Graco: The Market's As Impressed As Me

Summary

- Graco is a company that manufactures products for fluid handling, with a dominant presence in the construction industry.

- The company has a long history of stable revenue growth and high operating margins with a good return on capital.

- Despite being expensive on a price-to-earnings basis, I believe the stock is worthy of a hold-rating as the company has an impressive history and is low in risk.

Vesnaandjic

Graco (NYSE:GGG), a company that manufactures products for fluid handling. The company has an impressive history of good growth and strong margins, but as the company's valuation seems to already reflect these factors, I have a hold-rating for the stock.

The Company

Graco's offering consists of multiple purposes ranging from DIY to industrial applications.

The company's biggest segment is contractors, as the contractor portion of revenues represents 46% year-to-date as seen on the company's Q2 presentation:

Graco Q2 Presentation

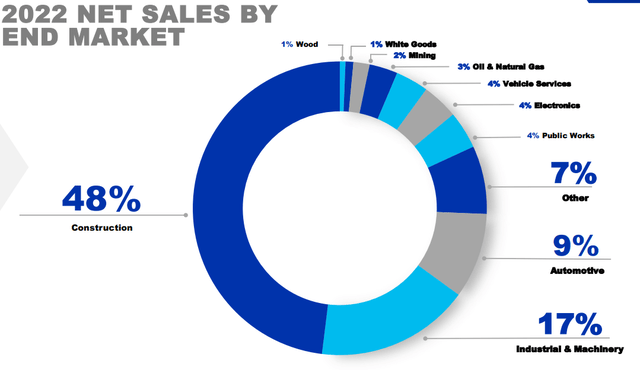

Although Graco serves numerous verticals, construction is the company's dominant application as it represents 48% of Graco's revenues:

Graco's stock has performed exceptionally well on the stock market, as the stock has gains of 233% in the past ten years:

Graco's Stock Chart (Seeking Alpha)

As the construction segment has stayed vibrant throughout the recent history, Graco's earnings have been quite stable, also represented by the stable growth in their stock price.

Financials

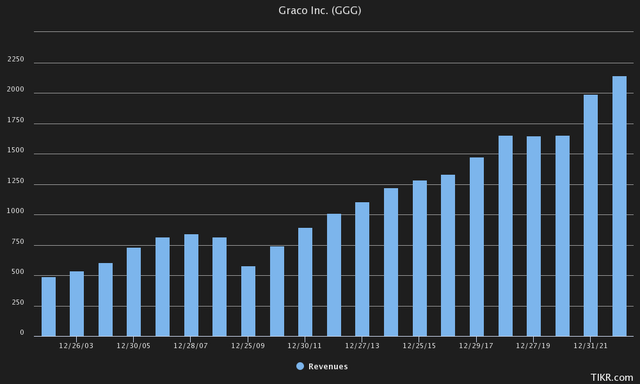

Graco's revenues have had an impressive history of growth, as the company's compounded annual growth rate has been 7.7% from 2002 to 2022:

Further, the company's organic revenue growth rate has been 6.3% in the period as told in Graco's Q2 presentation - the majority of growth has come organically.

The growth has slowed down in the company's most recent quarter, as in Q2 the company only had a nominal growth of two percent despite a high inflation. Graco's CEO Mark Sheahan attributes the soft revenue growth to the home center and pro paint channels in the company's Q2 earnings call, with further insight to Graco's performance across sectors and geographical areas:

"Contractor performance remained mixed, with growth in pavement, protective coatings and spray foam unable to offset softer sales in the home center and pro paint channels. EMEA was a bright spot during the quarter, growing 5% compared to last year, with growth in all reportable segments. Incoming order rates in many key product categories have been solid, and sales have improved as many of the adverse component and product availability issues that impacted EMEA last year have improved."

As impressively as Graco's long-term revenue growth, the company has maintained a very high operating margin for most of its history, with the trailing operating margin currently standing at 27.7%, a bit above the historical average despite the company's softer revenues in Q2. The company has maintained an EBIT margin of around 25% for most of its history, with the only significant drop happening in the real estate crash affecting 2009 and 2010:

Graco's Operating Margin (Tikr)

Graco maintains a healthy balance sheet. The balance sheet currently has interest-bearing debts of around $124 million, of which $49 million is in short-term borrowings and the rest in current portions of long-term debt - it seems like the company won't have any outstanding interest-bearing debt in a year, unless the company gains new borrowings. Graco also has a cash balance of $521 million.

