ECAT: Activist Saba Capital Has Been Buying This ESG Focused CEF Which Yields 9.9%

Summary

- BlackRock ESG Capital Allocation Trust (ECAT) aims to provide total return and income through flexible investments in public and private markets tied to ESG growth opportunities.

- The fund is well-diversified with 367 holdings and writes options on about 12% of the portfolio for additional income and risk-adjusted returns.

- Activist investment firm Saba Capital has been consistently increasing its stake in ECAT, and other institutional investors also own shares.

- ECAT has a termination date in 2033 which provides a tailwind to help narrow the discount.

- Looking for a portfolio of ideas like this one? Members of Yield Hunting: Alt Inc Opps get exclusive access to our subscriber-only portfolios. Learn More »

pcess609

The investment objective of BlackRock ESG Capital Allocation Trust (NYSE:ECAT) is to provide both total return and income. The fund uses a highly flexible approach and has the ability to invest in both public and private markets across asset classes. They look to identify untapped growth opportunities tied to the evolution of ESG.

My personal opinion is that the ESG concept is somewhat overhyped and oversold. But I don't mind investing in a fund like ECAT which may get a small edge investing in "good" companies. There is definitely an appetite for ESG-style investing from some large institutional investors.

The fund is well diversified. There were 367 holdings listed as of July 31, 2023. ECAT currently writes options on about 12% of the portfolio to generate additional income and enhance risk adjusted returns. The Trust invests at least 80% of total assets in securities that meet the ESG criteria described in the prospectus and shareholder reports.

ECAT does not use financial leverage directly by borrowing to make additional investments. But it occasionally uses derivatives, which is a form of economic leverage.

The trust is run by a strong management team led by Rick Rieder who is the head portfolio manager and the Chief Financial officer of Global fixed Income at BlackRock. Rick personally owns 187,316 shares of the fund with a value of around $2.85 million. But he recently sold 19,052 shares at $15.358 a share on July 3, 2023.

A Fund Activist Is Involved

Saba Capital, the activist investment firm run by Boaz Weinstein, has been consistently adding to its stake in ECAT. Boaz Weinstein has been involved in several proxy battles with BlackRock closed-end funds including ECAT, BCAT and BIGZ. He often posts about these proxy battles on his Twitter feed. I've linked to two of his posts below, and there are many more posts about the BlackRock closed-end funds.

Saba Capital runs (CEFS) which is a fund-of-fund ETF that manages about $120 million and contains many closed-end funds where Saba Capital is taking an activist stance to elect new board members or enact other shareholder friendly actions such as tender offers, share buybacks, conversions to ETFs or open-end funds or fund liquidations.

As of August 22, 2023, the largest holding in CEFS was (ECAT) which was over 18% of the portfolio NAV. The total holdings of ECAT by Saba Capital across all of Saba's funds is now a whopping 13,687,677 shares worth around $207 million. This is about 13% of the ECAT shares.

Some other activist style investors also own shares of ECAT including Rivernorth Capital with 5,482,077 shares. Overall, around 39% of ECAT shares are owned by institutions.

Here are some recent ECAT buys by Saba Capital:

ECAT - Recent Saba Capital Buys

Trade Date | Insider | # shares | price |

08/24/2023 | Saba Capital | 54,411 | $15.15 |

08/23/2023 | Saba Capital | 97,606 | $15.17 |

08/21/2023 | Saba Capital | 243,551 | $15.10 |

08/18/2023 | Saba Capital | 12,498 | $15.05 |

07/06/2021 | Saba Capital | 21,823 | $15.61 |

06/30/2021 | Saba capital | 41,361 | $15.66 |

Source: insidercow.com

The fund's inception date was September 27, 2021.

Here is the current asset allocation as of July 31, 2023. Note that ECAT uses a flexible allocation policy, which can vary considerably over time based on market conditions. Back in late 2021, it was primarily invested in fixed income securities. The negative allocation to cash equivalents is caused by derivatives used for hedging purposes.

Equity | 68.24% |

Fixed Income | 37.19% |

Commodities | 0.02% |

Other | 0.00% |

Cash equivalents | -5.44% |

At full ramp, they expect to have around 25% invested in private companies. But the ramp up of private investments is moving slowly, and they only owned 3.7% in private investments as of June 30, 2023.

Distributions

ECAT has adopted a managed distribution plan and uses an option overwrite program to help support a level distribution of income, capital gains and/or return of capital.

In February 2023, the Trust increased its monthly distribution rate by 25% from $0.10 to $0.125. Since inception in 2021, it has paid out a total of $2.28.

Share Repurchase Plan

BlackRock advised closed-end funds have authorized open market share repurchase programs through November 30, 2023, where up to 5% of the outstanding common shares may be purchased. This enhances the NAV by purchasing fund shares at a discount.

Here is a summary of the ECAT share repurchase activity as of June 30, 2023, since inception of the Fund's repurchase program:

Share Repurchase Activity For ECAT

- Number of Shares Repurchased: 3,325,611

- Dollar Amount of Shares Repurchased: $47,257,972

- Total Amount of NAV Accretion: $9,686,105

- Average Discount on Days Repurchased: -17.1%

Limited Term Structure

ECAT was set up as a limited-term fund with a termination date of September 27, 2033. At that point, investors will have the opportunity to tender their shares at NAV. This provides a tailwind as the current 12.75% discount gradually dissipates over the next 10 years.

The board has the option to extend the fund's termination date for a total of 18 months. There is also a chance the fund could change into a perpetual fund. But before doing this, there would be a 100% tender offer at NAV, which allows any shareholder to sell all of their shares at the NAV price. If the fund retains $200 million in assets after the 100% tender offer, it can turn itself into a perpetual fund.

