EEM Might Not Be The Best Way To Invest In Emerging Markets

Summary

- EEM invests in emerging markets in order to take advantage of fast-growing economies.

- The fund is top-heavy and focused heavily in a few countries.

- It's been underperforming for a while and there might be a better alternative.

SAKDAWUT14/iStock via Getty Images

iShares MSCI Emerging Markets ETF (NYSEARCA:EEM) covers more than 2 thousand stocks that represent a number of economies around the world. Some consider this fund as a good way to take advantage of world's fastest growing economies, many of which are expected to grow faster than the US economy, but I don't agree with this. I think EEM might be a poor way of playing emerging markets.

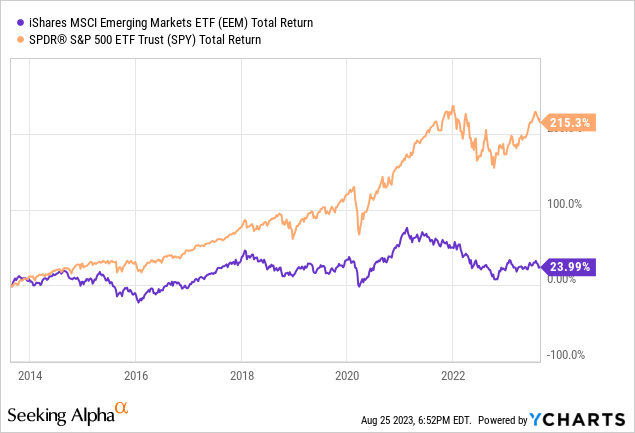

In the last decade, investing and holding EEM resulted in total returns of 24% for investors and virtually all of this came from dividends, whereas S&P 500 index (SPY) had a return of 215% during the same period which put EEM to shame. I would understand underperforming S&P 500 by a small margin or even a moderate amount, but this much underperformance signals a problem with fundamentals of a fund.

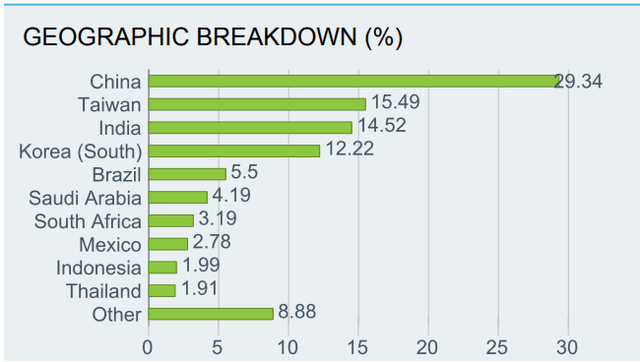

The fund invests in a number of countries, but it's mostly Asia-centric. The countries of China, Taiwan, India and South Korea account for 72% of its total weight in combination. This is somewhat expected since most of the emerging markets are in Asia. By itself this is not a problem, but it also risks underperformance if stocks in one or two countries in perform poorly. For example in recent years we've seen Chinese stocks sell off multiple times and this had a significant effect on EEM's performance during this period.

EEM Geo Distribution (iShares)

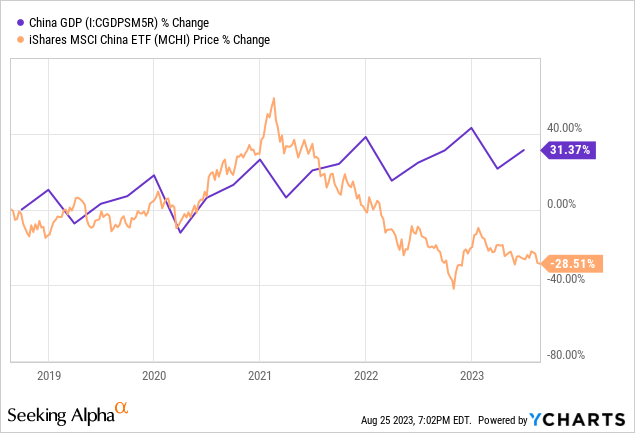

In the last 5 years, China's GDP grew by an impressive rate of 31%, but this didn't translate into stocks gains for the most part. During the same period, Chinese stocks were down -28.5%. I must mention that this performance was measured in US dollars and might have been influenced partially by currency exchange rates, but if you are an American investor, this is something you should keep in mind anyways when calculating your total return in your foreign investments.

