Retirement Passive Income: Why Enterprise Products Partners Is The Best

Summary

- There are four major requirements that retirees typically look for in an investment.

- EPD checks each of those boxes with flying colors.

- We share why EPD is the ideal retirement passive income investment.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios. Learn More »

NosUA

Retirees looking for passive income investments generally need securities that offer each of the following characteristics:

- A sufficiently high current yield to cover living expenses.

- A safe enough distribution to sustain the payouts through good times and bad.

- Enough distribution growth to keep pace with inflation.

- A security that will sustain - and ideally increase - its value over the long-term in order to preserve an inheritance for heirs.

While there are a growing number of potentially eligible securities in the current rising interest rate environment, one stands head and shoulders above the rest: Enterprise Products Partners (NYSE:EPD). In this article, we will discuss why EPD excels at meeting each of these requirements.

#1. Very Satisfactory Current Yield

Perhaps the most obvious way in which EPD meets the aforementioned criteria for a retiree's ideal passive income investment is its current yield, sitting at 7.8% on a NTM basis.

This is a highly satisfactory current yield for several reasons:

- Many financial planners suggest implementing the 4% rule for retirement budgeting. This plan basically requires withdrawing no more than 4% of their savings during the year they retire, and then increasing that amount each year based on inflation. Using this methodology is expected to last a retiree for 30 years or more if invested properly in a highly diversified portfolio of stocks and potentially even some bonds. A 7.8% distribution yield gives the typical retiree a near 100% cushion above the 4% rule, making it a great security to invest in when using this planning methodology.

- The current 10-year treasury interest rate is currently at 4.23%. Thus, WPD offers investors a very healthy premium to this level, making it a worthwhile income investment for investors willing to take on at least some risk.

- If your estimated retirement living expenses are $50,000, then you only need to have $641,025.64 invested in EPD stock to cover your expected lifestyle. As a result, investing in EPD could potentially accelerate your retirement date.

#2. Very Safe Distribution

Another reason to really like EPD as a passive income generator for retirement is because, in addition to being very attractive, its distribution appears to be very safe. In addition to never being cut and increasing for 25 consecutive years, EPD's current fundamentals also signal that the payout is very safe:

- It has the best credit rating in the entire energy midstream sector at A-.

- It has a very low leverage ratio of 3.0x, a whopping $4 billion in liquidity, a 19.7-year weighted average term to maturity on its debt (of which 82% matures in 10 years from now or greater and only 11% matures in the next three years with the vast majority maturing in 2025 and 2026), 96.7% of its debt is fixed rate, and it currently enjoys a weighted average cost of debt of just 4.6%.

- It generates very stable cash flows thanks to its well-diversified business model across geographies, products, and markets that generates the vast majority of its EBITDA from long-term fixed-fee, take-or-pay commodity price resistant contracts.

- Its expected 2023 distribution coverage ratio is expected to be a very conservative 1.74x

Given its impressive track record of distribution growth, its fortress industry-best balance sheet, defensive and dependable business model, and low payout ratio, EPD offers a very safe distribution despite also offering an extremely high yield.

#3. Distribution Growth Will Likely Outpace Inflation

Another reason EPD is such a good passive income stock for retirees is that its distribution growth is likely to outpace inflation moving forward. This is because:

- The Federal Reserve is currently waging war on inflation and have successfully brought it down to 3.18% based on the latest reading of year-over-year CPI. The Federal Reserve has signaled that it is prepared to continue restrictive monetary policy until the inflation rate is brought down to near its 2% long-term target.

- In contrast, EPD is growing its distribution at a ~5% CAGR. In 2022, it grew its distribution by 5%, this year it is on pace to grow it by 5.1% and is likely to sustain that pace for the foreseeable future.

- Between its very low leverage level, large growth project pipeline set to come online in the coming years, and substantial distribution coverage ratio, EPD has plenty of room to continue growing its distribution at a mid-single digit pace for years to come, which should outpace inflation over that period of time.

#4. EPD's Value Will Likely Grow Over Time

Last, but not least, there are several reasons why EPD units are highly likely to appreciate over time on top of the generous payouts being delivered to unitholders.

First of all, EPD's track record indicates that it is a proven long-term outperformer, generating an average return on invested capital of 12% over the past decade (which is quite impressive for a very capital-intensive industry) and massively outperforming the market over the long-term:

Moreover, nearly one-third of the partnership's equity (~32%) is owned by management. Given the track record and vested interest of management, we have a high degree of confidence that EPD will allocate unitholder capital very effectively moving forward.