To increase awareness of the contingent limited term structure, ECAT's name was changed to "BlackRock ESG Capital Allocation Term Trust" on April 5, 2023.

ECAT: Top 10 Equity Holdings - as of July 31, 2023

ECAT Top 10 Equity Holdings (ECAT fund web site)

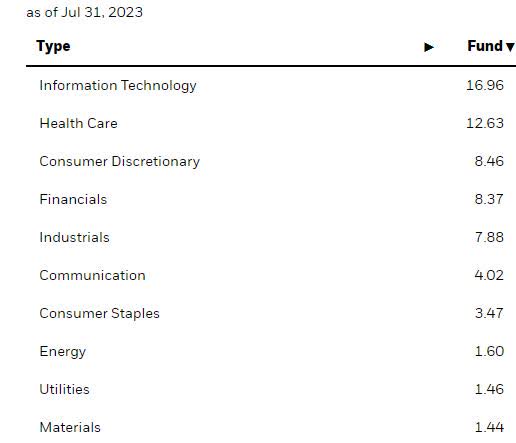

ECAT: Equity Sector Breakdown

ECAT Equity Sector Breakdown (ECAT Fund web site)

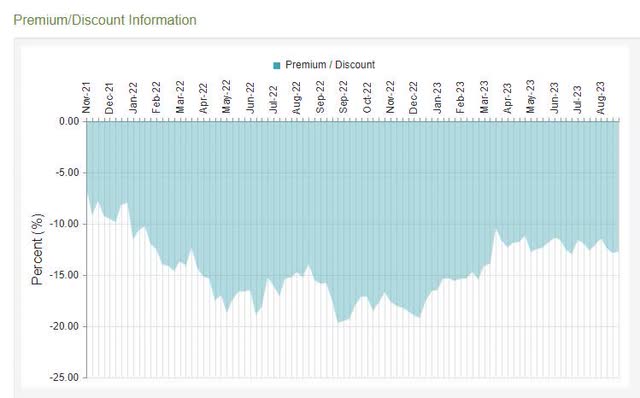

ECAT- Discount History Since Inception

ECAT Discount History (cefconnect)

Z-Score Analysis

The discount to NAV as of August 25 is -12.69%.

The 3 Month Z-Score is -1.03 sigma.

The 6 Month Z-score is -0.19 sigma.

The 1 Year Z-Score is +0.83 sigma

The discount has narrowed a bit over the last year due to the consistent buying by Saba Capital, but the double-digit discount may continue to narrow further if Saba continues buying.

Source: cefconnect

Fund Performance

The inception date for ECAT was in late 2021, right before the bear market year of 2022. Its NAV performance suffered in 2022 along with the overall market, and the market performance was even worse as the discount widened to 15% or higher.

But the fund has done quite well so far in 2023, and has been helped by share buybacks which are accretive to NAV.

Here is the total return performance record compared to its Morningstar Tactical Allocation peers:

ECAT NAV Performance | ECAT Market Performance | Tactical Allocation NAV Performance | Rank in Category (NAV) | |

2022 | -14.02% | -21.90% | -18.60% | 56 |

YTD | +10.73% | +20.66% | + 4.53% | 1 |

Trailing Returns

3 Month | 1 Year | |

ECAT Price | + 2.62% | +10.62% |

ECAT NAV | + 1.83% | + 6.25% |

Tactical Allocation NAV | + 2.69% | - 2.54% |

Source: Morningstar

BlackRock ESG Capital Allocation Trust (ECAT)

Total Investment Exposure= $1.78 Billion

Total Common Assets= $1.78 Billion

Baseline Expense Ratio= 1.28%

Discount= -12.69%

Monthly Distribution= $0.125

Annual Distribution= $1.50

Annual Distribution Rate (NAV) = 8.62%

Annual Distribution Rate (market price) = 9.87%

Dividend Yield Enhancement Alpha= 1.25%

Effective Leverage= None

Effective Duration Fixed Income= 1.93 years

Options % Over-Written= 11.71%

Summary

There are several reasons ECAT is attractive here:

- Access to some of BlackRock's best ideas across assets in the ESG space, including some private holdings.

- Tailwind from the 12.75% discount and termination date in 2033.

- Heavy recent buying from activist firm Saba Capital.

- If Saba Capital is successful, there may be upcoming shareholder friendly actions like tender offers or a merger with another BlackRock fund where you may receive NAV.

I would try to buy ECAT at a discount of 12% or higher. The fund is quite liquid, with an average trading volume of about 230,000 shares a day. Saba Capital has been an active buyer lately, which has added support to the fund price.

Marketplace Service For Those Hunting For Yield

George Spritzer's top investment ideas are being featured on Alpha Gen Capital's "Yield Hunting" marketplace service.

This service is dedicated to yield/income investors who wish to avoid market froth. We encourage investors to benefit from yield opportunities within closed-end funds, business development companies, and other niche areas. For safe and reliable income streams, check out Yield Hunting.

This article was written by

George Spritzer, CFA is a registered investment advisor at Southland Investments and specializes in managing closed-end funds for individuals. George uses the following investment strategies:1) Opportunistic Closed-end fund investing: Buy CEFs at larger than normal discounts to NAV and sell them when the discounts narrow. 2) Exploit special situations: tender offers, fund terminations, fund activism, rights offerings etc. Some of my premium articles are published on Alpha Gen Capital's "Yield Hunting: Alt Inc Opps" https://seekingalpha.com/author/alpha-gen-capital/research

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ECAT, CEFS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (10)