debt." One of the best-performing REITs during the 2010s, MPW fell into the cross-hairs of short-sellers last year - who have raised questions over the firm's corporate governance and tenant relationships - while its business model simultaneously received flack from media outlets. The critique has landed especially hard given the industry-wide headwinds impacting hospital operators in recent quarters as government relief funds waned while profit margins were hit by soaring labor expenses. Several of its largest tenants - including Steward Health and Prospect Medical - have required financial support from MPW. MPW becomes the 24th REIT to lower its dividend this year. Industrial REIT Eastgroup Properties gained 1% this week after it became the 65th REIT to increase its dividend this year, boosting its payout by 2%.

Healthcare: Sticking in the healthcare space, senior housing owner Ventas (VTR) - which we own in the Focused Income Portfolio - rallied 3% on the week after it provided further details on its previously-announced plans to transition operators on 26 facilities that are currently operated by Atria Senior Living, which have been among VTR's weaker-performing facilities in its critical Senior Housing Operating ("SHOP") segment. Seeking to replicate a successful 2021 transition of 90 underperforming Eclipse facilities to a handful of regional operators, VTR noted that Sodalis Senior Living will take over 13 facilities in Texas, Priority Life Care will operate 8 in Florida, and Discovery Senior Living will take over 5 in California beginning in September. Atria has agreed to facilitate an orderly transition to the Managers, which is currently underway. Despite the "disappointing" results from these facilities in recent quarters, VTR still achieved same-store NOI growth of 14% across its SHOP portfolio in Q2, driven by improved occupancy rates and a record-high 6.6% increase in Revenue per occupied room (RevPOR) growth.

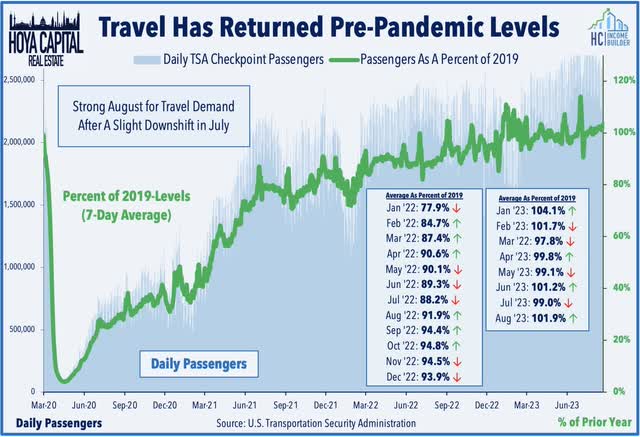

Hotels: Several of the more pro-cyclical REIT sectors - notably retail and hotels - were among the laggards this week on the heels of the surprisingly soft PMI data. Pebblebrook (PEB) slumped more than 6% this week after providing an operating update in which it noted that performance in July was "in line with expectations" led by a continued recovery in its Washington DC and San Francisco markets. PEB noted that Same-Property Room Revenues were up 2% compared to 2019, which represents a slight improvement from Q2 in which revenues were 1% below pre-pandemic levels. PEB also noted that its hotels in San Diego and Los Angeles did not suffer any material damage from Tropical Storm Hilary, but did see cancellations and early check-outs preceding the storm. Recent TSA Checkpoint data shows that throughput downshifted a bit in July - averaging 99% of pre-pandemic levels - but demand has been strong thus far in August, averaging nearly 102% of pre-pandemic levels.

Mall: Simon Property (SPG) - the largest mall owner in the world - slumped about 4% this week as its joint venture Sparc Group announced that Chinese-founded Shein will acquire a one-third interest in the retail company in a deal that seeks to enhance the global reach of Forever 21, one of Sparc's major brands. Initially founded in 2017, Sparc is a 50/50 joint venture between Simon Property and Authentic Brands, and the group has acquired a number of major retail brands including Aéropostale, Brooks Brothers, Nautica, Eddie Bauer, Forever 21, Lucky Brand, and Reebok. Sparc, in turn, is taking a minority stake in Shein, but financial terms were not disclosed. In our Mall REIT report, we noted that instead of deploying capital into acquiring additional mall properties, Simon has pursued a "vertical" retail integration strategy, which has proven to be at least moderately successful while providing the immediate benefit of keeping these tenants in business and paying rent.