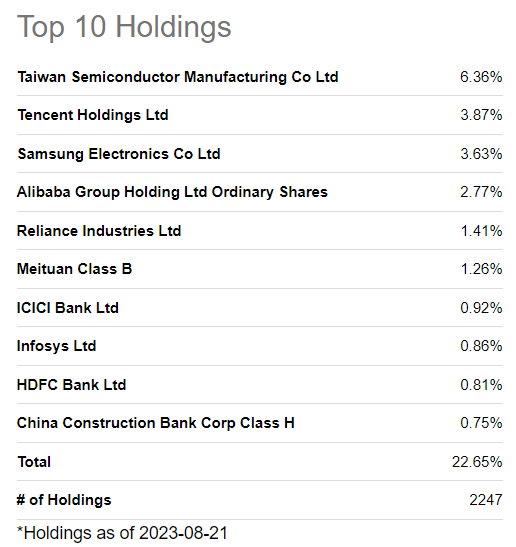

I would consider this fund "top heavy" because even though it holds more than 2 thousand stocks, the top 10 stocks account for 23% of its total weight. In fact, one stock (TSM) accounts for 6.4% of its total weight, while the first 3 stocks account for close to 14% of the total weight. Thus, most of this fund's performance will be driven by a few stocks at the top, almost all of which happen to be technology stocks.

EEM Top 10 Holdings (Seeking Alpha)

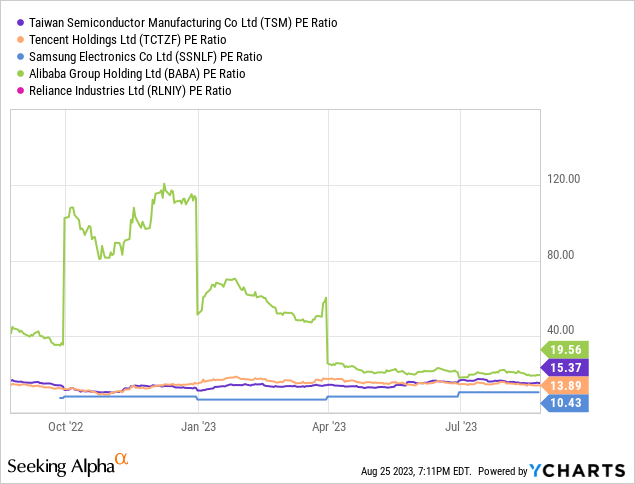

To be fair, the stocks in emerging markets tend to be much cheaper than their American counterparts. Below you will see the P/E values of top 5 holdings of EEM and these values range from 10 to 19. All in all, the fund's holdings have an average P/E of 12 (weight adjusted). This is pretty cheap compared to the P/E value of S&P 500 which is estimated to be 25 which is more than double EEM's P/E.

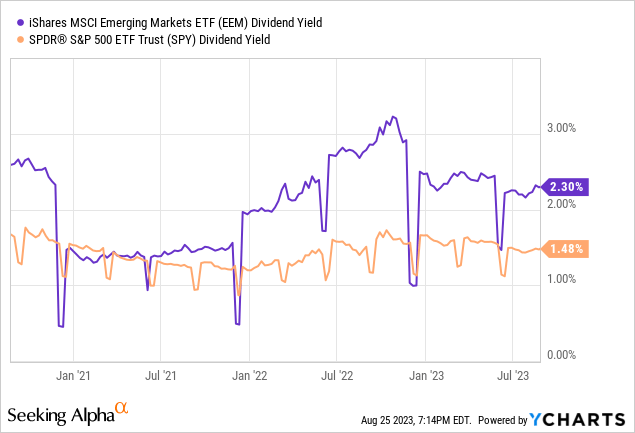

It's not just P/E values, either. EEM currently has a dividend yield of 2.4% which is significantly higher than the dividend yield of the S&P 500 index which is 1.5%. Then again, considering that EEM returned about 2.3% annually for the last decade, virtually all of the fund's returns came from dividends alone, which is less than ideal.

One could also argue that if EEM underperformed for a long time and if it's much cheaper than S&P 500, maybe it's overdue for an outperformance. After all, these things tend to rotate and one year's top performer can be another year's bottom performer and vice versa. For example, in 2020 Nasdaq vastly outperformed Dow and in return Dow outperformed Nasdaq in 2022 and Nasdaq outperformed again in 2023. This is a valid argument, but EEM hasn't underperformed for only a year or two but for more than a decade.

