JAKKS Pacific: Not Buying The Bargain Thesis

Summary

- JAKKS Pacific is a licensing and toy design company that operates in an inherently unpredictable business environment.

- Margins are still tight, despite operational improvements.

- We think the potential for long-term returns for common equity holders is estimated to be around 7-9%, making it a less attractive investment on a risk/reward basis compared to alternatives.

Spencer Platt

Thesis

Our thesis is the JAKKS Pacific (NASDAQ:JAKK) stock is not a bargain. Long-term equity holders might be able to expect a 7%-9% return on an effective compound annual basis, which they can find elsewhere with much less risk. Due to the 'hits' nature of the licensed IP toy business, future sales results are based on the timing of popular movies/games which is inherently unpredictable. Excess FCF is unlikely to appear as the company is a price-taker on margins, working capital/operating efficiencies have already been implemented and capex is a real cash expense.

Introduction

JAKKS Pacific is a fairly simple business. They license intellectual property, design toys and playthings based on that IP, produce it in China with third-party manufacturers and sell it (mostly) in the U.S. to (principally) Target and Walmart.

Much of the discourse we've seen around JAKK suggests the stock is currently a bargain. We have a different perspective. To give readers an understanding of our context, we work towards buying equities that we don't expect to have to sell for many years and for those businesses to generate a return to common equity of at least 10%. Our premise is that long term equity returns track long term business results. In essence, we try to ride the business, not the share price, and expect that over time one follows the other. We analyze and buy as if we are buying the whole company. It is through this lens that we view the business of JAKK.

JAKK Is An Inherently Unpredictable Business

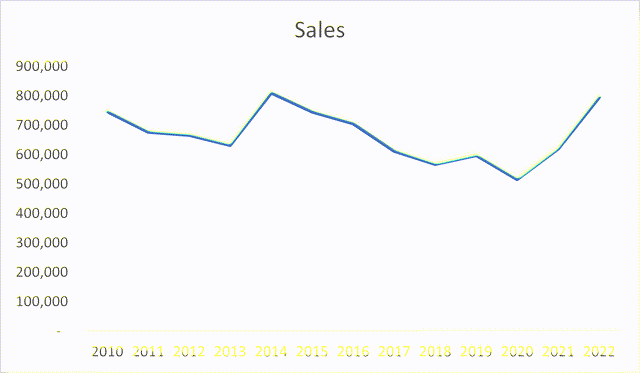

The chart above depicts the trend of sales (in thousands) over the last decade, based on JAKK financial statements. There is no analyst in the world that would predict this trend of sales, prospectively. Consider the forecast environment - guess at what movies/games will come out in the future, determine if the company can get the license to those properties, determine if those properties will be popular, will the toys created for those titles be popular, accurately forecasting demand to produce the right toys in the right quantities and then what externalities (Covid, geopolitics, etc.) could happen to disrupt business. It's just a hard job.

And before the 'yeah, but Covid' narrative, recall that the last decade had huge winners too (Frozen, Encanto, etc.). As a result, we think investors relying on prospective forecasts of business results for JAKKS are likely to be led astray - and, unfortunately, then won't know in which direction (positive or negative) they are being led.

In such an environment, we think the logical approach is to look at the structural characteristics of the business, over time, and assess how investors in the common equity might have benefited.

Think about it like surfing. You have no idea what the waves are going to be. Instead, study the history of the rider to gauge if they are likely to be successful in an unpredictable environment.

Margins Are Tight

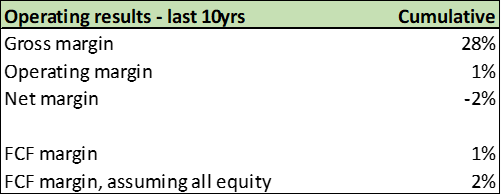

JAKK financial statements

To cut through the business volatility, we looked at cumulative business results over approximately the last decade from JAKK financial statements. Gross profit margins came in at ~28% and, on a free cash flow basis, margins were ~1% on sales (you'll see below why we think capex is a real cash expense and should be considered).

Historically, the company has carried debt which is now paid off. The company does have outstanding preferred share capital which is owed a 6% dividend and is senior to common equity holders. Assuming all common equity financing and ignoring any tax changes that might result, FCF margins would have been ~2% over this period (not much better). This would have been an aggregate amount of cash in the range of $175 million over the last 10 years.

The company has made operational efficiency improvements recently, which we discuss later.

Capex Is A Cash Expense

One consideration is that perhaps capex investment has been too high and will moderate thereby making prospective FCF margins better by comparison. This does not appear to be likely.

Over the last 10 years, the company invested around $120 million in capex (see JAKK financial statements). Based on the balance sheet, the total net long-term assets are basically flat. Even on a gross basis, investment has exceeded asset accumulation.

And this makes sense. The majority of the assets for JAKKS is in molds and tooling. These are things that get used up and need to be replaced or become obsolete when a particular toy is no longer offered for sale. We think the conclusion investors should draw is that capex is a real consumable cash expense for the business because there hasn't been a buildup in the asset base that would suggest the potential for cash flow leverage if sales were to exceed their historical range.