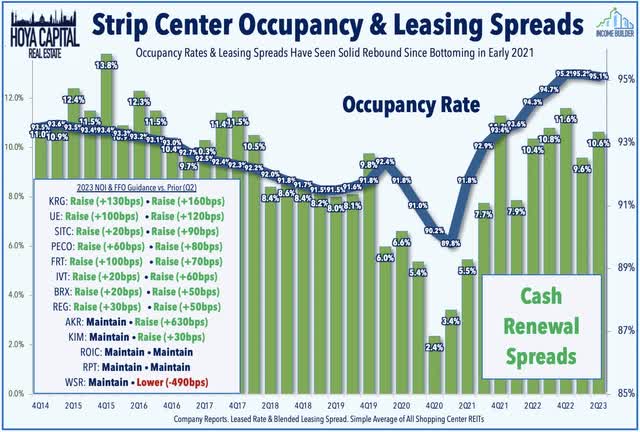

Strip Center: Sticking in the retail sector, Kimco Realty (KIM) - the largest strip center REIT - finished lower by about 1.5% this week after it announced a $173M acquisition of Stonebridge at Potomac Town Center in Woodbridge, Virginia - a suburb of Washington DC. The 504k grocery-anchored lifestyle property is 96% occupied and is anchored by a 139k SF Wegmans and the only Apple store in the greater trade area. In our Earnings Recap, we noted that strip center REITs were a notable upside standout with a near-perfect slate of upward guidance boosts as record-high occupancy rates resulting from a decade of limited new development fueled another quarter of double-digit rental rate spreads. Continuing a trend of better-than-expected results stretching back to late 2021, 10 strip center REITs raised their full-year FFO outlook while just one lowered their FFO target as demand for "big box" space has significantly exceeded the available supply despite the recent high-profile bankruptcies of Bed Bath & Beyond and Party City.

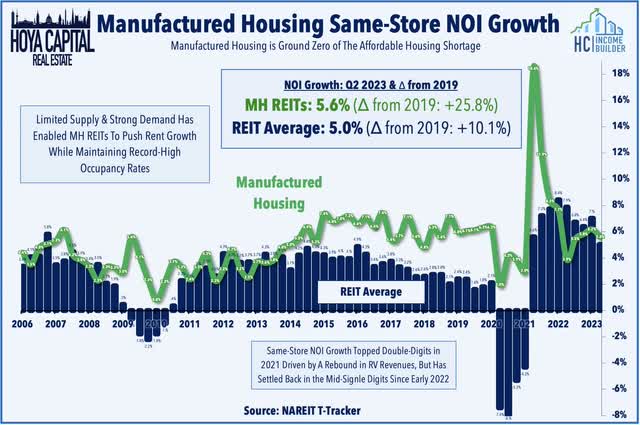

Manufactured Housing: This week, we published Manufactured Housing: The Sun Will Rise Again. Following nine-straight years of outperformance, MH REITs have uncharacteristically stumbled over the past year, pressured by direct and secondary effects of higher interest rates, which have been compounded by concerns over "climate risk" exposure and the effects of a post-COVID demand normalization in the recreational vehicle and marina business segments. Domestically, fundamentals within these REITs' core manufactured housing segment are as strong as ever. Propelled by COLA-effects, rent growth has accelerated this year even as broader residential rents have moderated. The RV segment has been a recent issue for both SUI and ELS, however, after several years of stellar performance. The pandemic-era surge in transient RV usage has moderated over the past two years - a trend that's particularly visible in new RV sales which are now expected to be 50% below pandemic-era peaks this year. That said, longer-term MH REIT fundamentals remain compelling given the lack of supply growth, persistent barriers to entry for new development, and a lingering unmet need for affordable housing, and we reiterated our high-conviction positive outlook.