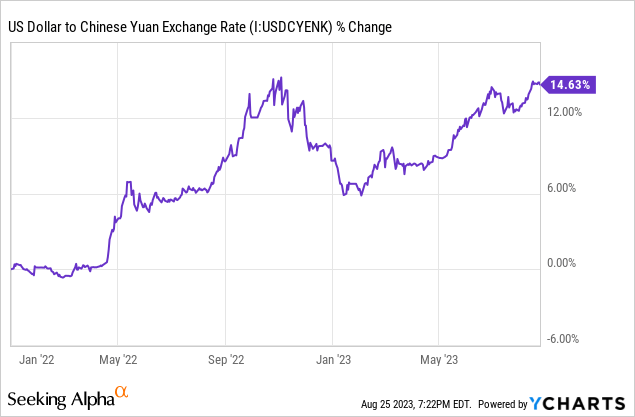

Another issue is the currency risk. Even if emerging markets were to outperform next year, you might still miss it if currencies in these countries depreciate significantly as compared to the US dollar. For example, since January of 2022, the US dollar appreciated by almost 15% against the Chinese Yuan so if you were holding any Chinese stocks during this period, and they appreciated by 15%, this would have been eaten away by these currency fluctuations.

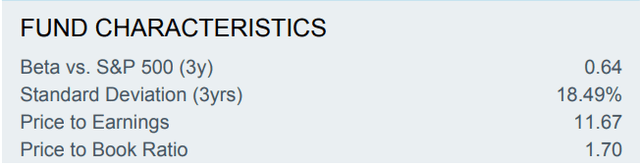

In addition to having a low P/E and higher dividend, the fund also has a low beta of 0.64 which means it's 36% less volatile than the S&P 500 index. As I've said in many articles before, low beta can be a good thing during bear markets or volatile times, but it can also play against you when we are in a bull market because your stocks will appreciate significantly less than the overall market. For example when a fund like this has a beta of 0.64 it means that when S&P 500 rises 10%, it will only rise 6.4% (rough estimate) and since we are in a bull market far more often than we are in a bear market (about a ratio of 1 to 6) a low beta can actually hurt a portfolio in the long run.

EEM fund characteristics (iShares)

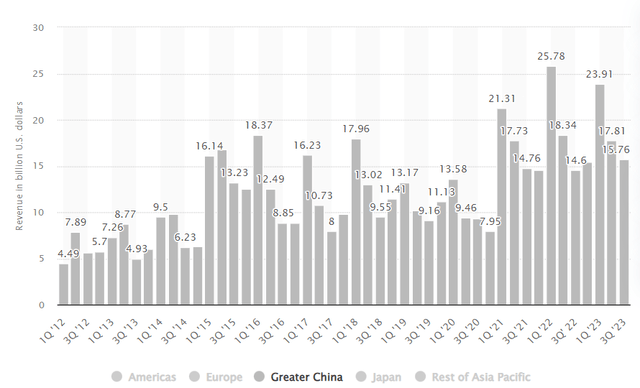

I believe the best way to invest into emerging markets is actually to invest into S&P 500. You might think it's absurd, but many of the companies in S&P 500 actually do business internationally, and they have strong growth prospects in emerging markets. For example, 15% of Apple's (AAPL) revenues come from China, up from 5% just a decade ago. We also know that Apple has plans to expand significantly in India in the next decade, which is another emerging market with an economy growing at an impressive rate.

Apple's revenues in China (Statista)

Many companies based in America such as Coca-Cola (KO), NIKE (NKE), McDonald's (MCD), Caterpillar (CAT), Starbucks (SBUX), Tesla (TSLA), General Motors (GM), Google (GOOG) and Microsoft (MSFT) generate a significant portion of their revenues, profits and growth from emerging markets. One could even say that those are international companies that just happen to be headquartered in America. According to one estimate, close to 40% of S&P 500 companies' revenues came from outside of the US in 2019 which is probably closer to 50% by now (if not higher). Granted some of this came from places like Canada and Western Europe which aren't exactly considered emerging markets, the point remains that more and more of S&P 500 revenues and earnings will come from emerging markets in the future, which means investors can get decent amount of exposure by staying invested in SPY instead of EEM.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPY, AAPL, TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)