Valuation

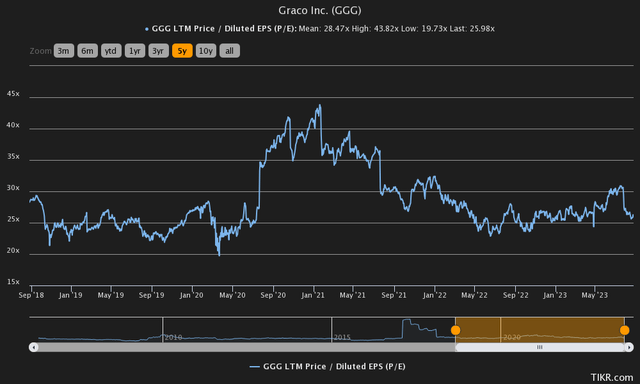

Graco has been quite expensive on a price-to-earnings basis in its recent history - with a current LTM P/E of 26 and a mean of 28.5, the stock is on the expensive side of the stock market.

The price-to-earnings ratio that I see as expensive on its own is explained by the company's growth history as well as the low risk level associated with Graco. To further analyze the valuation of Graco, I constructed a discounted cash flow model to determine an estimated fair value for the stock.

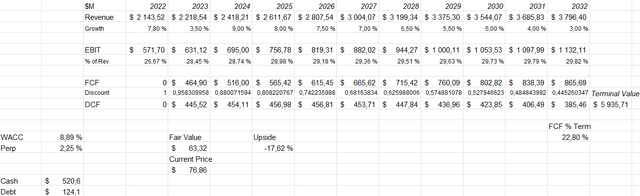

In the model I estimate Graco's revenue growth to be 3.5% for the current year, below the company's historical organic growth - as the real estate vertical sees cooldowns along with the economy and other verticals, the company could see temporarily soft growth. Going forward, I expect Graco to achieve a growth of 9% in 2024 as the market conditions bounce back from currently soft levels. In 2025 and beyond, I expect a growth that is initially a bit above Graco's historical average, with the growth slowly slowing down into a perpetual growth of 2.25%. I believe the growth above the historical average is justified for 2024 and 2025, as inflation could still be high.

I expect Graco to maintain and even have slight gains in the operating margin - for 2023 I estimate an operating margin of 28.45%, above 2022's margin of 26.67%. The margin continues to further increase into a margin of 29.82% in 2032; the company should have good pricing power and further leverage from a larger scale of operations. Graco also has a good return on its capital; the estimated growth in revenues shouldn't tie excessive amounts of capital in my opinion, which is why I estimate the company's cash flow conversion to be great.

These expectations along with a weighted average cost of capital of 8.89% put the estimated fair value of the stock at $63.63, around 18% below the company's current price of $76.86:

DCF Model of Graco (Author's Calculation)

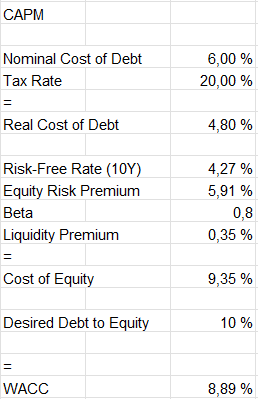

The used cost of capital is derived from a capital asset pricing model:

CAPM of Graco (Author's Calculation)

The estimated cost of debt of 6% is my estimate, as the company doesn't have significant amounts of debt to get the interest rate from; I believe the estimate is fair as it leaves room for margin above the United States' bonds. I estimate the company to have a long-term debt-to-equity ratio of 10%.

I use the United States' 10-year bond yield of 4.27% as the risk-free rate, as the 10-year period represents a good portion of a company's cash flows' values. The estimated equity risk premium of 5.91% is taken from Professor Aswath Damodaran's latest estimates published on his website.

Tikr estimates Graco's beta to be 0.80. The beta represents a low rate, as Graco is seen as a recession-safe investment that isn't leveraged with debt. I do believe, though, that Graco has certain systemic risks which should affect the beta - a significant crash in the real estate market poses a risk for Graco, as construction represents around half of the company's revenues. For example in 2009 Graco's revenues fell by 29 percent caused by the housing crisis, with the company's operating profit falling by 60 percent. Although a real estate market crash does affect Graco, the company has mostly kept a very stable performance, which is why I believe the beta of 0.80 should be somewhat justified, and used in my CAPM.

Finally, I add a small liquidity premium of 0.35% to the cost of equity, bringing the cost of equity to 9.35% and the WACC to 8.89%, used in the DCF model.

Takeaway

Although the DCF model points towards a moderate downside, I do not believe that a sell-rating would be reasonable for the stock - Graco has completed multiple acquisitions in the past creating shareholder value, which the model doesn't take into account. With an impressive past, and what I believe to be an equally impressive future, I have a hold-rating for the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.