Carvana: It Is Not That Simple

Summary

- Carvana Co. (CVNA) is a $7.5-billion market cap firm that operates a US e-commerce platform for buying and selling used cars.

- CVNA's financials are poor and the valuation levels are ridiculously high. The problem is that everyone knows about it. That's why the stock is up a whopping 790% year-to-date.

- I think we are still in a phase of euphoria where it is not worth trying to seize the moment to take a short position [just yet].

- There are reasons to believe that the current rally could last longer than short sellers have the patience.

- Therefore, I recommend speculators to wait for more signs of exhaustion of the current rally before going short, and long-term investors to avoid this meme stock altogether.

Joe Raedle

Carvana Co. (NYSE:CVNA) is a $7.5-billion market cap Arizona-based firm that operates a US e-commerce platform for buying and selling used cars. Customers can research, inspect, finance, and purchase vehicles online, with options for delivery or pickup.

If you take a quick look at the plethora of short-rated articles here on Seeking Alpha, you'll immediately understand that there are some problems with CVNA - several analysts can't rate it a "Sell" from quarter to quarter, doing that repeatedly. And in the meantime, CVNA stock is up a whopping 790% year-to-date:

Such performance is explained by the abundance of open short positions that must be closed at some point - this leads to a kind of domino effect in the trading order book [aka DOM] when short sellers, to cover losses, are forced to close out at any market price, driving the stock price higher and higher. Please excuse this explanation of a "short squeeze", I just wanted to make sure all readers understood the reason for such a sharp rise in CVNA's price.

Although CVNA has already seen such strong growth on a YTD basis, its popularity among short sellers continues unabated. And I'm not even talking about retail speculators, but solid folks in suits from Wall Street, for whom CVNA is still the ideal short candidate according to the latest Goldman Sachs data I found [August 21, 2023 - proprietary source]:

Goldman Sachs [August 21, 2023]![Goldman Sachs [August 21, 2023]](https://static.seekingalpha.com/uploads/2023/8/26/49513514-16930391933728004.png)

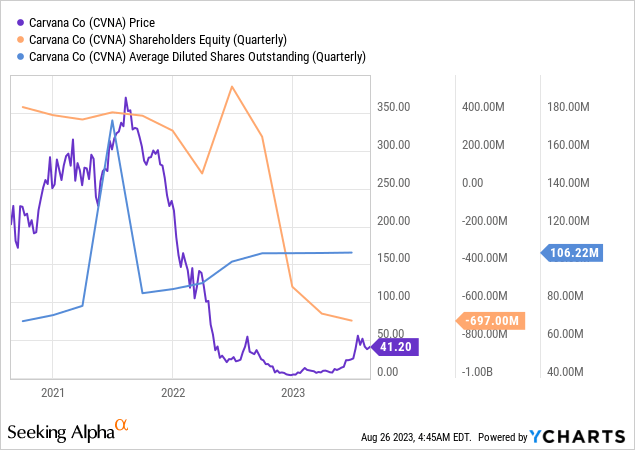

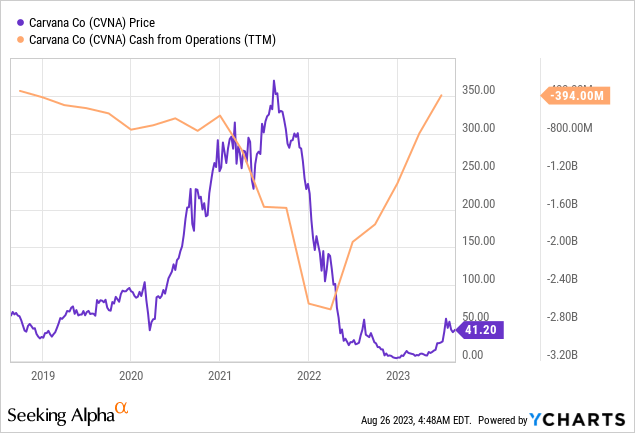

Throughout its history, Carvana has spent significant investor capital to drive growth, but it has never achieved consistent profitability or generated positive cash flow. What it succeeded in doing was burning of shareholders' equity and issuing more shares.

Kerrisdale Capital's June-dated CVNA article notes, that even during the pandemic, when it was one of the few online options for car buyers, Carvana couldn't turn an annual profit. Facing the risk of bankruptcy, the company attempted to cut costs and optimize its operations but still couldn't generate positive cash flow from operations.