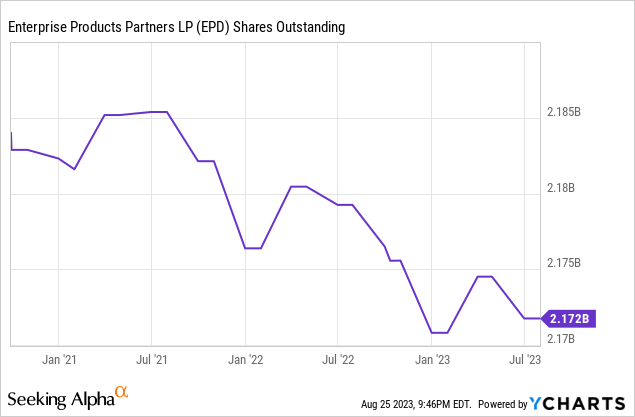

On top of the track record, EPD also has attractive growth potential in front of it. Between its active $2 billion buyback program that has led to a gradually declining unit count over the past three years...

...and its significant growth investment opportunities through high return, low risk organic growth projects and opportunistic bolt-on acquisitions, it is highly likely that EPD will grow distributable cash flow per unit moving forward.

This is further accentuated by the fact that EPD is retaining a lot of cash flow after paying out its distribution, enabling it to fully fund its growth projects and unit buybacks with cash instead of having to go to the debt or equity markets to raise additional capital.

Another point to note is that - given that EPD's leverage ratio is already quite low and will only be moving lower in the coming years as its large lineup of growth projects come online - it will have substantial extra capital that it can deploy if it wants to keep its leverage ratio within its target range. As a result, it may elect to use this capital to buy back a significant amount of units and/or make an additional acquisition. Either path will likely lead to significant upward pressure in the unit price.

Last, but not least, EPD's valuation is below historical averages right now, with its EV/EBITDA standing at 9.18x compared to its five-year average of 10.02x. As a result, there is a pretty good chance that EPD will see valuation multiple expansion in the years to come, especially if interest rates begin to normalize.

Investor Takeaway

For retirees looking for income, EPD is the obvious choice. Between its very attractive current yield, low payout ratio, fortress balance sheet, elite asset portfolio, recession resistant business model, solid distribution growth track record, momentum, and capacity, impressive returns on invested capital and long-term total return performance, substantial insider alignment, buyback program, lengthy growth runway, significant capacity for future buybacks, and discounted valuation, EPD checks all of the boxes for what a retiree could want in an investment.

As a result, it occupies a prominent position alongside numerous other attractive, lower risk, high yield, dividend growth opportunities in our Retirement Portfolio.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Investor for a 2-week free trial

We are the #1-rated high-yield investor community on Seeking Alpha with 1,500+ members on board and a perfect 5/5 rating from 150+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!

This article was written by

Samuel Smith is Vice President at Leonberg Capital and manages the High Yield Investor Seeking Alpha Investing Group.

Samuel is a Professional Engineer and Project Management Professional by training and holds a B.S. in Civil Engineering and Mathematics from the United States Military Academy at West Point and a Masters in Engineering from Texas A&M with a focus on Computational Engineering and Mathematics. He is a former Army officer, land development project engineer, and lead investment analyst at Sure Dividend.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EPD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (25)

First the thing that makes them safer is large family Control even our wonderful WES has some Roll Up Risk, the General Partner interest are similar to our needs how they get there is a reflection of Mr. Duncan and Mr. Warren and the way they set up the Company to fit themselves.

Mr. Duncan was a strategist with the planning and forward thinking to grow

long term projects and put in place Management to execute with precision.

That’s the culture today as new paid as built facilities come on line as planned.

My analogy for EPD is the MegaMind.

Mr Warren was much more the WildCatter and put growth at all cost first. This approach has them carrying more and less safe debt and their approach has of necessity become absorption so my analogy is The Blob as they grow by

merger versus purchase or long term projects not that either Company can’t do some of both by inherent personality this is the way forward each is growing.

We deliberately made EPD the centerpiece of our withdrawal to Cash Flow investing and safety; ET we were absorbed when our large ENBL holding became ET in December 21. Immediately making them our number two holding.

When our PSXP was rolled up, then our number three we immediately lost Cash Flow and became dividend Income we eventually traded one Share of PSX for

4.1 EPD immediately doubled our Cash Flow and returned it to Return of Capital enhancing its value even more.

This elevated WES to our number 3 and we have found by accident that is a good number of MLP’S to care for and grow consistently Compounding keeps our Basis safe way beyond Step Up Basis time. One of the major values of safe MLP investing. The difference in growth allowed by Return of Capital versus dividends is simply huge. For example we hit 17.2% increased Cash Flow YTD and still took out a lot of Cash for Property Tax this quarter. 4% Rule is of no interest to us growing our Income is. We are fortunate to be able to own safe MLP’S. Rule of 72 Compounding is extremely powerful.

Best Luck to Everyone

John

You should clarify that. After all under your construction it would also be okay to say the majority of EBITDA comes from fixed fee crypto trading. A combination of fee-based and crypto trading provides a majority of their EBITDA.