XMPT: Essentially A Bet On Long-Term Interest Rates

Summary

- The XMPT ETF is a fund-of-funds of closed-end funds focusing on municipal bond investments.

- Municipal bonds have very high duration due to the long-term nature of their assets, hence municipal bond funds tend to be very sensitive to interest rates.

- Given my view that long-term interest rates may continue to rise or stay higher for longer, I advise avoiding the XMPT ETF.

designer491

Recently, I wrote a cautious article on the Guggenheim Taxable Municipal Bond & Investment Grade Debt Trust (GBAB), noting that the GBAB fund may continue to face headwinds with rising long-term interest rates. Is the issue specific to the GBAB fund or the municipal asset class in general?

I believe the duration issue applies to the whole municipal bonds asset class. For example, if we look at the VanEck CEF Municipal Income ETF (BATS:XMPT), a fund-of-funds of closed-end municipal bond funds, we can clearly see that XMPT does poorly when long-term interest rates are rising. This is chiefly because municipal bonds have very long duration.

Given my macro view that long-term interest rates may continue to rise or stay high for longer, I would avoid municipal bonds and the XMPT ETF.

Fund Overview

The VanEck CEF Muni Income ETF is a passive ETF that tracks the performance of the S-Network Municipal Bond Closed-End Fund Index ("Index"), an index that measures the overall performance of U.S.-listed closed-end funds ("CEF") that invest in U.S. dollar denominated tax-exempt municipal bonds.

The funds underlying the index invest in municipal bonds issued by state or local governments or agencies that are generally exempt from U.S. Federal income taxes, although they may still be subject to AMT and state taxes.

The XMPT ETF has $201 million in assets.

Fund Of Fund Structure Brings Additional Cost

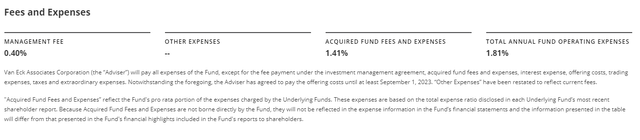

As a fund-of-funds, the XMPT ETF may incur additional expenses in addition to the normal management fees as investors are indirectly paying the management fees of the underlying funds through their holdings (Figure 1).

Figure 1 - XMPT has a 1.81% operating expense ratio (vaneck.com)

While XMPT's management fee is only 0.40%, if the acquired fees are included, the total operating expenses of the XMPT ETF rises to an expensive 1.81%.

Portfolio Holdings

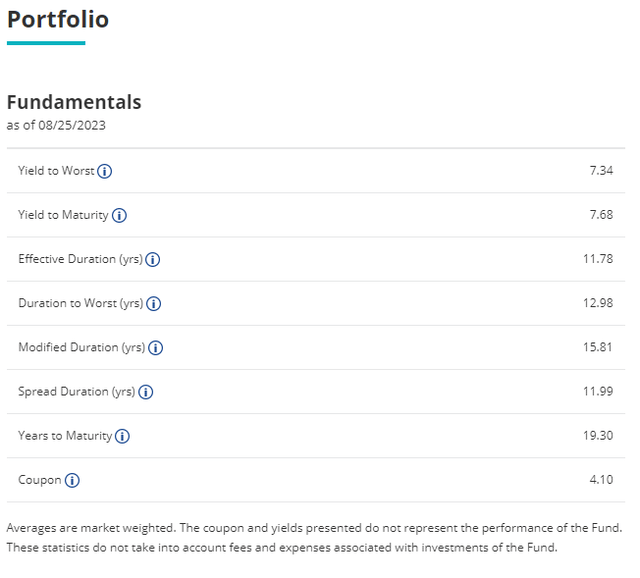

The XMPT ETF holds positions in 56 different municipal bond CEFs. Due to the long-term nature of many municipal bonds, the XMPT ETF's portfolio has an effective duration of 11.8 years (Figure 2).

Figure 2 - XMPT portfolio overview (vaneck.com)

Distribution & Yield

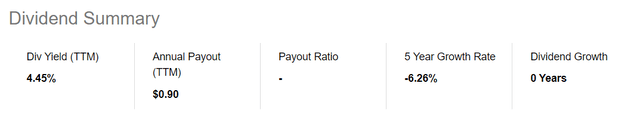

Municipal CEFs tend to pay fairly attractive distributions, with many funds paying distribution yields between 3 and 7% currently. Therefore, it is not unexpected that the XMPT ETF also pays a fairly attractive monthly distribution of $0.90 / unit over the trailing 12 months, or a 4.5% yield (Figure 3).

Figure 3 - XMPT pays a 4.5% trailing yield (Seeking Alpha)

Returns

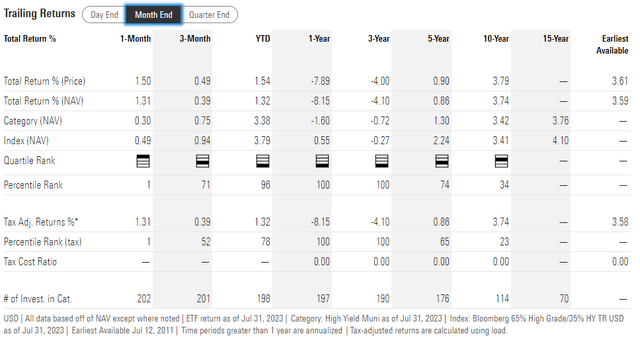

Figure 4 shows the historical returns of the XMPT ETF. Overall, XMPT's returns have been poor, with 3/5/10Yr average annual returns of -4.1%/0.9%/3.7% respectively to July 31, 2023.