Carvana is now trying to promote a new narrative. During the latest earnings call, the CEO outlined a three-step plan the company undertook: achieving positive adjusted EBITDA, attaining positive unit economics, and subsequently returning to growth.

But in reality, CVNA is still facing some very crucial challenges: The used car business, whether traditional or tech-driven, is capital-intensive with low margins.

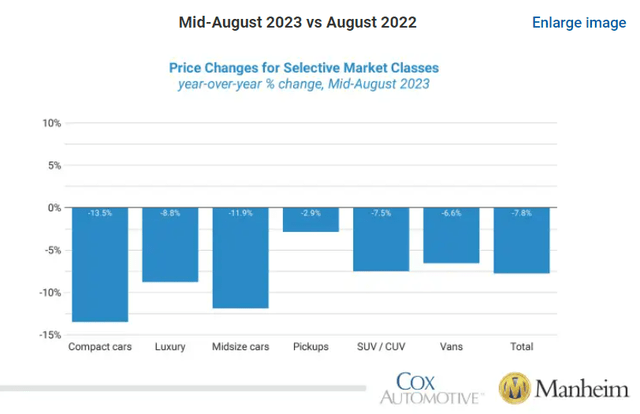

Yes, CVNA has indeed managed to slightly reduce its operating expenses and costs of goods sold (as a % of sales) in recent quarters, resulting in a positive adjusted EBITDA margin. However, given the peculiarities of the industry in which the company operates, it is very likely that it will have problems keeping the recent margin expansion going further.

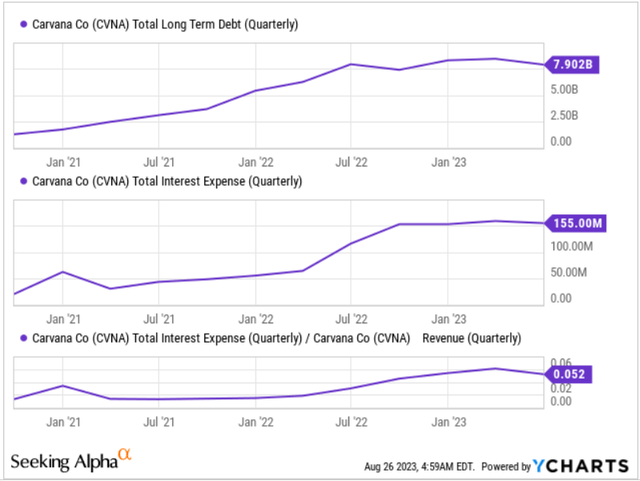

Even during favorable conditions like low-interest rates and high used car prices, Carvana didn't thrive. With the current unfavorable conditions and its significant debt, the company's only viable option is likely to eventually restructure its financial obligations.

Used Vehicle Value Index, Manheim YCharts

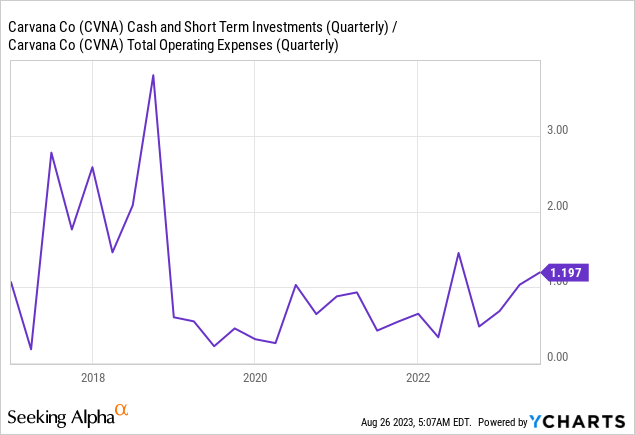

On the company's balance sheet, slightly more than a quarter of the cash burn remains [in the form of operating expenses]. From a historical perspective, this is not a problem for the company - the chart below clearly shows that this is not the first time CVNA has faced a liquidity problem. However, in the past, this problem was solved by new debt and equity increases. After such a strong increase in shares, the second option is more likely this time.

