Starting Small With Cannabis The Innovative Industrial Way

Summary

- Innovative Industrial Properties allows investors to participate in the booming cannabis market while receiving regular income through dividends.

- IIPR buys properties and leases them to cannabis businesses, providing a safe investment option for those interested in the cannabis industry.

- IIPR's preferred shares offer a 9% return and are cumulative, ensuring investors receive their payments even if they are not made in a given year.

A_Melnyk

Investment Thesis

Innovative Industrial Properties (NYSE:IIPR) is like a two-in-one deal for those seeking to get in on the booming cannabis business while still enjoying the safety of regular income. The business model is simple: buying a property and getting rent. What is unique about IIPR is that it leases the property to cannabis growers and retailers.

Because IIPR is a Real Estate Investment Trust 'REIT,' they have to pay at least 90% of their profit as dividends, which means money in your pocket. So, you're not just hoping the stock price goes up, you also get a piece of their profit.

The cannabis market is growing fast, and IIPR is right there with it. But, because the cannabis market faces many challenges, it alienates many investors. However, because IIPR acts as a landlord in a booming cannabis industry, it can easily replace underperforming tenants. For anyone looking to invest in cannabis but wants some safety, with regular pay-outs, IIPR is a top choice. It's a straightforward way to be part of a growing industry trend while earning some income.

An Extra Layer of Security

IIPR offers another enticing deal with its preferred shares (NYSE:IIPR.PR.A). For those not in the know, think of preferred shares as a special kind of stock. These aren't your everyday shares; they promise a generous 9% return. And here's the kicker - they're cumulative. In plain English, if the company doesn't pay you this year, they owe you the payment, which will be added to what they owe you next time.

Currently, the price tag on these shares is $25.6 each, a reasonable entry point for many retail investors. You can find and trade these shares on the NYSE. However, a word of caution: trading volume is relatively low. Just to put it in perspective, only 250 of these shares exchanged hands yesterday, representing a total trade value of $6405. When volumes are low, prices can sometimes be a bit unpredictable, and opening and closing positions in IIPR.PR.A can be difficult or at unfavorable bid/ask spreads. So, you might want to consider using Limit Orders.

Although both IIPR common and preferred shares pay dividends, the common shares can provide faster capital gains as the cannabis market grows, and if things go south, steeper losses, too. The preferred stock also is subject to the same dynamics but at a much slower pace. Think about it as a choice between sprinting and running.

Market Dynamics

The cannabis sector has been drawing attention from investors worldwide as numerous countries and US states move towards legalizing cannabis for medical use and recreational use. The US, under the 2018 Farm Bill, legalized hemp-derived products, paving the way for a surge in cannabidiol 'CBD' products. Meanwhile, the recreational and medicinal cannabis legalization trend in the US means a new market is opening its doors. These developments started a race among businesses and entrepreneurs trying to establish themselves in all areas of the cannabis supply chain, from cultivation to retailing, offering intriguing investment opportunities.

However, the cannabis market faces several hurdles. In the US, cannabis isn't accepted everywhere, and the rules aren't consistent across states where cannabis is legal, so companies have to adapt to different standards, which can be a hassle. Take packaging, for example; California allows 1 ounce of Marijuana, while in Maine, adults can carry 2.5 ounces. Differences extend to many other aspects, such as regulations on cannabis edibles, concentrates, delivery services, public use, CBD products, testing requirements, and many other regulatory differences, making it hard to centralize operations and benefit from economies of scale.

There is also a big banking issue. Since cannabis is still federally illegal, many banks shy away from it. This means that most dealings are in cash, which isn't always safe. More importantly, cannabis companies find it hard to access necessary capital.

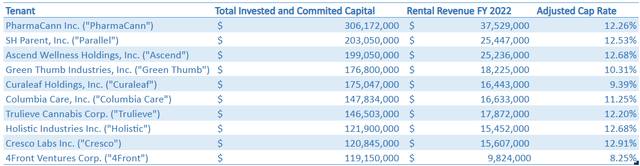

However, there's a silver lining. Companies like IIPR are filling in the gap provided by banks, helping cannabis ventures get the real estate and, in many cases, the infrastructure (ventilators, lighting) they need to expand production. Given that they are one of the few funding sources, IIPR can charge high interest, mirrored in the cap rates below.