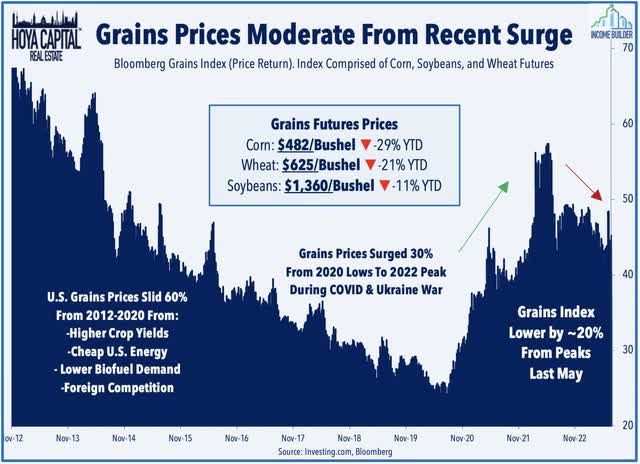

Farmland: Farmland Partners (FPI) gained about 1% on the week as it commented on data published by the US Dept of Agriculture showing that farmland values increased by over 7% over the past year "despite challenges like rising interest rates and extreme weather." The USDA report showed that U.S. farm real estate values increased 7.4% over the past year to $4,080 per acre, which follows an increase of 12.4% in the prior year. Cropland values averaged $5,460 per acre, an increase of 8.1% over the past year, which follows an increase of 14.3% in the prior year. The increase in farm values comes despite a roughly 20% dip in major crop prices from the peak levels in 2022, per the Bloomberg Grains Index. FPI has been a laggard over the past month, however, after significantly lowering its full-year FFO outlook prompted by rising interest expense. FPI now expects its FFO to dip over 50% compared to 2022, but to levels that are still about 12% above its full-year 2019 FFO before the pandemic. Grains prices remain roughly 50% above 2019-levels, which was the near-term bottom of a decade-long commodities slump.

Mortgage REIT Week In Review

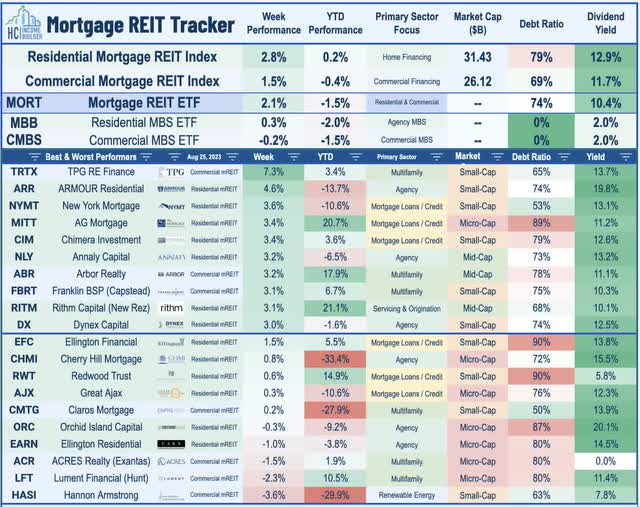

Mortgage REITs were among the leaders this week with the iShares Mortgage REIT ETF advancing 2.1% as volatility calmed a bit this week across interest rate markets. Residential mREIT Rithm Capital (RITM) gained 3% on the week after its pending deal to acquire Sculptor Capital was challenged by a group of Sculptor's investors, which said that the $639M deal "substantially undervalues the company." In late July, RITM agreed to acquire Sculptor - a real estate-focused asset manager - in an all-cash deal at $11.15/share, an 18% premium over the prior closing price. The letter of investors alleged that the special committee running the sale process may have excluded potential bidders before the Rithm transaction was agreed to. The group said it has been trying unsuccessfully to work with Rithm to "see if the terms of the transaction can be improved." Residential credit-oriented mREITs were among the leaders this week including TPG Real Estate (TRTX) along with New York Mortgage (NYMT), AG Mortgage (MITT), and Chimera Investment (CIM).

