Aviva: Shares Get Cheaper Despite Solid Results

Summary

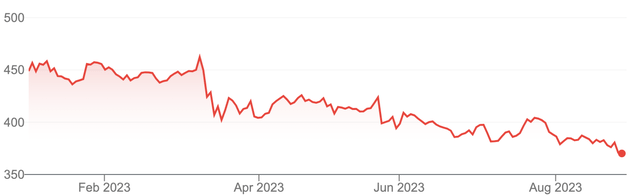

- Aviva's share price has been declining for several months now, falling around 10.5% in sterling terms since May and 20% from its March high.

- The company's financial results continue to impress, with profits growing and targets on track to be met.

- Real estate exposure within the asset portfolio may explain the poor share price performance.

- While that is a source of near-term risk, these shares offer a 9% dividend yield and the prospect of decent growth on top.

HJBC

This is a frustrating period for Aviva (OTCPK:AIVAF)(OTCPK:AVVIY) investors. Shares of the UK composite insurer have been on a downwards trajectory for several months now, falling around 10.5% in GBP terms since my last update in May and around 20% from their March high.

Aviva: Share Price (GBX Per Share)

Sharp-eyed followers will no doubt have observed that the stock's latest struggles began with the onset of regional bank fears in the United States. A European insurer and the US regional bank industry don't appear to share much of a connection, but commercial real estate concerns perhaps represent the common denominator explaining the poor price action.

While that is something to consider going forward, for now there is nothing in Aviva's financial results to suggest that anything is really amiss, and with these shares continuing to get cheaper I maintain a Buy rating.

Interim Results Look Fine

Aviva released results covering the first half of FY23 last week. Although the market has so far responded by docking another 3% from the share price, little in the release suggests anything is really off here.

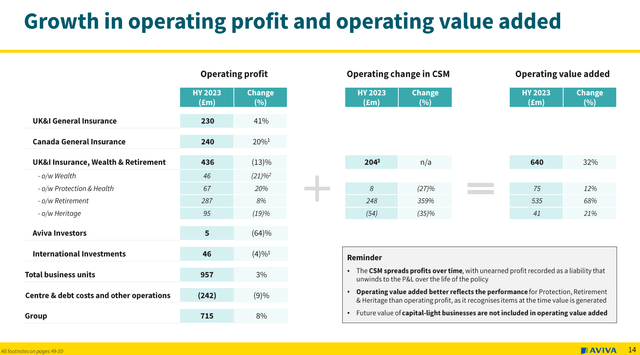

Results were generally good. General insurance ("GI") premiums increased around 12%, roughly balanced equally between its UK & Ireland (+13%) and Canadian (+12%) segments. Personal and commercial lines were up anywhere between 8% and 17% depending on the country, with Aviva obviously trying to pass on the inflationary environment to its customers. Underwriting profitability did slip - GI combined operating ratio was up a point to 94.8% - but in terms of underwriting result that was more than offset by the aforementioned growth in premiums. Operating profit in both GI segments was up further still as investment income is obviously benefitting from higher interest rates at the moment.

Source: Aviva FY23 Interim Results Presentation

All said, group GI operating profit was up around 30% YoY to £470m, helping to propel an 8% YoY rise in total group-wide operating profit. The stock of future profit was up 1.4% to around £7.9B.

On Track To Hit Targets

Last time out I had the FY23 dividend at 33-33.5 pence per share. That was based on management guidance of a £915m dividend cash cost, a 2.8B FY22 year-end share count, plus a low-single-digit contribution from a £300m share buyback program. Management have now guided explicitly for the FY23 DPS, which at 33.4 pence per share lands at the higher-end of that previously estimated range. With the shares currently at 370.35 pence in London trading the implied forward yield is a shade over 9%.