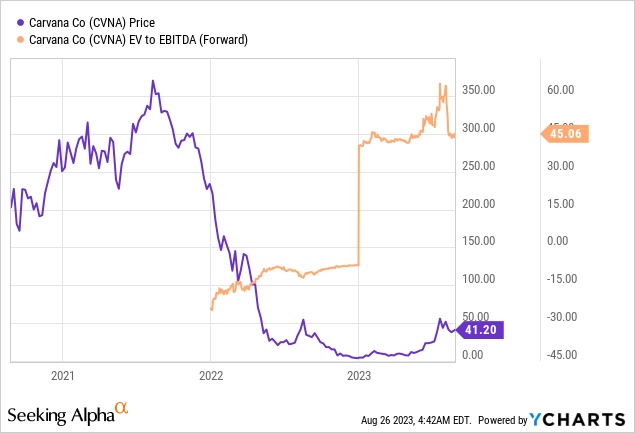

Is it worth talking about how high CVNA stock started to be valued after its YTD price growth? Right now, any buyer of CVNA stock is willing to wait for about 45 years of forwarding EBITDA, and that's even though the enterprise value is significantly inflated by debt that none of the banks are likely to refinance at an attractive interest rate (taking into account the recent increase in nominal interest rates).

So purely from a fundamental perspective, CVNA is in itself one very big red flag for investors. But the problem is that this thesis is clear to everyone.

Not only because the short interest reaches over 40-50%. Everyone realizes that sooner or later fundamentals will take over, but no one knows exactly when that will happen. That's why many short sellers keep returning to CVNA and try to short it again, thinking that it has already peaked. The bitter truth is that such attempts usually end in hurtful failure. To avoid this, short sellers need to take into account the relative strength of the stock and wait until it weakens.

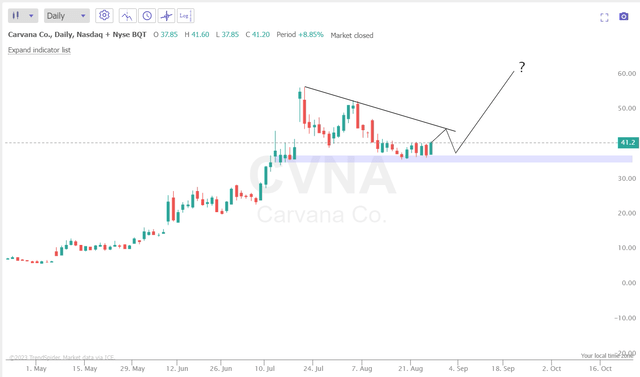

Overall, I think we are still in a phase of euphoria where it is not worth trying to seize the moment to take a short position. While the price on the weekly chart has drifted down from its previous local resistance in the $50/sh area. The squeeze may still continue.

TrendSpider Software, author's notes

Some banks now rate CVNA a "buy," according to TrendSpider data, which could paint a favorable picture for growth "against fundamentals" given high short interest and likely further positive news from the company.

On the other hand, could it be that the rejection of the resistance zone is exactly in line with the seasonality we have seen in CVNA's price action over the last 6 years, where September and October have been the most painful for growth?

The Answer Is - Nobody Knows

Anyone who wants to short CVNA at its current price level runs the risk of losing their capital if the current technical picture continues to develop as the technical analysis textbooks teach: Consolidation after breakout - new breakout to the upside:

TrendSpider Software, author's notes

On the other hand, buying CVNA is speculation, not a balanced long-term investment decision. That's because of CVNA's [in my humble opinion] abysmal financials, the difficulties of the industry, and the outrageously high valuation, which will inflate sooner or later anyway.

Therefore, I recommend speculators to wait for more signs of exhaustion of the current rally before going short, and long-term investors to avoid this meme stock altogether.

Thanks for reading!

Hold On! Can't find the equity research you've been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!

This article was written by

The chief investment analyst in a small family office registered in Singapore, responsible for developing investment ideas in equities, setting parameters for investment portfolio allocation, and analyzing potential venture capital investments.

A generalist in nature, common sense investing approach. BS in Finance. The thesis description can be found in this article.

During the heyday of the IPO market, I developed an AI model [in the R statistical language] that returned an alpha of around 24% over the IPO market's return in 2021. Currently, I focus on medium-term investment ideas based on cycle analysis and fundamental analysis of individual companies and industries.

Get a free 7-day trial +25% off for up to 12 months on TrendSpider with the coupon code: DS25

**Disclaimer: Associated with Oakoff Investments, another Seeking Alpha Contributor

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)

They control the stock and the narrative thru side deals and fake metrics.

They will stop at nothing to pump this up.