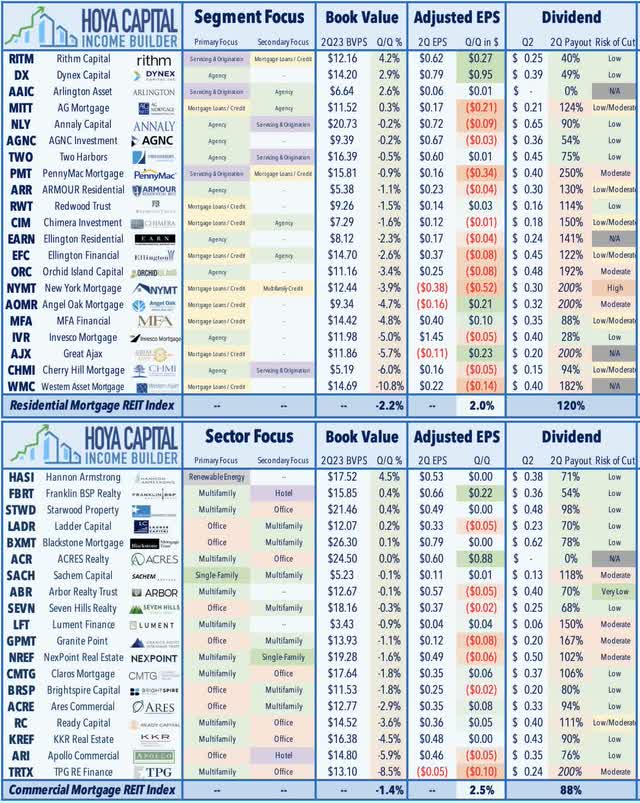

On the downside this week, Angel Oak Mortgage (AOMR) slumped 4% after it announced that raised capital and reduced debt through a $260M RMBS securitization - its third securitization this year - which has enabled the firm to pay down expensive debt. AOMR contributed loans with a principal balance of $94M, against which it carried $64M of debt on its highest-cost loan financing facility. Following punishing declines of over 60% last year on balance sheet concerns, AOMR has been among the top-performing REITs this year as its securitizations have enabled the firm to reduce its debt by $260m. Ellington Financial (EFC) gained about 1.5% this week after it announced that its estimated book value per share of common stock was $14.49 as of July 31 - which is down about 1% from the end of June. On average, the 21 residential mREITs reported an average BVPS decline of 2.2% in Q2, but recorded a 2.0% increase in their distributable earnings. On average, the 19 commercial mREITs reported an average BVPS decline of 1.4%, while the average commercial mREIT reported a 2.5% increase in comparable EPS.

2023 Performance Recap & 2022 Review

Through nearly eight months of the year, the Equity REIT Index is now lower by 1.9% on a price return basis for the year (+2.9% on a total return basis), while the Mortgage REIT Index is higher by 1.0% (+7.1% on a total return basis). This compares with the 15.0% gain on the S&P 500 and the 6.5% advance for the S&P Mid-Cap 400. Within the real estate sector, 6-of-18 property sectors are in positive territory on the year, led by Data Center, Single-Family Rental, Industrial, and Apartment REITs, while Cell Tower and Billboard REITs have lagged on the downside. At 4.24%, the 10-Year Treasury Yield has increased by 36 basis points since the start of the year - up sharply from its 2023 intra-day lows of 3.26% - and briefly exceeding its 2022 closing highs of 4.25%. The US bond market has stabilized following its worst year in history as the Bloomberg US Aggregate Bond Index has gained 0.4% this year. Crude Oil - perhaps the most important inflation input - is now higher by 3% on the year but remains 25% below its 2022 peak.