There is little to suggest that the dividend is currently an issue, notwithstanding the high yield suggesting otherwise. Cash remittances to the group center increased 3% YoY in H1, clocking in at £825m. Management has affirmed its wider cash remittances target - which sees over £5.4B cumulative over the FY22-24 period. H1 FY23 obviously marks the half-way point, and with the tally currently at around £2.6B that implies increased cash generation between H2 FY23 and FY24. Dividend cover is already ample even after allowing for debt interest and central spend, and it looks set to increase going forward.

Management has further guided for low-to-mid single digit per annum growth in the cash cost of the dividend post-FY23. Absent additional stock buyback programs implies the current 9% yield will be supplemented by circa 3-6% annual growth going forward. On a static yield that further implies anywhere between 12-16% annual total returns all else equal. Previously identified growth drivers like commercial insurance and bulk purchase annuities should be good for at least low single-digit annualized group-wide growth.

Real Estate Exposure To Blame?

Financial results continue to look solid; the current dividend is seeing increasing cover; and a 9% yield, plus the prospective of mid-single-digit per annum growth, is pointing to very attractive shareholder returns. Prospective investors will no doubt be looking for a catch, especially as the share price action these past few months doesn't point to a rosy outlook.

Real estate exposure in the company's asset portfolio may be one possible explanation. Interest rates have risen rapidly, and while that is good for Aviva in some aspects (e.g. higher investment income), it does raise the prospect of credit risk in its asset portfolio as borrowers struggle with higher repayments.

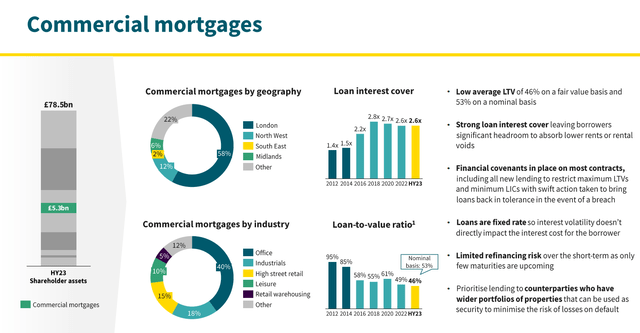

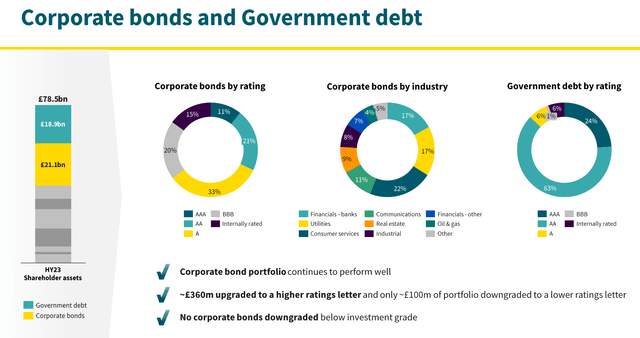

By my count commercial mortgages and corporate bonds linked to the real estate sector account for a little over 9% of Aviva's £78.5B asset portfolio, with that rising to around 50% when expressed a portion of Solvency II own funds. Office lending - an area of particular concern given additional work-from-home pressure - accounts for around 40%, or £2.1B, of the company's commercial mortgage holdings. The company also has a further £9.5B in lifetime mortgages - and therefore exposure to falling UK home prices - but this is generally a pretty conservative portfolio.

Source: Aviva FY23 Interim Results Presentation

My guess is that the market is worried that bad debts could erode Aviva's Solvency II position, thereby forcing the firm to cut the dividend to raise cash in a downturn.

For now the solvency coverage ratio remains quite high, ending H1 at 202%. Interest cover and loan-to-value ratios further remain relatively conservative, while the corporate bond portfolio hasn't shown much sign of deterioration. More quarters at higher interest rates may change that, though, and not for the better.

Source: Aviva FY23 Interim Results Presentation

While the above does point to downside risk and a subdued short-term outlook, the "reward" element is now a 9% dividend yield and the prospect of supplemental growth that could hit 5-6% per annum. The uncertain near-term stops me upgrading to Strong Buy, but these shares continue to look very cheap. Buy.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AIVAF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.