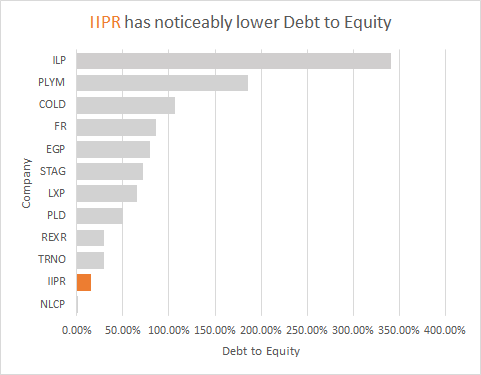

If Federal laws become more favorable towards cannabis, we can expect traditional banks to dive in, potentially reducing IIPR's unique lending advantage and impacting its cap rates. But it's not all bleak. The same open legal environment would also allow IIPR greater access to borrowing. This enhanced leverage could counterbalance potential drops in cap rates, ensuring IIPR's sustained growth and profitability. This is especially true for a company like IIPR, which has one of the lowest debt ratios in the Industrial REIT sector.

Seeking Alpha. Graph created by the author

Valuation and Growth

IIPR stands out in the industrial REIT sector. Except for a single microcap industrial REIT, IIPR boasts the most favorable valuation. It's distinguished with a Quant grade of A for valuation, the only company in the sector with such grade. Additionally, IIPR offers the highest dividend, further solidifying its leading position in the sector.

| Company Name | Symbol | Dividend Yield | Valuation |

| Innovative Industrial Properties, Inc. | Innovative Industrial Properties, Inc. (IIPR) Stock Price Today, Quote & News | 9.16% | A |

| STAG Industrial, Inc. | STAG | 4.21% | D+ |

| LXP Industrial Trust | LXP | 3.99% | D+ |

| Plymouth Industrial REIT, Inc. | PLYM | 3.11% | C- |

| EastGroup Properties, Inc. | EGP | 2.87% | D- |

| Terreno Realty Corporation | TRNO | 2.77% | F |

| Prologis, Inc. | PLD | 2.76% | D- |

| Rexford Industrial Realty, Inc. | REXR | 2.74% | F |

| First Industrial Realty Trust, Inc. | FR | 2.45% | D- |

| Americold Realty Trust, Inc. | COLD | 2.11% | F |

| Industrial Logistics Properties Trust | ILPT | 1.04% | C |

IIPR isn't just leading in valuation. It's a top performer in growth, too. Many of its tenants are short in cash necessary to expand production, and IIPR steps in to help. They don't just provide buildings but also enhance them with features like ventilators and humidity adjustors necessary for cannabis production. This means that tenants can expand, and in turn, they pay a higher rent to IIPR. It's a win-win, making IIPR an excellent way to gain exposure to the regulated cannabis market.

IIPR's preferred shares also have a higher yield compared to other industrial REIT preferred shares. For example, LXP's cumulative preferred shares have a yield of 7%, compared to IIPR preferred shares' 9%, despite LXP's higher leverage.

Summary

IIPR offers a unique investment opportunity, bridging the fast-growing cannabis industry with the stability of regular income. As a REIT, IIPR must distribute 90% of its income as dividends, ensuring a direct benefit for its shareholders.

With a strong balance sheet, IIPR stands apart in the REIT sector. Their business model involves not only leasing properties to cannabis businesses but also enhancing their facilities for optimal production in return for a higher rent, emerging as one of the few lenders to the cannabis sector.

IIPR preferred shares present an additional investment avenue with a 9% cumulative return, with a valuable layer of safety that protects investors from an evolving cannabis landscape.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)

They seem to be a better bet than the preferred stock, without the call risk.