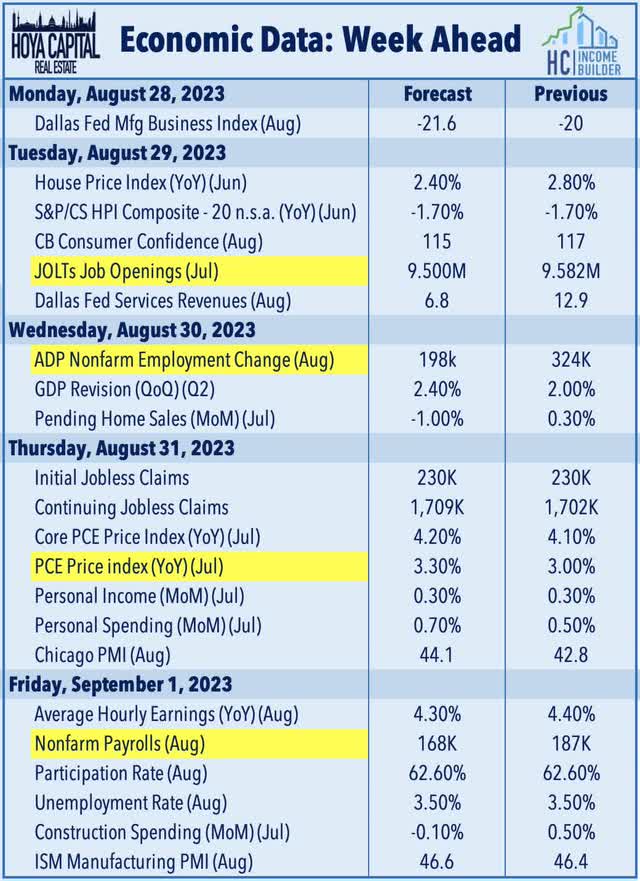

Economic Calendar In The Week Ahead

Employment data highlights another critical week of economic data in the week ahead, headlined by the JOLTS report on Tuesday, ADP Payrolls data on Wednesday, Jobless Claims data on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 168k in August, which follows a decent month of July in which the economy added 187k jobs. The closely-watched Average Hourly Earnings series within the payrolls report - which is the first major inflation print for August - is expected to show a cooldown in wage growth to 4.3%. 'Good news is bad news' will likely be the theme of these reports as several Fed officials have pinned their decisions to pivot away from aggressive monetary tightening on a long-awaited cooldown in labor markets. Speaking of inflation, we'll see the PCE Price Index - the Fed's preferred gauge of inflation - on Thursday, which is expected to show a year-over-year increase in prices of 3.3% - down sharply from the 7.0% rate seen a year ago. We'll also be watching the Case Shiller Home Price Index report on Tuesday, Construction Spending data on Friday, and a flurry of PMI data throughout the week.

For an in-depth analysis of all real estate sectors, check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read The Full Report on Hoya Capital Income Builder

Income Builder is the premier income-focused investing service on Seeking Alpha. Our focus is on income-producing asset classes that offer the opportunity for sustainable portfolio income, diversification, and inflation hedging. Get started with a Free Two-Week Trial and take a look at our top ideas across our exclusive income-focused portfolios.

With a focus on REITs, ETFs, Preferreds, and 'Dividend Champions' across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

This article was written by

Real Estate • High Yield • Dividend Growth

Visit www.HoyaCapital.com for more information and important disclosures. Hoya Capital Research is an affiliate of Hoya Capital Real Estate ("Hoya Capital"), a research-focused Registered Investment Advisor headquartered in Rowayton, Connecticut.

Founded with a mission to make real estate more accessible to all investors, Hoya Capital specializes in managing institutional and individual portfolios of publicly traded real estate securities, focused on delivering sustainable income, diversification, and attractive total returns.

Collaborating with ETF Monkey, Retired Investor, Gen Alpha, Alex Mansour, The Sunday Investor, and Philip Eric Jones for Marketplace service - Hoya Capital Income Builder.Hoya Capital Real Estate ("Hoya Capital") is a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations is an affiliate that provides non-advisory services including research and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital has no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIET, HOMZ, ALL HOLDINGS IN THE INCOME BUILDER REIT FOCUSED INCOME & DIVIDEND GROWTH PORTFOLIOS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.