Figure 4 - XMPT historical returns (morningstar.com)

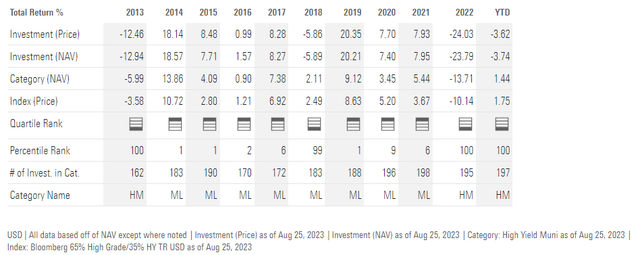

Furthermore, on an annual basis, XMPT's returns can be very volatile. From 2013 to 2022, XMPT's returns have ranged from -23.8% in 2022 to 20.1% in 2019 (Figure 5).

Figure 5 - XMPT annual returns have been volatile (morningstar.com)

High Duration Drives Return Volatility

Since default risk is generally low for municipal bonds, what causes XMPT's high annual returns volatility? There are 2 main drivers of volatility for XMPT.

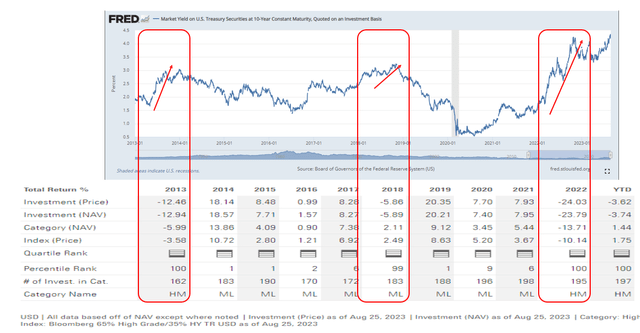

First, investors should recognize that the XMPT ETF has very high interest rate risk due to the long-duration nature of municipal bonds in general. If we super-impose 10-Year treasury yields on the annual returns of the XMPT ETF, we can see that the XMPT generally has poor performance when long-term interest rates are rising (Figure 6).

Figure 6 - XMPT performs poorly when interest rates are rising (Author created with data from St. Louis Fed and Morningstar)

In fact, given the high duration of XMPT's portfolio, a majority of the fund's returns are actually driven by duration instead of interest income from the underlying bonds.

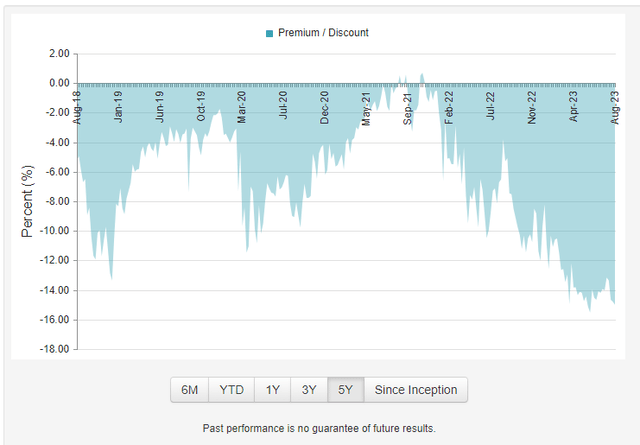

Secondly, given that XMPT invests in closed-end funds, investors are subject to the volatility of the underlying securities. For example, the largest holding in the XMPT ETF, the Nuveen Municipal Credit Income Fund (NZF), has a market price that fluctuates wildly against its net asset value ("NAV") (Figure 7).

Figure 7 - NZF premium/discount to NAV (cefconnect.com)

Although individual fund's premium / discount to NAV can be driven by a host of factors, for municipal CEFs in general, discounts are driven by interest rates. When interest rates are rising, many municipal CEFs' portfolios start to suffer and investors rush for the exits, widening their discounts to NAV.

Therefore, positive or negative returns on the XMPT ETF from interest rate duration is further magnified by the underlying funds' premium and discounts to NAV.

What Is Your View Of Interest Rates?

Depending on your view of interest rates, the XMPT ETF may be a buy or a sell at the moment. From a short-term perspective, many traders believe we may have reached peak yields, particularly as the Federal Reserve has been slowing down the pace of their interest rate hikes. If one believes long-term interest rates have reached a peak and is going to decline in the future, then XMPT should benefit from the double tailwinds of duration and discount to NAV closing.

However, my personal view is that long-term interest rates may continue to rise. I laid out the reasons in a recent article on the Simplify Interest Rate Hedge (PFIX), and I encourage interested readers to refer to the article.

Essentially, better than expected U.S. economic data in the past few months is leading to higher long-term interest rates as traders remove bets of a pending recession (one of the most common recession trades is to buy long-term treasuries as long-term interest rates typically decline into recessions). A strong economy also allows the Federal Reserve to maintain their hawkish monetary policies 'higher for longer'.

Domestically, profligate government spending is also leading to a wall of supply of treasury issuances, as the U.S. government's trillion dollar deficits must be funded. When there is more supply than demand for bonds, interest rates tend to rise.

Finally, international bond yields could also play a part in pushing up U.S. interest rates as the Bank of Japan ("BOJ") is loosening its grip on its yield curve control policies. When the BOJ allow Japanese yields to move higher, this reduces the attractiveness of foreign assets like U.S. treasuries relative to Japanese bonds, and may lead to higher U.S. yields as a result.

Conclusion

The XMPT ETF is a fund-of-funds that invest in municipal CEFs. Although municipal bonds generally have low default risk, they do have very large interest rate risks due to their long durations. The XMPT ETF typically does well when long-term interest rates are declining, as XMPT will benefit from duration as well as the underlying funds' discount to NAV narrowing.

Since my current macro view is that long-term interest rates may continue to rise, I would be hesitant to invest in the XMPT ETF. I rate the fund a hold (or avoid).

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.