Working Capital Extraction Appears Complete

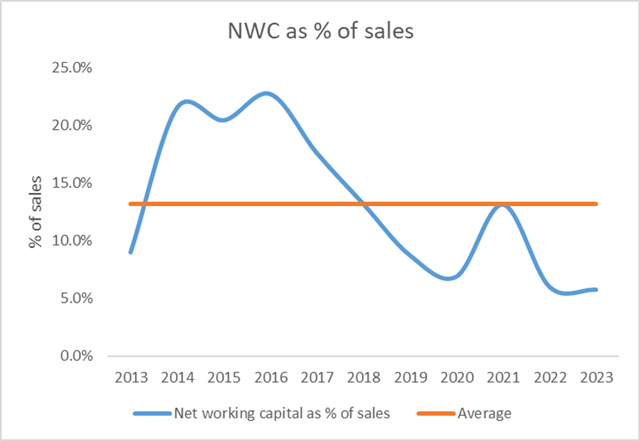

JAKK Financial statements

Investors might be thinking that perhaps the company is holding too much working capital that could be released as cash. This also does not appear likely.

The long-term historical average ratio of net working capital-to-sales is around 13% to 14%. In 2023, the company is considerably below its historical average. It looks like management has squeezed all the excess cash out of working capital.

This suggest to us that there isn't likely to be significant excess value tied up in working capital that could be released for shareholders.

Cost Control And Capital Allocation Is The Whole Game

Gross margins today are in line with long term historical averages around 28%. Given industry dynamics, we don't think the company has strong control over gross profit margins and acts more as a price taker. The strategy for shareholders to be able to accumulate cash from JAKK comes down to operating cost control and capital allocation. On this front the company has done well lately.

SG&A as a percentage of sales has improved over time from over 30% to closer to 20%. A reduction in the number of employees since 2017 feels like a key driver as employee headcount declined from over 800 to now around 600. The company has been able to continue to operate with fewer employees despite an upturn in sales thereby improving margins. That's great.

Historically, much of the income the company generated appears to have gone to debt holders. The company is now debt free. As mentioned, there is the preferred stock which is senior to equity holders and receives a 6% dividend. Should certain events occur it appears the company may have to pay a premium liquidation value for the preferred stock. For example, at June 2023, the preferred stock had a carrying value of $25.2 million and a liquidation value of $37.8 million (10Q Jun-23, pg 16). This makes it more difficult as an equity holder to calculate returns to common due to the structure of the preferred stock.

For common shareholders, the big question will be - what will the company do with the free cash flow?

The company is recently out of debt, does not anticipate paying any dividends in the foreseeable future (10K-22, pg.26) and has seen a sizable increase in shares outstanding in recent years (i.e. no net share buyback) (10K-22, pg. 49). The company could look at M&A but given the concentration in the industry, it might be difficult to find meaningful targets.

What Is The Potential For Long-Term Common Equity Holders?

We've made our view clear that we think long-term sales forecasts for JAKK is close to a meaningless exercise. To take a simplified approach we assume -

- Sales will mirror the previous decade (no forecast risk)

- Gross margins around 28%

- Operating margins around 6% - 7%

- Normal tax rate

- Capex the same as last 10 years (no forecast risk or inflation)

- No increase in net working capital

- The company pays preferred dividends

- Management banks the remaining FCF

Investors buying at today's prices may end up with a return of around 7% - 9% over the next 10 years, considered on an effective compound basis. We think that's the deal that common stockholders are getting here.

There are larger companies available that could generate the same results with a lower risk profile. In short, investors should be able to find superior alternatives.

Business results may end up better over the next decade. But to assume that you need a reasonable basis for predicting sales into the future. We don't think there is one. And since the company is at historically peak operating efficiencies, investors would be wise not to engage in wishful thinking.

If anything, standing at this moment in time, the one large obvious structural factor that is different are dramatically higher interest rates squeezing consumers.

Risks

A risk to our view would be if JAKKS sold the company to a larger toy business. A prospective acquirer could further eliminate costs and therefore justify a premium price. However, management's current stance does not suggest a sale of the company will happen.

The preferred shares have an embedded redemption option upon a change of control. The company has stated, "The Company considers the repurchase option to have no value as the likelihood is remote that this event, within the Company's control, would ever occur." [emphasis added] (10K-22, pg. 64)

Our interpretation of this is that the company is, at present, not considering a sale of the business or a repurchase of the preferred stock. This of course can change in the future.

We find the preferred capital a complication in the analysis for common stockholders. For the preferred stock, dividends haven't been declared/paid and the company apparently does not expect the repurchase option to be effected. We wonder - how do the preferred shareholders expect to cash out?

We think common stockholders would do well to consider the preferred stock in their analysis. Any cash going to the preferred shareholders (either through cash dividends or Liquidation Preference) (JAKK 8-K, Aug-19, pg. 9) will be cash not available to common shareholders, thereby affecting the long-term return profile of the common equity.

Given its strong financial position today, it might be cheaper for the Company simply to redeem the preferred stock now. The longer dividends accrue to the preferred stockholders, the more expensive it will be to redeem in the future and the less cash that will be available for the common shareholders commensurately, particularly given the Liquidation Preference of 150%.

Conclusion - Better Play Elsewhere

We aren't suggesting that investors should short the stock or there is something wrong with the business. It is simply that to be a common shareholder you have to have some reasonable expectation of better business results over time.

Inevitably there will be great quarters and years for JAKKS in the decade to come. There will also be challenges. On balance the company seems adept at turning a profit over time but, if history is any guide, those profits are likely to be modest. We think shareholders of the buy-and-own variety (such as ourselves) will have more fun elsewhere. Traders looking to catch a turn on a seemingly cheap asset might have a chance to make some money if they are good at playing hot potato around near term movie/game blockbusters and the associated merchandise. That's just not our game.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.